Are ASX tech highflyers Pro Medicus, Technology One, Wisetech & Xero too high to buy?

The S&P/ASX 200 Information Technology (XIJ) sector has been the best performing of the 11 major ASX sectors over the last 12-months. As per the chart below of sector performances over the last year, you can see it hasn’t even been a close race. Tech wins hands down.

For many Aussie investors who’ve been lucky enough to have gone along for the tech sector ride, the gains have been a welcome boon. However, there are also likely many who’ve from time to time looked at the soaring share prices of a Pro Medicus (ASX: PME), a Technology One (ASX: TNE), a Wisetech Global (ASX: WTC), or a Xero (ASX: XRO) and lamented that they were “Too high to buy now…”

As we’ll see, each of the charts of these ASX tech superstars are very much moving in a bottom-left-top-right direction, and for PME and TNE one could argue – appear to be moving exponentially so! Surely then, this must mean that they’re still too high to buy!?

Buy high, sell higher

This brings me to one of the most underrated and probably underutilised investing strategies in markets: Buy high, sell higher.

No that’s wrong Carl, it’s actually “Buy low, sell high”. It’s what Warren Buffett does, therefore it must be the correct way to invest. (I hear you say!)

I contend there’s just as much value in the ‘buy high, sell higher’ strategy as there is in Mr Buffett’s! This makes more sense when you consider that I’m a technical analyst, and more specifically, a trend following technical analyst.

This means it’s my job to find the very strongest uptrends and consider them for potential investment. It also means I’ll also consider the very strongest downtrends and consider them for potential shorts (i.e., Sell low, buy back lower as it were – but this is a topic for another day!).

I believe there’s generally a very good reason why a company’s share price is moving in a bottom-left-top-right direction on its chart. A rising share price equates to excess demand for the company’s shares. This means the demand for the company’s shares over the historical range of price points it has traversed was greater than the supply of its shares at those price points.

I’m not too fussed with the why, I just assume that those demanding (and just as importantly, those withholding supply) have done their research and understand exactly why they so clearly love the stock. Also, the greater the rate of share price appreciation observed, the greater they must like the stock.

Who am I to argue with these investors? (Especially considering I’ve done absolutely bupkis research on the fundamentals on my own!)

There were several points along the collective PME, TNE, WTC, and XRO share price journey over the past 6 months where I’ve really liked the look of their charts. Each morning since May 14, I’ve been publishing a list of my favourite ASX uptrends and downtrends. It’s called ChartWatch ASX Daily Scans and I invite you to follow along.

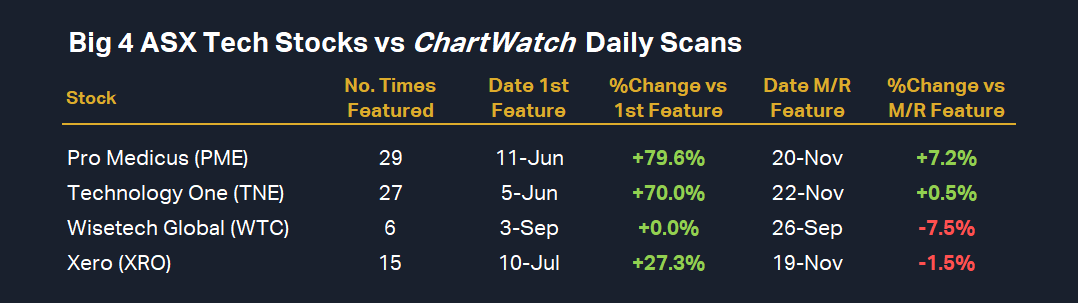

The table below shows each time I’ve run any of these four tech highflyers in ChartWatch Daily Scans Uptrends list as a Feature chart. Feature charts are those that I feel each day stand out from the others in terms of trend strength and quality. Note that there are likely many dozens of times each of these stocks made the regular uptrend scan shortlist.

I’ve included performance of each stock since the first Feature, as well as since the most recent (“M/R”) feature. My point here is not to say, “Well wasn’t I clever”, it’s to point out that for many of those 80-odd times these stocks made Feature, it probably looked to many an untrained eye as “Too high to buy”.

Also consider I have no idea what the performance from the most recent feature is going to be over the next 6 months. I can’t tell the future. It could be up 60% or down 60%, that’s not relevant to me. I just care that I am finding and taking advantage of opportunities that demonstrate the strongest trends.

