Amundi's big idea for 2023: Invest in defensive assets (at first)

It’s been a strange couple of years. Perhaps the only part of life where there is some level of predictability and normalisation is occurring is in financial markets. I say that despite the word ‘unprecedented’ being bandied about liberally.

Unprecedented was the extremely low cash rate globally for the past decade. Unprecedented was the global pandemic – more so the response and timing than the existence of a pandemic. Unprecedented is the fact we are heading towards a recession with better consumer savings rates consumers and healthier balance sheets in companies than we’ve seen in the past.

Though market cycles are not entirely predictable, there are phases and responses experienced commentators tend to expect at different points of the cycle. There are also methods of investing that might typically be better suited to different parts of the cycle too.

If you take the emotion out of it, that’s what we come back to – and that’s where Amundi Asset Management’s 2023 Investment outlook comes in.

It’s not a crystal ball, but rather a measured look at potential outcomes and how investors might adjust their portfolios across 2023. In this wire, I’ll look at the key path they see for the coming year.

A story of inflation, interest rates and even some good news

We’ve already learnt this year that central banks will do whatever it takes to combat inflation. That’s a story that will continue into 2023. Official cash rates have a lag effect on the economy and inflation, so we won’t know for months if enough has been done.

That said, Amundi are tipping for the US cash rate to top out at around 5.25% by the end of the first quarter. This is slightly above what markets have been factoring in. Amundi also anticipate a continuation of the US bear equity market, a strong US dollar, and higher rates. It expects a shallow recession in the US.

The Ukraine-Russia war continues to be the primary geopolitical risk Amundi are watching in 2023, with the energy crisis stemming from this an ongoing challenge. Amundi’s base case is for a ceasefire in the second half of 2023. However, for this to occur, we need to see military capabilities weaken on both sides along with a security guarantee for Ukraine from the West. Overall, Amundi is tipping for a deeper recession in Europe and the need for a smaller and targeted fiscal support package for the EU.

“2023 will be a two-speed year, with plenty of risks to watch out for. Bonds are back, market valuations are getting more attractive, and a Fed pivot in the first part of the year could trigger interesting entry points,” say Vincent Mortier, Group Chief Investment Officer and Matteo Germano, Deputy Group Chief Investment Officer for Amundi.

Some of the positives for 2023?

Amundi has spotlighted China for some benefit in 2023. It believes the Chinese housing market will start to stabilise and anticipates some loosening of the zero-COVID restrictions (due to public pressure). These will be beneficial from a business perspective.

There is still a risk of heightened tensions between the US and China (and between Australia and China – even as the recent meeting between President Xi and Prime Minister Albanese gave some hope of improvements).

There are also gains to be made from ‘the great repricing’ in markets. Amundi thinks there should be some promising entry points across equities markets next year, particularly as markets start to price for a Fed pivot in the first half of the year. US and quality/value/high dividends will be a promising tilt, to begin with.

Bonds are of course, back in business and will continue to be in 2023. Amundi views high-quality credit as a good focus area.

How to play the outlook

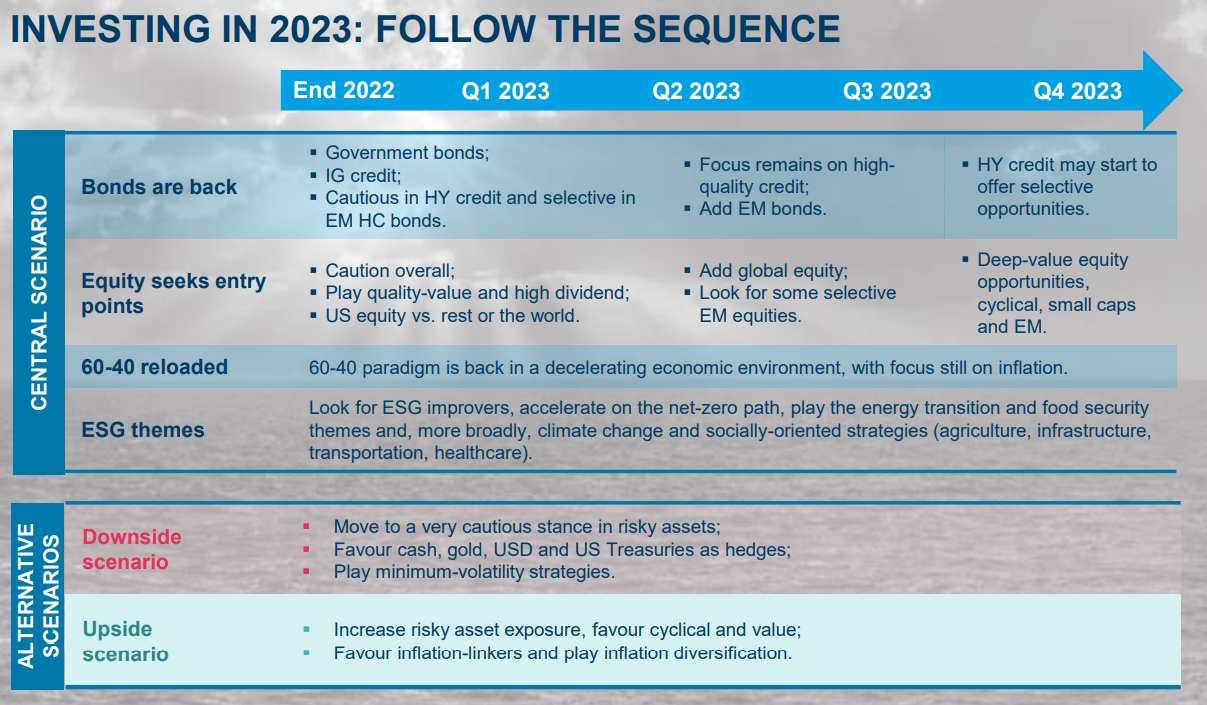

It’s all well and good to talk about the macro side – but what does this all mean for investors? Amundi has given their playbook on investing next year.

It’s a careful approach categorised by high quality and a selective approach throughout the year. And like other managers, Amundi also believes the 60:40 portfolio will make a comeback in 2023.

So in short – play it safe, take selective opportunities where there is solid quality and value across equities and credit markets and diversification never goes out of fashion. There’s also a question of how investors should be thinking about portfolio construction more generally.

The inflation-parity portfolio

As inflation will continue to be a hot topic into 2023, Amundi’s Head of Cross-Asset Strategy Lorenzo Portelli believes investors should be considering an inflation-parity approach to portfolio construction. It is an extension of the principle of diversification, though not one investors have necessarily consciously thought of until now.

It effectively requires the following:

- Equal-weight allocations across all the sources of inflation (cyclical, services, energy and food).

- Diversification across asset classes and within equities at a sector and regional level.

- Use of assets like infrastructure and real assets for their stable dynamics.

Whether or not you take this approach, it’s certainly worth thinking about how your portfolio responds to inflation (be it rising or falling) and how to construct a more resilient portfolio.

The final word

“Start defensive in asset allocation, but stand ready to adjust through the year,” says Monica Defend, Head of Amundi Institute.

Whether or not markets follow this exact trajectory – and whether Amundi’s sequence for the year is the right approach remain to be seen. The crux of its outlook comes down to being cautious. Even in the best markets, that’s not a bad way of thinking about your investments and portfolio.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics