A megatrend you can't ignore: Livewire readers have their say

ESG is undoubtedly one of the themes of the decade. Investment managers are constantly seeking out new ways to make money and a positive difference to the environment. Companies have been moving ahead of the public sector by publishing corporate governance reports, pivoting product processes, and making concrete promises to reduce emissions by key dates (usually 2030 or 2050).

However, ESG is also an area of investing without precedent or a universal standard as of the publishing of this piece. So does that make it more difficult to invest?

The title of this wire reflects what we're trying to do this series - explain the megatrend then find the companies or assets that have what it takes to deliver strong returns and a world-changing legacy.

We asked you to give us your own opinions and about 1,000 of you answered our call. This wire is the compilation of those responses - and already, there is a yawning divergence in opinion over what to do with your money even if you back the megatrend which makes it possible.

Fast Stats

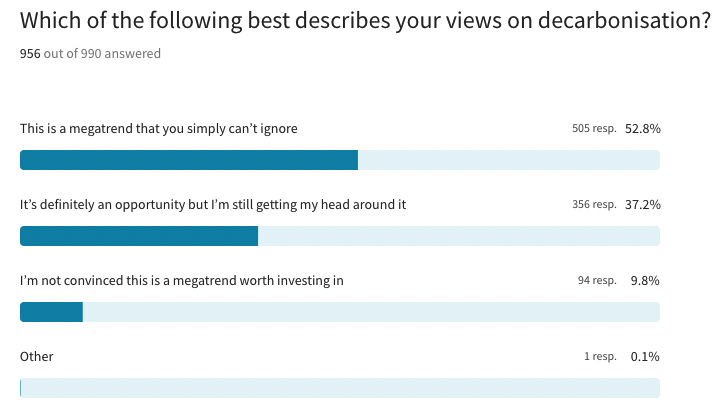

- 53% believe decarbonisation is a megatrend you can't ignore, while 10% are still holding out

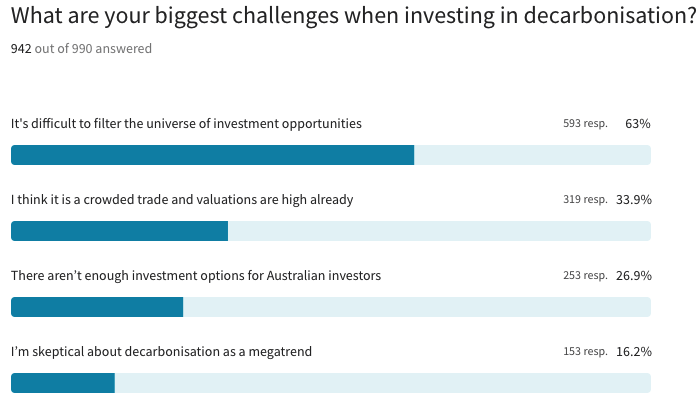

- 63% still find it difficult to filter out the best investment opportunities

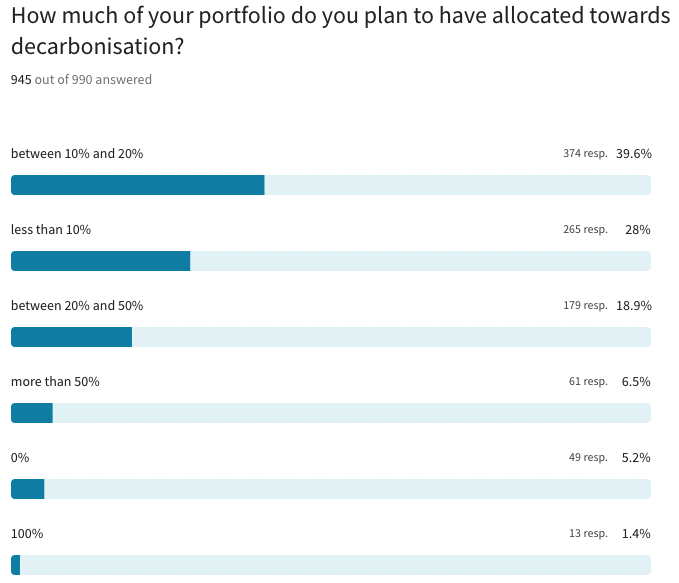

- More than half of you would allocate <20% of your portfolios to the green thematic

- One out of every five readers don't have a specific timeframe in mind for holding onto these investments

Green energy gets the green light

Our survey found that an overwhelming majority of readers accepted decarbonisation as an opportunity that cannot be ignored. However, nearly 40% of you also believe decarbonisation is an opportunity with more questions than answers.

