A missed opportunity for many Australians

In Australia, many investors are familiar with cash, term deposits and equities. However, bonds remain less well understood and under-invested, which could represent a missed opportunity for Australian investors looking for consistent income, defensive attributes and portfolio diversification.

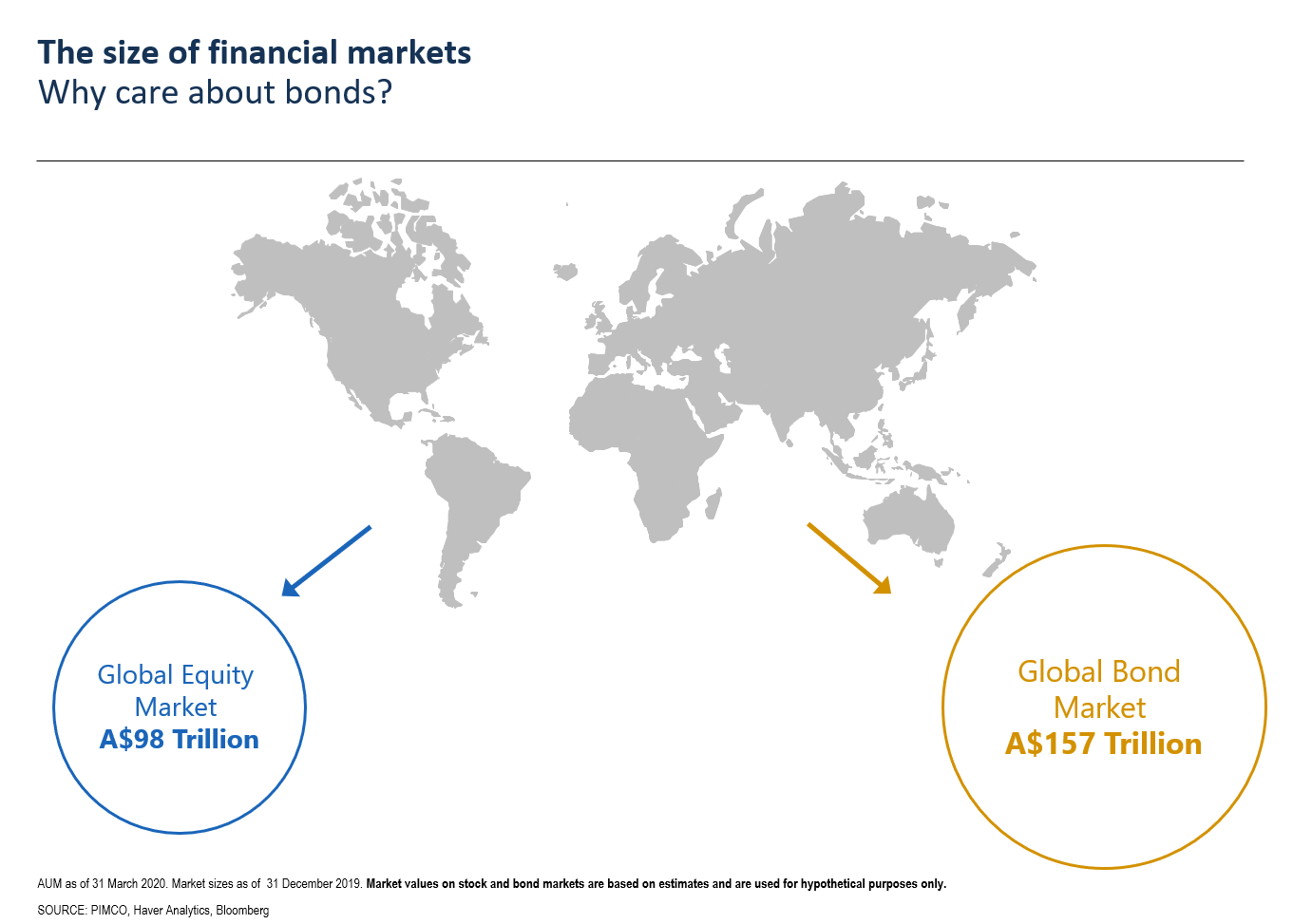

In fact, as you can see in figure 1, the global bond market is actually much larger and more diverse than the global equity market.

Figure 1.

