Airlie: What the macro crossroads mean, and one stock on the right path

Russian tanks are in the streets of Ukraine, Australia is underwater, and so are large swathes of global markets.

Goldilocks has well and truly left the building (in a canoe, probably, if she's anywhere near the catastrophic floods along our eastern seaboard right now). The strangely positive returns of 2021 have given way to volatility. And it’s likely to be with us for a while, said Matt Williams, co-portfolio manager at Airlie Funds Management on Tuesday.

“We’re at a crossroads. We’ve moved from COVID and we’re into Ukraine. And I don't mean to be glib about an unfathomably tragic situation but in the short term it means we’re getting a spike in inflation as energy prices react,” he said.

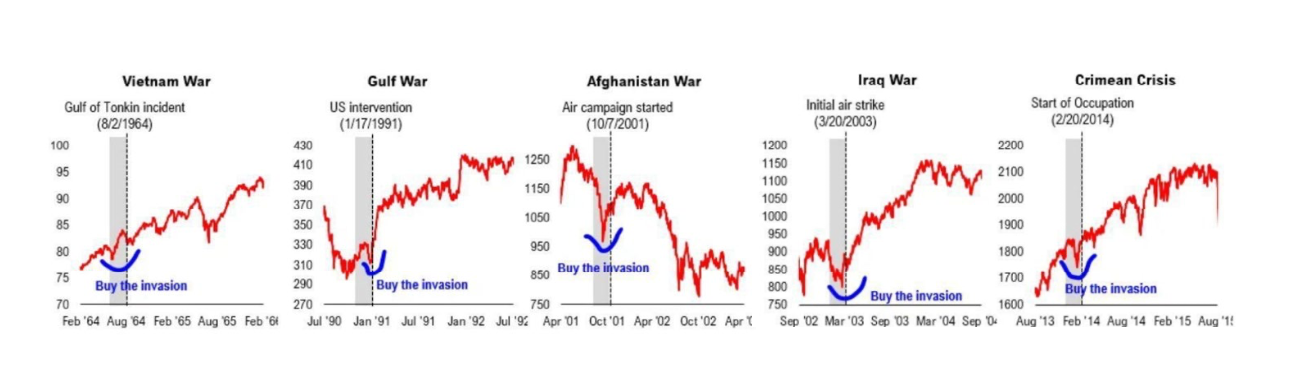

“But history suggests these macro events have been buying opportunities. And they do ultimately pass, and hopefully, this one does soon and then we’ll be back to concentrating on central banks.”

The fleeting effects of macro events

Source: Fundsrat, Bloomberg

Inflation’s resting heart rate

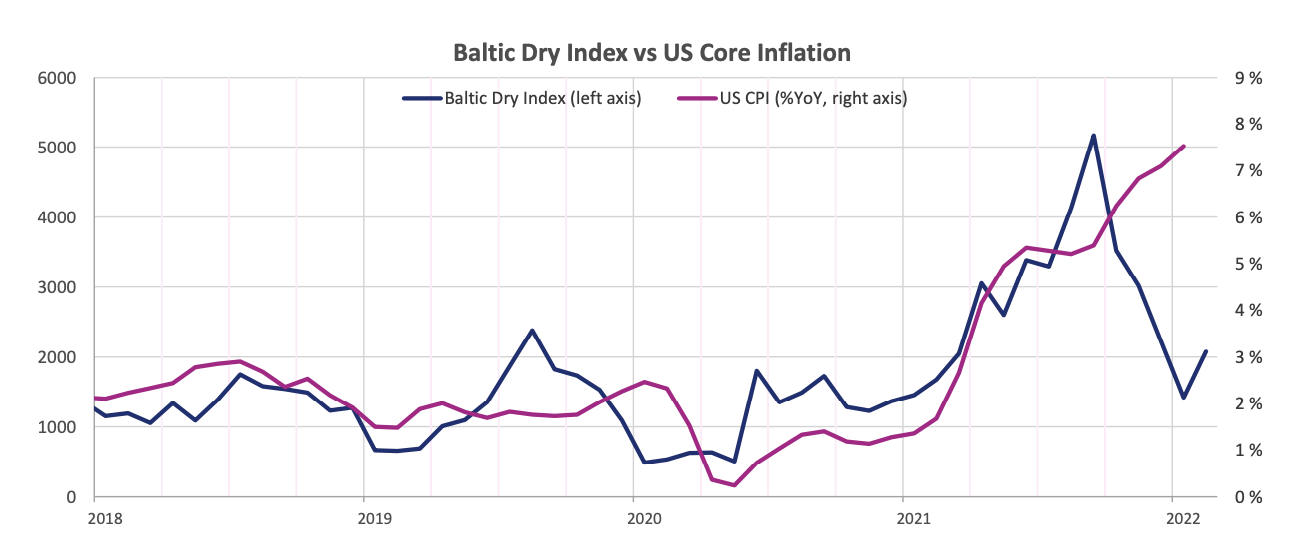

Speaking to investors during his latest webinar, Williams said macro events rather than company fundamentals are driving stock prices currently. On inflation, he expects it will be higher for longer, but believes the current upward pressure will soften slightly later in calendar 2022.

In the US, he expects inflation will settle at around 6.7% and that, as a rule of thumb, anything higher than 6% is bad for markets. As a partial gauge, Airlie refers to the Baltic Dry Index - a measure of the costs of moving goods via sea - versus inflation, as shown below.

