A systematic approach to screening Biotechs

Little is more exciting than a speccy healthcare stock (The possibility of rapid price appreciation is probably only rivalled only by a good mining micro-cap).

As it happens, one of my first ever investments was in this space: Medical Developments International (ASX: MVP). After enjoying an impressively anaesthetising experience with their patented green whistle after a footy injury, I read about the product receiving approval to be used in the British military, as well as expansion into other European ambulance markets.

I didn't have a clue about what to pay attention to regarding financials at the time, so the subsequent share price rollercoaster was in hindsight unsurprising.

It served a good lesson though. When looking at Biotech companies, understanding the product and market size is of course essential, but so too is having a process to analyse their fundamental operations.

Given the lack of profitability in many cases, conventional analysis needs to be adjusted. In the first part of this biotech collection, we learnt about the lifecycle of a biotech. In the second part, our experts will share their insights into analysing them.

Responses from:

- Kanish Chugh from ETF Securities

- Dr Bianca Ogden from Platinum Asset Management

- Claire Aitchison from Independent Investment Research

Understand the complexity of the space

Kanish Chugh from ETF Securities

Biotech companies can be valued in the same way as other businesses: by analysing the value of their future profits. Their potential profits are heavily determined by their intellectual property (i.e. patents), which grant de facto monopoly overproduction of certain kinds of drugs. For this reason, an important factor to analyse is a biotech company's clinical trial results, which ultimately determine their future intellectual property and drug pipeline.

A red flag can be when the opposite occurs. Because patents typically only last 20 years, when they expire it can spell trouble for biotechs. These “patent cliffs” – when many patents expire all at once – can drive mergers and acquisition in the biotech space and be another driver of value.

There are also important differences with analysing biotechs that investors should know.

The first and most obvious is complexity. Biotech companies’ products can be challenging to understand. Every investor knows what TV shows are--Netflix’ primary product. And off the back of this comes the ability to assess Netflix competitive position vis-à-vis Disney, etc. But how many investors really understand nucleoside modified mRNA, as in coronavirus vaccines?

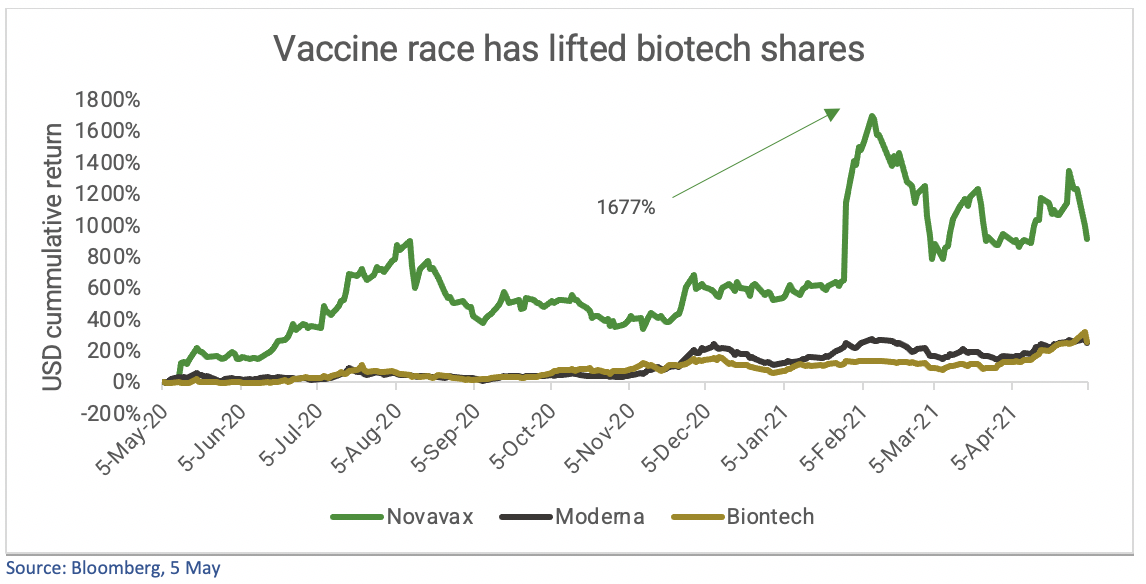

The second is the sheer unpredictability of clinical trial results. Only 14% of new drugs get final approval from the FDA. This means that when promising drugs have successful trials, biotech stocks can go to the moon. Novavax, for example, saw its share price jump 1677% in just 9 months after the success of its coronavirus vaccine candidate.