Click on the image to enlarge

Click on the image to enlarge

Comparing bonds and equities

Corporate bonds can sound complicated, but at their core are quite a simple investment. Companies can raise capital either by borrowing from a bank (which may not be practical for large companies), issuing equity/shares (which is an ownership stake in the company), or issuing bonds to borrow money. A bond is simply a loan with some additional requirements. They pay a fixed interest payment (a ‘coupon’), and the lender (in this case the investor) receives their principal back at maturity.

Let’s compare equities to bonds to provide a better understanding of some of the differences.

Click on the image to enlarge

These characteristics can make corporate bonds an attractive option for investors wanting more certainty in terms of income and less variability of returns.

A large and global universe of investments

Because the universe of corporate bonds is so large globally, investors have a large opportunity set when looking to invest in corporate bonds. Bonds are issued by very high quality Australian or global companies (think of Australian banks as an example, where the chance of bankruptcy or default is very low), right through to smaller companies or those in sectors or industries that may be more challenged in the current environment.

For those riskier companies, investors should expect higher interest payments (coupons) as compensation.

In many cases, investors would be familiar with the companies issuing these corporate bonds, and may already own shares in the companies. The difference is that as a bondholder, there is greater certainty in terms of interest payments and in the worst-case scenario (i.e. bankruptcy), bondholders are repaid first.

