ARB: A long term growth story

“Finding the really outstanding companies and staying with them through all the fluctuations of a gyrating market proved far more profitable to far more people than did the more colourful practice of trying to buy them cheap and sell them dear.” - Phil Fisher

When it comes to investing pitfalls, it’s common to think in terms of what’s been bought, not sold. Yet, selling a stock can be the biggest mistake there is, especially when you come across a great business, run by first class people. Opportunities to compound wealth over decades in a high quality business are rare and when you find one, it pays to make the most of it.

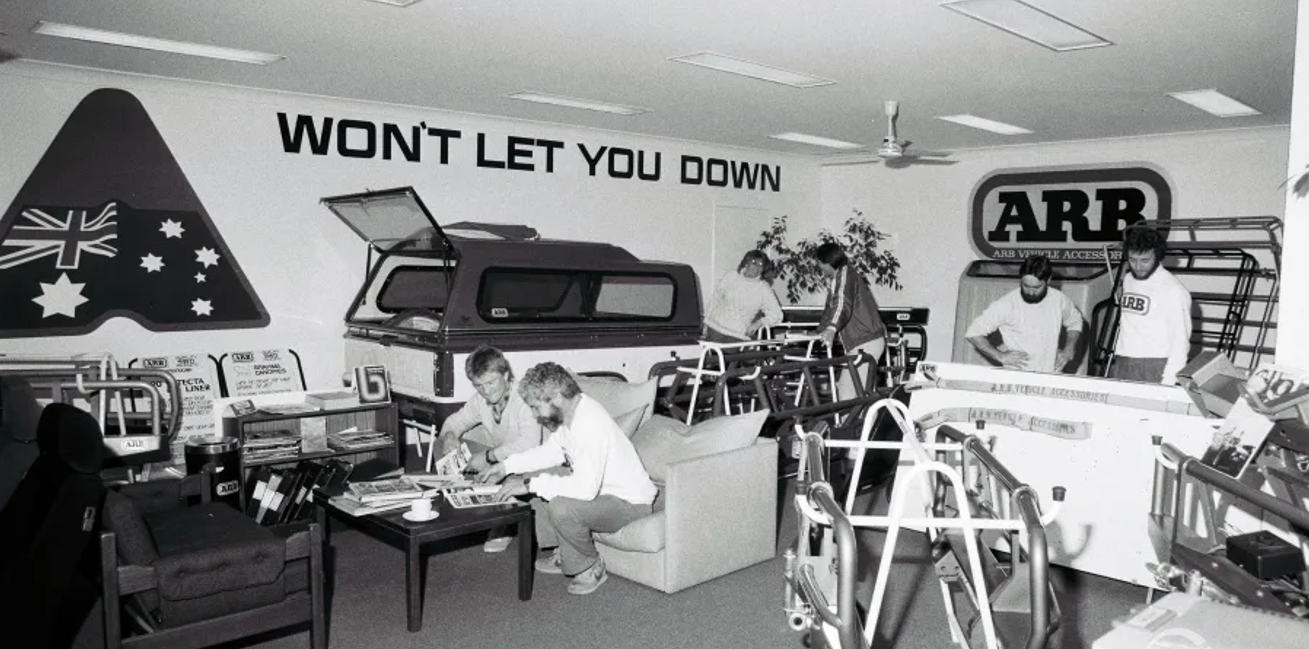

At Celeste, one example of a stock creating long term wealth for unitholders has been ARB Corporation Ltd (ASX:ARB). ARB is a global manufacturer and distributor of 4x4 vehicle accessories and was listed in 1987 at 0.65c a share with a market capitalisation of $6.6m. In its first year ARB generated $14m in revenues and less than $1m in profit after tax. Some 45 years later, as at the time of writing (30th June 2021), ARB’s share price closed at $43.20, with a market capitalisation of $3.5bn. FY20 reported sales were $465m with earnings of $57m. Over these 45 years, patient execution of the strategy has seen ARB join a rarefied club of microcaps that have gone on to become ASX 200 listed companies.

Celeste made a sizeable investment in the company in 2004 when ARB was trading at $3.41 and it has been a part of the portfolio ever since. In the piece below, we unpack the factors that we feel have contributed to ARB’s success and explore why we think the company remains attractive as a long-term investment.

A top-down meets bottom-up story

ARB has been a direct beneficiary of structural change in the global automotive market over the past four decades. In 1987, 5 million light trucks were sold in the U.S. representing circa 30% of total vehicles sold. As at 2020, the number of light trucks sold has grown to over 11 million, representing 76% of all total vehicles sold. Recent data suggests this trend is only accelerating as vehicle design now acknowledges greater participation of the female buyer and in doing so, broadens the addressable SUV market. Further, technological innovation continues to drive down running costs and improve the actual and perceived environmental impact of these vehicles. In Australia, a similar trend has been evident with passenger vehicle sales in decline, whilst 4WD and SUV sales have grown.

In FY 2020, SUV’s accounted for approximately 50% of all vehicles sold locally and grew by 5.9% year on year.

Passenger vehicle sales accounted for approximately 24% of the market but fell 30% year on year. This market share drift to SUV/4WD’s has been ongoing for a number of years with SUV/4WD’s only 30.5% of total vehicle sales in Australia as recently as 2010.

One would suspect over 45 years of growth and profitability, the forces of competition and new entrants into the market would squeeze margins, temper sales growth and mute cash flow conversion.

