Are we there yet?

L2 Capital Partners

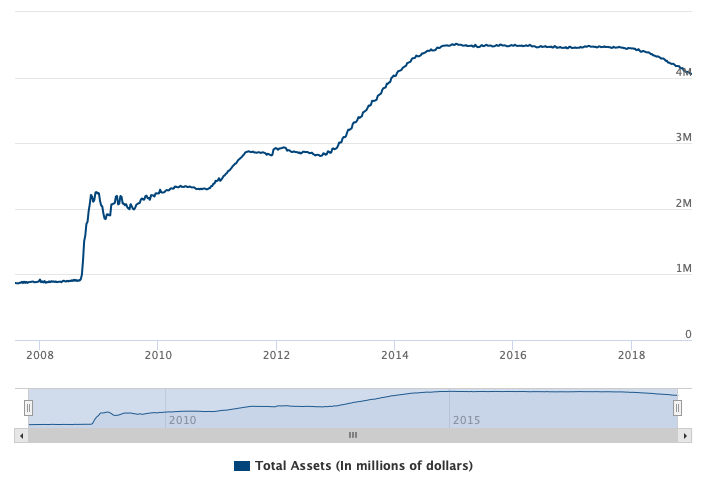

Last month we saw the FED raising rates for the 9th time in the last 3 years, now to 2.25-2.5% per annum. Also, this month, the FED might keep its Quantitative Tightening (QT) program to US$50 billion per month, in order to reduce its inflated balance sheet.

With higher rates and more QT, the US Government will have difficulties rolling over its debt, now above US$21 trillion – with the majority of the debt coming due in the next 5 years. Add to this, the fact that over the next 5 years, corporates need to refinance about US$4 trillion of their outstanding debt, which should increase competition for funds and put even more pressure on rates – and, maybe, investors will become more selective with their purchases (think about that juicy high yield bond, paying the stunning 6% amount)…

I believe it is worth mentioning that Netflix, a cash-burning entity, raised US$800 million in October of last year issuing a bond paying 6.375% (against expectations of 6.25%) – the euro-tranche was on par with expectations. The yields are starting to move, even though slightly. As we know, risk starts slowly, then happen all at once. I have written about Netflix before, but will talk more about it later on.

But whilst we are on the subject of rates, I found important to remind everyone that the FED raised rates “only” 6 times in 1999-2000 before bursting the bubble it had created. It´s been 9 times already in this cycle… and counting. Besides, the FED has increased its bond sales (Quantitative Tightening) in October 2018 to USD50 billion per month, nothing to sneeze at.

The stock market is starting to feel uneasy and president Trump is already lashing out on Powell, saying “the head of the nation’s central bank threaten U.S. economic growth and appeared to enjoy raising interest rates”. Trump is obviously not happy with the direction of the rates in the US, and the higher rates are threatening to derail this bull market that has lasted for over 10 years now – one of the longest in US history.

The tax reform, enacted at the end of 2017, gave the markets a boost in early 2018, but it is unlikely to help this year and the comparisons will start to weigh in. Besides, and I have written about it before, corporations used this boost to increase share buybacks, instead of investing in new technologies and increasing efficiency. By the time the bear market arrives, and it always does, these companies will be loaded with debt and not able to compete with more lean and efficient new entrants (being new companies or companies from other countries).

Also, these companies will be forced to service the debt (some of them are already failing to do that) at a time when interest rates are higher, sales are down and competition is fiercer. Who knows, maybe they will have to sell shares (together with everyone else) to pay off debt – not a rosy picture.

And debt is what is not missing in this environment. Consumer debt, corporate debt, government debt, student loans and credit card loans are all at record levels.

Maybe Trump´s actions and the tax reform have been designed to counter the FED hikes. But the hikes are going to be here for a while, and the tax cuts will have had most of its effects in 2018. It is difficult to see how the economy can do well with lots of debt, at a moment when interest rates are rising and there are high health care costs – and inflation in general – reducing the amount of discretionary income of the population.

The price to be paid at the end of this bull market will be enormous – as it should be. There should have had a decent correction many years ago (2000), but the “maestro” did not allow the purge to occur, enabling the creation of a much bigger bubble that burst in 2007-08. This one too was not allowed to cure itself, so more stimulus and lower interest rates were the medicine recommended by the PhDs in the FED and other central banks. The bubble we are in today has seen no precedents in history and one has to be extremely careful in analysing investments at this point in time.

The US mid-term elections went on as I expected - Democrats took over the House by a little margin, whilst the Republicans remained in control of the Senate (of the 35 new “vacancies”, 26 were from Democrats and only 9 from the Republicans). If Trump’s popularity starts to soften, Democrats might try to launch another campaign for impeachment of the president, adding to the woes of the markets.