It’s also why I have a strict risk management regime as well as an absolutely clinical methodology for exiting an investment (also technical analysis-based). I can’t predict the future, so I don’t worry about it. I just follow my investing plan. The rest takes care of itself.

Not expensive, cheap!

I’ll leave you with this thought and then we’ll move onto answering the question of whether there remains any share price upside in our quartet of ASX tech highflyers (I’ll do an up-to-date TA on each and we’ll also check out their latest Broker Consensus ratings and target prices – stay tuned!).

A rising share price isn’t necessarily a sign that a stock is expensive. I’d go so far as to argue that a strongly rising share price is more likely to indicate the stock in question is actually cheap.

I know, this is a bit of a brain bender. I’m suggesting that the exponential chart you’re baulking at buying might actually be cheap and not expensive. Even bendier, therefore, that the stock in question is more likely to be a BUY and not a SELL or AVOID?

This could be the paradigm shift in your investing thinking you’ve been waiting for!

Consider this: The reason why that share price is rising so strongly is because of the high conviction held by investors who are using their hard-earned cash to purchase its shares. They’ve done the research (we assume they are making rational decisions based upon all available information) and they’re buying today with the expectation of strong earnings growth down the track. They believe the fundamental outlook of the company will more than justify their current investment.

Basically, the “demand-side” as I call them, believe investing in this stock right now is the best decision they can make with their capital compared to all other alternatives. Dare I say, the demand-side thinks the stock is cheap, not expensive.

Now consider the “supply-side”, that is, those who already own shares in the company. They’re reluctant to sell those shares unless compensated by higher, and higher share prices. Why does this group of investors also so desperately want to own shares in this company?

For the same reason: They’ve also done their research, and they too agree investing in this stock right now is the best decision they can make with their capital compared to all other alternatives. Dare I say, the supply side thinks the stock is cheap, not expensive.

So, when we have a strongly rising share price trend, it tells us the demand-side thinks the stock is cheap and not expensive, and the supply-side thinks the stock is cheap and not expensive.

Perhaps then, the only person looking at the stock with the strongly rising share price who thinks it’s expensive is you? 🤔

This paradigm shift is perhaps the trigger you needed to help you start thinking more like the market!

Is Pro Medicus (PME) too high to buy?

Technicals

%20chart%2027%20November%202024.png)

The perfect chart for a trend follower. This is the epitome of excess demand. I cannot possibly describe for you in words just how well this chart demonstrates a market in total agreement: We want to own PME shares.

At any point over the last 2-years you could have argued this chart was “Too high to buy”, or “Too expensive”, or “It’s run too far”, or “If I buy now, it’s guaranteed to go down!”.

You could argue any of these points today too, but I would argue that strong short and long term trends (double green and steeply rising trend ribbons), excellent price action (rising peaks and rising troughs), and predominantly demand-side candles (i.e., those with white bodies and or downward pointing shadows) all combine to indicate a clear state of excess demand here.

This can mean only one thing for me.

Brokers

%20Broker%20Consensus.png)

