An investment with half the risk of equities

Shut up and take my money.

What? Well, it's likely the first thing I would have said to you if you had told me that I could invest in an asset that could generate strong returns with only half the risk of investing in global equities.

And - I must be honest - the high-yield market doesn't get me revving like its stock market counterpart. But the data doesn't lie.

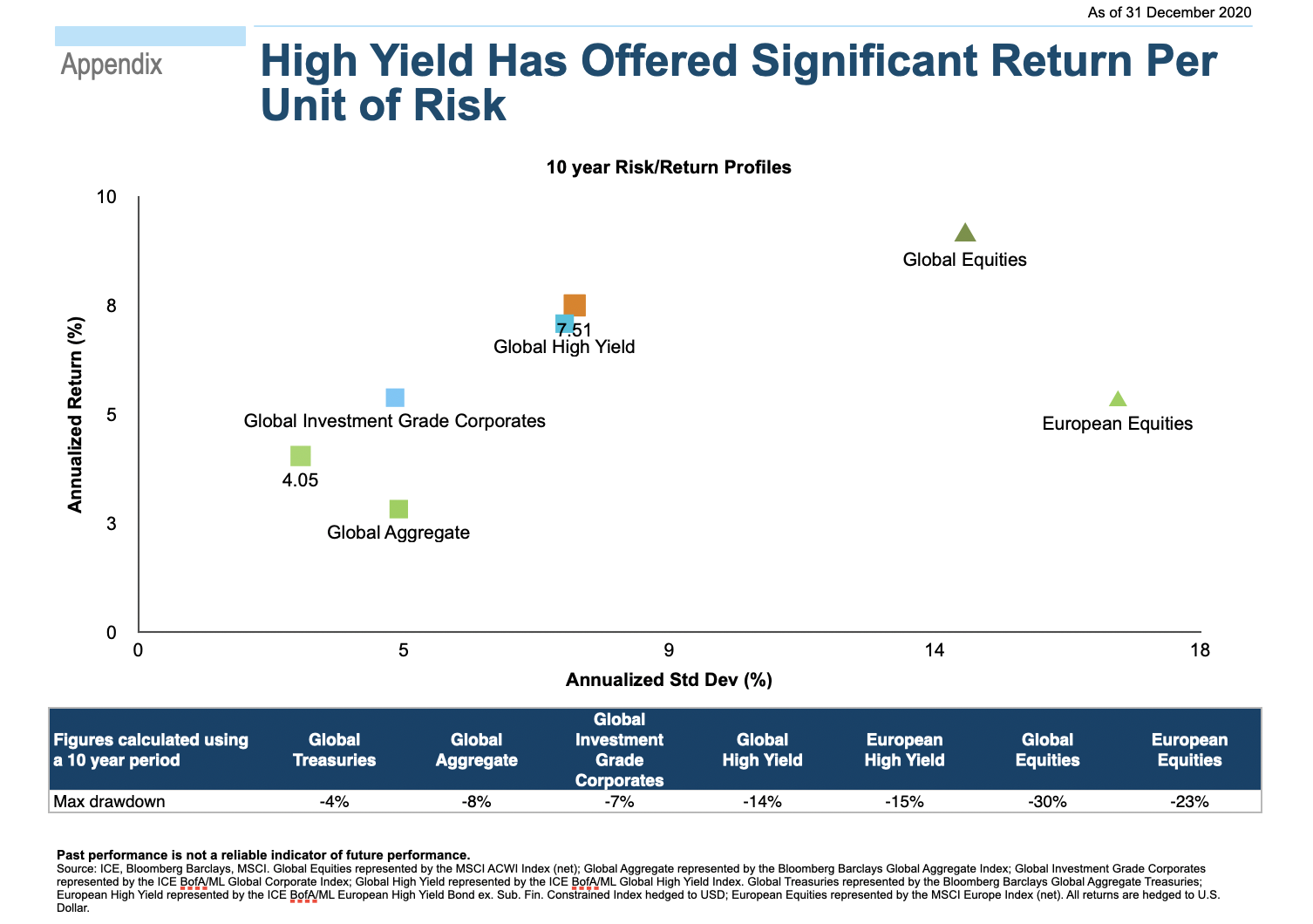

According to T. Rowe Price's global high yield portfolio manager Mike Della Vedova, global junk bonds are half as risky as global equities, as is the standard deviation of global high yield returns. Over the past 10 years, the maximum drawdown experienced by the global high yield market was 14%. For global equities, that jumps to 30%.