Even in Dr Stuart Palmer's keynote address released this week, Stuart references a range of global data about why the need for net-zero emissions is more important than ever while admitting technology alone may not be enough to change course.

That's what this series will focus on - finding great examples of initiatives and businesses that have passed our experts' tests for true net-zero ambitions. After all, if you're investing in this thematic, wouldn't you want to know your money is actually going towards tangible good?

Settle in, there's a whole world to discover

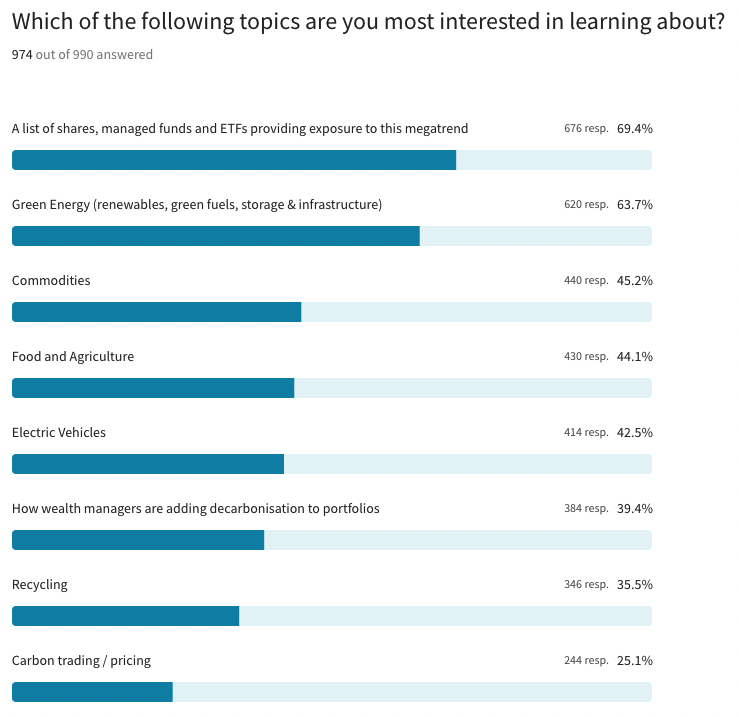

One thing which really stood out in this survey is how varied your interests are in the space. While most of you want investments that provide exposure to the decarbonisation megatrend, there's also a large percentage of you who want to learn more about the products behind those investments.

Green energy, commodities (both hard and soft), and even electric vehicles all featured highly in our survey.

It's clear that the interest of readers is not just to learn about this megatrend but to learn about all the possible opportunities in it - even if that means venturing into unlisted or unpopular ideas.

For the 20% of you who wanted to hear how the wealth managers are reacting to the trend, we've got two pieces already up and running. This one from John Malloy Jr. looks at all things emerging markets and the impact the push for net-zero is having on assets beyond Australia or the United States.

Change starts in the home

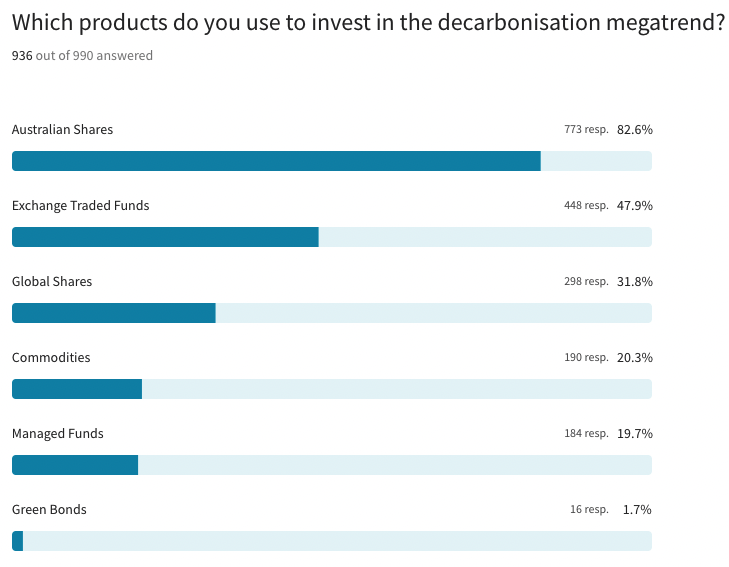

For those who are already in the trade, you're making some big moves in a range of asset classes. Local equities continue to remain the fan favourite with more than 80% of you saying you look to the ASX for ideas first. After that, it's a whole range of ETFs, global equities, and even managed funds.