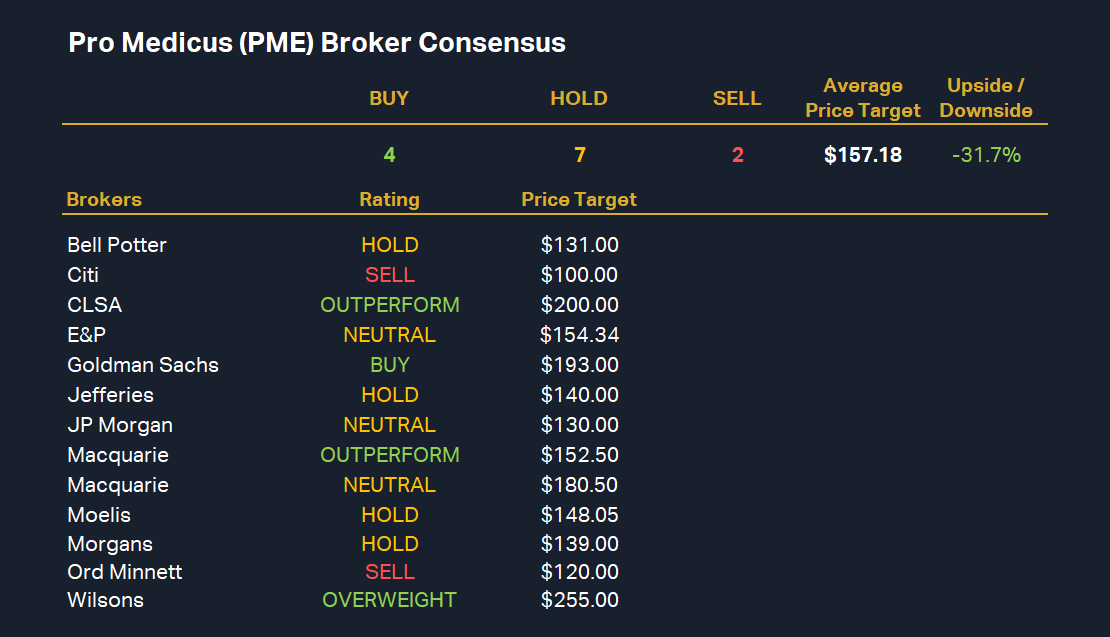

Note that all broker ratings and targets are taken from broker research notes collected since July 1 (to keep them current).

To obtain a stock’s Broker Consensus Rating, we assign a value of +1 to any rating better than HOLD/NEUTRAL/MARKETWEIGHT, a value of 0 for any rating equivalent to HOLD/NEUTRAL/MARKETWEIGHT, and a value of -1 to any rating worse than HOLD/NEUTRAL/MARKETWEIGHT.

We then take the average of all assigned rating values and assign a Broker Consensus Rating of BUY to values greater than +0.5, a rating of HOLD for values between -0.5 and +0.5, and a rating of SELL for values less than -0.5.

PME’s broker consensus rating is +0.15, resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $157.18. This suggests brokers collectively believe the stock is around 31.7% overvalued based upon the closing price on Tuesday 26 November of $230.

Is Technology One (TNE) too high to buy?

Technicals

%20chart%2027%20November%202024.png)

