A will to win: How Ausbil's Paul Xiradis built a $20 billion business

Paul Xiradis, or "X" as much of the street knows him, was pleasantly surprised when he got the call. After more than four and a half decades in investment management, and having built Ausbil from the ground up to the $20 billion funds management house it is today, X has been inducted into the Funds Management Hall of Fame.

It's an illustrious list, an award presented by the Australian Fund Manager Foundation, celebrating those who have made a significant, substantial and longstanding contribution to the Australian funds management industry. It includes the who's who of Australian investment royalty over the last 25 years - including Olev Rahn, Kerr Neilson, Anton Tagliaferro, Peter Morgan, Chris Cuffe, Geoff Wilson, Catherine Allfrey, John Sevior, Phil King and more.

.jpg)

Over the past 25 years, the awards night has raised millions for its charity partners, Odyssey House NSW and the Sydney Children's Hospitals Foundation, as well as various other charities.

Given Ausbil's funds are truly some of the industry's top long-term outperformers, the recognition of X's "will to win", as Ausbil's co-head of equities John Grace put it, is well-deserved and arguably overdue.

The first person he called was his wife - a testament to the importance of family in X's life - an award he wanted to share with her given the sacrifices they made early on to get the business up and running.

"It was 1997, I was approaching 40, we'd just had our third child, which was a pretty big commitment, and had to put in my hard-earned dollars into establishing this business," X recalled.

"There was a fair bit of risk money involved. I had to remortgage my home to find the funds to do so, but I decided that the reward would be there if we worked hard. It's been a lot of hard work to get to where we are today."

At a time when markets were tough and investment managers were split into either the value or growth styles, X had a bold vision - one that would see the firm break even in just 18 months.

Instead of focusing on one bucket or the other - X innovatively abandoned the status quo and went about convincing the market that a "pragmatic core" or style-agnostic approach could help investors add value regardless of the market cycle.

"That wasn't looked upon very fondly by consultants initially, but over time, because we proved that we can actually add value in good times, bad times, growth markets or value markets, it's now a recognised process," X said.

The major breakthrough came five or six years later, when Ausbil won its first big institutional mandate - a quarter of a billion dollars. "Big money at the time," X said, although I would argue it still is. Ausbil won a "flurry" of mandates thereafter. That first big win, a major industry fund, is still a client decades later.

In this interview, X shares some of the major lessons from his decades in markets, the mistakes that have made him a better investor today, the importance of a great team, and why he isn't planning on hanging up his boots for quite some time.

He also shares how he is thinking about markets today, where he is seeing opportunity on the ASX and a high conviction stock pick for the next 12 to 18 months.

.png)

The making of X

It wasn't until he started working in finance that the pseudonym "X" was born - mostly out of necessity as his colleagues couldn't pronounce or spell his last name.

He started his career at Westpac, working his way up from general banking into investment management. In the "old days", the banks forced their employees in investment management to be across every asset class - from fixed income to global equities, Aussie large caps and small caps.

It's rare, nowadays, for fund managers to competently understand the interplay of these asset classes, X said, which likely isn't great for the end investor.

"Being exposed to those asset classes very early in my investment career and then understanding how each asset class interrelates with each other, the diversity impact and also the benefits because we were managing diversified funds," he said.

"That was very pivotal for me, in the sense that I was exposed to the many facets of investment markets, and it was where I discovered my love of markets, particularly equities."

X left Westpac and joined AFT in March 1987. Black Monday came a few months later in October.

"Prior to the crash, the view was that no matter what you did, you were going to make money because it was a bull market and no matter what you invested in, you could add a bit of value. It seemed and was pretty easy," X said.

But as the saying goes, all good things come to an end - and in these periods of distress, an investor is truly tested. Despite the market falling by 25% in one night, X would go on to have one of his best-performing years. And it all came down to a few realisations.