If you'd like a sneak peek at what's coming on the investable ideas front, check out this piece.

Finally, there's a minority of you backing green bonds which is an interesting thing to note. The Bank for International Settlements recently launched green bond funds which will help finance investments across the Asia Pacific region.

As of June 2020, 16 national governments have issued their own green securities. Australia is not one of them, in perhaps another showcase of how behind this country is on the global push for net-zero.

Erm ... Please explain

An overwhelming majority of readers here simply said that the investable universe is simply too large. Further, this trend has received an avalanche of media attention - giving opportunistic managers a chance to slot in buzz words without any other evidence of action.

In the same line, a lot of you also think that the ESG and climate trade are already too crowded. Valuations are already high for many of these names.

- Core Lithium (ASX:CXO), for instance, is up 655% since its 2011 listing.

- The aforementioned Fortescue Metals (ASX:FMG) is up more than 270% since Fortescue Future Industries was launched five years ago.

- Even Viva Energy (ASX:VEA) which has already been touted as an ESG winner by Lennox Capital Partners is up nearly 15% year to date (though that share price rise is probably for a very different reason).

From zero to hero: our investors want in (but not all-in)

When it comes to the actual portion of portfolios that investors are game to allocate towards the decarbonisation megatrend, the answers vary widely. Nearly 70% of you want to invest a minority stake in the space.

This is perhaps a reflection of both the lack of opportunities and the idea that this trade is one worth buying in on when it becomes less crowded.

We also had 13 people say they are going all-in on the decarbonisation trend. If that's you, we want to hear what your investment philosophy and screening process is!

Equally interesting, 49 people said they would allocate zero. Will they be the 49 most or least intelligent people in the room when all is said and done? Only time will tell.

Hold on for longer

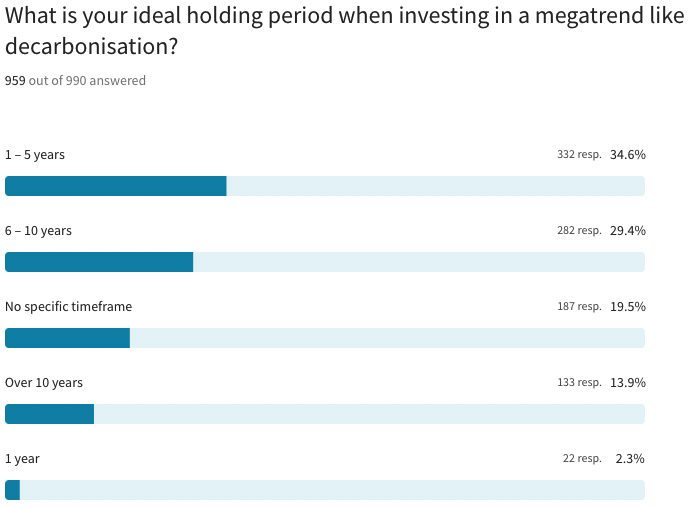

Buy, hold tight, repeat. That's the message we have received from our readers when asked about the time frame they would hold onto the assets. Given net-zero's goals are usually pegged in blocks of 10 years (i.e., by 2030, 2040, and 2050), our investors are using that as guideposts for how long they expect to hold onto these assets.

A not-insignificant chunk of our readers also doesn't have a specific timeframe in mind for these investments. Does that make those holdings a forever play?

Stay tuned!

Thanks to the many hundreds of you who responded to our survey. My colleague Angus Kennedy is working on part two of this series - dedicated to the specific stocks, ETFs, and managed funds our readers are using to harness the decarbonisation trend. Stay tuned to see what the readers have chosen.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

If you have questions or topics you'd like us to cover (even ESG-related!), flick us an email: content@livewiremarkets.com.

4 topics

3 stocks mentioned

1 contributor mentioned