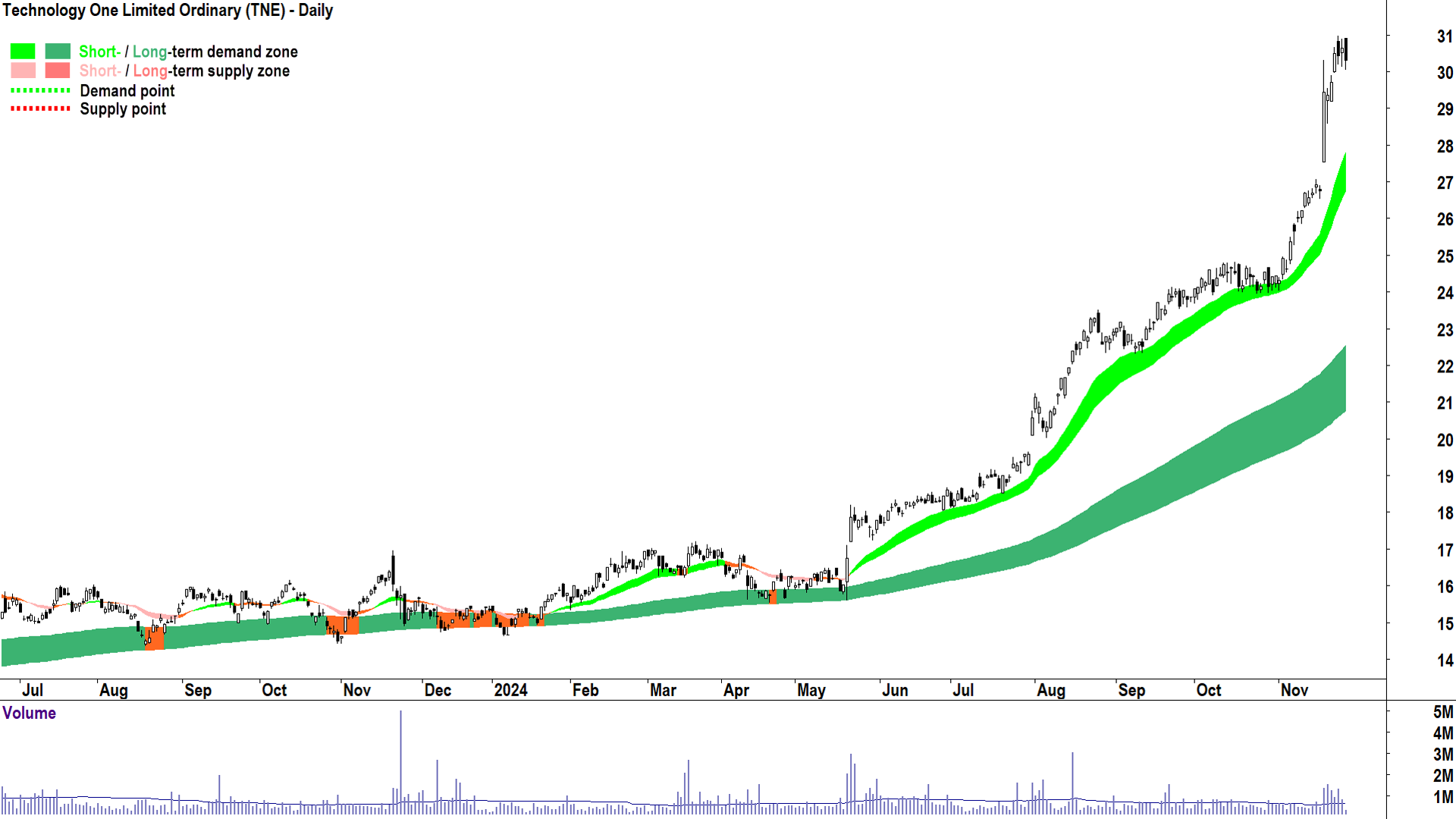

I could almost go “ditto” for this chart of TNE. It has been exemplary for nearly every candle since May.

If there is a slight fly in the ointment compared to PME, it’s the very moderate supply-side candles (i.e., those with black bodies and or upward pointing shadows) creeping in at the end there.

They’re tiny within the context of the broader trends (excellent) and price action (also excellent) so I’m not too worried about them at this stage.

I will continue to monitor them, however, as a growing number of supply-side candles, along with their growing sizes – could indicate the supply-side is potentially taking control of the TNE price in the short term.

There’s evidently so much demand in the system outside of those few candles that I suggest if there is a pullback here – it will likely be very mild. In this scenario, my model suggests watching the short term trend ribbon closely as a zone where the price might bounce from.

Brokers

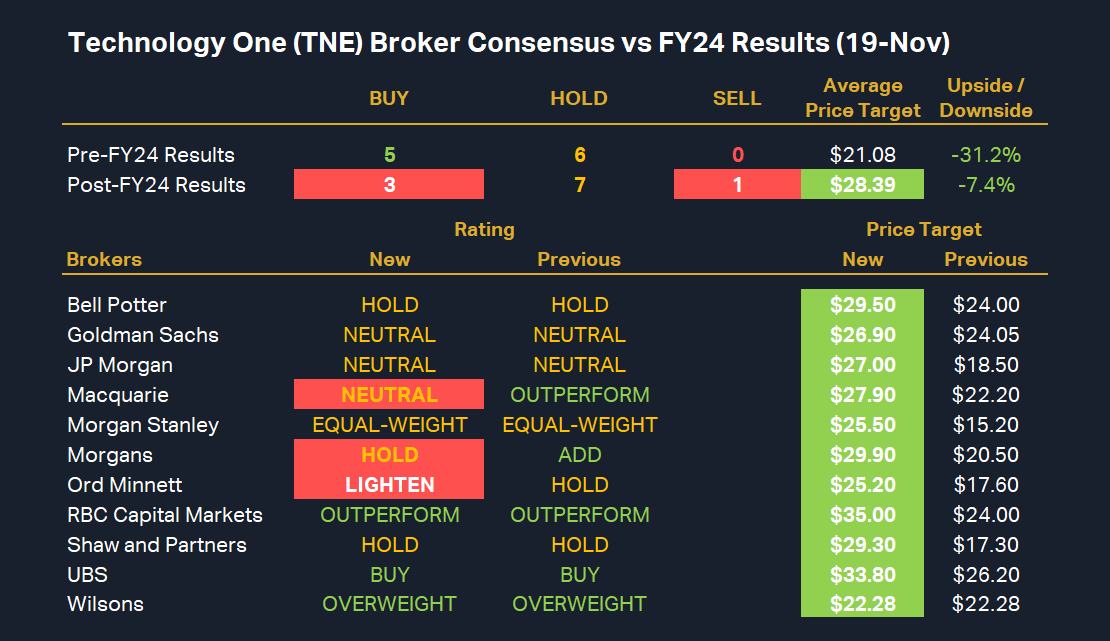

%20Broker%20Consensus%20vs%20FY24%20Results%20(19-Nov).png)

