Are we at 'peak earnings' for these stocks?

There was a large, unanswered question looming over the American big banks recently. Was Q3 the peak for bank earnings or the start of the cyclical decline?

The question is an extremely valid one. Bank earnings are, above all else, dominated by the margins question. When interest rates were soaring, the biggest banks could pass on all of the Federal Reserve's rate hikes and watch the interest payments come in. But now that the Fed has started to cut rates and has likely flagged more to come, those elevated margins are likely going to be a thing of the past.

This, combined with very high valuations, is exactly why Orbis' Shane Woldendorp is staying away from the US banks despite another string of beats from the majors.

In this wire, we'll recap the Big Bank earnings season stateside and garner Orbis' view on where they are finding value in the global equity markets. As a hint, they are finding value in the banking sector - just not in the US - but I'm also willing to bet you can't guess where that value is hiding until we reveal the answer to you.

First, the big bank results in brief.

JPMorgan Chase & Co (NYSE: JPM)

- Revenue +3% to US$39.54 billion

- Net income -2% to US$12.9 billion

- Diluted EPS of US$4.37/share

- Net profit margin -4.8% to 32.62%

Bank of America (NYSE: BAC)

- Revenue -0.5% to US$23.8 billion

- Net income -11.6% to US$6.9 billion

- Diluted EPS -10% to US$0.81/share

- Net profit margin -11.13% to 28.97%

Citigroup (NYSE: C)

- Revenue -2.4% to US$17.88 billion

- Net income -8.7% to US$3.24 billion

- Diluted EPS -7.3% to US$1.51/share

- Net profit margin -6.4% to 18.11%

We have not included Wells Fargo in this list as it's not a well-known entity to Australian investors although it is a larger institution than Citigroup. We have also not included Morgan Stanley and Goldman Sachs as these are more investment houses rather than retail-facing financial institutions.

Did you glean any key takeaways from the Q3 US banks' reporting season?

Most of the large US banks surprised on the upside over the quarter, which was largely driven by the solid performance of their capital markets divisions. Credit costs appear to have normalised and many of the banks mentioned that US consumers are still strong. Many of the banks also appear to be accumulating excess capital due to the uncertainty surrounding Basel III given the final regulations are set to be released in 2025.

What is Orbis’ view on holding US banks as part of a global equity portfolio at the moment?

We have held positions in the US banks in the past, but not more recently. In our view, US banks appear expensive when compared to many other regions.

For example, the average US bank trades at around 2.1 times tangible book value – a substantial premium to the average bank globally, which trades at 1.2 times tangible book value. On top of high valuations, US bank earnings also strike us as unsustainably high. Credit costs remain low, but more importantly, they currently collect a big spread between interest earned on excess deposits held at the Fed (which carries no credit risk) and interest paid to depositors. That spread is not likely to be sustainable in the long run, putting earnings (net interest income) at risk.

Where are you finding more opportunities instead?