In this Q&A, Mike drops a bond-shell or two (see what I did there?) on common perceptions of the high yield market. Plus, he shares:

- Why high-yield is currently even lower risk than ever,

- Where he sees opportunities, and

- Why investors should brace for more volatility ahead.

Mike Della Vedova - High Yield Portfolio Manager at T. Rowe Price

What is one thing that investors should be aware of?

I'm a credit guy, so I am a bit more boring when it comes to incredible statistics. But I think the most important thing investors should be aware of is the risk-return of global high yield compared to global equities. The risk is less than half.

If you look at the standard deviation of global high yield returns it is half of that of global equities. If you look at the last 10 years of maximum drawdowns that those markets have seen, the global high yield market had a maximum drawdown of 14%, global equities had a maximum drawdown of 30%. So it's more than two times.

So a lot of folks who are very comfortable investing in equities and see high yield as too risky, I don't believe they realise that when you look at a lot of that volatility and those risk parameters, global equities are twice as risky. And the return give up isn't that much.

For example, with the European part of my high yield portfolio over the last 10 years of average returns, we're talking 7% versus 9%. But for only half the volatility.

I don't think it's an unbelievable statistic, but its something you tell people and they just go: 'No, that can't be right!'. And I think a big part of that is that we are essentially looking at junk bonds, and therefore, people naturally think that's where you lose money. But the statistics point to the fact that you're more likely to lose money by twice as much in equities.

So, someone else's trash is another's treasure?

I fully understand that viewpoint, because not many Australian companies issue high yield. It is something that is very, to an extent, removed for some investors. You invest in the opportunity set that is presented before you and that makes complete sense to me. But if it can be someone's treasure, then it's definitely worthwhile for investors to think about casting a wider net and think about the opportunity that is out there that's less risky than something that they currently accept.

What role do you believe high yield should have in investors' portfolios?

I think in a balanced portfolio, high yield can find a pretty important role. It can provide a good level of income for investors. That is the basis of what we're looking for in fixed income, but given where yields are right now around the world, you have to look in other places for income and high yield does provide that.

Investors may not realise it, but high yield provides that level of income with a lot less volatility than equity structures.

It sits above equity in seniority of any capital structure. And within that, it also allows you to focus on the risk you want so you can really capture that upside credit risk; if you're selective.

In addition, a lot of high yield capital structures will have multiple securities you can invest in, whilst there might just be one on the equity side, for example, common stock. And so you can really focus and be more selective on your risks, knowing you're still going to get a very good level of income generated by those investments.

By nature, it is still on the high-risk side of the fixed income spectrum, and there has been quite a lot of volatility in bond markets lately. Do you think this volatility will continue throughout 2020?

I think it's always hard to say what's in the future. But one thing that I truly believe in, is that I do think investors need to brace for further volatility. It's something that gets forgotten about when there's a lot of potential income or return in the market, when potential yields are lower, then you have to expect further volatility.

So right now, we are seeing talk of where will yields go. Well, yields are very low, in a lot of cases for sovereign bonds they're negative on an absolute return basis. But historically, yields are very low, and that's given us the current environment on a macro and economic level.

But given the rally that we've seen on the equity side as well, future potential global equity yields going forward are arguably also potentially lower than they have been on a historical basis because of the high pricing. So, if you look at that, or most opportunities for investors, they are looking at potentially lower yields. And that means you have to be very cautious of volatility. And I see that as the biggest potential risk to investors right now.

