APRA proposes to phase-out bank hybrids by 2032

UPDATED: See my refined reflections on this odd plan here.

APRA has today released a new proposal to phase-out the use of bank hybrids by 2032, although keep hybrid securities in place for insurers like IAG, Suncorp, QBE and Challenger.

While this was a surprising solution from the regulator, which was not anticipated by the market, we had many years ago argued to APRA that the banking system would be better served by getting rid of hybrids altogether and simplifying their capital structures. This note will quickly summarise the key elements of the proposal, which you can read here.

In short, we are likely to see ASX listed hybrids slowly replaced over time with both unlisted and listed bank-issued, Tier 2 subordinated bonds.

Because the major banks will by 2032 replace their current hybrid capital, which is worth 2.15% of their risk-weighted assets (or $38.2 billion), with an extra 1.25% of Tier 2 (worth $22.2bn today), there will actually be negative net supply of regulatory capital (or new Tier 2). Put another way, investor holdings of current hybrids are 72% larger than the required new issuance of Tier 2.

There are currently A$41.3bn of ASX listed hybrids. There was historically a vibrant ASX listed Tier 2 market with $1-2bn deals commonly issued by the major banks.

APRA is proposing to phase-out the use of hybrids by 2032 and will consult to the industry until mid 2025. Technically, the phase-out will start in 2027 and be completed by 2032.

In 2027, all existing hybrids will count as Tier 2 capital (they will not become Tier 2 instruments as such - they will simply contribute to reported Tier 2 capital holdings).

By 2032, all hybrids will have to be replaced by Tier 2. The extra Tier 2 that banks have to raise will be worth 1.25% of their assets (specifically, risk-weighted assets). This will occur gradually over time as hybrids mature.

Banks will also be required to increase their common equity Tier 1 capital (CET1) by 0.25%.