"One thing I recognised in that period was that good companies and strong business models are essential and do well in an uncertain world. I realised that concept stocks and small illiquid stocks were going to be the death of any portfolio manager if they weren't careful. And I came to understand that liquidity was essential," X reflected.

That was a turning point, X said, and since then, he's kept his eyes laser-focused on quality stocks and liquidity - the ability to be able to move the portfolio as circumstances change.

"You should be in control of your portfolio, not let the portfolio control you," he said.

Lessons from more than four decades in markets

Unfortunately, we all make mistakes - whether you misread something, or something occurs out of the blue - but humble investors choose to learn from these mistakes rather than trying to eliminate them completely.

"You've got to realise that not every portfolio, or every stock you have, is a winner, but you want to make sure that every stock that you have within the portfolio has a prospect of actually adding good value, over and above what you think the market will deliver," X said.

Another lesson, having been exposed to a number of different cycles over the last 45 years, is that periods of adversity, like when markets are dislocated, are when the greatest opportunities arise.

"Having a level head, learning from experience, doing the work, having a level of conviction to follow your instincts and also perceive value creates some fantastic opportunities," X said.

"You have to have the ability to see the woods from the trees, make sure that you do the work and also understand the psyche of the market because the markets can be so self-fulfilling in a lot of ways."

In other words, be greedy when others are fearful, and fearful when others are greedy.

So, where are we in the market cycle today?

Markets are not cheap, and investors should expect a fair bit of volatility from here. However, X is positive that over the next period or so, equities will continue to prosper.

"Part of the reason I say that is that I believe that interest rates are going to trend lower. I believe that after some weakness and softness in economic activity globally, we are in a period of pickup," he said.

"With rates coming down and activity starting to improve on a forward basis, we believe that there'll be broadening in the improvement of underlying earnings, which is generally pretty good for equity markets. However, we do recognise that equity valuations are high and therein lies a risk because things can deteriorate rather quickly."

That's not something investors need to worry about, though, particularly if they carefully review their portfolios and take the below on board.

"Make sure you have a good liquid portfolio, make sure you have quality companies that you are invested in, and make sure you can adjust your portfolio when the circumstances do change," he added.

Challenges and opportunities over the next 12 months

"I think there's a high degree of complacency that interest rates are definitely going to be decreased and there's definitely a lot of complacency that inflation is under control," he said.

"The risk is that it may not be. And if we do cut too aggressively, we could re-engage economies to the extent where inflation does come back in a big way. And that could be really unsettling as far as the market's concerned."

That said, X believes investors should expect a broadening of earnings growth across the market and argues that after a period of economic softness, we should see a pickup in activity.

"That does imply that you want to be more exposed to cyclical companies. Steer away from companies that were the beneficiaries of higher rates," he said.

"Nowadays, the market gets to those conclusions rather quickly and you can find that people are already positioned for that to occur. Valuations can get extreme and the market can get ahead of itself. So, it's important to have an appreciation of where you are within that. That is a challenge."

He still sees REITs, for instance, as an opportunity, despite the sector soaring 40% since November last year. However, he warned that if interest rates need to be jacked up again, that could unravel quite quickly.

While the AI thematic is taking the market by storm, X prefers to play the theme through a safer bet.

"I think the market is probably underappreciating the pickup globally in electrification and electricity demand," he said.

"It's driven by a number of different factors, some that are well known, such as EVs and the electrification of things, but also increasing extreme weather events - so, heating, cooling and maintaining base load power are becoming far more important."

Investors can play this energy opportunity through utilities, but also other enablers such as copper, other metals, engineering services, and companies exposed to nuclear power.

"There are a number of different areas which we think look interesting to us and it really is being driven by the increased demand for electricity generation to power the requirements of this new modern world that we are living in," X said.