What is causing the volatility that we are witnessing?

It's coming from all sorts of areas. And one way you can think about what we've seen in the press very recently, with concerns about the pace of recovery. Unbelievably, if that pace is almost too quick, inflationary pressures and what that can mean for example on government curves, then you really are looking at near term volatility being sparked.

It's almost the battle between core economic underlying fundamentals that will drive companies and their opportunities versus the technicals in the market. Those focused on yields and the technical push and pull of the demand for those types of securities, driven by near-term concerns on where inflation could go. I think that's what we've really seen over the last two weeks.

I think anytime you see volatility, investors need to sit back and focus on what risks they're trying to price and effectively take advantage of.

And if you think about that push and pull of fundamentals versus technicals, we're focused very much on those companies right now that are going to benefit more from a more stable economic outlook and our recovery than the technicals on their bonds. I think that's one way that investors can look through the near term volatility, to try to capture mid-term returns.

There's been a flood of retail investors entering the market who may not know so much about fixed income products. So with that in mind, how is T. Rowe Price positioning this portfolio to withstand the volatility that we're seeing right now?

People need to really think about whether they understand the risks. And I think that's a key thing. Do they understand what they're investing in? And with the price of those risks, is it a good return?

Effectively, we're in the business of identifying and pricing risk within our opportunity set. And I think most investors, if they really dug down to the core of it, that's what they should be thinking about.

High yield investments are sub-investment grade corporates at the weaker end of the spectrum on a ratings basis. So if they're weaker companies, they are overall likely to benefit more from economic recovery, especially if they have already survived through 2020 and have got forecasts that show liquidity and survivability through 2021.

That effectively means that their balance sheets, while they may be weaker than their investment-grade counterparts, are stable and sustainable enough to get them through. And if those securities are trading weakly, and there is a higher level of risk right now, then going forward they could be a great opportunity, because they are going to benefit from the recovery.

The drawdowns that we've seen historically over the last 10 years within high yield have been half of that of equity markets globally. And so we are really focused on core credit risks within high yield.

The COVID-related sectors have really suffered. So we're thinking about entertainment, transport, the type of names that are very much focused on footfall. But as I said, if they've got balance sheets, they've either drawn down some levels of debt, managed them, potentially repaired them through 2020, and are showing liquidity forecasts that demonstrate they will be fine on a cash generation basis going forward for 2021 and into 2022. Then they're the type of sectors we've been rotating to.

So for example, some are core in the retail area, some in entertainment type of areas. If they've made it this far - and by doing very focused bottom-up analysis, we believe that they're going to make it - then quite often we're finding that those risks are somewhat mispriced for their survivability and do represent good opportunities.

