An expanded BRICS will take some time to make progress on “de-dollarisation”

.png)

At the BRICS summit last week, the five-member group of developing nations (Brazil, Russia, India, China and South Africa) agreed to expand the alliance further to include Argentina, Ethiopia, Iran, Saudi Arabia, Egypt and United Arab Emirates. The new members will join in January.

In a multi-polar world, the members of BRICS are motivated by a desire for balanced globalisation and governance – and are especially interested in reducing the role of the greenback in global trade, given the reach of the US sanctions regime and how it has complicated trading in oil (which is priced in USD). Notably, the new members include prominent OPEC nations.

Will they succeed in “de-dollarisation,” reducing the role of the global reserve currency? First, some background.

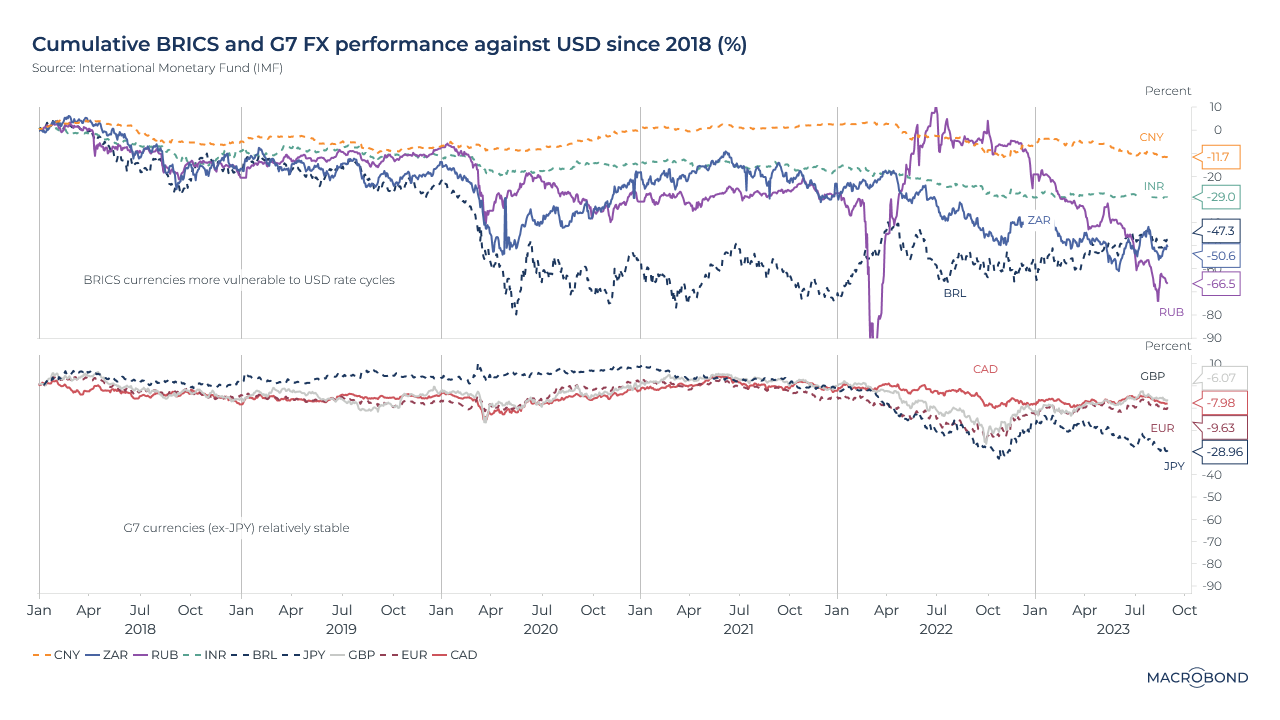

BRICS expansion is coming after the US has seen its steepest-ever rate-tightening cycle, which along with the greenback’s safe-haven status has led to a sharp appreciation in USD.

Such appreciation can hurt emerging-market nations in several ways: 1. Dollar borrowings get more expensive; 2. Twin-deficit countries can be compelled to control inflation and manage their exchange rate via rate hikes; 3. Capital flow vulnerability; 4. Current-account surplus countries fund US trade and budget deficits via investment in Treasuries, and 5. US can thus avoid external imbalances at the cost of macro vulnerability and deflation fallout in other nations.

