Amazon Revisited – Muted Impact So Far

There has been no bigger retail story over the last 12 months than Amazon’s entry into the Australian market. This time last year we gave our initial view (Amazon Not Introducing Internet to Australia) on how Amazon will impact the Australian retail landscape with particular focus on ASX listed retail stocks. In this paper we assess Amazon’s progress so far and reinforce our positive retail sector view given attractive valuations relative to sustainable free cash flow.

Online retail sales growth has accelerated

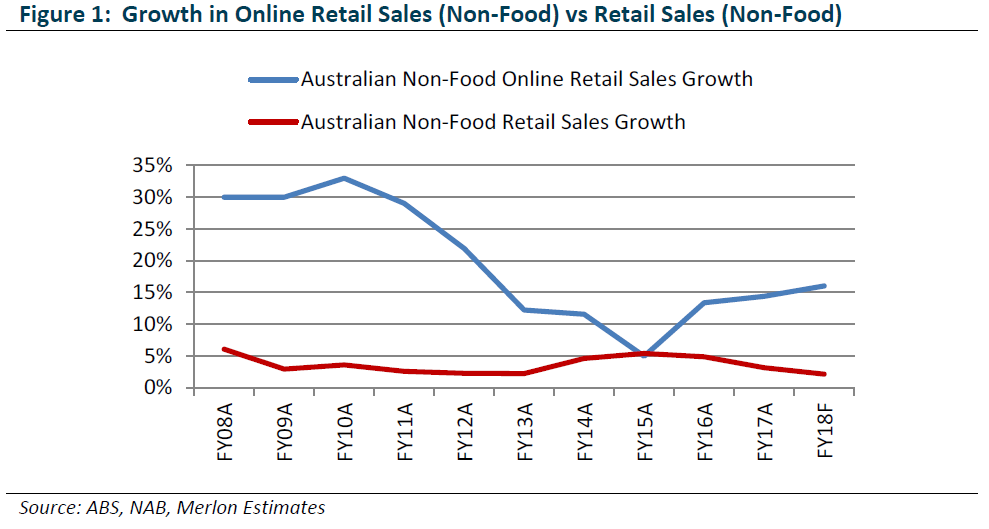

Following some weakness in mid-2017, online sales growth has accelerated to an estimated 16% in FY18 despite the backdrop of a more subdued consumer spending environment (Figure 1).

We outlined why we expected this to be the case in our last report. We believed that Amazon’s launch would be an important catalyst for online penetration. Both directly in terms of Amazon generating its own local sales, but also indirectly with the mass publicity for Amazon’s launch driving increased awareness of online shopping and established retailers improving their online offerings to compete with Amazon (more on this later). There has also been significant new emphasis placed by retailers on cyber sales events such as Black Friday (a huge event in the US).

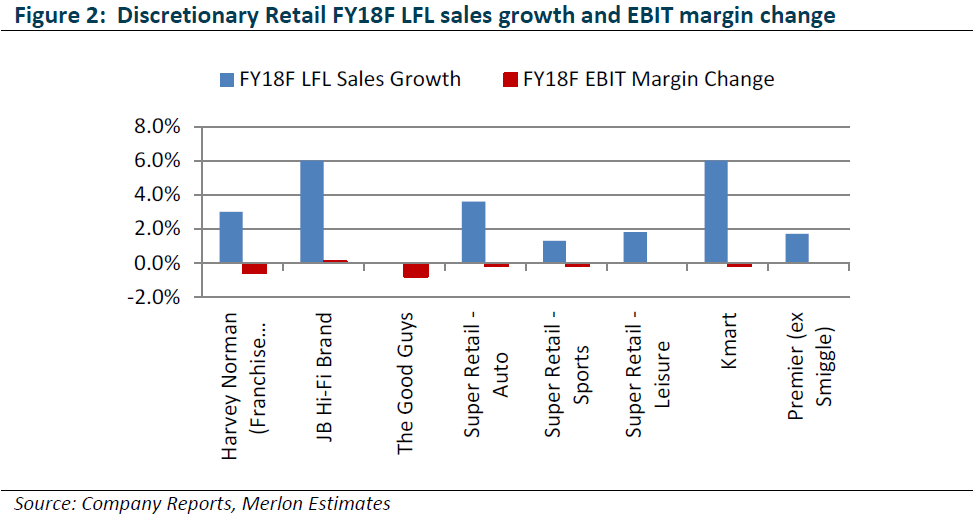

Despite this strong online sales growth, there has been no discernible impact yet on Australian retailer’s sales and aside from some company specific issues, margins have been largely stable (Figure 2).