TNE’s broker consensus rating is +0.18 (down from +0.45 prior to its FY24 results release on 19 November), resulting in a Broker Consensus Rating of HOLD. Its consensus (average) target price is $28.39 (up from $21.08 prior to its FY24 results). This suggests brokers collectively believe the stock is around 7.4% overvalued based upon the closing price on Tuesday 26 November of $30.65.

Is Wisetech Global (WTC) too high to buy?

Technicals

%20chart%2027%20November%202024.png)

WTC very nearly would have read like the first two…until the C-suite shenanigans of October, and that (related) pesky 22 Nov trading update!

It’s a great reminder that the best companies and the best technical trends can be dislodged by unforeseen news events.

There’s still plenty to like about the WTC chart, though, most notably the still-strong long term uptrend. You can see just how well my long term uptrend ribbon continues to support the price – even through both of those fundamental shocks.

The rally from the 22 Nov event is sound for now, as in, the rate of price appreciation since indicates plenty of buy-the-dip activity. However, I am concerned that there could be a great deal of latent supply lurking in the system towards the pre-news peak around 135-140.

Ideally, we see a continued strong rally back towards that zone, accompanied by a return to rising peaks and rising troughs and a predominance of demand-side candles.

If, on the other hand, we begin to see an increased prevalence of supply side candles anywhere from here, through the 21-22 Nov gap, and into 135-140 – I would become concerned the supply-side is beginning to grapple with control of the WTC price.

So, steady as she goes for now, but I’ll definitely be paying close attention to the way the technicals develop from here.

Brokers

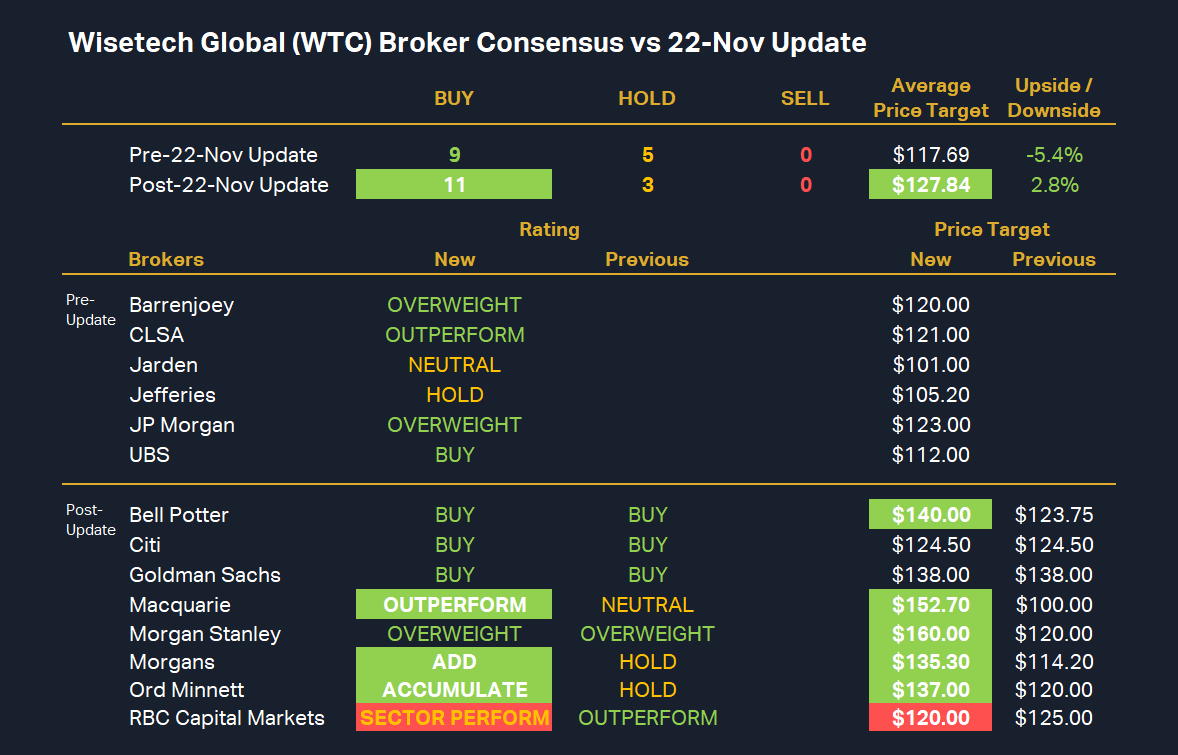

%20Broker%20Consensus%20vs%2022-Nov%20Update.png)