Given this backdrop, the next chart shows how BRICS currencies have been more volatile against the USD than the G7 nation currencies even considering the Japanese yen volatility, for instance.

This provides the context for BRICS expansion. The nations are seeking both a multipolar geopolitical world and potential “de-dollarisation” – starting with members gradually encouraging using non-USD currencies to facilitate trade.

Multipolarity: BRICS countries have common interests that differ from the Western alliance. The original five members also had their own geopolitical reasons for supporting expansion. In Iran, Russia adds one of its allies to the bloc. China supported membership expansion to promote the bloc’s economic heft. Brazil's president is advocating a common BRICS currency. India is seeking a geopolitical balance to its relationship with the US.

As for the oil trade, the inclusion of Saudi Arabia, the world’s largest crude oil exporter, could further support the development of oil payments in non-dollar currencies by China – the world’s biggest oil importer – and other member nations. And six of the top 9 oil-producing nations will be part of the expanded BRICS.

De-dollarisation: BRICS leaders are at odds with a single, all-powerful reserve currency. While there is some talk of a common currency being established (which is not viable or likely in the near future), a more plausible outcome would be the gradual increase in member nations trading in their own currencies to reduce the reliance on USD.

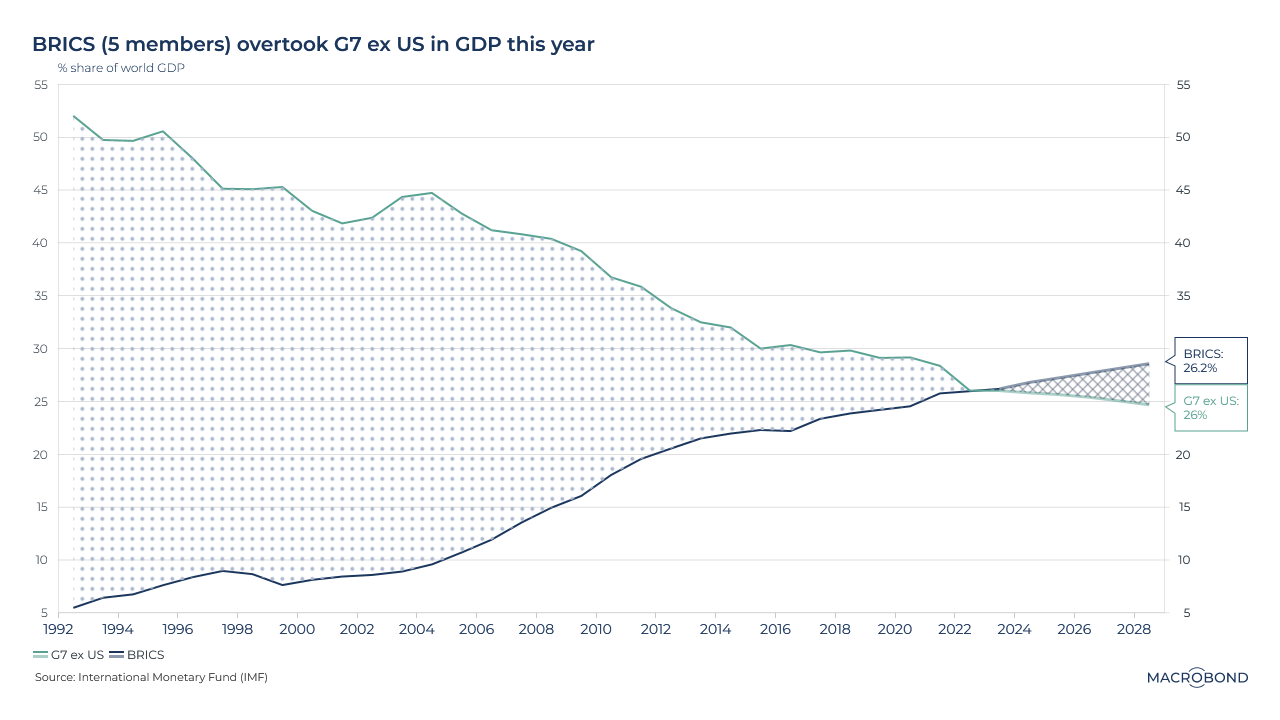

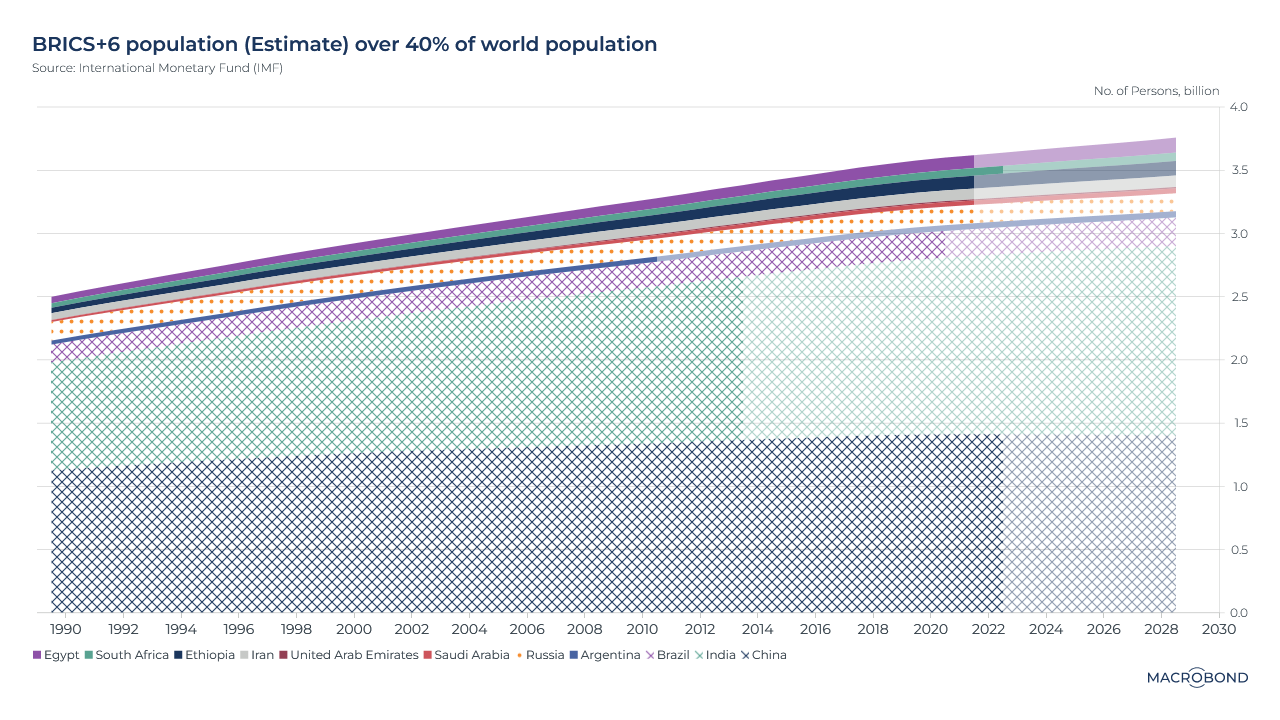

Indeed, the aggregate economic and demographic heft of the expanded BRICS is notable, as the following two charts show. There are favourable demographics (3.7 billion people, about 40+ percent of the world’s population), vast natural-resource wealth, and an aggregate holding of 40 percent of global foreign exchange reserves.