In the case of Harvey Norman and The Good Guys (TGG), there is currently a battle for market share in appliances which is causing material margin pressure. We expect this to be short-lived and not related to Amazon. Rather it is a consequence of Harvey Norman trying to capitalise on a destabilised TGG following the buy-out of its remaining Joint Venture Partners (JVPs) just prior to it being acquired by JB Hi-Fi. Other businesses such as the JB Hi-Fi brand and Super Retail’s businesses have been reinvesting in price and/or costs to improve their in-store and online propositions but their margins are broadly unchanged. Regardless, most listed retailers are growing their online sales at a greater rate than the total online retail market as they put more focus on that channel and are growing off a low base. Given subsidised delivery and the cost of picking goods, it is likely these online sales will be lower margin than in-store sales but this is already factored into our and market long-term forecasts.

Launch failed to live up to the hype

After an initial false start on Black Friday (24 November 2017), Amazon finally launched on 5 December 2017. Despite much hype leading in, consumers were ultimately underwhelmed by the limited range and lack of deep discounts foreshadowed by the media.

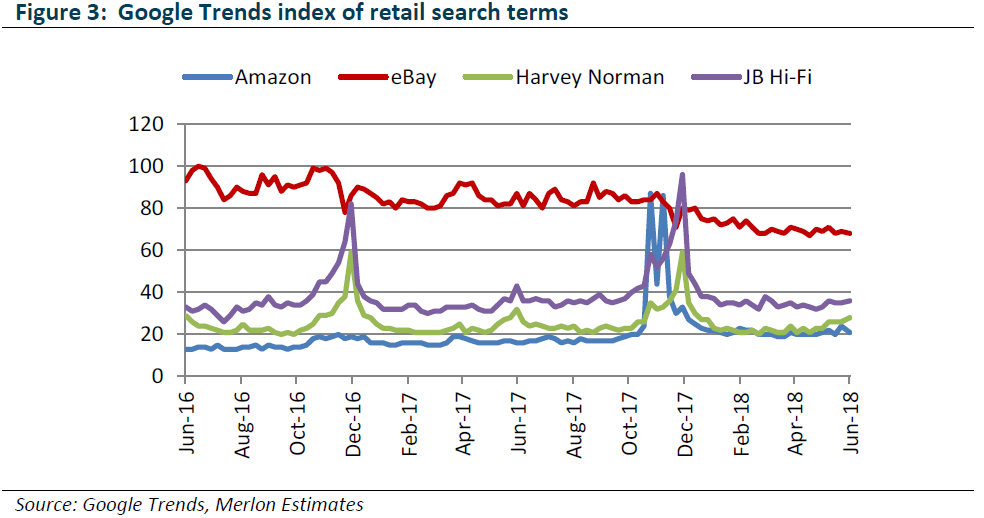

Given Amazon’s secretive nature it is unlikely it will disclose its Australian retail revenues for the foreseeable future. Regardless, it is fair to say that initial take-up has been below expectations. While by no means a perfect measure of web hits or sales, using the “Amazon” search term in the Google Trends tool (for Australia only) shows interest spiked around Black Friday and the eventual launch date but fell back to earth by January (Figure 3). While Amazon’s search popularity has settled a little higher than prior to launch, it still lags eBay, JB Hi-Fi, and Harvey Norman. As we suggested in our last report, Amazon’s growth seems to be coming mostly at eBay’s expense given its significantly declining trend while JB Hi-Fi and Harvey Norman hold firm.

Initial retail offer was weak but is improving

As we expected, Amazon’s initial product offering was relatively limited. The problem for Amazon is that the Australian site was always going to be compared to the US site, which is what Australian consumers are familiar with and will judge it against. But this is unfair since Amazon’s US site has been operating since 1994 and operates in a much larger market.

While Amazon is operating across 23 retail categories, there are large gaps in the range with key brands (e.g. Apple, Samsung, Nike etc.) providing Amazon with either limited (often dated product) or no access to their own product ranges. Moreover, while the range has reportedly expanded to 60 million SKUs this is almost totally represented by third party sellers with Amazon’s own range estimated to be only 1.5 million SKUs currently. In short, it will take many years for the Australian site to get anywhere approaching the range of the US site.

