After the rally. What is the fair value of the 10 year?

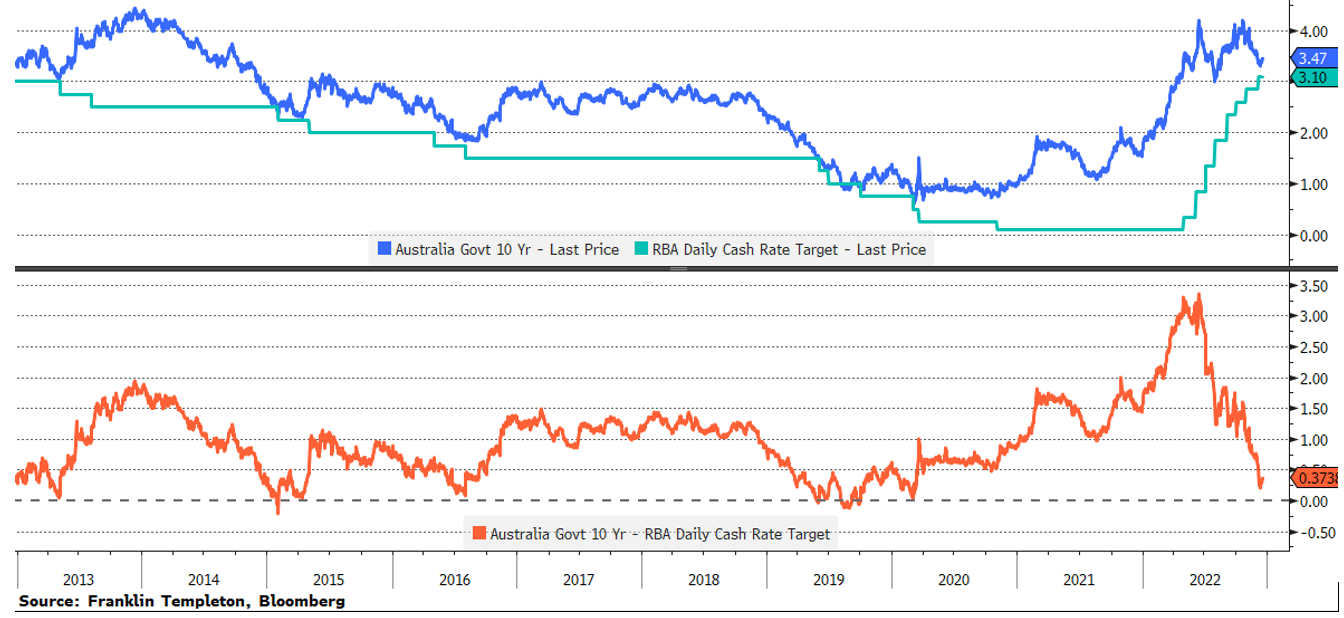

A much welcome rally in bonds over recent weeks has seen the Australian 10-year government bond yield fall by around 80bps from its high of ~4.20% in mid-October to ~3.40%. With the cash rate now at 3.1%, this is a premium of only 30bps - the lowest since 2019. The US 10-year treasury over the same period has rallied from around 4.23% to ~3.5% which has been a significant driver of the move in local yields as is typically the case.

The move lower in 10-year yields has dramatically outpaced yields in the shorter end of yield curves. In the case of the US where the 2-year yield sits at ~4.25%, the 2/10 curve is at near record inversion levels. The Australian yield curve remains positively sloped largely as the market projects a much lower terminal rate for the RBA than the Fed -appropriate in our view. That said, the Australian yield curve is close to the flattest it’s been in 10 years.

There are varying theories and approaches for determining the fair value for term yields. There is little mileage in outlining all of these, but we have always liked the pure expectations theory which simply suggests that the fair value for yields is the average of the expected policy rate over the term of the bond plus a term premium. The dominant component of this is therefore the average of the policy rate over time, or 10 years for the 10-year government bond. Put simply, are you better off locking away your money given a yield on offer or rolling short term deposits in line with the policy rate?