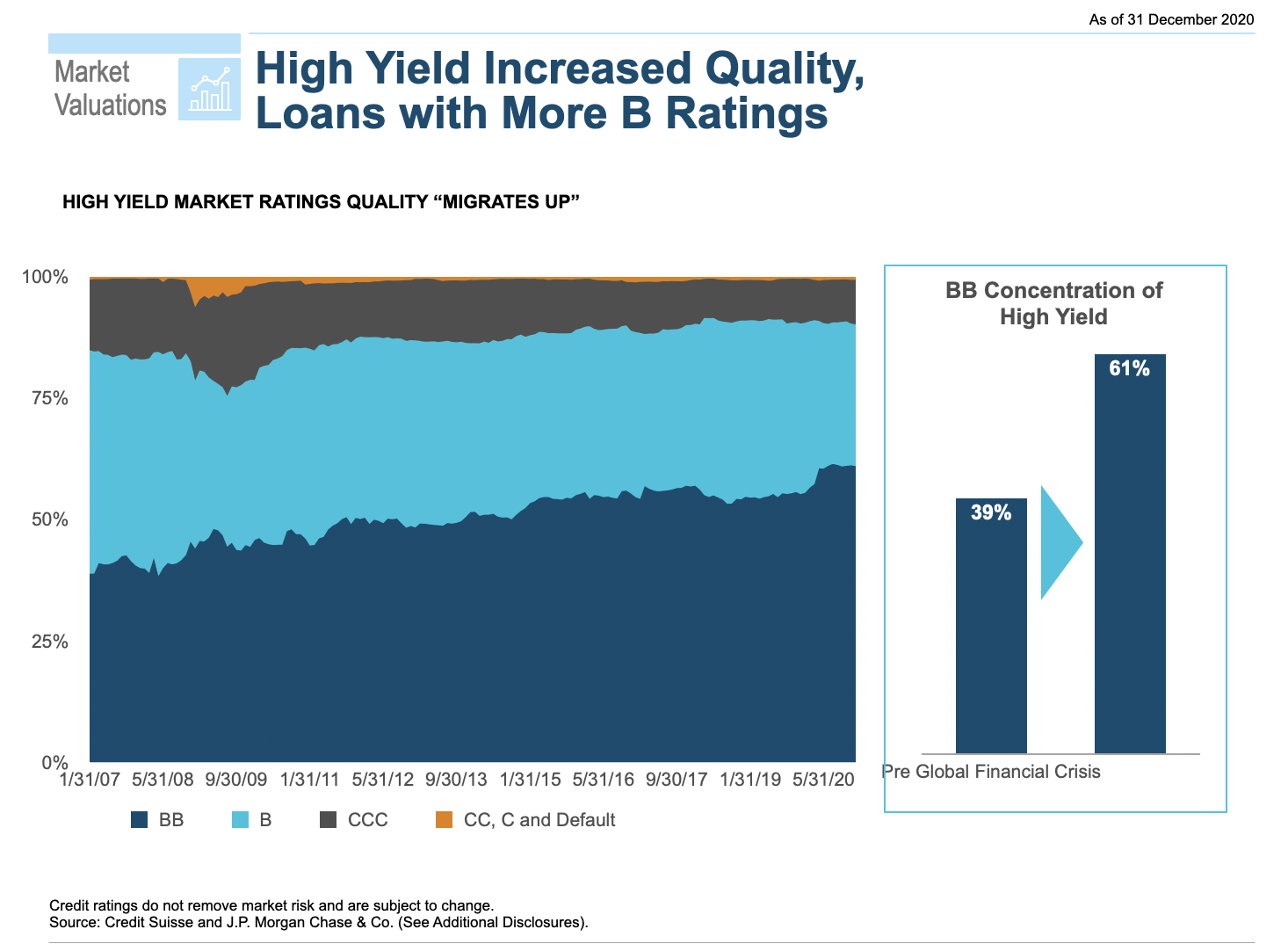

I think you are talking about "fallen angels;" a bond that has fallen from investment grade status to become a junk-bond. Have these fallen angels boosted the overall quality of the junk bond/high-yield market?

Fallen angels are a slightly different animal and probably are an even better opportunity to invest in. So last year, we saw a record level of almost US$250 billion worth of fallen angels globally. I mean, that's a record. And what that means for the overall state of the market is that actually helps suppress the default rate, because we're talking here about investment-grade companies that are being downgraded to high yield.

Now, if the public rating agencies believe they're going to survive, then quite often they get downgraded by one or two notches, so they go to BB. Now, BB is the upper end of high yield and statistically, those companies don't default in the very near term. And so what happens is, by having the overall universe of high yield go up with these big structures, especially if you've got US$250 billion of them - and if proportionally they have a lower default expectation - then your default rate actually comes down overall. And that's good for investors.

If you go back just over a decade to the Global Financial Crisis, BBs represented less than 40% of our overall global market. They now represent over 60%. And so the average rating is very, very strong.