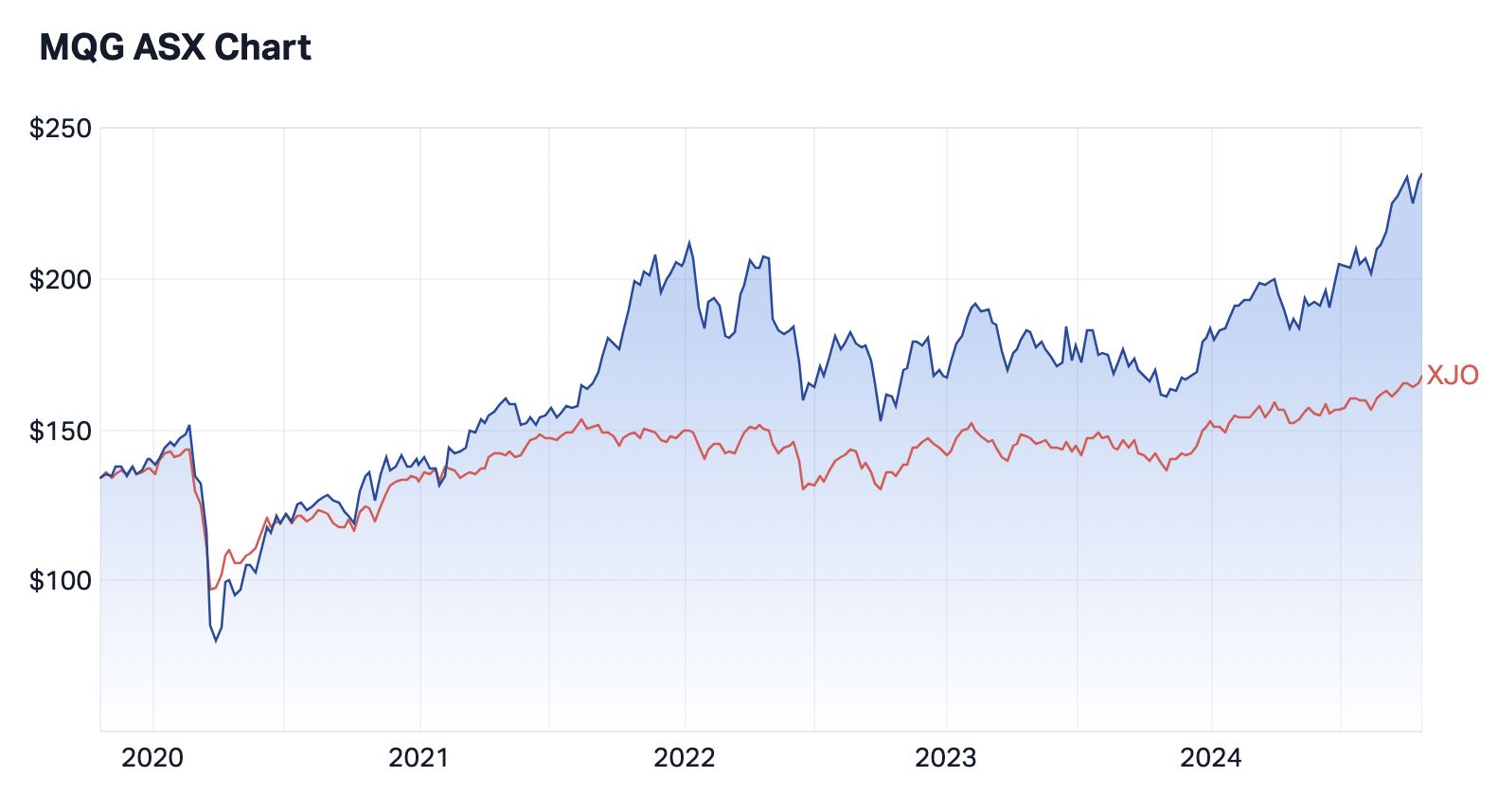

For example, X has high conviction in Macquarie (ASX: MQG) - a company that has a number of different drivers and should benefit from this environment over the next 12 to 18 months.

