A stock for the future: Electronics, Appliances and Automation

Mitsubishi Electric (ME) is one of Japan’s largest industrial conglomerates with a hugely diversified product range including air conditioners, refrigerators, car alternators and industrial robotic arms. In terms of earnings, Mitsubishi Electric’s (ME) three largest segments are:

- Electronic and Energy: railcar propulsion systems, stadium screens, power asset control systems and turbines, elevators, and escalators

- Home Appliances: air conditioning units, refrigerators, television screens, home lights.

- Industrial Automation: Control systems, AC servos, electro power steering systems, car navigation, electric car motors and inverters.

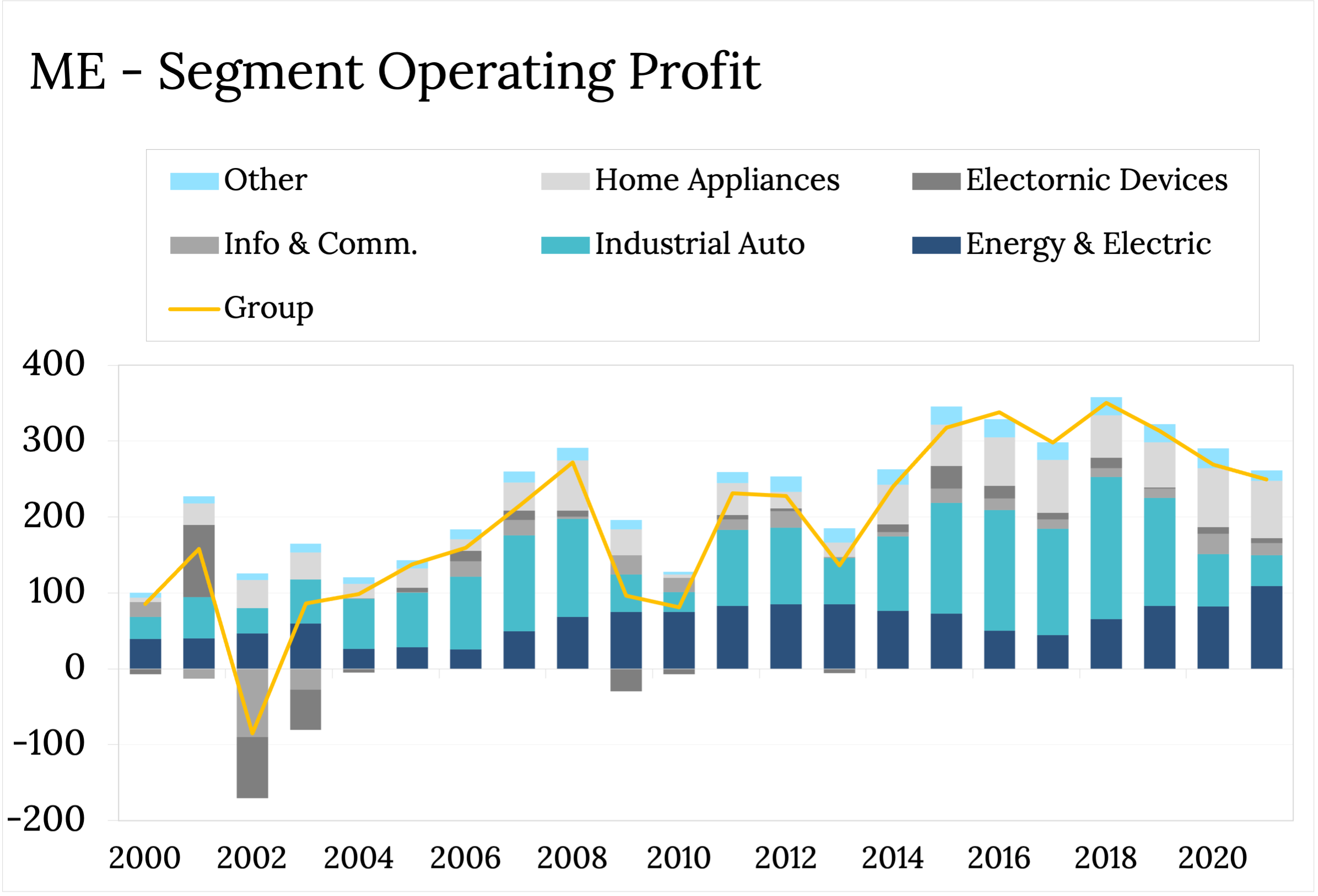

This scale and operational breadth are partly what attracted us to ME as diversification helps insulate the group from underperformance in any given business unit. For example, the strength in Energy & Electric and Home Appliances has enabled the group to partially offset the significant weakness in Industrial Automation, which itself was a function of weaker global auto demand (~50% of Industrial Automation sales are auto exposed).

