Add growth and diversification to your portfolio with an allocation to resources

What motivates investors to incorporate this asset class into their portfolios?

Natural resources are the essential building blocks of daily life and continue to underpin our economic and social progress. The long-term trends of growing populations, prosperity and urbanisation, particularly among developing economies, are leading to rising global consumption growth rates of natural resource minerals, energy and food.

Developed economies are shifting towards renewable energy, electric vehicles, and bringing supply chains back home. This transition requires the development of new infrastructure, which investors increasingly understand can create opportunities for their portfolios.

The supply side of the natural resource sector is also looking promising and another reason investors are motivated to incorporate a resource-specific allocation within their portfolios. Urbanisation and changing weather patterns are reducing the availability of farmable land, while mining companies are being cautious with their capital expenditure due to rising costs. Oil companies are paying down debt and buying back their stock in order to reinvest in their businesses. As a result, many natural resource companies have strong balance sheets, enabling them to navigate through volatile times and take advantage of opportunities for their shareholders.

Investors are particularly interested in sectors including the major oil producers, uranium, gold miners, lithium, and copper. These areas have the potential for profitability and growth, especially since they align with the global movement towards decarbonisation and the increasing adoption of renewable energy sources and electric vehicles.

By adding natural resource companies to their investment portfolios, investors can benefit from the growing demand for resources and take advantage of the potential for long-term value creation in a rapidly changing global landscape.

What’s the outlook for commodities in 2024: Where are we now and where are we going?

Softness in China’s economy, among other things, has led to a weak year for natural resource shares relative to the broader equity market in 2023.1

However, as we head into 2024 we feel that having a well-diversified exposure to natural resources has rarely looked more important.

While geopolitical matters are almost impossible to predict, we think it is possible that 2024 could bring something of a “return to normal” in the macroeconomic environment. Over the past four years, commodity markets have been rocked by everything from COVID-19 and China-US trade tensions to fighting in Ukraine and the Middle East. As these conflicts reach some resolution in 2024, political attention in the US will turn increasingly to domestic affairs ahead of November’s elections. In our view, any return towards normalised trade and geopolitical relations would be positive for natural resource companies.

Thankfully, our positive outlook on resource shares is underpinned by secular trends that are somewhat easier to assess or predict. First, the world’s population is still growing – the United Nations estimates that the Earth’s population passed eight billion in 2022 and will pass nine billion before 2040. Most of this growth is coming from developing countries that continue to pursue higher standards of living, including reducing the considerable gap between their consumption of food, energy, and materials versus developed countries.

Secondly, developed economies are in the early stages of shifting to renewable energy, electric vehicles, and the reshoring of supply chains. This will require the upheaval and duplication of existing infrastructure and will be very resource-intensive. For example, a report released by the International Energy Agency (IEA) suggests that keeping pace with current emission pledges would require around 80 million kilometres of power line installations or upgrades by 2040, an amount equivalent to the existing global grid.

In our view, the developing nations trend referred to above could blow the IEA’s prediction of peak oil demand by 2028 out of the water. Meanwhile, the developed nations’ shift to renewables could lead to even greater demand for certain metals and materials than we saw during China’s urbanisation drive in the 2000s.

What are the biggest risks for commodities in 2024?

We believe that many natural resource shares have already priced in a lot of potential risks related to slower economic growth in the US and China. A less heralded risk is what will happen if funding and regulatory factors prevent responsible companies from producing enough energy and materials to maintain and grow standards of living. This could lead to higher sustained costs for commodities and disruptive price spikes in times of geopolitical turbulence. Although supply shocks can bring bumper short-term returns like those seen in 2022, we are of the view that they help nobody – both producers and consumers – with both benefiting from manageable prices rather than chaos.

Another underappreciated issue is that the natural resource sector is failing to attract a broad enough range of talent to science, technology, engineering, and mathematics (STEM) roles in the sector. These careers entail working on some of the most important challenges to society – most notably the need to provide life-enriching resources while minimising the environmental damage for future generations. Attracting new talent and different ideas from underrepresented groups like women and minorities could lead to a significant payoff for society.