As the chart below shows the Australian 10-year yield often gravitates toward the policy rate when the RBA is easing rates, or the market starts to pre-empt easing. Intuitively, if the 10-year yield moves below the policy rate, the market holds high conviction in future easing. The top panel below highlights the two yields, showing the recent convergence of the 10-year yield toward the current policy rate of 3.1%. The lower panel plots the spread between the two over the last 10 years.

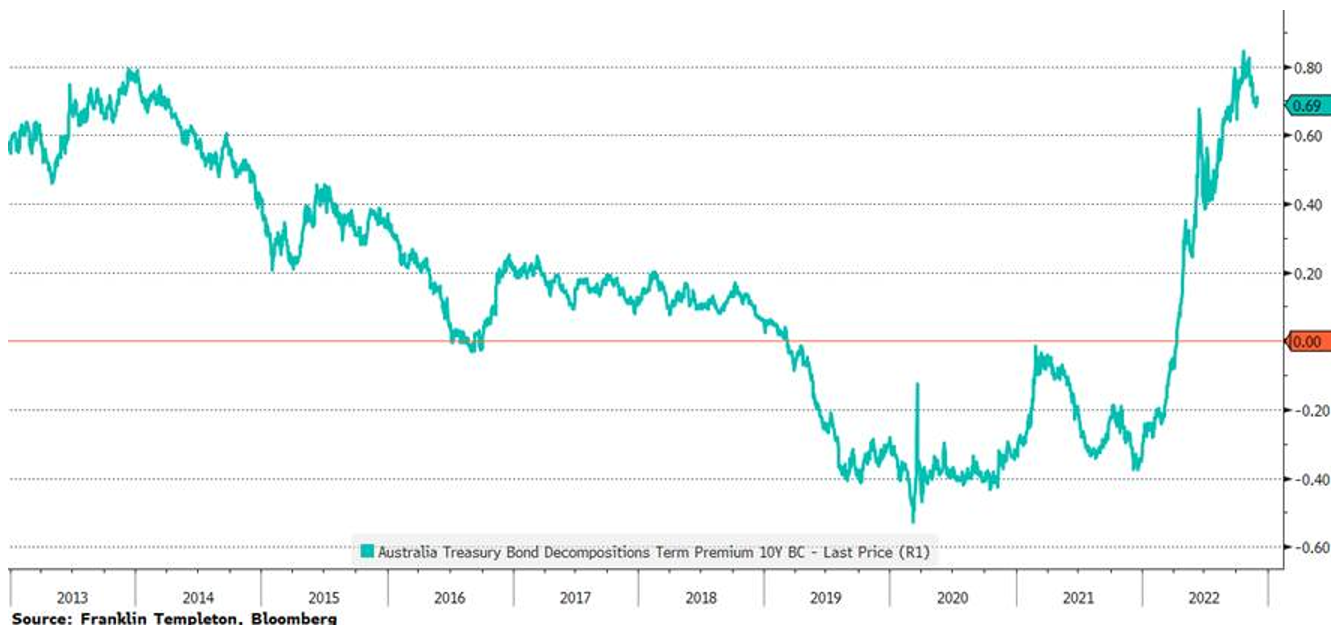

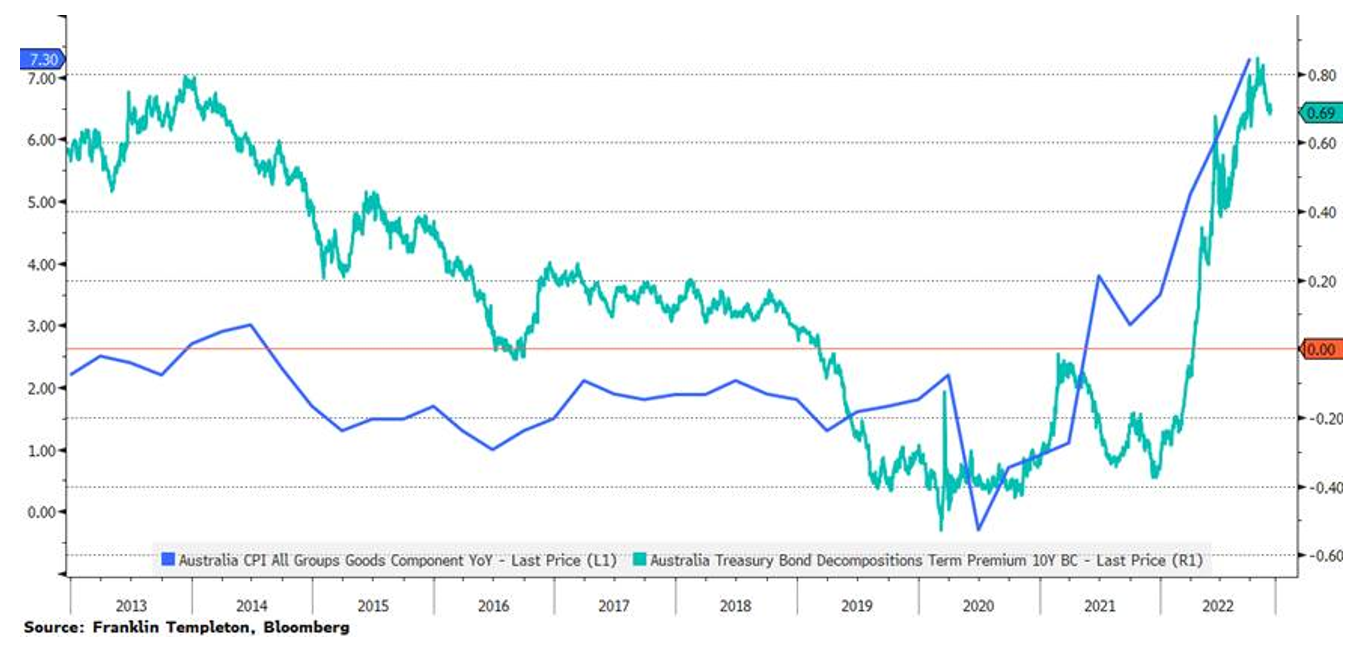

If the pure expectations theory suggests yields should reflect the average policy rate plus a term premium, how significant is the term premium component? The Australian Office of Financial Management estimates the term premium for Australian 10-year government bonds in the chart below.

For years prior to and during the pandemic the premium was very low and even negative. More recently, it has moved much higher. If this premium can be characterised as compensation for uncertainty, it makes sense that the current period requires a higher buffer for the uncertainties around inflation.

Recently, in a speech at the CEDA dinner governor Phil Lowe suggested that the years ahead could experience more supply side shocks ‘leading to more variability in inflation from year to year’. In other words, the multiyear experience of very low and stable inflation might be challenged.