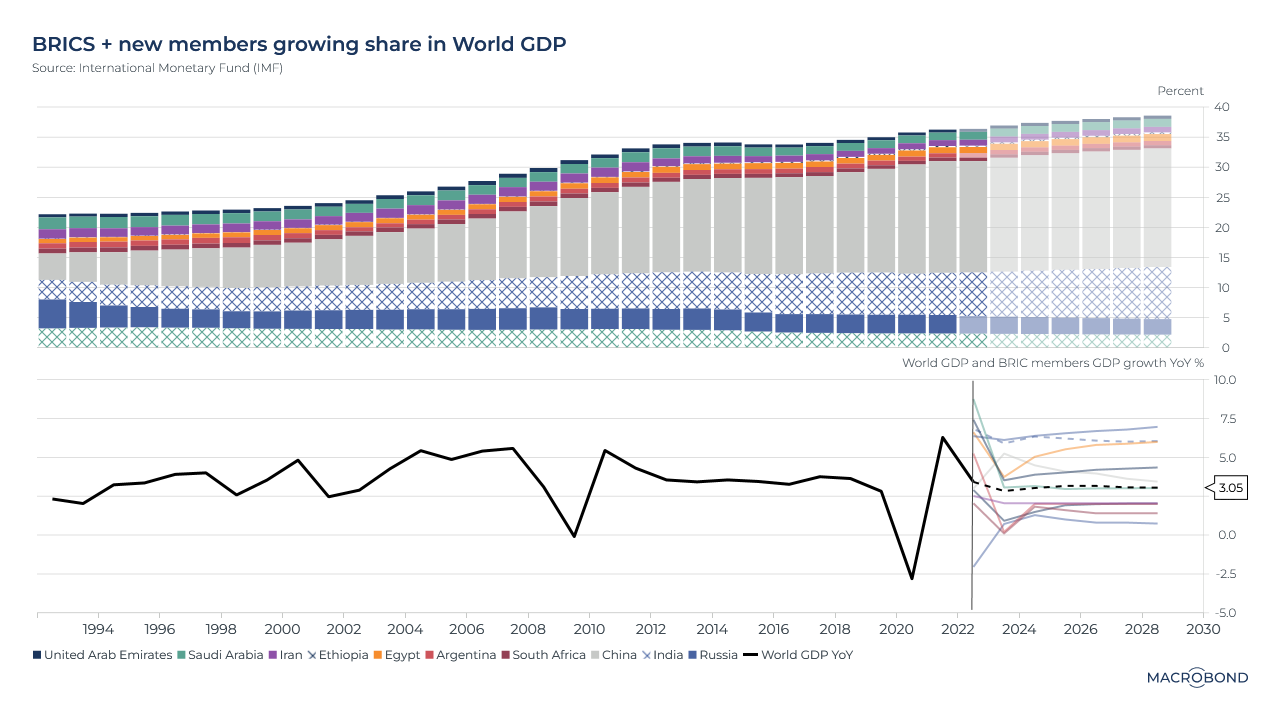

IMF projections estimate the expanded BRICS will contribute about 39 percent of global GDP by 2028, as the next chart shows – the result of growth that will outpace global GDP for most member countries.

More steps towards de-dollarisation:

This research paper, published by Cambridge University Press, examines how the BRICS have developed multiple de-dollarisation initiatives to reduce currency risk, bypass US sanctions and establish critical infrastructure for a prospective, alternative global financial system.

In the wake of sanctions on Russia and its expulsion from much of the global financial system in 2022 due to the Ukraine war, the nation’s non-western allies could move away from using the USD.

The BRICS’ development bank has been lending in Chinese yuan, and announced it would make loans denominated in the currencies of South Africa and Brazil.