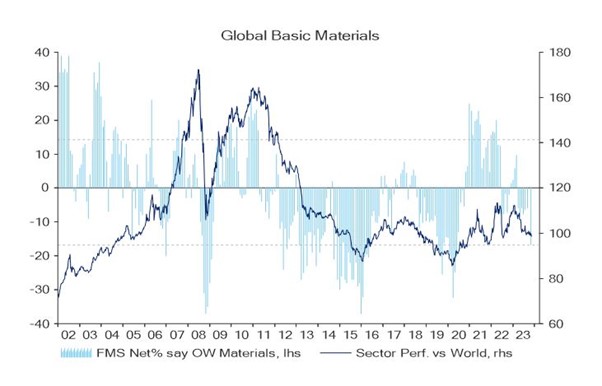

Given all the above, one could argue that natural resource companies play a bigger role in the world’s future than ever before. Yet most investors have minimal exposure to these companies (Figure 1)

Figure 1: Global investors are underweight metals and mining companies

Why should investors consider commodities above all others in 2024?

Investors should consider the natural resource asset class above all others in 2024 due to the compelling opportunities it offers. An allocation to natural resources can provide global equity-like return outcomes achieved via a different path while also providing diversification to the ‘magnificent seven’ technology companies that are so predominant in investor portfolios today. Its low correlation with traditional equity and fixed-income assets helps mitigate risk and enhance portfolio stability.

As the global demand for resources continues to grow, driven by population growth and the pursuit of higher living standards in developing countries, this sustained demand is creating a strong foundation for potential long-term growth and profitability.

The transition towards renewable energy and the shift to electric vehicles present significant opportunities for resource-intensive industries. The need for infrastructure development, supply chain reshoring, and the adoption of clean technologies all open doors for enabling natural resource companies to thrive.

Finally, the supply side of the natural resource sector is favourable. Low mining capital expenditure and healthy balance sheets of major companies position them to navigate volatility and capitalise on value creation opportunities.

Considering these factors, investing in the natural resource asset class in 2024 allows investors to align their portfolios with global trends, access diverse growth prospects, and potentially generate sustainable returns in an evolving economic and environmental landscape.

What investments have you made recently to set your portfolio up for 2024: What are your top three positions heading into 2024?

In the final quarter of 2023 we reduced the oil & gas exposure in the portfolio that had performed well, and sold a few positions that were failing to deliver on expected returns, The companies we increased investment in were in the mining, uranium and paper sub-industries. Gold has recently traded above US$2,000/oz and project growth, along with operating efficiencies, are both positive for the sector. Copper has been resilient, and numerous production disruptions and closures are tightening the market balance. Iron ore is remaining strong, and corporate activity is high.

There has been an active market in energy mergers, with Exxon (NYSE: XOM) agreeing to purchase Pioneer (NYSE: PXD), and Chevron (NYSE: CVX) agreeing to purchase Hess (NYSE: HES). The activity in lithium is very high, and we expect there is more to come in the gold industry.

Our key overweight sectors are in uranium, copper, lithium, and gold. For individual positions, our top three overweight companies are Ivanhoe Mines (TSE: IVN) in copper, Cameco (NYSE: CCJ) in uranium and Agnico Eagle (NYSE: AEM) in gold.

The chart

The resource sector had a strong performance in 2003-2007, gaining over 300%. Many projects were built and the rapid continued industrialisation and urbanisation of China drove a ‘super-cycle’ in equity returns for resource companies. With the GFC (Global Financial Crisis), resources slump (2014-1015) and, to a lesser extent, the COVID-19 disruptions, resource equities had many ups and downs but overall marked time with no net new gain for 13 years (2008-2021). This is quite extraordinary and has driven much interest and capital away from the sector. In a classic cyclical way, this sets the stage for the next boom. The first light has emerged post-covid with resource shares up around 19% (2021-2023). Given that the world industrial economy is pivoting towards electrification of transport, renewable electric generation and battery storage of electricity, we view the coming growth in demand for resources to be a greater driver than the China led demand and expect this area to have many interesting and rewarding opportunities for investors in the years ahead.

Learn more about the future of resources

Our team invest in high-quality mining, energy and agriculture companies with the flexibility to invest across the supply chain, taking advantage of price shifts between upstream and downstream sectors and across industries. For further information, please visit the fund profile below.

1 S&P Global Natural Resources Index vs MSCI World in USD terms, year-to-date to 8 December 2023. Past performance does not predict future returns.

5 topics

1 fund mentioned