Some of the companies we saw were triggered by the reduction in oil prices in the first quarter of last year. So some of the biggest fallen angels were very large capital structures for energy companies, names like Occidental Petroleum and PEMEX. We are not a benchmarker, so if you are able to select what you want to buy and what you don't, then it's a great opportunity.

Are there any fallen angels that you think won't be able to recover? What sectors should investors avoid?

I think you have to look at everything on a case by case basis. So, there are some fallen angels within sectors that on a secular or transformation basis are moving very quickly. For example, the automotive sector, so the big OEMs. They're facing the big secular shift of electrification and moving increasingly to EV, and the pace isn't entirely within their control, given government changes around the world to acceptance of internal combustion engines... and then the potential for autonomous driving, which is post EV, the next potential secular shift.

So there are a lot of moving parts there, pardon the pun. You will have to be cautious with those ones. I'm not saying they will fail as an industry, but there's a lot going on aside from just their current rating.

But if you're selective and look at their capital structures and their plans and projections, then there are definitely those types of businesses that are very investable. I mean, look at Ford, for example, and their current plans on EV and the scale of the opportunity set you can invest in and the selection of the whole bond curve there. That does look interesting.

So it sounds like there is opportunity even within the more risky sectors?

Never say never. We are willing to look at all sectors. If you just rule out something because of an overall perception or expectation of a sector, there are definitely potential opportunities that are left behind for investors. That's why it takes a lot of effort, but digging into the weeds is worthwhile.

Where in particular do you see opportunity? Can you take us through an example?

I think from our point of view, there remain good opportunities in more defensive areas, to help build ballast in any well-structured portfolio. So if you were to look at companies within the cable area, we're talking about the infrastructure for data; for mobile data, for business data, really from what I'm doing now, for work from home data transfer, that's mission-critical.

Now, those type of companies are often big structures, big and liquid, and therefore at certain times investors take different views, and there can be good opportunities in those type of names. There may not be as much value left in them, but they do provide great income and a degree of stability.

Another one that we are looking at right now is within the retail names, for example, some of the supermarket chains in Europe. A name over here was in the process of a leveraged buyout of the third biggest supermarket chain in the UK, ASDA, so those type of opportunities. It's a more stable sector, but given the buyout, you see a change in the capital structure, you see potentially increased levels of leverage and that means there's increased risk. So, therefore, those type of names, those core sectors do help right now and if you look for some of those opportunities within those core sectors there's still good opportunity to be had.

