Access to Super? A stake in your mortgage? Have we got the answer to Australia's housing affordability crisis?

There are some things you can count on to appear in a Federal Election campaign - climate change, taxes, high-speed rail, and the subject of this particular wire - housing reform.

The last week of the election campaign has seen the rebirth of a controversial policy measure that could allow young people to access their superannuation balances as an aid to buy their first home.

However, a range of pundits, analysts, and even super funds have already called out the approach (again) saying that house prices will increase if the policy goes through - and not on a one-for-one basis either. Not least independent economist Saul Eslake who said on LinkedIn this week that the policy will be "greeted with despair".

Does anyone learn, Saul notes?

Even Senator Jane Hume (VIC) told Radio National that the policy will admittedly lead to a "bump" in the cost to buy a home.

In contrast, Labor is proposing an equally radical and controversial concept - let the government buy a stake in your home, which could be as much as 40% for new homes. When that home is sold down the line, the same proportion will be taken out of the selling price from your take-out total.

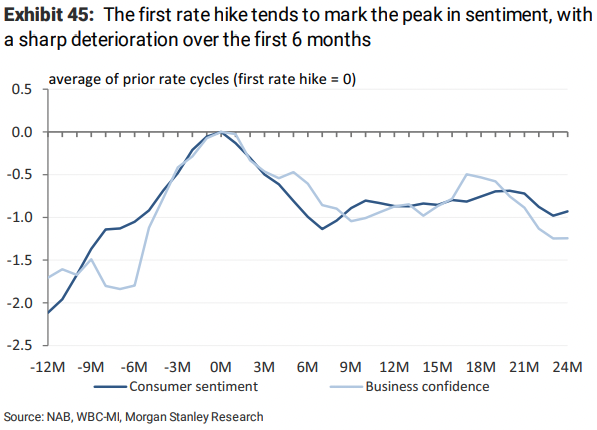

Either way, prospective home buyers are already taking notice - as this Morgan Stanley chart shows.

Remember, we're just talking about the cost of buying a home. We haven't even started on all the other taxes and payments which come with it!

An industry view

The industry view on the use of superannuation in buying your own home is clear - don't do it. Industry Super analysis predicts that house prices will go up if the policy is implemented - whether you use the scheme or not.

A 30-year-old on the median wage with a $20,000 starting balance could be between $14,700-$29,100 worse off at retirement.

Novel solutions

In amongst all this, economists are split on how best to handle the housing affordability crisis. Like Peter Tulip of the Centre of Independent Studies, some argue that the answer is supply and demand. Some estimates put the housing shortfall at 160,000+ by 2032 as the population trends renormalise and international migrants return to our shores.

Others have proposed more unusual solutions including the creation of a national housing developer or even more initiatives to create more social housing. Either way, a lot of shrewd observers have come to the same conclusion - housing "reform" usually resembles more of a band-aid rather than surgery.

Although I am perfectly aware those are not comforting words especially when the RBA's own research shows the debt to take on house prices is looking messy at best, shocking at worst.

So what is the answer? This wire will take a look at some of the options on the table, and most importantly, whether any of them are realistic.

If you want to talk about inflation, you must talk about housing

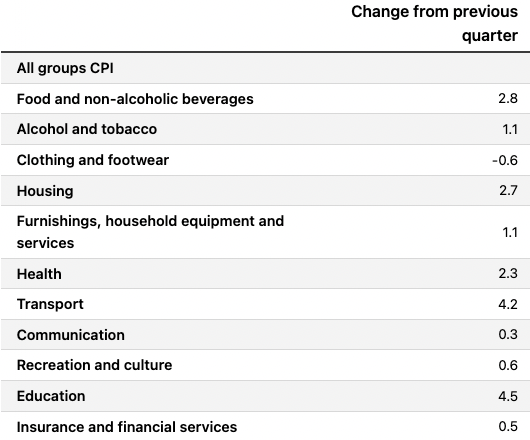

In an email conversation I had with Damien Klassen of Nucleus Wealth this week, I was actually reminded of an important point. The most significant, core influence on inflation in Australia is actually housing as this table shows:

Damien says he has no problem with the introduction of a super-for-housing policy but he does think that it doesn't address the crux of the problem.

"Do I have a problem with using super? Not really. Except that housing already has a raft of tax breaks, and superannuation is yet another tax break. And so, it will be doubling down even further on tax breaks for property," Damien says.

"Both parties want to help homeowners buy, neither is helping to lower the ongoing cost," Damien adds.

Unsurprisingly, Damien firmly believes rising rates will be the biggest issue for housing affordability. With the ratio of mortgage payments to rent already at record highs, Damien argues that consumers are going to start realising that paying more than twice as much a month on your mortgage repayment than a rental property just won't cut it.

Putting all your eggs in one basket

For investors, the way you may most likely think about owning additional properties is as a hedge against inflation. Louis Christopher from SQM Research says it probably won't be different in this cycle.

"Real estate has historically been perceived as an appropriate hedge against inflation and I believe the community will look to real estate once more if the RBA fails to tame inflation," Louis says.

Like Damien, Louis believes we're not addressing the core part of the problem. He thinks using superannuation will not dampen prices in the medium to long run - in fact, give it another year and if this policy gets up without a recession, prices could be back on the rise by the end of next year! Further, dipping into your retirement fund would only increase your personal finance concentration risk.

"Having close to nearly half of one’s superannuation in a home breaks the recognised benefits of asset class diversification and potentially puts a significant amount of one’s retirement savings at risk of a major housing downturn on an asset that is usually highly geared to begin with."

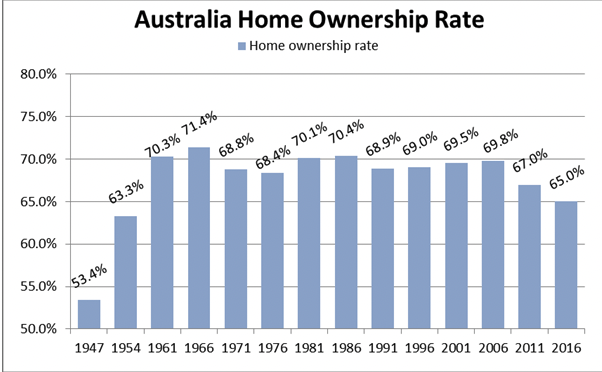

Chart of the week: who wants to own a home?

Louis also passed on a chart that I find fascinating. It is a steady and slow decline in homeownership in Australia based on our national census.

The point that Louis is trying to make is that no matter the grant, subsidy, program, or indeed policy measure, there is no evidence that any of these schemes have actually had an effect on homeownership rates. There's been no hindrance (apart from soaring prices) but the options placed on the table don't exactly help either.

Conclusion

At the end of all this, one of these two options will end up becoming the official solution to our housing crisis. Whether you believe it's a band-aid or the start of something greater, you cannot argue with how long we've been talking about this. To prove it, here is a direct quote from an article dating back to June 2010 featuring economist Harley Dale:

We're seeing a lot more debate about constraints on the supply of new homes, and federal and state governments are beginning to introduce policies to boost the housing supply. Hopefully we'll turn a corner.

It's funny how the more things change, the more they stay the same... unfortunately.

5 topics

1 contributor mentioned