"I think it's really well placed. It has been invested for many years in new power generation, which has been well seeded and offers good growth and actually will be harvested over the next few years. They also have great exposure to data centres across the globe, even beyond the recent success of AirTrunk," he said.

In addition, with a more volatile world on the horizon, Macquarie can benefit - particularly from commodity volatility through their risk management solutions for their growing client base, he added.

"We will be living in fairly volatile times and commodities are fairly volatile. Macquarie benefits from that through their business and you've seen them do incredibly well with that," X said.

"So, I think for me, if you've got lower interest rates, you've got data centres, you've got increased demand for energy, and we're also going to be living in more volatile times, Macquarie should be the net beneficiary of that."

Family, culture and nurturing the next generation

While others in similar positions may have stepped away from the tools, there's no sign that X will be slowing down anytime soon.

When it comes down to it, he loves investing - he truly, undoubtedly loves what he does. He relishes debates with his team, providing fresh perspectives, and having thought-provoking conversations with colleagues. That said, he's learning to enjoy the other parts of his life.

"I travel twice a year - normally to Europe and the other area that we go to is Hawaii. But I am a person that can get bored rather quickly. While I am away, I'm thinking about markets, and I can't wait to get back to the office. It's still in me," he said.

"I also have young grandchildren, who I really enjoy spending my time with. Most weekends, they're at our place. My wife is a typical Greek mother and grandmother, she loves the family and cooking. We enjoy that, but I also enjoy working, so I'm not ready to hang up my shingles yet."

That's not to say he doesn't have a strong bench for when he does eventually decide to retire.

"We have been nurturing people along the way. People who believe in Ausbil, believe in our process, people who really want to carry it forward," he said.

"We've got diversified products, very experienced individuals and people who have been within the business for many, many years."

He's not lying. The staff turnover at Ausbil is next to zero. Really, it's because X regards the Ausbil team as an extension of his family - and is steadfast in celebrating the team's wins, both big and small.

"It is a family culture, but that doesn't mean that we're not professional in what we do. And that's not saying that we are lenient or turn a blind eye to people not doing the right thing. But equally, that means that it's nice to have a place where you can enjoy work and bring people along the way," X said.

.jpg)

This dedication to culture seems to be working.

Khay-Tuck Chow, Ausbil's quantitative expert, described X as "caring, kind, brilliant and surprisingly funny" - a man who is always there with guidance on everything from career to life.

Meanwhile, John Grace, Ausbil's co-head of equities, argues he has a "will to win" which sees X "up most nights, whether he’s at home or on holidays. He always focused on markets, he’s always watching - he never misses a beat.”

Nicholas Condoleon, Ausbil's deputy head of Australian equities, added that X is “loyal, smart, strategic, considered, consistent, patient, unflappable - regardless of what’s going on in the world or equities markets, he always remains calm and can see things clearly."

He describes working at Ausbil as the best job in the Australian equity market - mainly because X "treats everyone at Ausbil like an extension of his family and that’s what makes it such a unique place to work," but also because he gets to learn from the "Warren Buffett of Australian equities."

"During the two most significant equity market events of the last 18 years that I’ve worked at Ausbil - we’ve been through the GFC and the global pandemic - and on each occasion, I distinctly recall being at X’s office - and asking him why he was doing this with his portfolio - and he responded because everyone else is doing the opposite," Condoleon recalled.

"He’s an independent thinker, he doesn’t follow the herd in equities markets, and I think those moments really crystallise him as an investor. I think that is key to understanding Ausbil's performance - the way that he reacts differently in those tumultuous periods."

"He gets the big calls right - like avoiding the bubble in listed property trusts before the correction in 2007 and 2008. Or not becoming too defensive during the pandemic in 2020 when others capitulated. These decisions have been very good for our investors," he said.

2 topics

1 stock mentioned

1 contributor mentioned