Reports of Amazon discounting prices by 40% were also predictably overplayed. We had assessed that Amazon’s US pricing compared to JB Hi-Fi was already similar on a like for like basis except for a few select categories. However, we would note that Amazon’s first party pricing has gotten sharper in recent months, particularly in media, gaming and small appliances. On the other hand, consumers have grown weary of third party sellers with pricing that is highly variable and at times exorbitant. Until this is corrected, Amazon’s price perception will be hampered.

While pricing is still a mixed bag, Amazon is clearly becoming more aggressive on its marketing and promotions. We can observe this in a few ways.

First, up until 30 June 2018 Amazon had been offering new users a $20 discount code for purchases of $79 or more. While this in of itself an attractive offer, the offer has been blatantly abused by some customers (as shared on social media) who have been able to set up multiple accounts with the same shipping address and payment methods. The fact this has not been policed more strictly by Amazon probably suits itself anyway since it boosts subscriber numbers (likely a key KPI when reporting to head office).

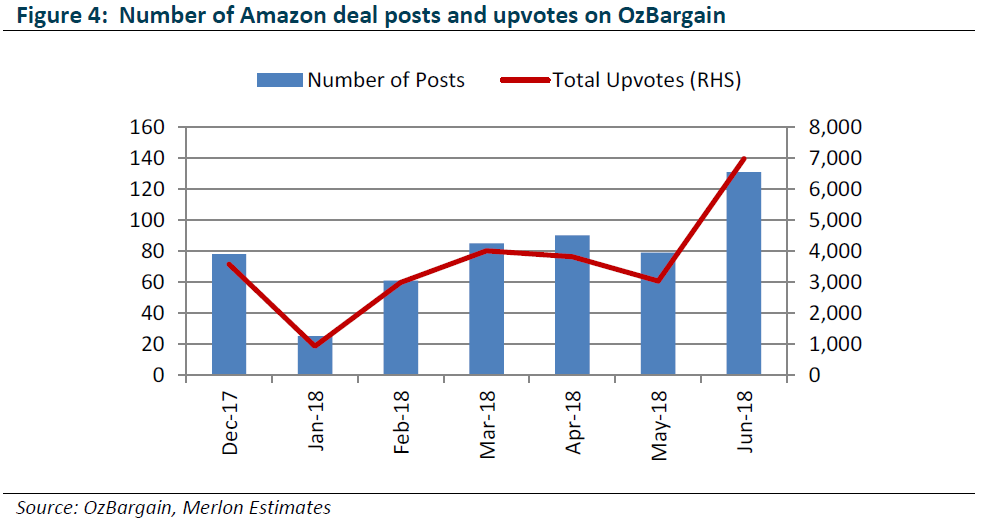

Second, Amazon has been running a series of “Lightning Deals” and other special offers that have been heavily discounted for limited quantities and time (as is standard on their other sites). When combined with the $20 discount code and other programming quirks (i.e. items with an original price of greater than $79 that are heavily discounted have incorrectly been made eligible for the $20 discount) there has been some truly special deals for the most savvy consumers. To try to quantify the quality and cut-through of these offers we have been tracking OzBargain (ozbargain.com.au), an Australian community website where thrifty (or tight) consumers post deals by retailers. This site is an excellent indicator of which retailers are becoming more (or less) aggressive on price. The number of Amazon deals posted by users and the quality of these deals (as measured by user upvotes) has increased significantly over the last few months (Figure 4). As an indication, each post generates about 2,000 clicks on average through to Amazon’s website so these deal posts can generate a meaningful amount of web traffic and sales.

Third, Amazon has undertaken a significant marketing campaign across TV, Print, Digital etc. Its current “A-Z” themed advertising spots are running during prime time on FTA TV.

Finally, to mark the arrival of Amazon Prime, Amazon has announced that Amazon Prime Day will occur on 16 July 2018. This is a value-added sales event Amazon employs across its websites to encourage consumers to sign up to Prime. While there are likely to be some excellent deals, it is unlikely to match the significance of sales in other countries given the aforementioned more limited range available and very low numbers of current Australian Prime members.