This recent surge higher in term premia both in Australia and offshore is more a reflection of the recent inflation challenge and is likely to settle down as inflation cools in 2023. Term premiums are unlikely to stay at current elevated levels but may also struggle to get back to zero or negative.

Putting it all together, despite the hyper aggressive monetary tightening now underway, we don’t see policy rates remaining at current or higher levels. Whether the RBA pauses now at 3.1% or goes a little higher, we are in the late stages of the tightening. Thereafter, the likelihood is that cuts are coming in late 23 or 24. The cash rate may not go back to the 0.75% pre pandemic level quickly but equally the neutral rate in our view remains in the 1.5-2% area and we don’t expect policy to remain restrictive (above 2%) for an extended period.

If we take a ~2% average over time and then add a term premium of 0.5-0.75%, then the fair value for the 10 year is probably in the 2.5-2.75% area. Term premiums might keep yields higher than this in the near term so 3% might be a shorter-term floor but we will have to see. In other words, yields can move a little lower in the short term.

On the other hand, yields in the short to intermediate part of the curve (2-5 year) will rally the most when central banks pivot away from their current approach. Hence, this remains where our duration positioning is concentrated.

Learn more

With an absolute return approach, Franklin Australian Absolute Return Bond Fund is designed to deliver stable, income style returns regardless of traditional fixed income market performance. Find out more by visiting the fund profile below.

.png)

1 fund mentioned

.jpg)

.jpg)