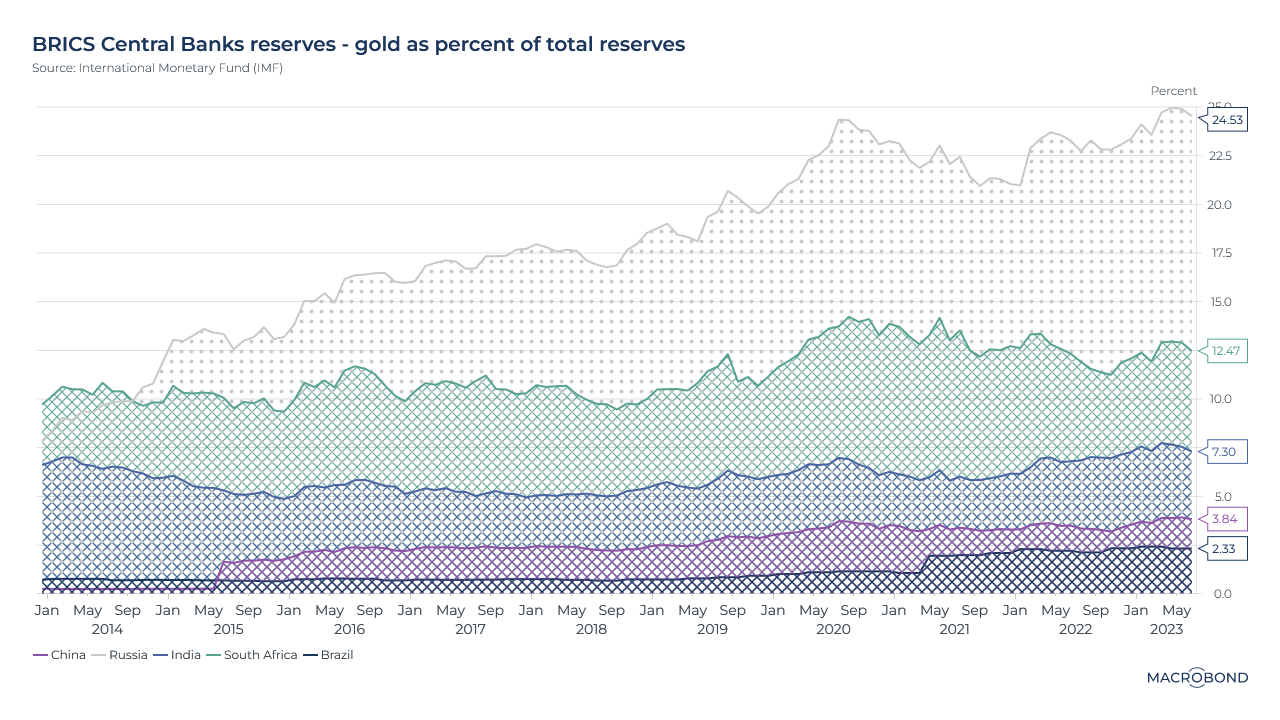

And as the next chart shows, BRICS central banks are adding ever more gold to their reserves of foreign currency.

.png)

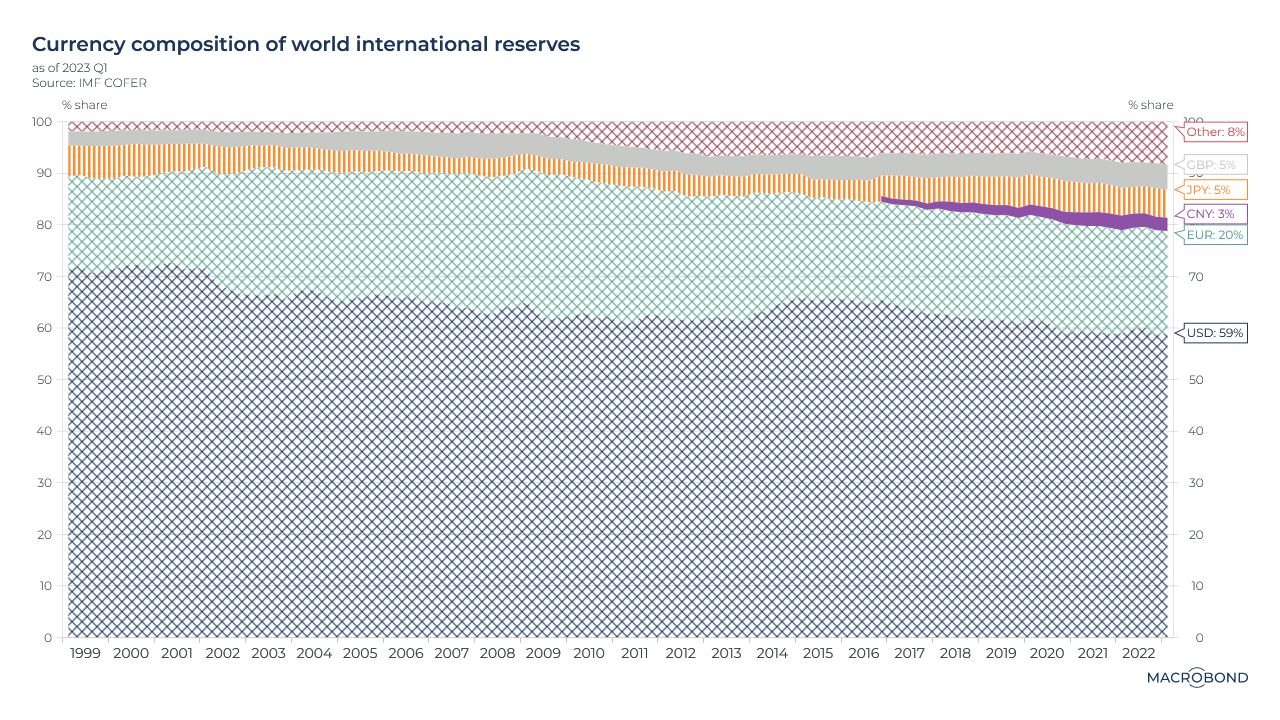

Meanwhile, the USD is declining as a share of central bank reserves on a global basis, as IMF data in the next chart shows. The greenback fell to a 20-year low of 59 percent in March, while the Chinese yuan’s proportion has risen steadily since 2017, reaching 3 percent.

