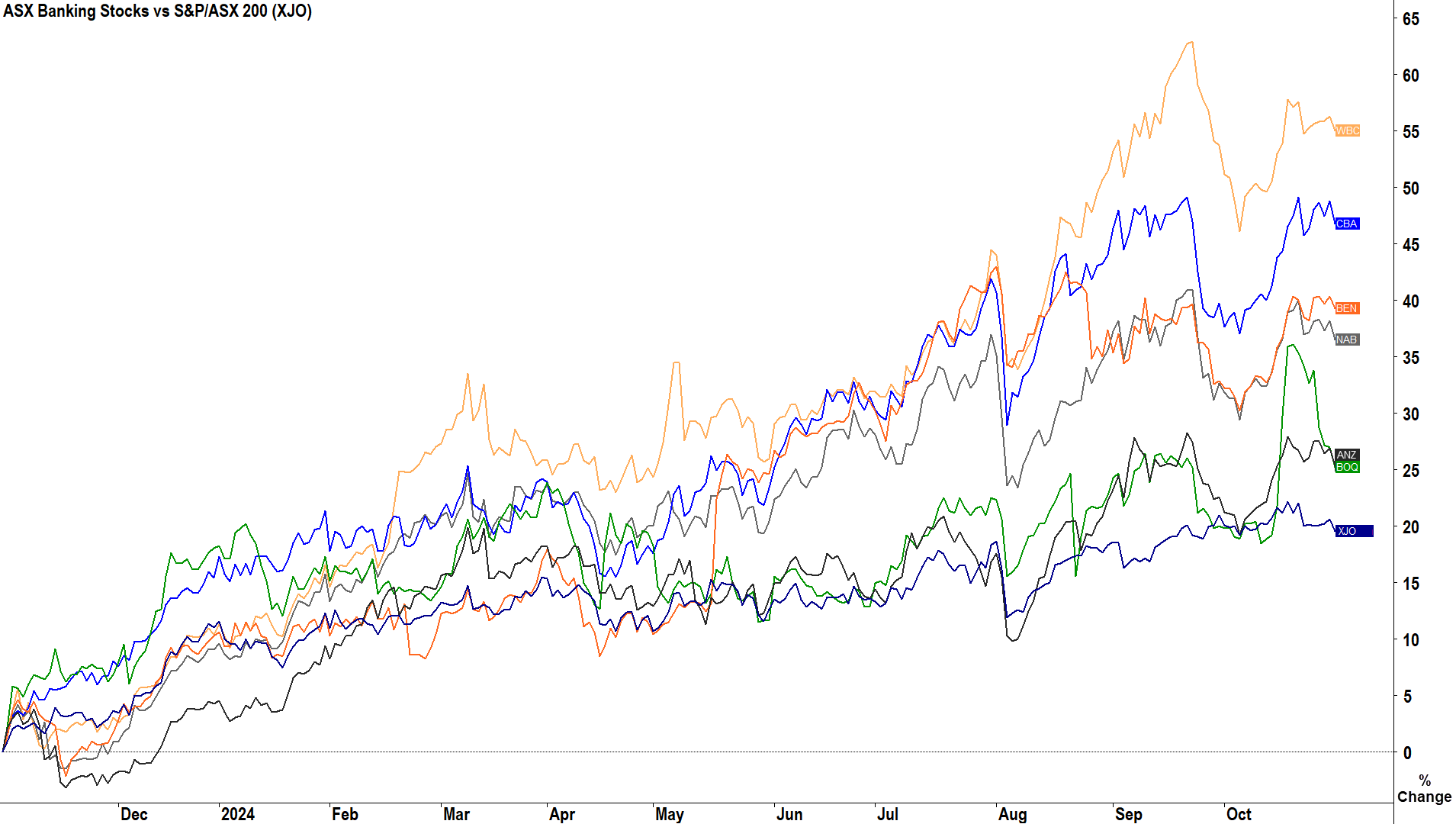

Are ASX bank shares overvalued? This is what the big brokers say…

Major broker Macquarie has been adamant that Australian bank shares would “UNDERPERFORM” the broader Australian share market since 13 March. It was on that day it chose to simultaneously downgrade three of the Big Four - ANZ Group (ASX: ANZ), National Australia Bank (ASX: NAB), and Westpac Banking Corporation (ASX: WBC).