Despite what many people say about the US economy, it is not all rosy. The number of Americans not in the labour force is now at a record level – almost 100 million people! So one has to take this unemployment rate number with a pinch of salt.

Many skilled investors have already alerted for a potential correction, but all these warnings continue to fall on deaf ears. I am talking about Ray Dalio, Jeff Gundlach, Paul Singer, Stanley Druckenmiller and Howard Marks, to name a few.

A few months back, Warren Buffett said that “if interest rates are destined to be at low levels…it makes any stream of earnings from investments worth more money. The bogey is always what government bonds yield”. In my humble opinion, one cannot simply trust valuations today – they are wrong because rates are wrong. This is a period of financial repression, as Jim Grant would say.

I know, it´s difficult to make the case for being conservative, knowing that the BTD (buy the dip) strategy has done so well over the last 10 years. Volatility had disappeared from the market (until last year) and many of the new fund managers have not seen a market crash in their lives – there was only one direction, and it was up.

The US GDP, as expected, was strong for the 3rd Q, but softening is expected on the 4th. Caterpillar and 3M have already guided lower – not to mention Apple and Nvidia. We can see signs of inflation looking at Wal Mart and Target, even though oil has crashed in 2018. The money printing program (QE) carried on by the FED caused tremendous inflation in asset prices. We are yet to see this inflation on the register machine in the supermarkets.

We experienced in 2018 what might happen on a global scale, in all asset classes, with the weakest links breaking first: cryptocurrencies, pricier real estate, emerging markets and a few stocks.

Cryptocurrencies, a bubble that humbled the tulip mania, started to crumble down in the beginning of last year. Some prices have fallen by more than 95% from its peak, and the majority has seen losses of over 80% since then.

Bitcoin was the most famous cryptocurrency. At its high, early last year, one bitcoin was traded for almost US$20,000 and there were hoards of people trying to get in and buy it. Today it is less than US$3,600 (down more than 80% from its peak). We have heard stories of young people making millions in bitcoin (and similar cryptocurrencies) in 2017 and the projections of it reaching US$60,000 or even US$800,000 were abound. Suddenly they were going to displace bank accounts and money and we all would use cryptocurrencies for day-to-day transactions. Many investors got carried away with the allure of easy and quick money and entered this market based on the outlandish projections of the so-called experts. Oh, what a difference a few months made…

Emerging markets were another bubble caused by a system loaded with cash and low interest rates. The search for yield made investors disregard risk and focus only on returns. Argentina, a country whose history of default puts some African countries to shame, raised in 2017 a 100-year-bond with a coupon of only 8%! At the time, I even posted a question on Twitter about it (with a spoil answer at the end): what are the chances of Argentina; a country which has defaulted on its obligations 8 times since its independence (200 years ago), 5 times in the last century, the last default being only 4 years ago; defaulting on its debt in the next 100 years? Pretty high, I would say.

But the markets took no clue from this and the deal was oversubscribed. Less than a year after the deal, Argentina came crashing down and it was receiving the biggest loan in the IMF´s history, after its currency lost almost 50% of its value. If you have bought the bond, the good news is that there is less than 98.5 years to go now…

And that is not all. If we look at China, probably the biggest risk in the emerging markets space, the situation is not much better. The wealth management products (WMP) are basically leveraged and mismatched money market funds, with over US$4 trillion in assets and US$15 trillion in liabilities. They are off-balance sheet so, as it is, the banks do not show them on their balance sheets.

One of the things with these WMPs is that the long-term assets are having problems and not performing as well as they were expected. If people decide to take their money out – and they might just do it – problems will appear and they will cascade through the economy.

Liquidity cannot simply dry out without starting a credit crisis of unseen proportions – and we might be seeing the very beginning of this happening, with the devaluation of the Chinese currency and the (bad) performance of the Shanghai stock market. China accounts for over 60% of all the money created in the world between 2007 and 2015! According to Bloomberg, China´s debt to GDP was over 250% last year (and increasing) – obviously, as with every number in China, we should take it with a pinch of salt – It might be much higher than that!

A quick reminder that China is the largest foreign holder of US debt in the world, followed by Japan – what happens if it decides to liquidate its position? I am not suggesting they might do it, I am simply raising a point that very few people think about and it is another source of risk.

The trade war is not helping also. It could be longer and more painful than many expect and no-one knows exactly the impact that it will have in the US, China and other markets. China is responsible for almost 40% of commodity consumption in the world – a slowdown of the country or a big devaluation of the currency will have a devastating impact on commodity prices (copper, iron ore, coal, oil, etc) and on countries dependent on it.

The housing bubble in China is also achieving epic proportions. Jim Chanos said that China is building circa 20 million flats a year, when it “only” needs 6-8 million – so a big part of its construction has been built for speculative positions, which corresponds to 15% of China´s GDP (or 3% of the world´s GPD). China´s real estate accounts for over 20% of that country´s GDP, compared only to Spain and Ireland before the GFC. Dateline has a very interesting documentary on youtube about it (link), but there are many more documentaries like this one.