For ARB, this hasn’t been the case. As at the time of writing, market expectations for FY21 are for year on year sales growth of 21%, to $564m, delivering $94.4m in net profit, 65% growth on FY20. While competition levels have increased, it has been the strategic execution of the management team that has allowed the company to weather this environment over the years.

Management have driven efficiencies in their local manufacturing operation, moved some production to a company owned facility in Thailand and made several astute investments. ARB has developed a host of unique 4x4 vehicle accessories, driven by a significant investment in its local engineering capability, and nurtured commercial relationships with an array of tier one global auto manufacturers (OEM’s). It is these actions that have enabled ARB to remain best of breed in the international 4x4 market over the last 4 decades.

While we have maintained a long term investment in ARB, it has always been required to meet the Celeste investment process at every stage we were presented with new information or financial data. For us, this has meant constantly re-assessing the company based on our three pillars:

- The quality of the business model and the industry,

- The quality of the financial reporting; and

- How well this represents the cash flow the company produces and the quality of the board & management team.

When new information on the company would become available, we would ask ourselves:

- Has our view of the business model, board & management team, and the quality of accounts changed?

- Does this then change our expectation of revenues, earnings and cash flow we expect the business to generate over the next 10 years?

- What valuation are we prepared to pay today for this cash flow that reflects the risks, has limited downside to our capital invested and skews returns to the upside?

ARB’s sales have proven to be resilient through many macroeconomic disruptions (the Global Financial Crisis, several oil price shocks, acute currency volatility, the Japanese earthquakes of 2011 impacting automaker supply chains and more recently the Covid-19 recession).

The ARB management team have been meticulous in targeting underserviced parts of the 4x4 accessory market, investing in engineering, creating sector specific intellectual property and scaling developed product into a global market. With three of the founding directors still active within the company, we believe that at ARB you get access to unique operational muscle memory and a highly aligned and passionate team.

…but valuation?

Since the emergence of Covid-19, we have seen international travel come to a standstill, with the ‘holiday at home’ theme growing in popularity for consumers around the world. Concurrently, governments and central banks have created an extremely accommodative economic backdrop, enacting record levels of fiscal and monetary stimulus. This confluence of events has led to a very strong sales backdrop for ARB despite what initially seemed to be a dire outcome for automotive and auto aftermarket sales. Market sentiment too has changed with the ARB share price increasing from the March 2020 low of $10.81/share to the current $43.20/share, an increase of 300%.

Given the scepticism around the longevity of this growth and the pull-forward effect brought upon by these factors, many have argued that the company is overearning and at a 40% EV/EBITDA premium to the ASX Small Ordinaries Index, it may be expensive.

If we use history as a guide, it could have been suggested many times that ARB, trading on significant premium to the market may have been termed optically expensive. When Celeste first built a position in the company in 2004, ARB was trading on a 40% EV/EBITDA premium to the market, and at the time the share price of $3.41 looked expensive on FY04 earnings. The real point however was to assess underlying earnings over the next 5-10 years and on that trajectory, ARB looked to offer compelling value.

Where to from here?

Herd over-reaction to new information can be a source of opportunity. However, market under-reaction to material information, is often a simpler way to generate returns. If we look at market reaction to significant news flow over the last few months we believe this has been the case for ARB. Following the announcement that ARB was partnering with Ford to develop a full suite of premium, aftermarket products for the all-new Ford Bronco, we were surprised at the muted reaction from the market. On the day, the share price rose less than half a percent and a modest 2% over the following month. Up until recently, we believed the market was significantly underestimating the potential earnings from the Bronco partnership, and the evolution of a deeper commercial relationship with Ford globally.

So why do we think this? The Ford US Bronco opportunity is best understood with reference to the potential addressable market. As of the 25th March 2021, Ford announced that it had 190,000 reservations for the Bronco, and some 125,000 had been converted into orders. Assuming that remains the case and no further conversions are made, a fitment rate of 20% (using the aftermarket accessory rate on the Jeep Wrangler as a proxy) would mean 25,000 Broncos accessorised with ARB product. You could argue that 20% on a vehicle purposely designed with modular parts to be customised to be too low. But again, in order to be conservative let’s assume 20%. If a new Bronco owner fully kitted out the entire ARB range available to their truck they would spend approximately A$18,000.

If we discount this to an assumed average of $5,000 per vehicle and applied an aftermarket industry margin of 65%, this translates into $81.3 million in incremental revenues for ARB.

You could take this a step further and apply a margin on after-tax earnings (using Fox Factory, a US listed ARB comp with OEM exposure), which at 13% (and similar to ARB’s after-tax earnings margins of c.12%) would be $10.6 million in incremental NPAT. This represents approximately 14% of forecast FY21 revenues and 11% of forecast NPAT, leaving us to believe a 2% rise in the share price over the month following the announcement as relatively modest. Over the past few weeks we have begun to see the share price reflect the US opportunity but is yet to factor in Bronco unit sales growth, the potential for additional model launches from Ford including the Raptor and the F-150, and the potential for similar opportunities with other OEM’s.

For ARB, we believe new OEM partnerships that leverage the ARB brand and IP will open up additional opportunities with new vehicle releases and the potential to enter new markets. ARB has an articulated product and partner strategy to significantly grow sales and earnings over the next +5 years. ARB continues to meet the Celeste investment process and we believe remains a compelling long-term investment opportunity for our investors well into the future.

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic

1 contributor mentioned