Watered-down Amazon Prime is here

The long anticipated launch of Amazon Prime is another area of improvement. However, this aspect of the local offering again feels like a cheap imitation of the real thing.

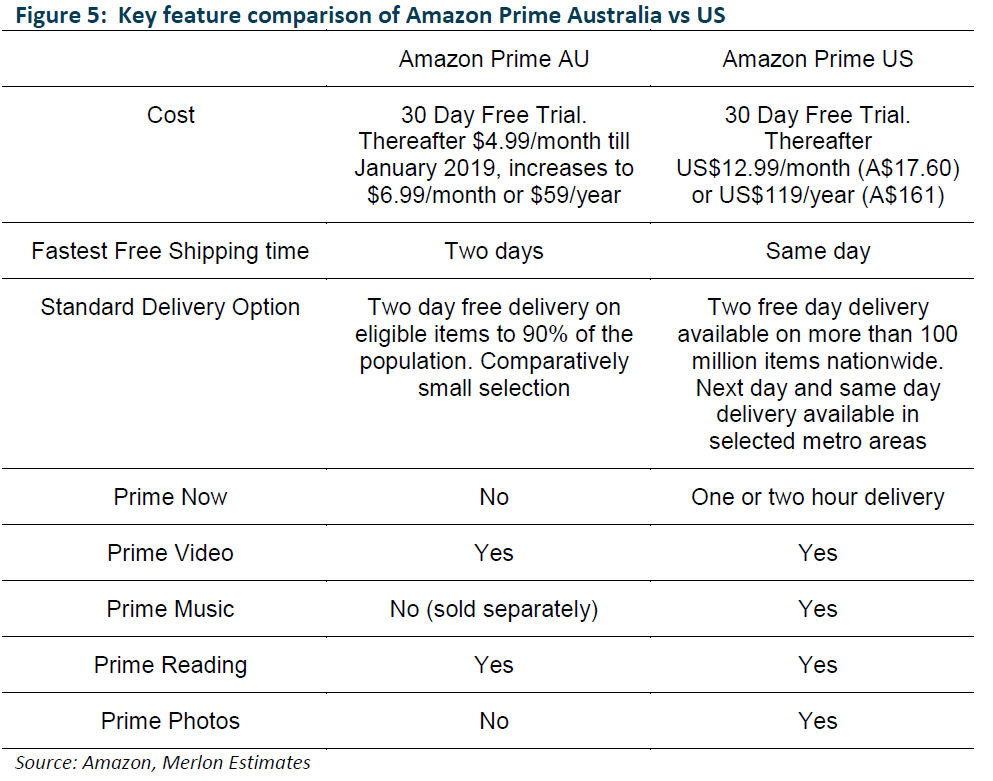

While it is indeed far cheaper than the US Prime, it is lacking in features (Figure 5). Most notably, while the two day free delivery is very competitive with current online retail offerings domestically, it does not match the one or same day free shipping provided by Amazon for US Prime members on certain items. We believe this reflects both the lack of Amazon’s current scale and the challenges of lower population density that were discussed in our first paper. Also, while Amazon Prime Video access is included, it is a much narrower selection than the US equivalent since the rights to much of the content are already held by the likes of Netflix, Stan etc. Other features such as Prime Music (sold separately) and Prime Now are not included.

It’s important to acknowledge that Prime in Australia will improve over time as it gains scale. It will in particular be aided by the opening this year of the Sydney fulfilment centre (43,000 square metres), which will supplement Amazon’s current Dandenong fulfilment centre (24,000 square metres).

Blocking access to Amazon’s offshore sites

Amazon has stopped shipping to Australian customers from its offshore websites as of 1 July 2018. Instead, it will now offer a selection of Amazon US products to Australian customers through the Australian website.

This brings home the real reason why Amazon launched last year. As outlined in our first Amazon report, we had been told that Amazon had decided to launch here due to the abolishment of GST low value threshold on overseas consumer purchases. It appears Amazon planned for this so that it could switch off its offshore websites to Australian customers. This move appears to be aimed at driving take-up of Australian site while also avoiding setting a precedent for other foreign governments to force Amazon and the like to collect GST. Australia is the first government to put the onus on vendors rather than customs to collect the GST since it will be costly. Interestingly, other retailers and marketplaces including eBay will not be blocking Australians access to offshore sellers.