These three joined Bank of Queensland (ASX: BOQ) (UNDERPERFORM rated since 23 September 2023), Bendigo and Adelaide Bank (ASX: BEN) (UNDERPERFORM rated since 22 September 2023), and Commonwealth Bank of Australia (ASX: CBA) (UNDERPERFORM rated since 20 January 2023).

So far, this hasn’t been the ideal portfolio positioning as Aussie banking stocks have been some of the best performers in the S&P/ASX 200 over the past 12 months. But Macquarie is not alone in its scepticism of the lofty valuations of Aussie bank shares – plenty of its peers have also advised clients to be underweight or completely out of the sector altogether this year.

In this article, we’ll review broker positioning across the major Australian banks, as well as Macquarie’s latest comments on each of the Big Four. Does Mac still think Aussie banks are overvalued, and when do they expect share prices in the sector to finally adjust? Hint: The time of reckoning may be nigh!

Broker consensus for Australian bank shares

See below broker consensus tables for each of the major Aussie bank shares. I have used the Market Index Broker Consensus archives for all of the information.

For each of the tables below, all ratings and targets are taken from broker research notes since May 1 (to keep them current). To obtain a stock’s Broker Consensus Rating, I assign a value of +1 to any rating better than HOLD/NEUTRAL/MARKETWEIGHT, a value of 0 for any rating equivalent to HOLD/NEUTRAL/MARKETWEIGHT, and a value of -1 to any rating worse than HOLD/NEUTRAL/MARKETWEIGHT.

I then take the average of all assigned rating values and assign a Broker Consensus Rating of BUY to values greater than +0.5, a rating of HOLD for values between -0.5 and +0.5, and a rating of SELL for values less than -0.5.

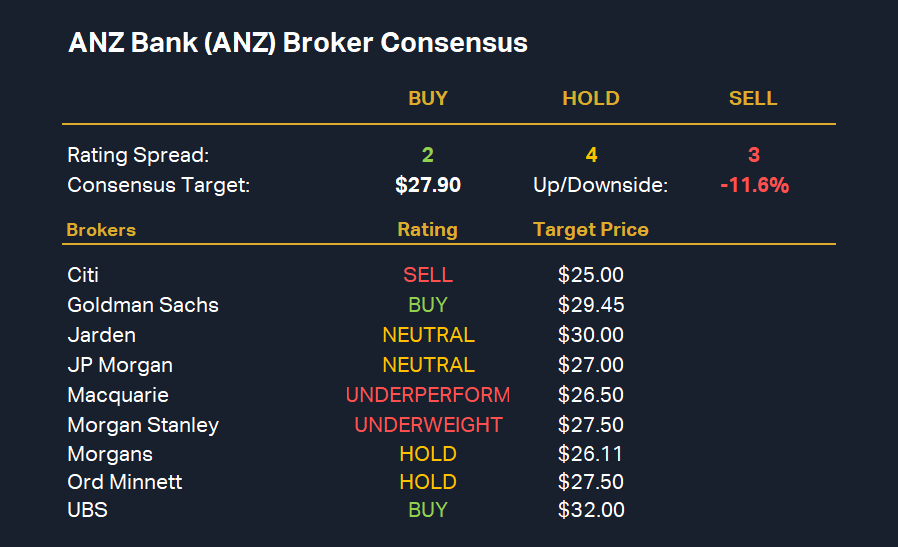

ANZ Group (ANZ)

%20Broker%20Consensus.png)

ANZ’s broker consensus rating is -0.11 resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $27.90. This suggests brokers collectively believe the stock is around 11.6% overvalued based upon the closing price on Tuesday 29 October of $31.56.