Industrial automation - the ‘Jewel in the Crown’

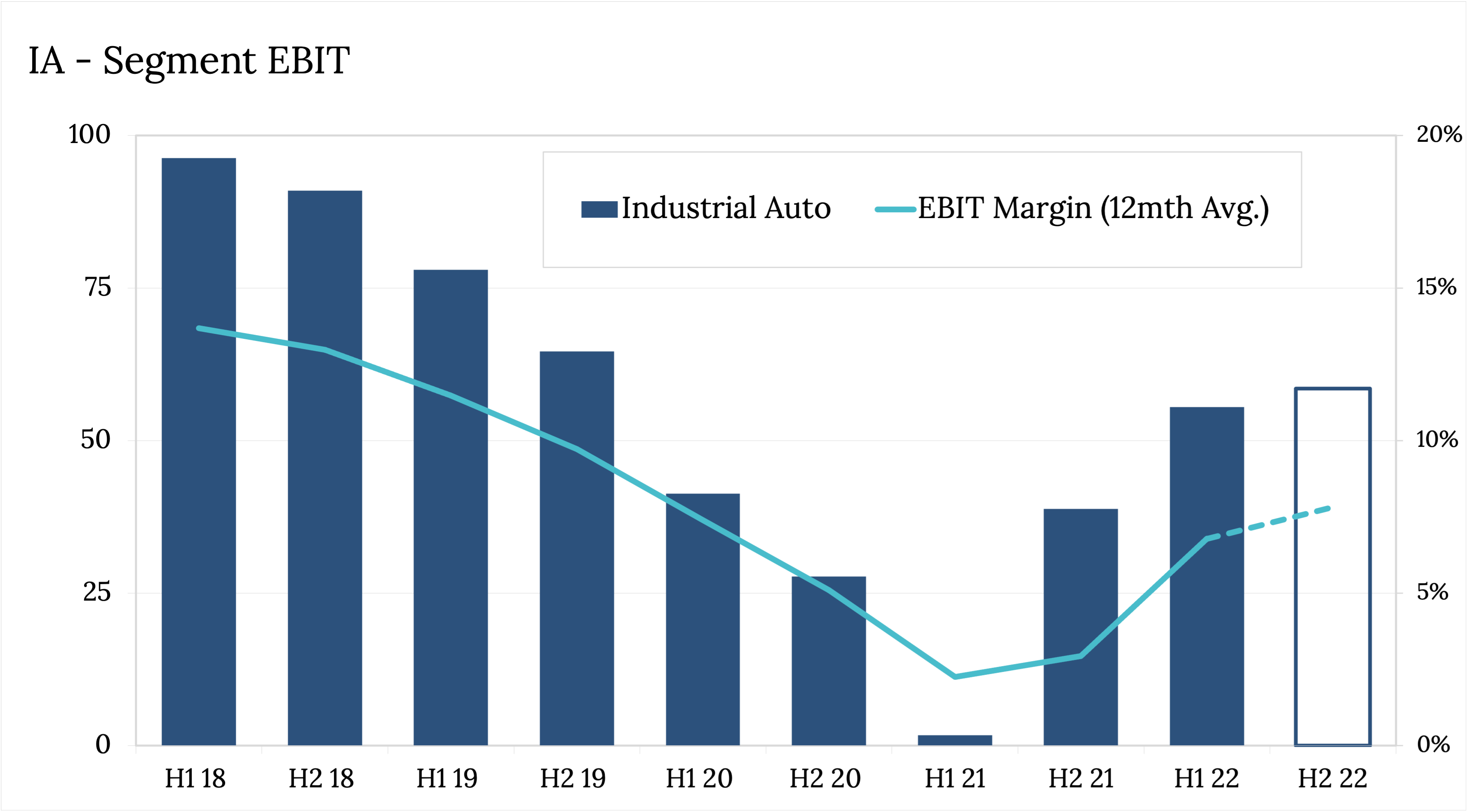

That said, the Industrial Automation business is the other key reason we were attracted to ME. Despite its cyclicality, Industrial Automation is a high-quality business with through-cycle returns which are both the highest in ME’s portfolio, and amongst the highest in its industry. This is partly a function of Industrial Automation’s massive installed base helping generate increasing levels of recurring maintenance and support revenues. Encouragingly, ME continues to deploy a reasonable amount of incremental capital into this high returning business with segment assets almost doubling from JPY740bn in 2009 to JPY1,300bn in 2020.

Recent operating results also demonstrate that Industrial Automation’s earnings momentum has turned the corner. For example, in the most recent half year result, the division delivered solid earnings growth, and FY guidance is implying more strength in H2 on the back of higher sales and margins. Encouragingly, overall returns in Industrial Automation continue to look reasonable on a through-cycle basis suggesting there is still good upside to earnings should the cycle remain accommodating.

Environmental and social benefits

In addition to this supportive cyclical backdrop in Industrial Automation, we think a large part of ME’s portfolio of businesses should also benefit from several structural tailwinds set to play out over the next few years.

As one of the world’s largest manufacturers of air conditioning units, ME will play a leading role in supplying some of the most energy efficient units to help drive down global GHG emissions. To demonstrate its commitment to reducing GHG emissions, ME has announced a net zero GHG target by 2050. As one of the world’s largest suppliers of electrical components to the transport industry, ME will also be front and centre in the electrification of various transport modes around the world. Additionally, ME should benefit from the likely increased demand for automation solutions as the world faces major demographic headwinds and shrinking labour pools. In addition ME screens very favourably in the ‘Social’ and ‘Environmental’ pillar of our ESG framework given the immense societal benefit of ME’s products and services, particularly as global economies begin transitioning to ‘new normals’.

