Alarm bells ring for commercial property

One of the fascinating dynamics in the transition to this new normal where the search for yield is dead is that many asset classes – and the investors who populate them – have yet to face up to the reality of risk-free government bonds paying annual interest rates of 4-5 per cent. Given the Reserve Bank of Australia’s cash rate will likely be around 3.5 per cent in a few months, government-guaranteed bank deposits will be offering similar returns.

Anything riskier than Aussie government debt has to beat that 4-5 per cent yield hurdle – and by a very handsome margin because these bonds are perfectly liquid and risk-free! Put differently, you need to receive extra return compensation for both the additional credit (or capital loss) risk and illiquidity risk. The saying used to go that “there is no alternative” (TINA) to chasing risk. Today there are many risk-free or low-risk alternatives.

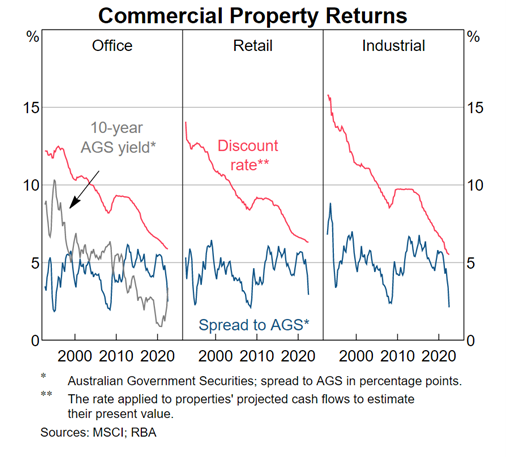

A classic example is a commercial property. A recent speech from the Reserve Bank of Australia’s Jonathan Kearns highlighted that while 10-year Australian government bond yields had jumped from 1 percent to 4 percent, the expected yield on office, retail and industrial commercial property had hardly moved.

This has meant that the return premium you get on commercial property above the risk-free interest rate on government bonds has dropped to its lowest levels on record. Historically, commercial property has paid a 4-5 percent annual extra yield above Commonwealth government rates. That has recently slumped to 2 percent or less, signalling that commercial property yields will have to rise sharply.

The only way that will happen is if their values fall sharply, which is what normally occurs in every recession. In fact, there is a reason banks don’t normally lend much to commercial property owners or residential developers: the regulator does not like them doing so because these sectors have been the single biggest bank killers over the last 150 years. ANZ and Westpac almost went bust because of their commercial property exposures in the 1991 recession. The difficulty of accessing bank finance has meant commercial property and residential development owners have had to borrow from non-bank lenders, which will now have to carry this can.

Commercial property investors note that the market is afflicted by illiquidity as buyers and sellers cannot agree on where the real valuations – based on much higher yields – lie. Naturally, they don’t want to report large write-downs of their asset valuations, which would increase their loan-to-value ratios and potentially breach loan covenants. This is showing up in the enormous disconnect between the valuations listed real estate investment trusts (REITs) are claiming on their assets and the sharemarket’s estimate of their worth.

According to Credit Suisse, retail and industrial REITs are trading at a 20-25 per cent discount to their net tangible assets, while office and diversified REITs are trading at heftier 30-40 per cent discounts. This implies that sophisticated equity investors do not believe the accounting valuations attached to the REITs’ underlying properties, which the RBA’s analysis implicitly supports.

The challenge here is liquidity. In illiquid asset classes like commercial property, residential property, infrastructure, private equity, and venture capital, valuations may take several years to adjust to sudden shifts in interest rates. While house prices started falling at around the time the RBA began lifting its cash rate in May this year, they will likely continue adjusting downwards for at least another 6-18 months in response to the 30 per cent-plus reduction in buyers’ purchasing power.

Then there is the fact that there are about $500 billion of fixed-rate home loans charging only 2-2.25 per cent interest rates that will switch to variable rates north of 5 per cent over the next 12 months. It is no wonder that the RBA’s boss, Phil Lowe, reckons he has time on his side.

The listed equity market tends to respond much more quickly to rate changes, which is why we have seen global stocks fall as much as 30-40 per cent from their 2021 peaks at various points this year.

Equities are pricing in both current and expected future interest rate rises. Here in Australia, the RBA will have lifted its cash rate by an astonishing 300 basis points by December, which is unprecedented in the inflation-targeting period. Financial markets are further pricing in a terminal rate at around 4 per cent sometime next year. On Friday, the RBA signalled that its terminal rate will be lower at 3.5 per cent.

In the US, the Federal Reserve has hoisted its policy rate from 0.25 per cent to 4 per cent and will likely hit 4.5 per cent next month. The bond market expects the Fed’s terminal rate to hit about 5.2 per cent, which the listed equity market is adjusting to (higher discount rates mean lower prices).

What is not clear is whether listed equities have properly priced in the reduction in earnings that will flow from a significant slowdown in economic growth as a result of this immense interest rate shock. The market may need to see hard evidence in the form of material earnings downgrades before it reflects these changes in corporate valuations.

The one asset class that immediately reflects all current and expected future interest rate changes is, of course, the bond market, given that bond prices are determined by these rates. Last year, CBA would pay just 0.26 per cent interest on a five-year senior-ranking bond with a AA- credit rating.

This rate reflects the credit spread (or interest rate margin) CBA pays above a proxy for the cash rate, which is the quarterly bank bill swap rate (BBSW). In mid-2021, the credit spread on a five-year CBA senior bond was just 0.25 percent above BBSW. And BBSW was only around 0.01 percent.

Today, BBSW has surged from 0.01 per cent to 3.1 per cent. And CBA’s senior bond spreads have jumped from 0.26 per cent to 1.2 per cent. So CBA has to pay a total interest rate of about 4.3 per cent on this type of debt, which is multiples of the 0.26 per cent they would have offered last year.

As another example, an even safer AA+ rated, 10-year South Australian government bond paid a fixed-interest rate of only 1.2 per cent in December 2020. Today, the interest rate on the same bond is about 4.7 per cent.

An even more aggressive story has played out in the big four banks’ BBB+ rated tier 2 bonds, which rank behind their senior bonds, but ahead of their lower-ranking BBB- rated hybrids in the capital stack.

Last year a CBA tier 2 bond would pay a spread above BBSW of about 1.25 per cent, giving a total floating interest rate of 1.26 per cent. The spread has since expanded from 1.25 per cent to about 2.9 per cent above BBSW, which means the total annual interest rate on this floating-rate CBA bond is about 6 per cent today.

The fixed-rate version of the CBA bond, which prices in both current and future expected RBA cash rate increases, naturally offers an even better interest rate of about 7 per cent.

The takeaway here is that changes to the central bank’s risk-free policy rate ripple slowly out across the economy, much like the waves created when someone dives into a large lake. On Coolabah’s internal modelling, it can take between one and five years for RBA rate increases today to have their full impact on future inflation.

This week both the RBA and the Fed stressed the long and variable lags associated with the consequences of monetary policy adjustments, and the fact that they have already lifted interest rates by an unusually large amount in a very short space of time.

On Thursday, the Bank of England likewise signalled that most of its heavy lifting had already been done after a 75-basis-point rate rise took its policy rate to 3 per cent, dismissing market expectations for another 200 basis points of increases.

There appears to be a globally synchronised effort to signal to markets that central banks will pivot to more modest rate increments as they take time to observe the real economic consequences of the huge increase in the cost of both public and private borrowing over the last six to nine months. This is a perfectly sensible approach.

In the meantime, you should consider whether your asset valuations reflect these new realities.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers.

1 topic