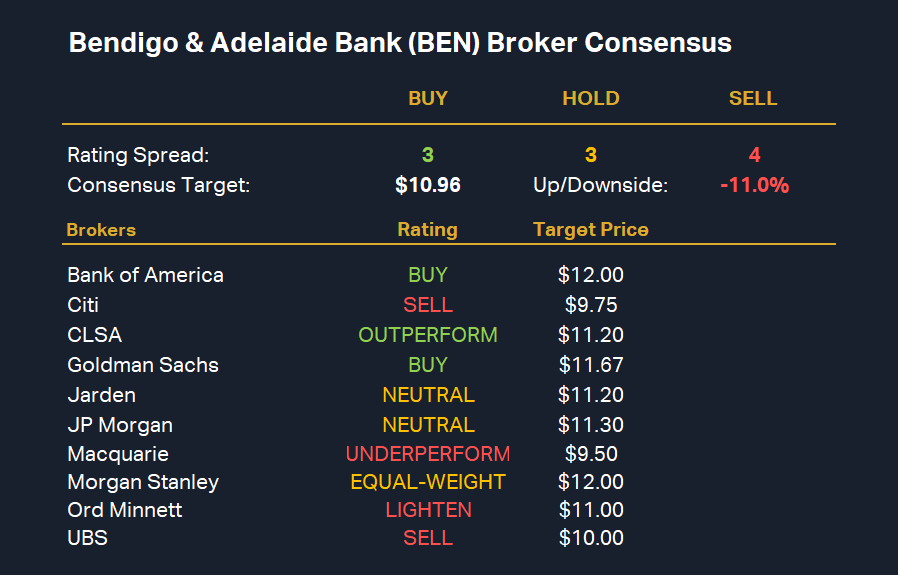

Bendigo and Adelaide Bank (BEN)

%20Broker%20Consensus.png)

BEN’s broker consensus rating is -0.1 resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $10.96. This suggests brokers collectively believe the stock is around 11.0% overvalued based upon the closing price on Tuesday 29 October of $12.31.

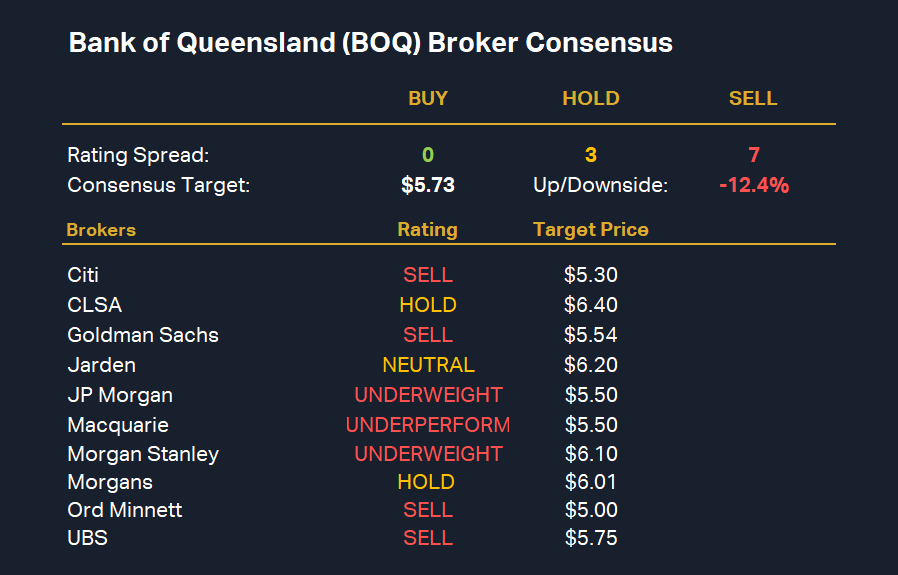

Bank of Queensland (BOQ)

%20Broker%20Consensus.png)

BOQ’s broker consensus rating is -0.70 resulting in a Broker Consensus Rating of SELL. Its consensus (average) target price is $5.73. This suggests brokers collectively believe the stock is around 12.4% overvalued based upon the closing price on Tuesday 29 October of $6.54.