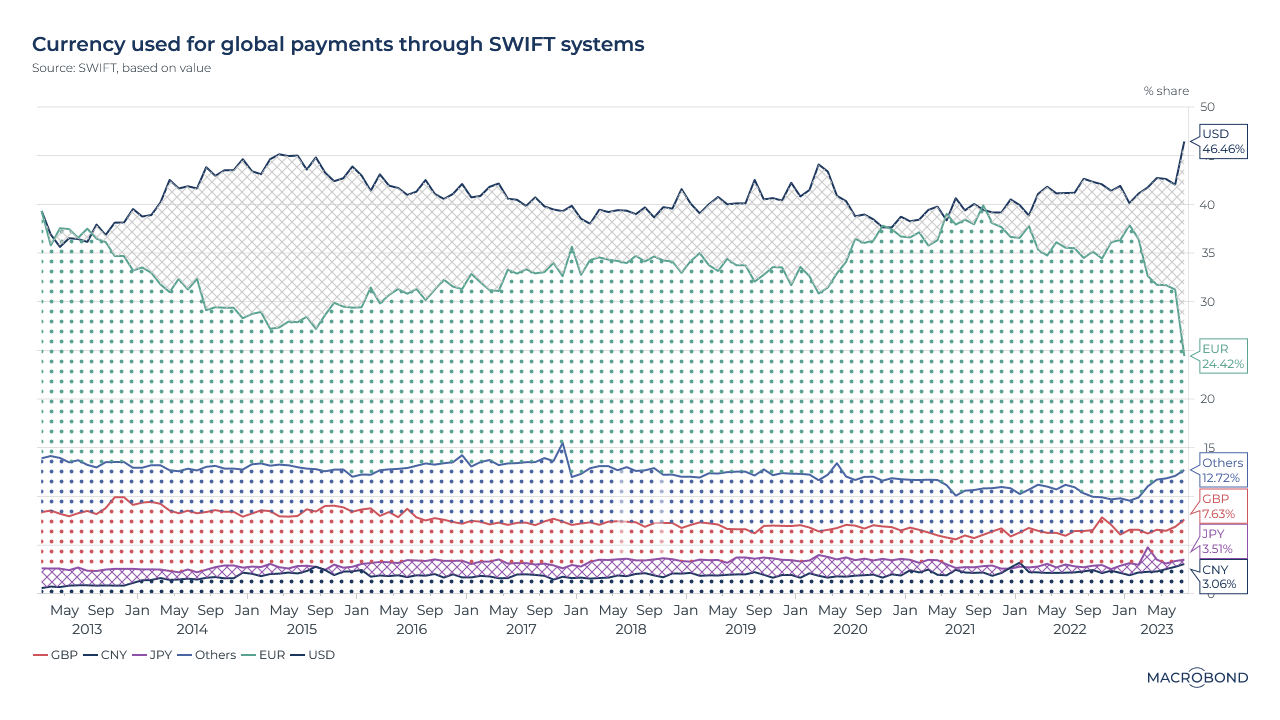

However, de-dollarisation is not imminent. The dollar still dominates global trade – and is one side of almost 90 percent of the world’s foreign-exchange transactions, according to the Bank for International Settlements. And as the next chart shows, the dollar has grown to 46 percent of all global payments made through the international SWIFT network.

Dislodging the dollar would take the creation of a lot of financial infrastructure and economic and geopolitical convergence, including a common BRICS central bank and fiscal union.

Moreover, countless businesses and traders around the world would independently need to decide to use a currency other than the USD. And investors used to the safety and liquidity of Treasuries would need to be willing to hold a non-USD equivalent.

Given all of the moving parts, it will take years for the BRICS to drive their de-dollarisation agenda. But for now, BRICS expansion adds economic might to the bloc and supports gradual complementarity – above and beyond the powerful symbolism.

Despite the small size of some of the new members and the varied interests of the BRICS countries, the dollar’s dominance is being questioned and may well be challenged over the long term.

2 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)