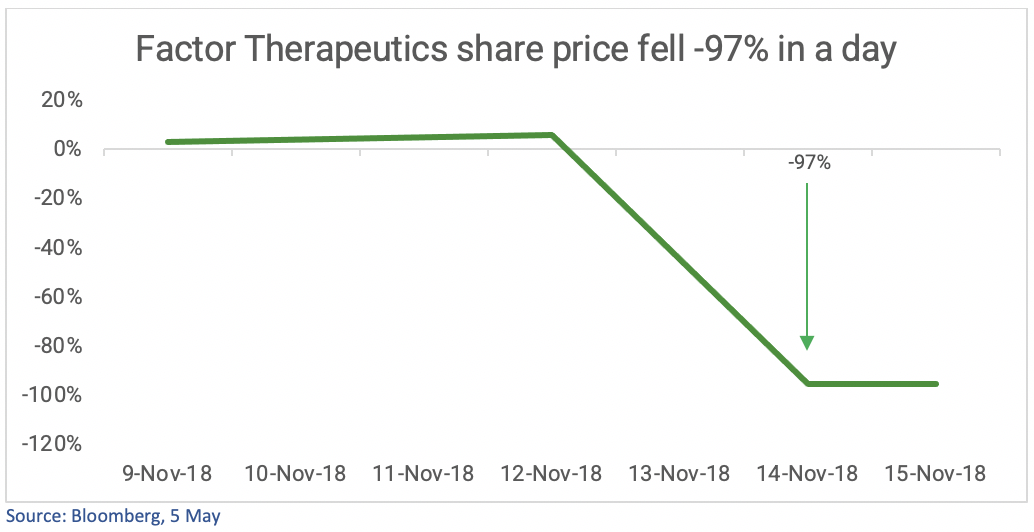

However this dynamic also works in reverse: when promising drugs or treatments flunk their trials, biotech share prices can fall like lead balloons. For example, ASX-listed Factor Therapeutics (ASX: FTT) saw its share price fall -97% in a single day after its wound dressing treatment was found to be ineffective. Because of the “binary” outcomes of clinical trials, biotechs can be popular with short-sellers.

Current innovation coupled with forward-thinking

Dr Bianca Ogden from Platinum Asset Management

Earnings won’t help you when valuing an exciting biotech – most of them don’t have earnings! Even if you find a company that has earnings today, and it does look optimally cheap (via a P/E or other metrics), it still doesn’t mean anything because the main franchise may have matured. Once again, it will rely upon the scientists in the lab to come up with something new. You need to understand what they are doing and the science backing it, as well as the teams behind the business activities, occurring.

It is important to understand how a company spends its money. There are many aspects to look out for, such as solid scientific thinking, appropriate experimental design, and excellent clinical and commercial approaches. Taking shortcuts and dismissing competition are red flags. You have to think years ahead and consider what the standard of care will evolve to, or what technologies are being developed at private companies. You always have to take a global perspective and you cannot dismiss private companies.

It's a marathon: sustenance is crucial

Claire Aitchison from Independent Investment Research

Biotech companies are often in the development stage and do not generate revenue. As such, companies need to be assessed on the technology, drug or device they are seeking to develop. Biotech companies offer a binary outcome, the treatment either works or it doesn’t. This is the risk investors take.

When looking at early-stage companies, where the company is at in the life cycle of a product is important. Typically, there is a greater level of risk for a company whose product is in the pre-clinical trial stage given the product is unproven and the product is at the beginning of its life cycle. New drugs can take 10-15 years to become approved for marketing. Companies in the later stages of development carry less risk in terms of the development life cycle, however, success will depend on the outcome of the final phase of clinical trials and the ultimate determination of the regulatory authority. Mesoblast is a great example of the volatility a company can experience based on the outcomes of regulatory decisions.

Given biotech companies are yet to generate revenue they typically rely on capital raisings to fund their operations until a product is out-licenced or approved for use by the relevant regulatory authority. Investors should be wary of companies that are required to come to market regularly to raise cash. If they are unable to raise sufficient cash, they may not have a valid prospect in the pipeline and they are biding time until they find one. A company with good cash coverage means the company is not going to have to regularly come to market and avoids potentially diluting shareholder positions.

Conclusion

With profitability out of the question for many biotechs, attention must be geared towards what they are using their capital for: Is their R&D delivering results and are they progressing through the necessary trial stages? Naturally, there is always a degree of complexity when it comes to understanding the product itself, and this is where research must be done regarding the problem it is aiming to solve and other products on the market. If not, it may not be a pretty outcome for shareholders; fortunately, I have heard a certain green whistle that is apparently a great way to wash away the pain.

Join me and our guests in part three of this collection, where our guest fundies will discuss the allure of the space and their tip for the next big discovery. In part 1, we unpacked the lifecycle of a biotech, an essential process for determining success.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series.

If you enjoyed this wire, please click like and comment below the biotechs you have on your watch lists and what drew you to them.

4 topics

2 stocks mentioned

2 contributors mentioned