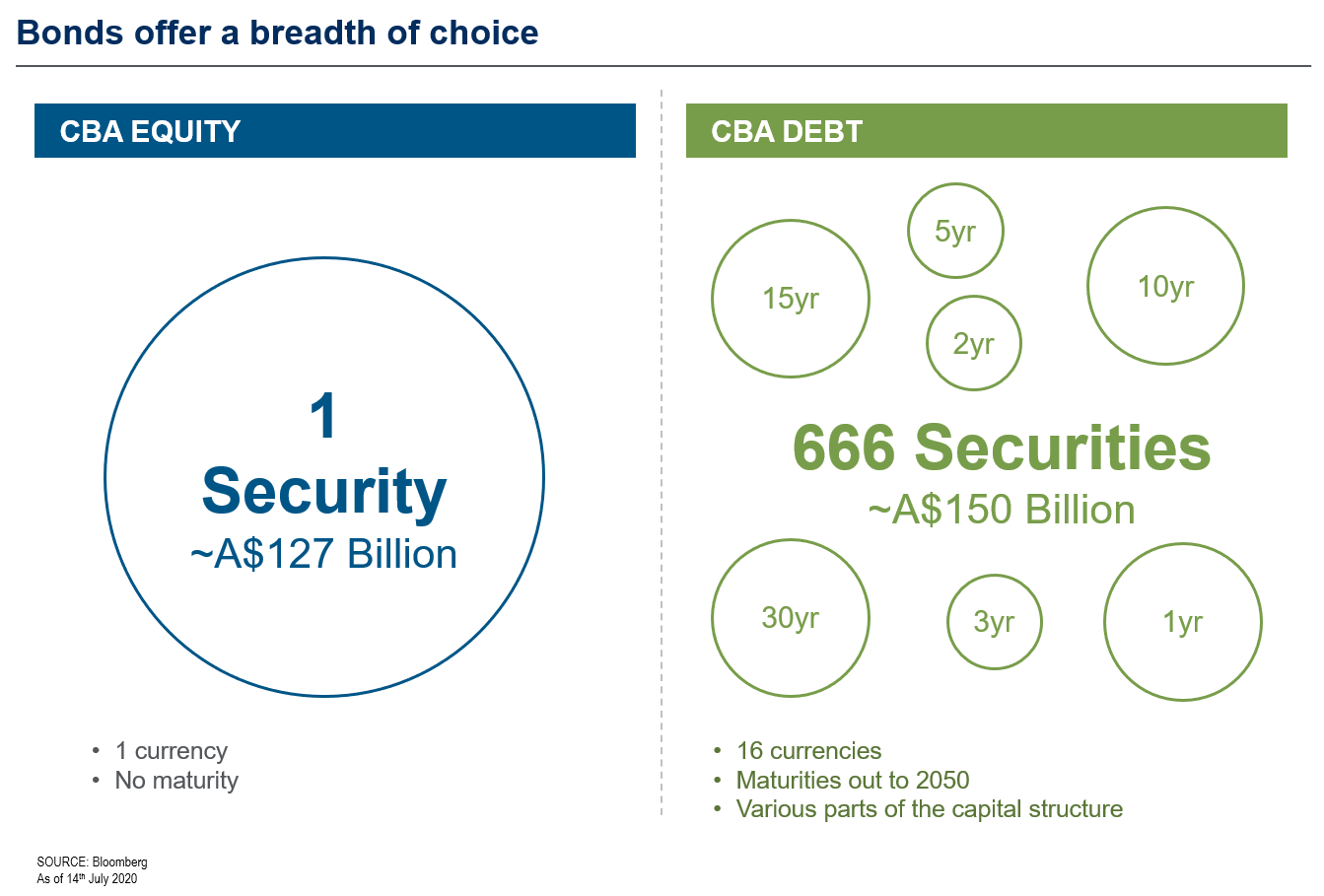

Let’s use the example of the Commonwealth Bank. As you can see in figure 2, CBA actually has more money outstanding in bonds than shares, across a wide variety of currencies and many different maturities.

Figure 2

Click on the image to enlarge

Where does this fit in a portfolio?

Corporate bonds can be an attractive option for investors looking for income and returns above cash or term deposits, but with a more stable income stream and less volatility than shares. They offer another way of investing in some of the world’s largest and most successful companies, without some of the risks that can come with share investing. Although there is not the same potential for upside as shares, they can provide greater security and consistency.

High quality corporate bonds can provide defensiveness to a portfolio in difficult market environments, consistent income, and diversification from other investments like shares and property.

What returns can you expect?

Most of the expected return from corporate bonds typically comes from the interest – or coupon – payments. They can also provide some capital appreciation because at times the opportunity arises to invest when their price is trading below their maturity value, or sometimes a company may issue a bond (allowing investors to buy it) at a discount to its maturity value. Since bonds repay their principal upon maturity, this can lead to some capital appreciation as the bond moves towards maturity and repays the principal, as well as the income payments received along the way. We saw such a situation arise in March, which has provided an opportunity for investors to lock in attractive income from high quality companies.

For a portfolio of high quality corporate bonds, an investor could expect a return, made up mainly of income payments, of somewhere from 2.5% – 5% per annum.

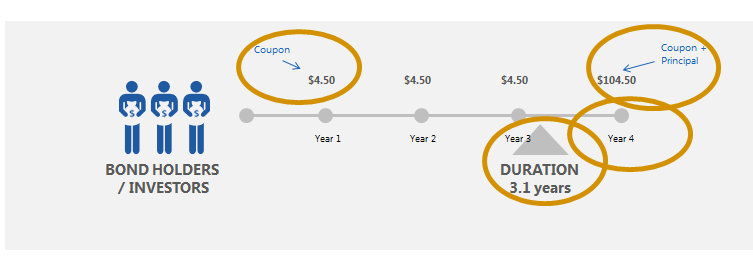

In Figure 3 you can see the example of a bond with a maturity of 4 years, paying a coupon of $4.50pa. The investor pays $100 at the start to the company issuing the bond. They then receive the coupon payments each year, and at maturity receive the final coupon payment as well as their principal back.

Figure 3

Click on the image to enlarge

Source: PIMCO. The information provided above is for illustrative purposes only.

The level of income or return expected varies depending on the credit quality of the company issuing the bond.

- High quality, investment grade companies, where the risk of default is very low, are currently paying income on average of around 1.5% per annum above what you would expect from owning a government bond.

- For higher yielding companies (those that may not have as strong balance sheets or face more challenges in the current environment) that margin above government bonds is over 6% per annum, but can come with commensurately higher risk and capital volatility.

- For a portfolio of high quality corporate bonds, an investor could expect a return (made up mainly of income payments) of somewhere from 2.5%–5% per annum.

What happens to bonds when markets sell off?

Because of the characteristics we have discussed, bonds tend to be more stable and defensive than other asset classes even in periods where markets are volatile. Although their prices can vary over the short term, income (coupon) payments are still made and because of the certainty of receiving the principal back at maturity, it means that prices do not tend to fluctuate as widely as for riskier investments.

Corporate bonds are a difficult asset class to access for individual investors as the minimum investment amounts are typically too large, and it is a space where PIMCO strongly believes that professional management can add value for investors. This can include searching the global bond universe for the best opportunities with attractive coupons, constructing diversified portfolios so that the risk of default or problems in any individual company is reduced for the portfolio, and importantly carrying out credit research on individual companies to focus on those that are of high quality and mitigate the risk of default.

Often, periods of volatility can lead to attractive opportunities to invest in bonds. For example, in March 2020, we saw the price of corporate bonds fall over the short term, but as noted the coupon payments remain fixed. This provided the chance to lock in income payments from high quality companies at attractive prices.