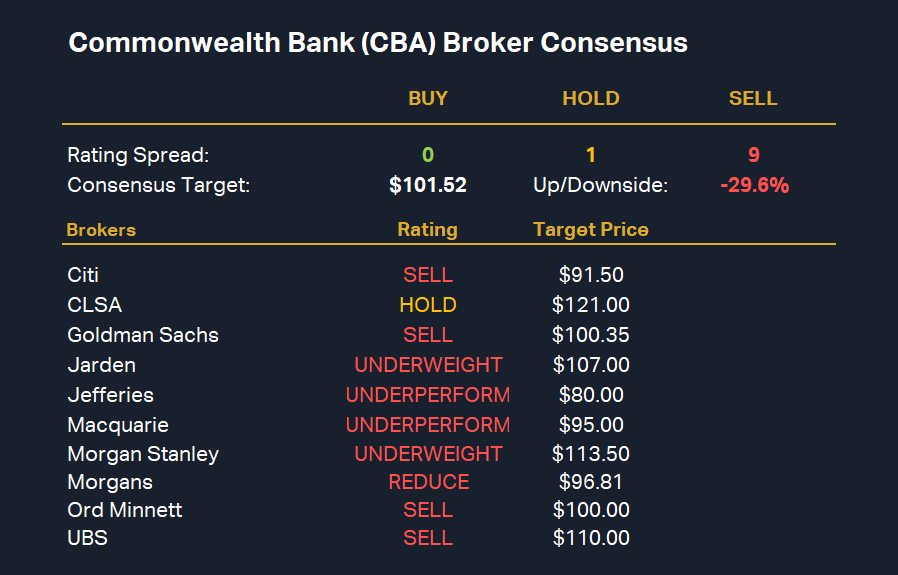

Commonwealth Bank of Australia (CBA)

Commonwealth Bank of Australia (CBA) price chart.

%20Broker%20Consensus.png)

CBA’s broker consensus rating is -0.11 resulting in a Broker Consensus Rating of SELL. Its consensus (average) target price is $101.52. This suggests brokers collectively believe the stock is around 29.6% overvalued based upon the closing price on Tuesday 29 October of $144.17.

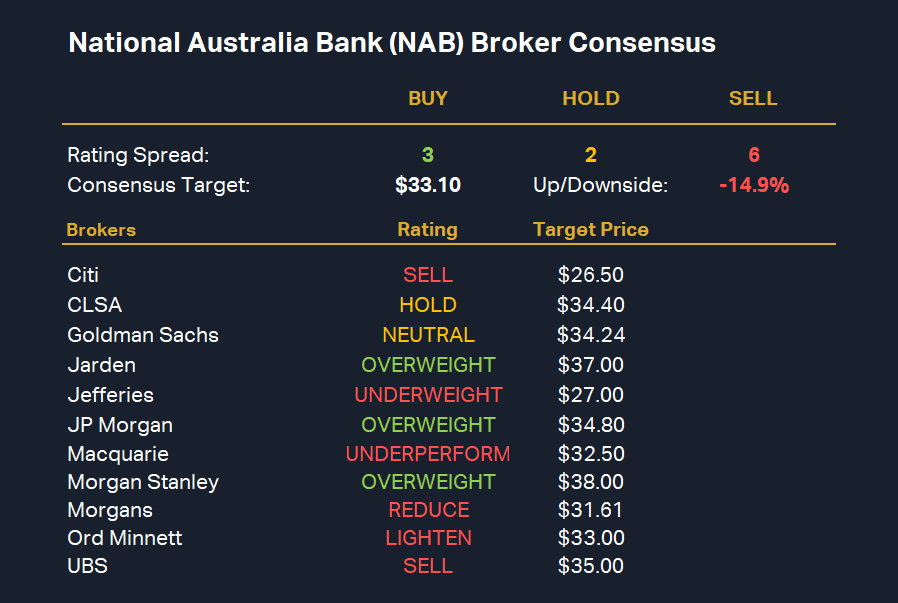

National Australia Bank (NAB)

National Australia Bank (NAB) price chart.

