Are AREITs still defensive?

Right from the start over 50 years ago, Australian real estate investment trusts (AREITs), then known as listed property trusts (LPTs), were tailored to risk averse investors. Often approaching or in retirement, they needed a regular, reliable income stream and AREITs suited them perfectly.

Aside from the global financial crisis (GFC), when the sector embarked on a foolhardy and expensive offshore acquisition binge, AREITs have delivered on their promise.

In the aftermath of the GFC, AREIT managers cleaned up their act, making the sector more resilient through lower debt levels, increased sources of financing, and less speculative activity. AREITs got back to their knitting.

Then came the pandemic. No matter how bad the scenarios investors might have planned for, deserted office towers and shopping centres probably didn’t number among them. And yet here we are. Half the country is back in lockdown and shopping centres and office blocks are empty once again.

With the pandemic accelerating the shift to online retail and the trend to work-from-home, income investors were already concerned that AREITs might not be the reliable investments they once were.

Thanks to delta, many are now asking whether AREITs are defensive at all.

It’s a fair question. Yet backed by my team’s knowledge and experience, plus the data we’ve collected over the past year or so, I can answer it with an unequivocal ‘yes’.

Three reasons to back up the 'Yes' thesis

#1 Delta may be a "game-changer" but vaccines mean we can deal with it

And if not, we have a proven capacity to develop new vaccines that will probably address whatever nature can throw at us. Europe and North America, where things are returning to normal even with high daily caseloads, point the way.

As our politicians keep reminding us, we are going to have to learn to live with the virus. Tourists in Europe are now transiting airports; crowds at football stadia are back and in full voice; and people are out and about, living with the virus. In a few months, Australia should be in a similar position.

I recommend investors look beyond the recent scary headlines and the lockdown blues and focus on where we will be this time next year, and beyond. That’s what long term investing is all about.

#2 How AREITs will sustain themselves until we get there

The Government’s National Code of Conduct is back in play but landlords have enough capital to get them through should tenants be eligible for rental support. Most of the income streams on which AREIT investors rely are not at risk.

The current situation is unlikely to be as demanding as it was in 2020. Even if it is, the data over this period is reassuring. There was a strong recovery in operational performance of sectors most impacted by the pandemic, especially large mall retail. We’ve also seen good growth in asset values across most asset types, a reflection of investor demand and the belief in a sustained economic recovery.

While lockdowns have re-introduced uncertainty and the unequal burden of the leasing code, AREIT management teams and investors are looking at life after lockdown.

If the next few months are tough, it will only be temporary with encouraging signs around vaccination rates a boost to consumer and business sentiment.

Our soon-to-be-published reporting season wrap will highlight the resilience of AREIT income streams. The lease contract, which drives these incomes, delivers a level of protection to income investors, which ordinary listed shares don’t offer. This is the key differentiator for the AREIT sector and what will sustain it into the future.

Surviving a global financial crisis and a pandemic are the ultimate stress tests. AREITs, despite a few bumps along the way, have come out the other side.

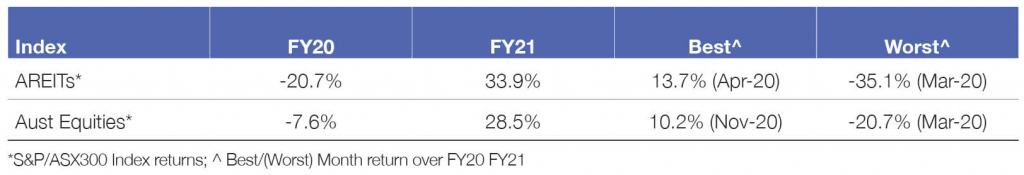

#3 Questions remained in the first 12 months but are now mostly answered

A year ago, there was a lot of fear around property. The ASX 300 AREIT index crashed 20.7% while the ASX-300 only fell 7.6%. As noted in my last wire, AREITs – the come-back kids, the ASX300 REIT index posted a staggering come-back in FY21, delivering a return of 33.2% versus the ASX300 returning 28.5%. There is a lot more confidence in the sector than a year ago.

Investors generally don’t cope well with risk and uncertainty. Yet that is all they have seen in the last 18 months. While AREIT prices have been a rollercoaster, operationally they have shown a level of resilience far beyond what doomsayers expected and gave investors the opportunity to snap up some bargains.

After a difficult period, we believe that AREITs are very much alive and kicking goals for income investors.

Access a steady stream of reliable income

To find out more about the income options that APN Property Group provides, please click the 'CONTACT' button below.

4 topics

1 contributor mentioned