A tale of two cities: Singapore and Hong Kong

As economies around the world recover from the Covid-19 pandemic, demand for global talent has intensified. This has played out in a pronounced way among two cosmopolitan Asian financial (and expatriate) hubs, Singapore and Hong Kong.

Lacking natural resources, these small economies need to attract and retain global talent to grow. And right now, one is clearly winning.

In his speech at the recent National Day Rally (21/08/22), Singapore Prime Minister Lee Hsien Loong announced new policies to attract and retain high-quality foreign talent. Hong Kong, mired in travel and Covid-19 restrictions remains several steps behind. The divergence is nowhere more apparent than in the office markets in each city.

In Hong Kong, strict Covid-19 policies and the demonstrations of 2019 contributed to an expatriate exodus that is proving hard to reverse. Hong Kong now has a striking hole in its once glamorous office market, having been home to the most expensive rents in the world, and by some margin.

While still claiming top honours, prime office rents are falling faster in Hong Kong than in other office markets globally however this cannot be wholly attributed to the departure of expatriates. In 2017, Chinese mainland corporates accounted for somewhere between 25-50% of Hong Kong’s leasing transactions. This trend has now slowed to a trickle1.

Singapore’s office market has been a beneficiary, recently toppling Hong Kong’s position as Asia’s premier financial centre. It has moved up to third place in the 32nd Global Financial Centres Index (GFCI)2, behind New York and London who led the index, and tellingly ahead of Hong Kong, which now sits in 4th position.

The economic growth outlook, normally a key indicator of office demand, puts Singapore ahead of Hong Kong at least for the next year. Government estimates have Singapore’s GDP growth forecast at 3-4% while Hong Kong’s is much lower at -0.5% to 0.5%3.

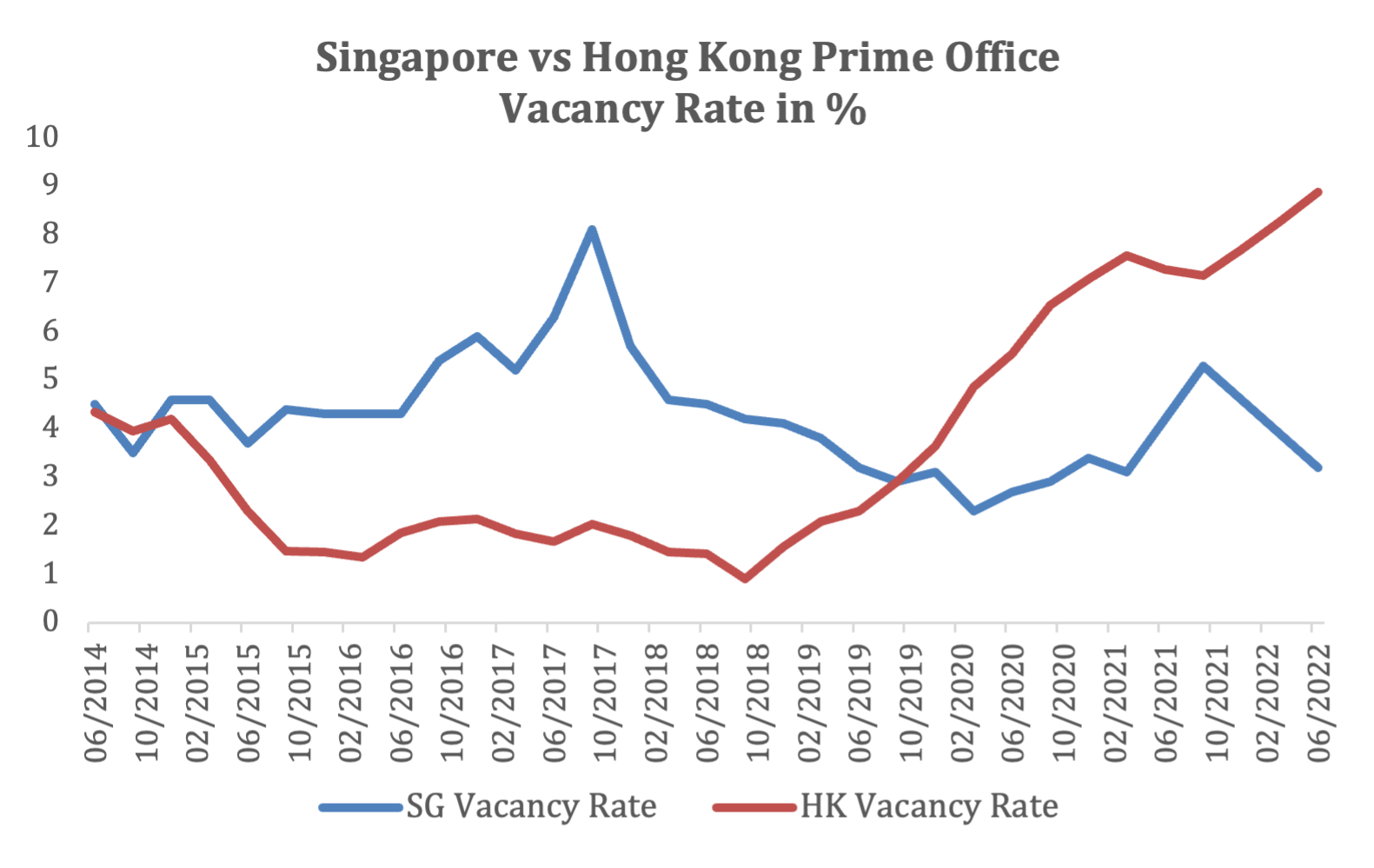

The chart below paints a stark picture of how the office markets have performed in these two cities. According to Colliers data at the end of June this year, the Hong Kong Prime office vacancy rate was at 8.9% and rising, whereas the Singapore Prime office vacancy rate at 3.2% and declining. For investors in Asia, the question is whether these trends will continue to diverge or reverse.

Recently, Hong Kong’s chief executive John Lee unveiled plans to attract talent, enterprises, and investment. Measures included visa and tax concessions for skilled workers returning to the financial hub and a cut in property taxes for non-permanent residents 4.

While these initiatives may improve sentiment, Hong Kong has an opportunity to consolidate its position as a strategic bridge between mainland China and the West as ‘Asia’s World City’5, which will be a driver for future demand in office space.

Particularly, Hong Kong is integral to the Greater Bay Area (GBA) project, occupying the key role of its international financial, transport and trade hub.

For now, we prefer the fundamentals of the Singapore office market. The vacancy rate and the rental trends data tell the tale of two cities – Singapore’s Grade A office market is expected to finish the year with rental growth gains of around 10% according to JLL6. This compares favourably to Hong Kong, which is expected to end 2022 with rental declines in the -3% to -5% range7.

For the Dexus Asian REIT Fund, now offering a running yield of 6.96%, our ~26% geographical portfolio allocation to Singapore – almost twice that of our Hong Kong allocation – should pay off8.

Broaden your income horizons

With over 35 years of expertise in property investment, funds management, asset management and development, we have a proven track record in capital and risk management and delivering superior risk-adjusted returns for investors.

We believe that the strength and quality of our relationships will always be central to our success and are deeply committed to working with our customers to provide spaces that engage and inspire. Click here to learn more about the Dexus Asian REIT Fund.

2 topics