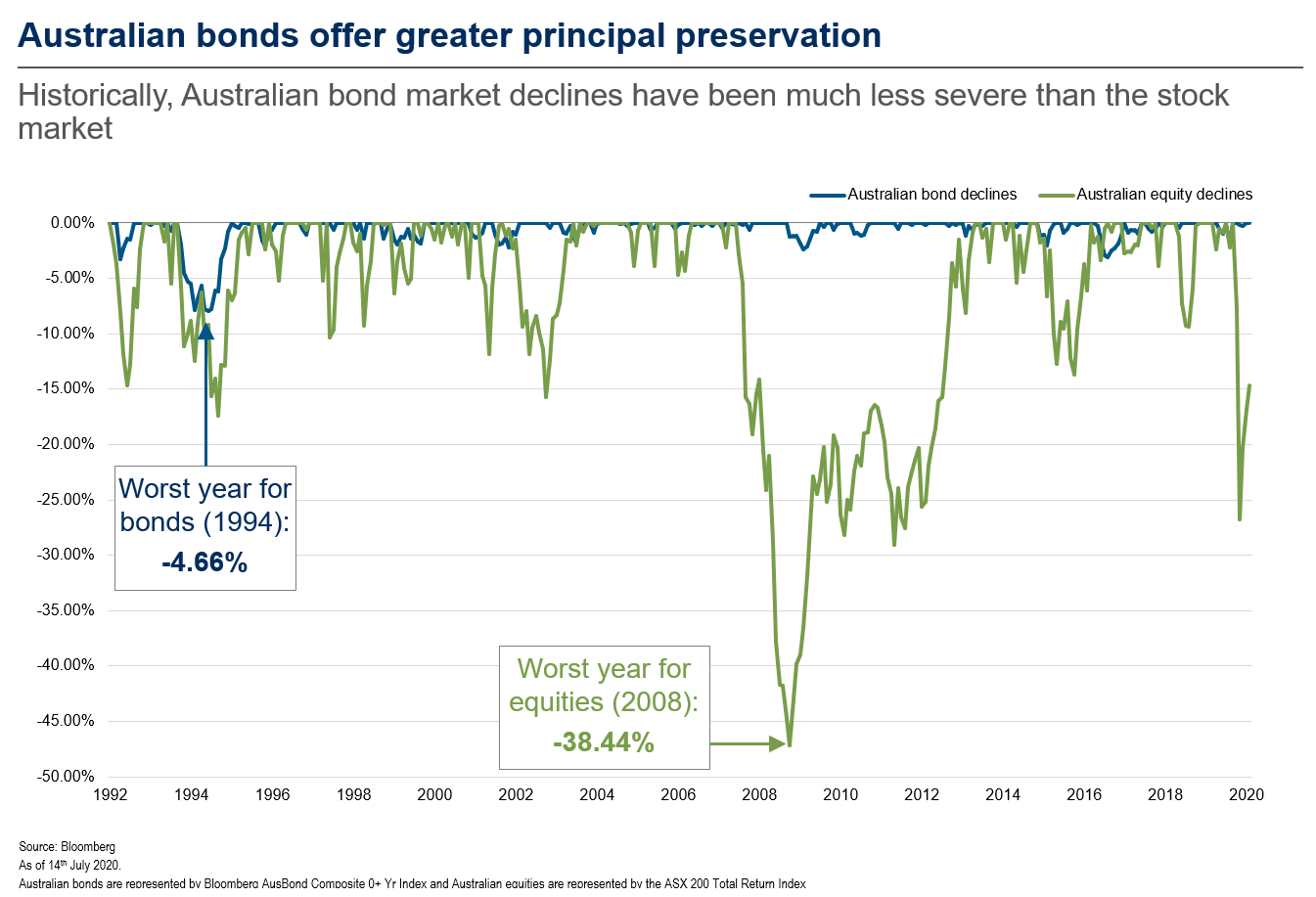

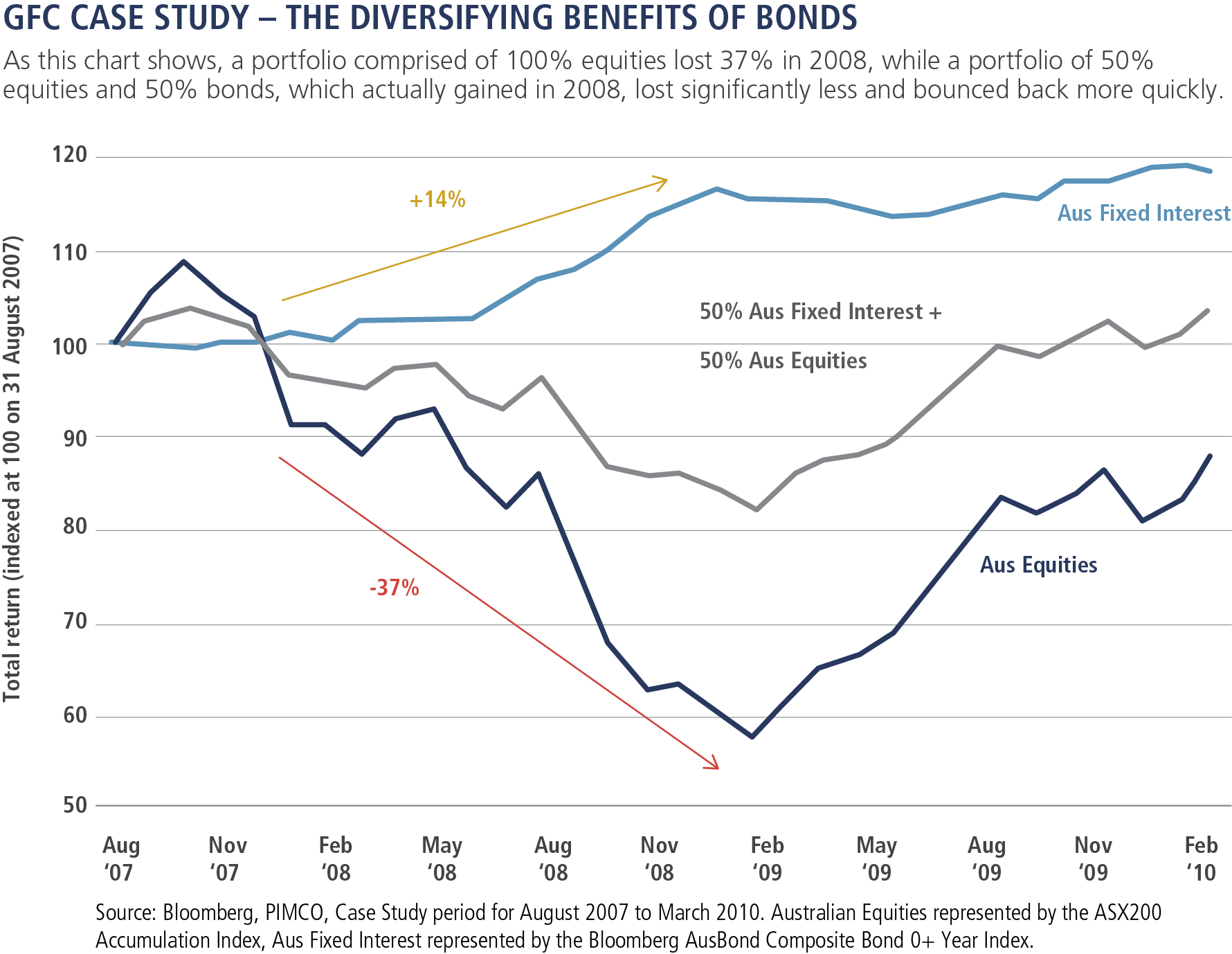

Historically, bonds tend to be much more stable than shares in market corrections and can be a good diversifier and shock absorber for portfolios, as we can see in figures 4 and 5 below.

Figure 4

Figure 5

This chart shows that a portfolio comprised of 100% equities lost 37% in 2008, while a portfolio of 50% equities and 50% bonds, which actually gained in 2008, lost significantly less and bounced back more quickly.

Overall, corporate bonds can play an important role in client portfolios. They can offer:

- Defence – lower volatility than shares and more stability through market corrections

- Income – at their heart bonds are an income investment paying fixed interest payments that can’t be varied or cut like share dividends

- Diversification – from equities, property and other riskier investments in a portfolio

Invest with the worlds premier fixed income manager

Want to find out how fixed income can play a role in your portfolio? Hit 'contact' to get more information, or click here to learn more about PIMCO's credit solutions and latest views on opportunities in the credit market.

1 topic

1 stock mentioned