%20Broker%20Consensus.png)

NAB’s broker consensus rating is -0.27 resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $33.10. This suggests brokers collectively believe the stock is around 14.9% overvalued based upon the closing price on Tuesday 29 October of $38.91.

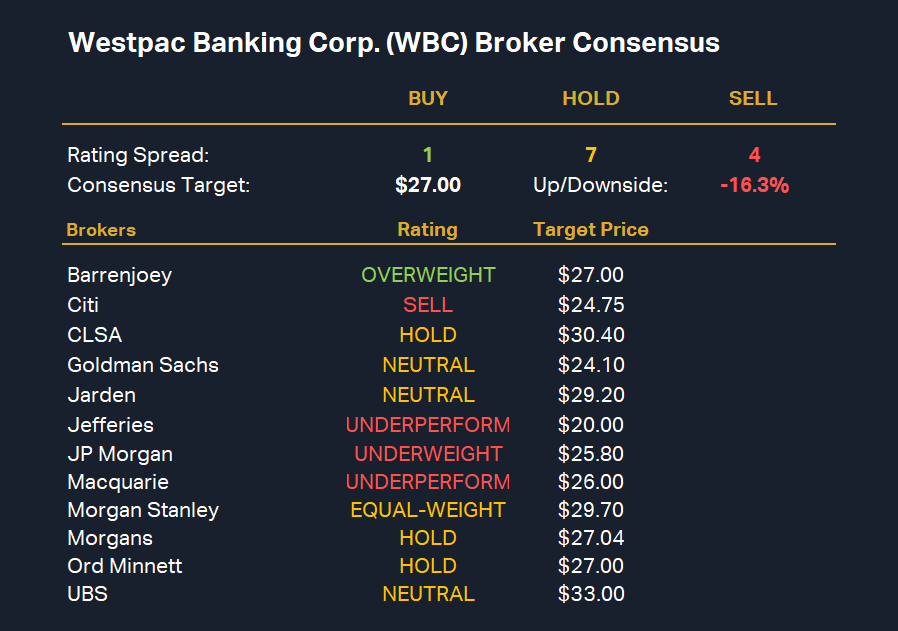

Westpac Banking Corporation (WBC)

Westpac Banking Corporation (WBC) price chart.

%20Broker%20Consensus.png)

WBC’s broker consensus rating is -0.25 resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $27.00. This suggests brokers collectively believe the stock is around 16.3% overvalued based upon the closing price on Tuesday 29 October of $32.24.

Mac’s latest views on the Big 4

“Following a solid lead from the US banks, trading income may again be a source of positive surprise. However, given recent issues in this business, we think the market will likely look through this, given the future risk to revenues from additional oversight and reduced risk-taking. While consensus earnings are difficult to read given inconsistencies with SUN treatment, we see risk to current pre-provision earnings expectations over the medium-term and are around 3-5% below consensus.” Rating: UNDERPERFORM Target Price: $26.50

“Despite CBA’s very elevated valuations, as rates remain higher for longer, we see no apparent risk to earnings in the near term, with potential upside risk from better margin and expense management. However, once rates are cut in 2025, we expect margin pressures to emerge, driving our below-consensus forecasts for 2HFY25E and FY26E.” Rating: UNDERPERFORM Target Price: $95.00

“We expect the recent strong business credit growth trend to support NAB's revenues. However, we see headwinds to consensus earnings over the medium term from rate cut impacts and business lending competition affecting asset spreads.” Rating: UNDERPERFORM Target Price: $32.50

“Our estimates are broadly in line with consensus, and we expect minimal surprises in the FY24E results. However, we see risk to FY25E and FY26E pre-provision profits as we remain above market on costs and below market on revenue (due to lower margins from rate costs like for peers).” Rating: UNDERPERFORM Target Price: $26.00

This article first appeared on Market Index on Wednesday 30 October 2024.

5 topics

6 stocks mentioned