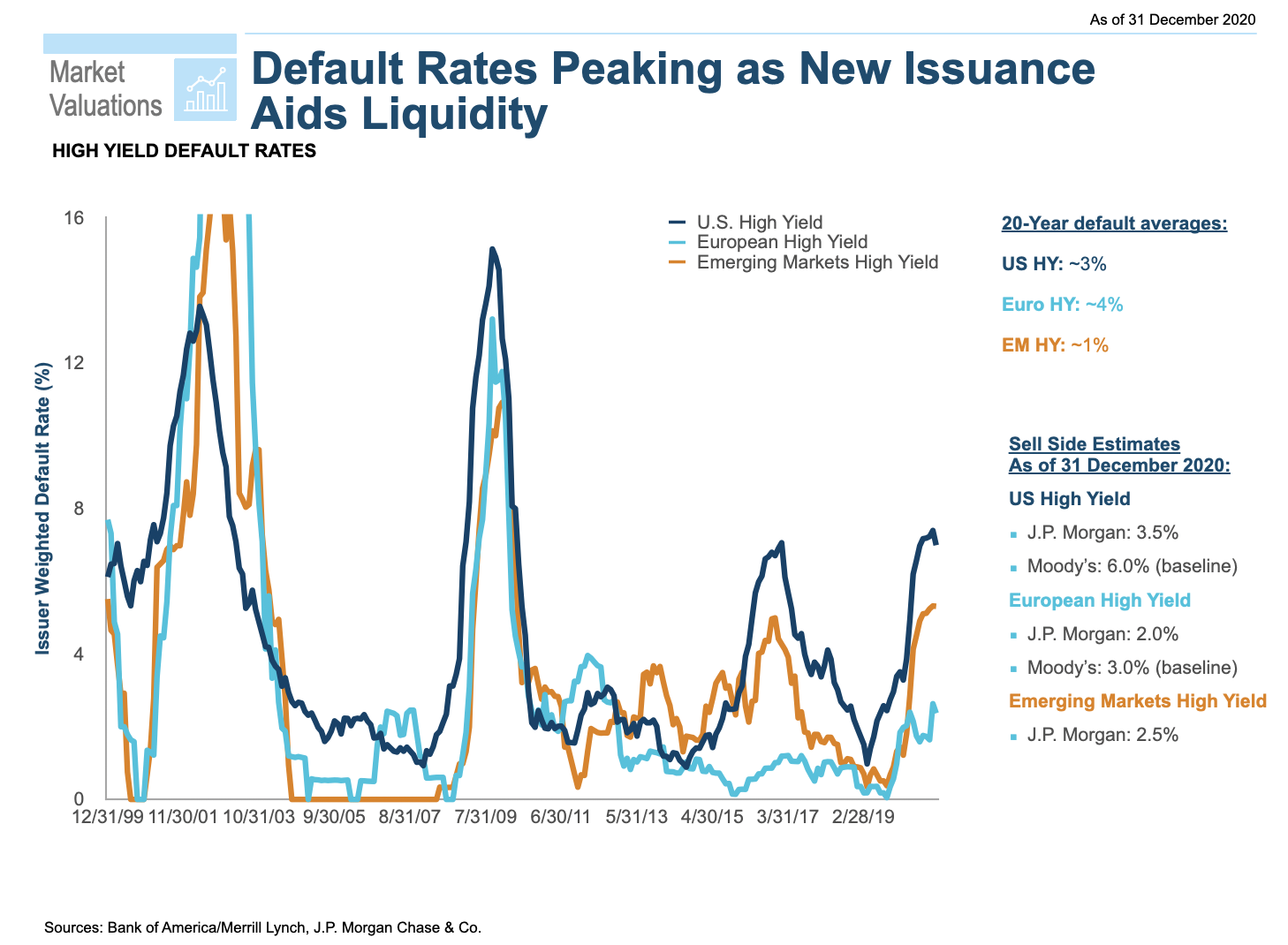

How are you pricing the risk of default in the high yield market?

Look, it's frighteningly low. And all be honest with you, if we go back a year, internally, we probably expected US default rates around 10%, and European default rates closer to 4.5%. US rates last year ended up coming in around 7.5%, European less than 3.5%. So the repairs to the balance sheet I mentioned earlier, and the monumental level of fallen angels both really suppressed that. So if you looked at that from a line by line basis, you would probably expect default rates globally in the 2% area, potentially slightly under that, so recovery rates are actually going up.

How much an investor actually gets back after a company defaults has also increased significantly. And it was well above 50% last year. So if it's 2% default rates globally, and you get 50% of that back, then you're losing 1%. That's 100bps. So you lose 100bps. So what are you earning? Well, if you look at the basis points you earn right now, on the spread over the risk-free rate within global high yield, it's around 390bps, so almost 400. Even if you went through all those defaults, you're earning almost 300bps of return. And that's because of other risks, such as liquidity in any premium. So even with default rates well below historical averages, that 2% figure, there's still great opportunity out there on a risk-adjusted basis.

Invest with confidence

The global fixed income universe has expanded rapidly in recent years. With dedicated teams of sovereign, credit and currency experts located across the US, Europe and Asia, T. Rowe Price is ideally positioned to capture this growth and the market opportunities it offers by seeking to cut through the noise to generate consistent, long term returns. To learn more, please visit the fund manager's website.

Never miss an update

Hit the 'follow' button below to be notified every time I post a wire or hit the 'like' button to let us know you enjoyed it. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

2 contributors mentioned