Source: Macquarie Equities

For how long? It’s too tough to call, but Williams believes inflation won’t dip below 3% in the short or medium term.

Two global names for your bottom drawer

In this environment, a couple of global names Williams expects might be worth buying and holding are:

Airbnb (NASDAQ: ABNB)

Spotify (NYSE: SPOT)

On the local front, cloud accounting software firm Xero (ASX: XRO) is appealing except for the crucial aspect of its share price: it’s currently too high, Williams believes.

But he floats the enticing prospect the Kiwi cloud-based accounting software pioneer might be a takeover target for the likes of Microsoft, Paypal or Oracle. Why? Because few companies in the space have such tight ties with their customers.

“And at a US$10 billion market cap, it’s a bite-sized acquisition for one of those companies, so that’s a risk – we think - of not owning Xero,” Williams says.

M&A here to stay – for now

Merger and acquisition activity has been a bone of contention for a while. From the record levels set last year, when $5 trillion of deals were inked, the broad view has been that 2022 would be a far softer year for M&A.

“It might continue,” says Williams. “Though the current macro situation is cause for pause. Global private equity firms and pension funds might be deterred, but it might prove a ballpoint for markets,” says Williams.

Some of the companies in Airlie’s portfolio have been offered bids in the last six months, as much as 25% of the portfolio, in fact. Tabcorp (ASX: TAH) was lobbed with a bid, as was Smartgroup Corporation (ASX: SIQ), though neither progressed.

But on the other side of the table, several companies owned by Airlie bought assets.

“None of these companies saw our stocks bet the farm but solid execution is needed for successful share price performance in these acquisitions,” Williams said.

The most exciting deals

The Nick Scali (ASX: NCK) and Dicker Data (ASX: DDR) purchases of furnituremaker Plush and Exeed – for $103 million and $68 million, respectively – were the standout deals among companies Airlie owns.

Williams and his team see huge synergy benefits ahead for both acquirers and are confident the management teams have bought wisely.

But on the other side of the transactions, several companies on Airlie’s books went shopping:

- CSL Limited (ASX: CSL) > Vifor Pharma

- Aristocrat Leisure (ASX: ALL) > Playtech (but currently stalled)

- Ampol (ASX: ALD) > Z Energy (ASX: ZEL)

- Ebos Healthcare (NZX: EBO) > Life Healthcare

- Healius (ASX: HLS) > Agilex Biolabs.

Half-year reporting season

“It was better than we expected, especially when you consider most of Australia’s eastern seaboard were in lockdown for at least part of the first half,” Williams says.

“Australia has handled Omicron much better than expected and is now opening up. So, the second half also looks a lot better than it did in early January”

For Williams, the main takeaways from the Australian half-yearly reporting season just ended were:

1. Increasing inventory levels across many Australian companies

2. Lower cash flow, related to the point above, and rising borrowing costs

3. Heightened interest rates also impacted cash flow across most company results.

A favourite stock

Newscorp, an “old world” media stock, usually conjures images of a slow-moving, low-margin business. But given the firm owns some of the most recognisable global brands across media and publishing, Will Granger, equities analyst, outlined several reasons why it was recently added to the Australian equities fund.

A raft of businesses sits in the Newscorp stable, The Wall Street Journal and Barron’s newspaper and online news services, and Foxtel, in which it maintains a 60% stake – arguably among the most well known.

WSJ and Barron’s are held in the firm’s Dow Jones division, while Foxtel is part of Subscription Video Services.

The other business units are:

- Digital real estate

- Book publishing

- News Media.

Print ads are yesterday’s news

In a nutshell, the WSJ has 3.5 million subscribers of WSJ – more than three times Newscorp’s closest competitor. Print advertising has long been relegated to “yesterday’s news,” declining from a peak of US$50 billion to less than US$10 billion since the early 2000s – a drop of 80%.

In response, NWS’s business models have adapted. The Journal’s digital subscriber base continues to grow at a rapid rate, doubling since 2018. This more than offsets the newspaper’s declining print subscriptions.

And there’s plenty of room for further growth, Airlie’s Granger agreeing with management’s targeting a total potential market of around 12 million readers.

Digital advertising contributed $320 million in annual revenue in 2021. This comprises around 60% of total advertising revenue, as the company pivoted away from print, which contributed less than 15% to the bottom line.

Total publishing revenue, a combination of subscription and digital advertising, hit an eight-year high last year.

Other media brands:

- New York Post

- Foxtel (65% stake)

- The Sun

- The Australian

- Binge

- Kayo Sports.

The jewel in the crown

And locally, NWS’s The Australian is among one of the nation’s oldest print media mastheads. But the parent company’s 61.4% ownership of realestate.com.au is among the most attractive parts of the company.

“Applying our fair value to these ‘free’ assets, you get an implied share price of around $60 for the REA Group exposure – versus the stock’s current price of around $135,” Granger said.

"Newscorp gives you a chance to buy one of

Australia's best businesses at 50 cents in the dollar."

A sure way to lose money

Wrapping up the session, Williams left viewers with a positive reminder: “The headlines and worries might encourage you to go all-in on cash. But there’s only one way to guarantee you’ll lose money to inflation. And that’s to not invest your savings at all.”

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

6 stocks mentioned

2 contributors mentioned