Governance shortcomings and response

Typical of most diversified enterprises, one of the inherent risks and challenges ME faces is ensuring proper oversight of often far-flung local operating units. This became very apparent when the company announced that fraudulent product testing had been identified at some facilities within the Electronic & Energy segment.

While clearly disappointing from a Governance standpoint, ME has at least acknowledged the severity of these incidents and demonstrated a commitment to improving its internal risk management protocols. For example, both the CEO and Chairman have resigned, with the Chair to be replaced by an independent external candidate. The Board has also appointed an externally chaired committee to investigate each of ME’s 22 facilities (findings due in April 2022) and established a ‘Governance Review Committee’ to identify control improvements. Finally, ME has flagged US$260m in IT upgrades and the creation of a new ‘Quality Assurance Division’ to be led by a direct report into the CEO to enhance group oversight.

It is still early days, but we also take some comfort in the fact that these incidents have largely been confined to the Electronic & Energy segment and don’t yet appear to be widespread. Furthermore, while management have yet to quantify the financial impact of these internal control failures, we don’t think they will likely be material. In any case, ME has the balance sheet flexibility to fund any large potential liability with ~JPY500bn of net cash on hand (~US$4bn).

After the share price weakness, ME is now trading on an EV/Invested Capital multiple of ~1x, which is a level the stock has rarely traded below. The combination of decent valuation support and a strong balance sheet caps a lot of the downside potential from here.