Unsurprisingly, there has been a poor public reception to the change. The move is likely to cost it at least $500m of sales to its offshore sites, which will only partially be offset by increased domestic sales. In fact, with Australians spending an estimated $5b spent online at offshore websites, there is likely to be some swing back in spending to local online and bricks and mortar retailers given Amazon’s actions and the fact that offshore goods under $1,000 have now become 10% more expensive.

Australian retailers are improving their online offers

Incumbent retailers and marketplaces are not waiting idly by to have their lunch cut by Amazon. While many retailers are lifting their games in the online space, three examples are worth highlighting, each with a key focus on shipping.

JB Hi-Fi expanded its range of shipping options prior to Christmas with the aim of giving customers more choice. Customers can now opt for Express Delivery (one-to-two business days), Courier Delivery (same day) and Three Hour Rush delivery. While these options are not free, some customers will be willing to pay for added speed and certainty.

eBay has recently announced two significant initiatives to combat Amazon. Its eBay Plus program is similar to Prime, providing free shipping and returns on 15 million items from 10,000+ retailers. After a free 30 day trial, users will incur an introductory price of $29 for a 12 month subscription or $49 after the current offer expires.

Lastly, Australia Post has launched Shipster, another subscription based program offering free shipping on orders of $25 or more at over 50 of Australia’s largest retailers including Harvey Norman, Myer etc. It is priced similarly to Prime at $6.95/month but is free for the first two months with some partner retailers currently giving away 12 month memberships to loyalty card holders.

Housing market remains a greater cause for concern

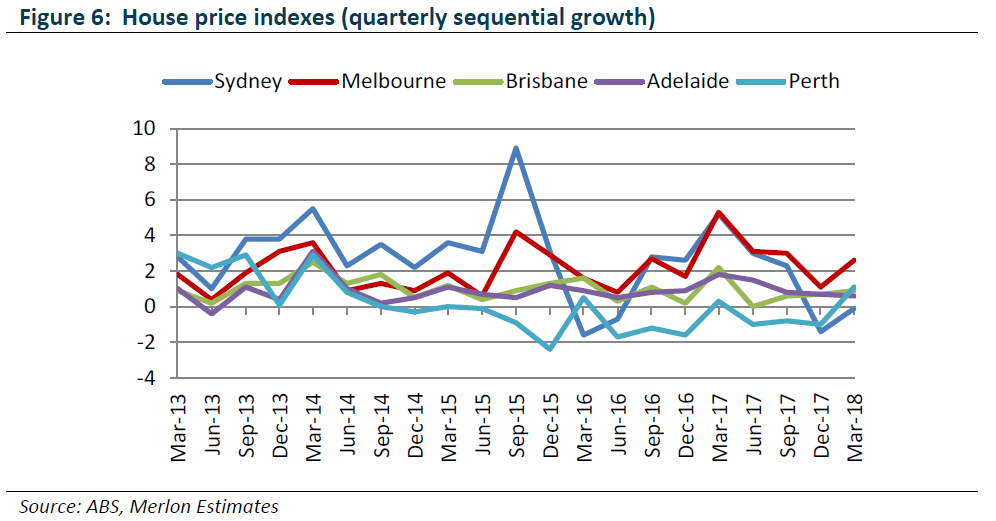

House prices are a key input into the consumer outlook given the link between household wealth and consumer spending. As previously outlined, Australian residential property is modestly overvalued but not to the extent suggested by many commentators (Are Concerns About Housing Prices Overblown?). More recently, the tightening of credit availability is putting downward pressure on house prices, particularly in Sydney (Figure 6). Notwithstanding this weakness, we still believe a house price crash is unlikely given the favourable tax treatment of housing, historically low interest rates and solid rental growth.