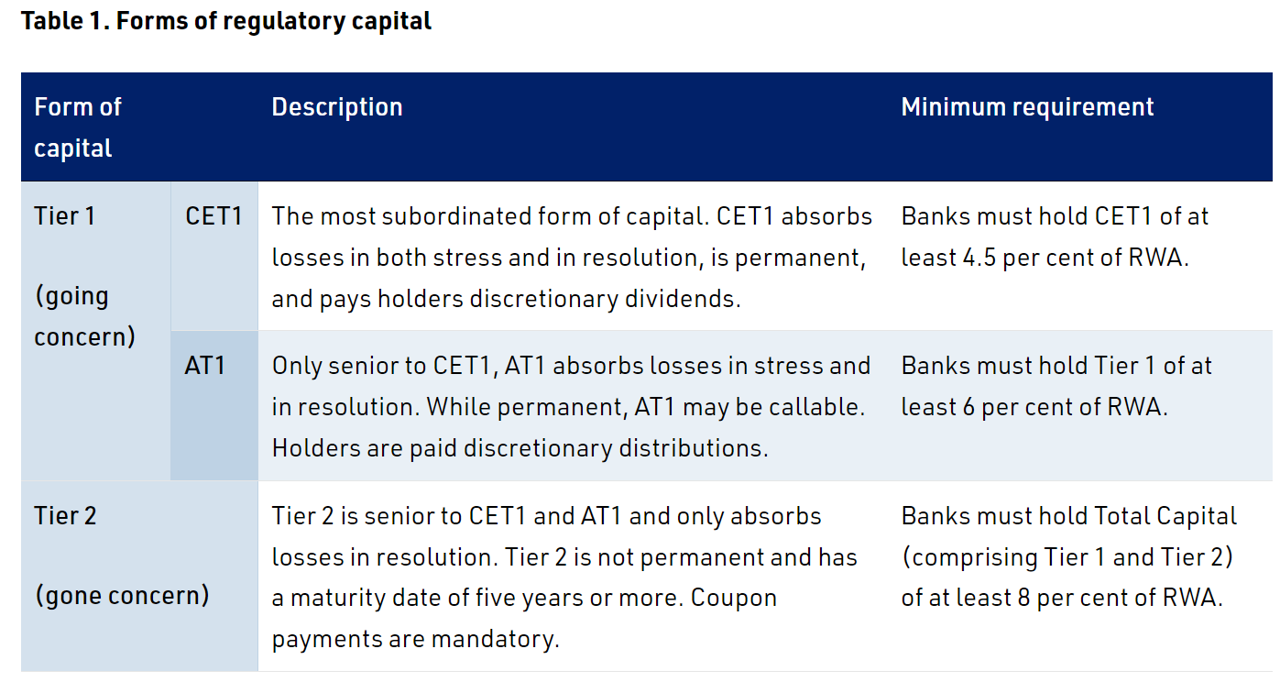

This combination of 0.25% CET1 and 1.25% Tier 2 will replace the current 1.5% minimum AT1 that APRA requires banks to target.

If banks hold extra Tier 2 worth 1.25% of RWA, this would result in a circa 0.9% reduction in current loss-absorbing capital (given the existing 2.15% of AT1).

One might think that banks could hold a buffer above the 1.25%, but their current de facto Tier 2 target is 6.5% of RWA and they were already planning on holding a modest buffer above this. That buffer size is unlikely to change - so the incremental increase in Tier 2 needs is still 1.25%.

This means there is in theory negative net supply of Tier 2 assuming hybrid investors switch into Tier 2 - that is, the $41.3bn of AT1 hybrids will be replaced by a smaller quantity of Tier 2 - for the 4 major banks, 1.25% of RWA is currently worth $22bn. On a like-for-like basis, there is currently $38.2bn of major bank AT1 securities outstanding that will eventually be replaced with $22bn of Tier 2 in current day terms.

In CY25, there are AT1 hybrid calls/maturities worth $4.9bn and in CY26 there are AT1 calls worth $4.7bn. Since the banks are going to be holding excess AT1 capital (2.15% vs new target of 1.25% Tier 2), they may simply call the maturing hybrids in 2025 and 2026 and not replace them with much, if any, Tier 2.

Note that banks have to have the extra 0.25% CET1 in place by January 2027 – this will likely further delay the need to issue replacement Tier 2 given the additional CET1 arrives first.

There are major bank Tier 2 maturities in CY25 worth $8.6bn. Average annual gross issuance for Tier 2 for the last 3 years has been $18.2bn across the four majors alone (even if the banks replaced the $4.9bn of maturing AT1 in 2025 with Tier 2, total gross supply would be materially less than recent years).

We would expect to see Tier 2 issued in listed and unlisted formats – APRA seems comfortable with retail ownership of Tier 2 given it does not have the same equity-conversion features of AT1 that were the source of APRA's anxieties.

APRA has clearly defined Tier 2 as "gone concern" capital and does not expect Tier 2 to be converted into equity to support CET1 unless a bank is declared non-viable, or a gone concern (this is very different to AT1 that possibly stops paying coupons as a bank's CET1 declines below 10.25% and it remains a going concern, or AT1 formally and automatically converting into equity when a bank's CET1 ratio hits 5.125%).

The change in supply expectations over CY25 and CY26 would not seem to warrant any material change in Tier 2 spreads. On the day, Tier 2 is very modestly wider by 1-2bps.

Listed Tier 2 will in time become the highest-yielding bank regulatory capital security on the ASX.

There will be around 1.9% less equity/hybrid capital protecting Tier 2 investors, which at the margin is negative, although the Aussie banks already hold world-class CET1 ratios that are calibrated by APRA to ensure they are "unquestionably strong".

And this will have to be weighed against additional ASX switching from hybrids to Tier 2, which APRA itself highlights:

"Banks could source the Tier 2 funding domestically, including from previous AT1 investors, or offshore. APRA expects the material demand from offshore investors for Australian Tier 2 capital instruments will remain"

In terms of market reactions, we have ASX hybrid spreads a bit tighter and Tier 2 spreads very slightly wider.

5 topics