WTC’s broker consensus rating is +0.79 (up from +0.64 prior to its 22 November trading update), resulting in a Broker Consensus Rating of BUY. Its consensus (average) target price is $127.84 (up from $117.69 prior to its 22 November trading update). This suggests brokers collectively believe the stock is around 2.8% undervalued based upon the closing price on Tuesday 26 November of $124.40.

Is Xero (XRO) too high to buy?

Technicals

%20chart%2027%20November%202024.png)

Excellent. Back to perfection. Ditto everything I said for PME: I can’t fault this chart.

If there are doubts about whether XRO shares have more upside – they’re not evident in trends, price action, or candles – and that’s all I need to know.

Brokers

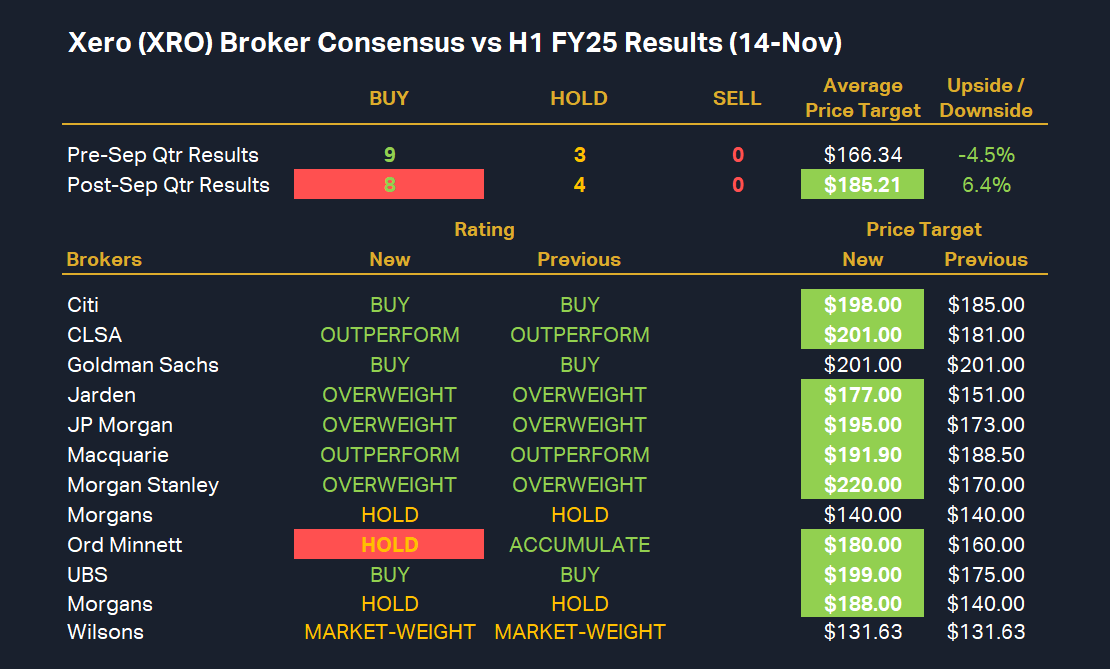

%20Broker%20Consensus%20vs%20H1%20FY24%20Results%20(14-Nov).png)

XRO’s broker consensus rating is +0.67 (down from +0.75 prior to its first half FY25 results release on 14 November), resulting in a Broker Consensus Rating of BUY. Its consensus (average) target price is $185.21 (up from $166.34 prior to its first half FY25 results). This suggests brokers collectively believe the stock is around 6.4% undervalued based upon the closing price on Tuesday 26 November of $174.14.

For more information on technical analysis and my technical analysis methodology, be sure to check out my Technical analysis for beginners: ChartWatch Primer

This article first appeared on Market Index on Wednesday 27 November 2024.

5 topics

4 stocks mentioned