Longer-term financial targets

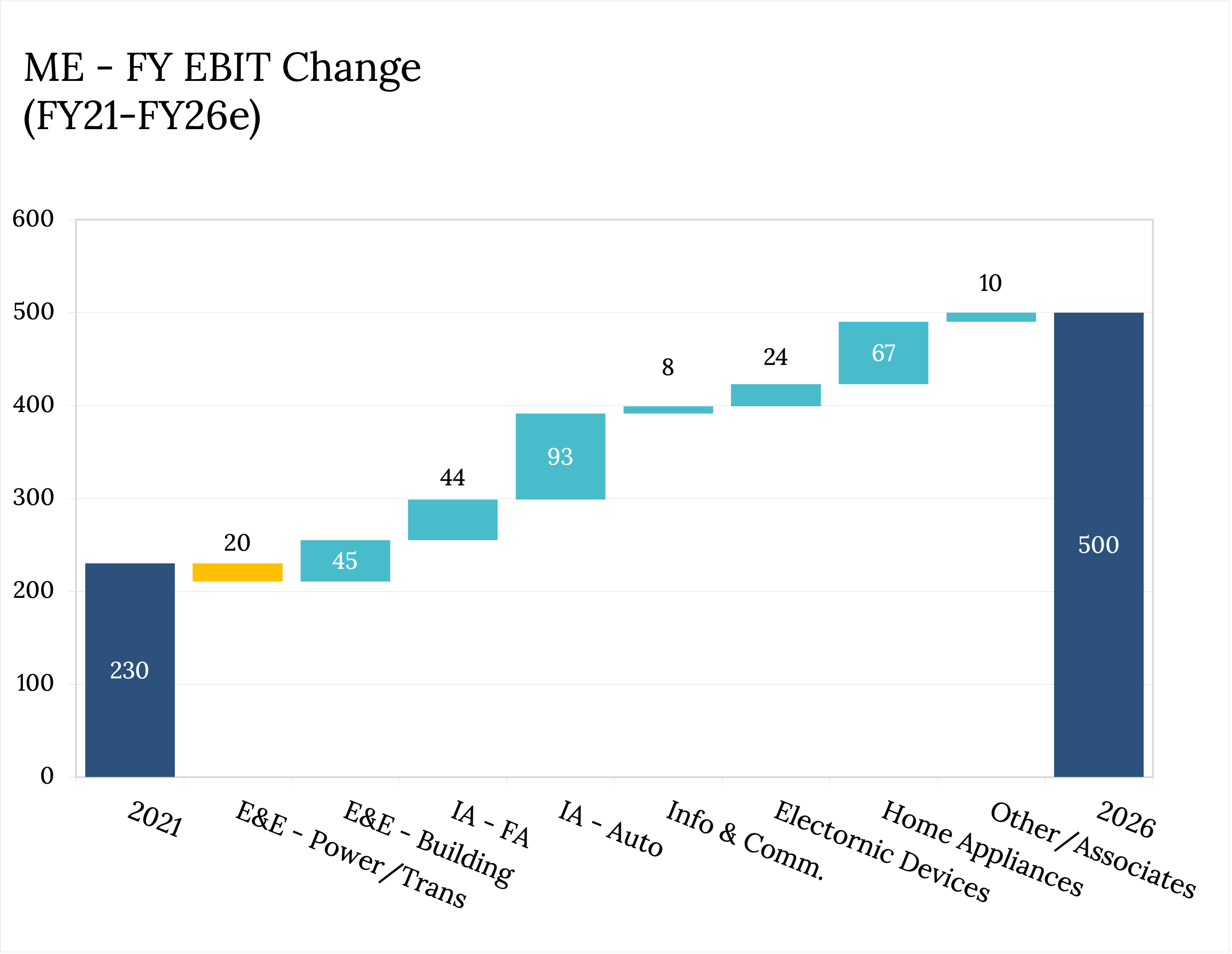

Management have set a March 2026 EBIT target of JPY500bn. This solves for a Return on Capital of more than 15%, which would result in a share price around 2,600 range, if the market capitalises those returns on a multiple of ~1.5x EV/Invested Capital.

While we think the assumptions underpinning this EBIT forecast look very optimistic, particularly the assumptions built in for growth in Electronic & Energy and Home Appliances, those for growth in Industrial Automation look far more reasonable. Using this guidance and applying far more conservative growth estimates for Electronic & Energy and Home Appliances then returns should trend to ~12%. Based on a multiple of ~1.2x EV/Invested Capital, a share price of around 1,900 looks likely (25% upside). As a cross-check, this implies an EV/EBIT of ~10x and a FCF Yield of ~6.5%.

While acknowledging the company still has a lot to do to remedy governance concerns, we think ME remains a very attractive equity given its exposure to several cyclical and structural tailwinds, a pristine balance sheet, some decent valuation support, and the ability to make good money even if financial targets are only partially achieved.

3 topics