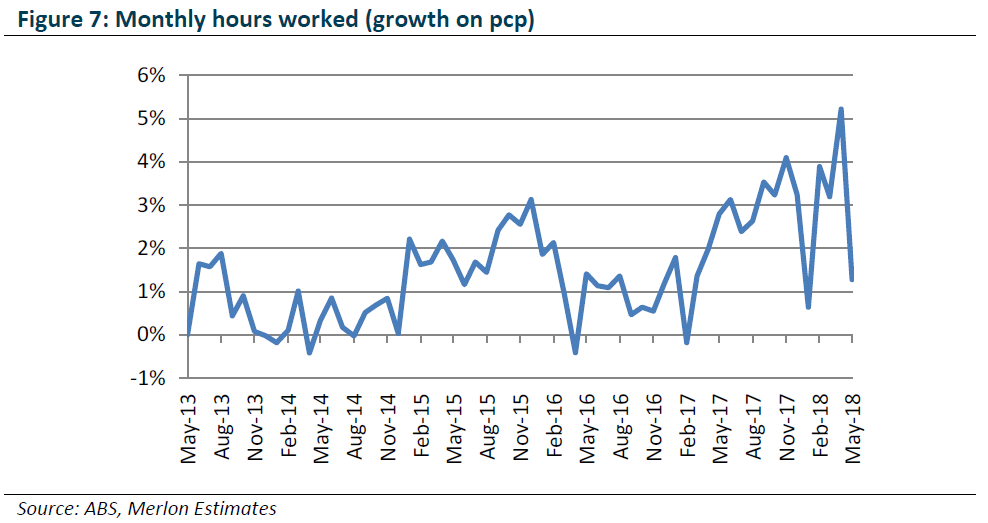

Conversely, we believe the strength in the job market (as measured by monthly hours worked) is being overlooked by the market and should aid consumer spending (Figure 7).

Retail sector still looks like good value

In summary, we continue to believe Amazon will be successful in Australia but that it will take a number of years. We do attempt to factor in Amazon and online competition more broadly by applying a meaningful sales and cash flow haircut to our long run estimates for each retailer, with a few exceptions where we believe online poses a limited threat (e.g. Bunnings). The more significant short to medium term threat is the slowing housing market. However, we remain relatively optimistic that we are not headed for a hard landing and also believe buoyant employment will support consumer spending.

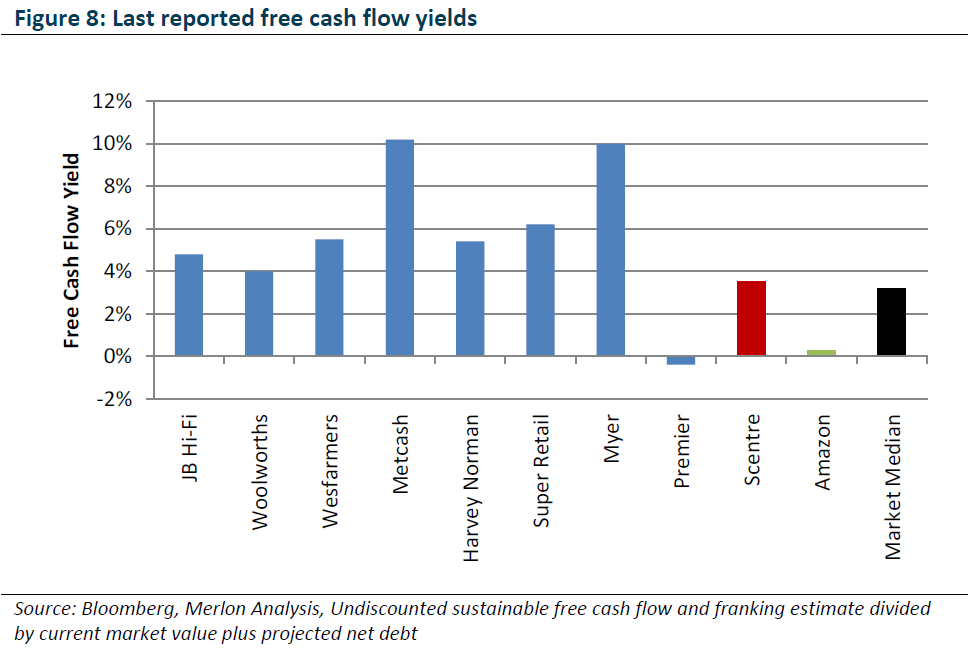

While retail stocks generally enjoyed a sharp bounce over Christmas on rumours of strong trading and relief over Amazon’s lacklustre launch, they have largely returned to prior depressed levels and continue to offer excellent value relative to the market (Figure 8).

We retain positions in Harvey Norman, JB Hi-Fi, Super Retail, Wesfarmers, Woolworths and Metcash but have no exposure to retail Real Estate Investment Trusts.

For more insights from Merlon Capital Partners, please visit our website: (VIEW LINK)

2 topics