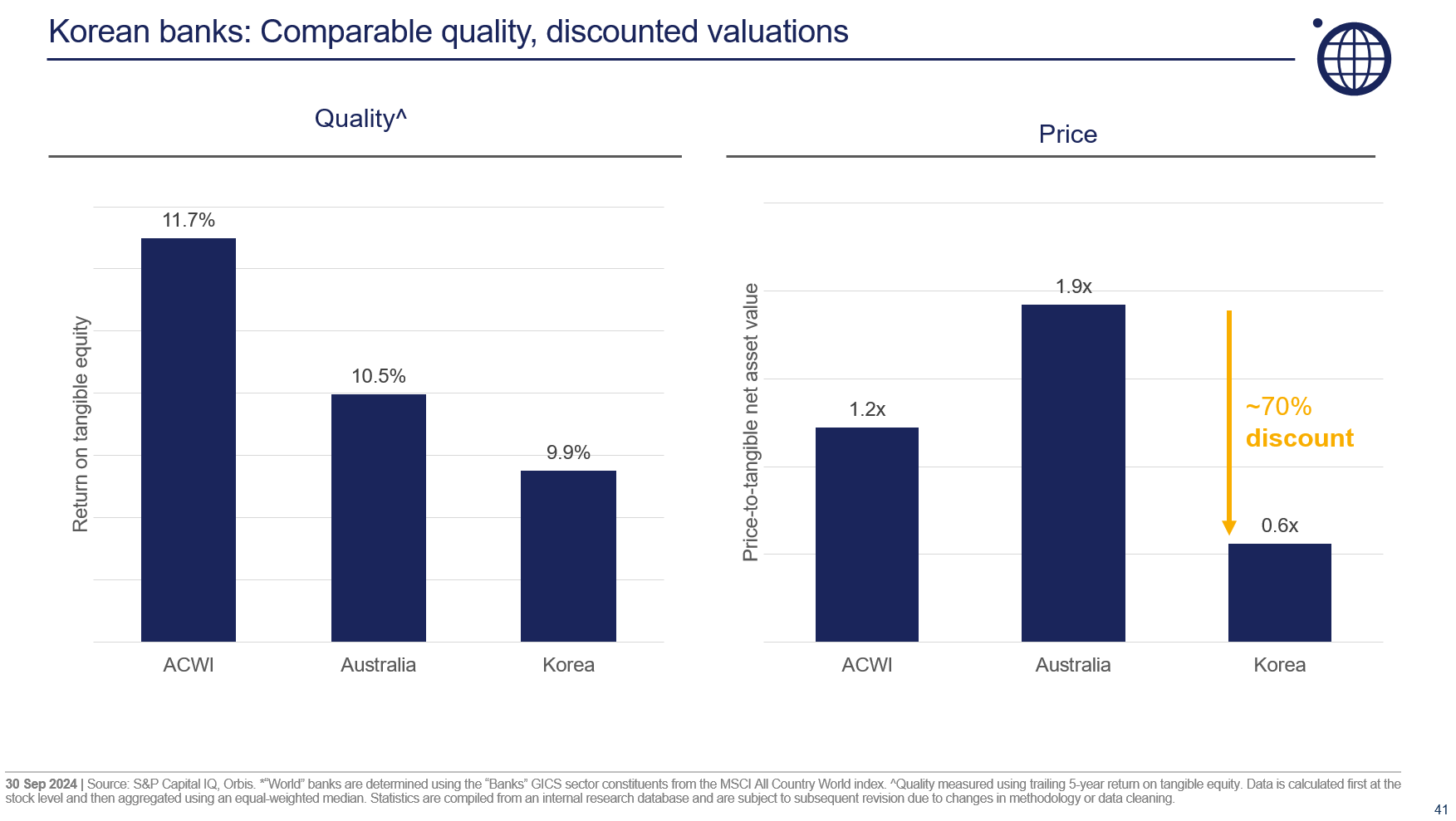

By contrast, we have been able to find opportunities in banks in other parts of the world, such as Korea. Despite the solid fundamentals of Korean banks, they trade at only around 0.6 times tangible book value – around a 50% discount to that of global banks and an even bigger discount to Australian banks.

.png)

Part of the reason for this discount is that Korean banks have historically paid out a lot less of their earnings in dividends when compared to other banks globally. Despite low payout ratios, dividend yields for Korean banks are at around 4%. Increased payout ratios driven by easing regulations for the banks would boost dividend yields even further.

On top of this, governance looks to be improving. For example, the regulator recently announced a “Value-Up” program that aims at enhancing shareholder value. This is a very similar program to what we have seen recently play out successfully in Japan. We’ve been engaging with our holding companies in Korea on these topics for some time, which seems to be bearing some fruit.

What would it take for you to start initiating a position in/become more positive on US bank stocks?

For long-term investors like us, the price you pay is almost the only thing that matters. There are some high-quality US banks, but in our view prices currently reflect overly optimistic expectations.

Lower share prices would be a reason why we would get interested but share prices also don’t usually fall for no reason. As such, in the event that share prices fell we’d be examining why and how the facts have changed, too.

As contrarian investors, we are naturally drawn to out-of-favour areas. Given the substantial premium that the US banks are currently trading at compared to that of global banks, it’s fair to say that they do not fall into this camp.

2 topics

3 stocks mentioned