Many well-respected analysts expect a soft landing on China´s economy. The idea behind it is that the central government will transfer some of the debt to the local governments, and these local governments are forced to sell assets to pay down debt, and this will be done in an orderly manner. Well, I have never seen a soft landing, especially in a bubble-like situation, so I would not bet on it.

Moving to Russia, we get to see a country that is highly dependent on oil and gas and it has flexed its muscles towards Europe a few times in the recent past. Company valuations are very low and this might entice a few investors, but the risks remain. The rouble has lost value in the last 12 months due to the difficult relationship with the USA, especially due to the Syrian war and new sanctions related to the annexation of Ukraine. Russia is an important player in EM and it has developed a special relationship with China, with commerce and military exercises taken place between the two nations.

Many years ago, when I visited Russia and spoke to a few dignitaries in there, including the Ministry of Finance and some bank owners, the message was unanimous and clear: Russia is a player in oil. Therefore, one´s view on oil prices dictates the economy. With the aging population and an entitlement mentality, if oil prices tank, Russia will have problems.

In regards to the Middle East, conflicts (in the case of Yemen and Saudi Arabia, war) like Israeli-Iran, Syria and the meddling of Russia and the US are escalating. The region is a powder keg and it does not need many sparks to ignite an explosion. Unemployment is rampant in many countries and the religious life is taken to extremes.

Emerging markets are taking a turn to more dictatorial regimes and that, although is not a burden for economics, does not bode well for sentiment.

Turkey, Indonesia, South Africa, and others all have their own problems and are suffering – to a certain extent – because of the strengthening of the US Dollar and internal problems. The fact that there are less USD available and that the cost of these USDs are higher, is definitely impacting the EM universe, but I am not going to talk about each one of those because of the relative minor importance of them compared to China. I am in no way disregarding the tail risks, I am just trying to do a more global exercise here.

Brazil might be the exception in the EM space, with a new president who started his term in January this year bringing a more liberal approach to the economy. We have to observe how he will deal with the situation there, but the country seems to be fine. Obviously, Brazil is not a stand-alone country and it depends on others to trade and grow. Problems elsewhere can derail what can be the beginning of a long-term bull market for Brazilians.

So, from EM, let´s get to another possible source of problem: Italy. The Italians are having problems adjusting their budget to what the European Commission (EC) requires. The government wants to deliver on its campaign promises of tax cuts, a universal basic income and pension changes, but the EC is not happy about it and it might impose a fine to the country.

Italy´s debt to GDP is above 130% and it is the second highest in Europe, behind only Greece. Last year, the Italian Cabinet Undersecretary (second-in-command to a politically appointed Cabinet Minister) Giancarlo Giorgetti said that Italian banks will need a recapitalization if the spread between the Italian and German bonds continue to rise towards 400bps. Definitely not what one wants to hear.

It seems to be a problem of Italy, and Italy alone, but this showdown might have repercussions in countries like Spain and Portugal. The showdown between Italy and Germany maybe only starting – and Italy is no Greece. I heard the other day that it is not that the European Union cannot afford to let Italy go, it cannot afford to keep Italy in.

But talking about Germany, there are risks there too. Merkel´s party lost over 10% of its votes in Bavaria last year and suffered a further blow in Hesse. These defeats could prove themselves to be crucial for Merkel’s tenure, jeopardizing her 13-year-tenure as premier and causing further de-stabilization in Europe.

It is impossible to talk about Germany without talking about the biggest potential financial risk for the world at the moment, according to the IMF: Deutsche Bank. The institution has over US$70 trillion in derivatives and no one knows exactly where they are. It is not the only leveraged financial institution, but it is definitely the largest one – JPMorgan coming close in second place. To imagine that a single event can bring down one of Europe´s largest banks (and the financial markets with it) is alarming.

Brexit is still an ongoing process with uncertain outcomes. There are speculations of layoffs, rate hikes and distress for the country proliferate everywhere. Negotiations with Ireland (mostly) are being carried out and this should be a difficult process – to say the least.

Greece´s problems are far from solved. Instead, they are buried close to the surface and can – and will – emerge as soon as the world remembers that they still exist with the problems having only gotten worse. I love to look for bargains and I am sure they will appear in Greece in the not too distant future.

Japan is the same old story for many years now. The growth rate isn’t convincing, population is getting older and low yields do not spur growth – oh boy, don’t we know it! To add insult to injury, an increase in consumption tax is expected this year. This increase could provoke a recession, according to analysts.

The world´s third largest economy could also suffer from the trade war between the US and China. Its biggest exports are vehicles, steel and semiconductors. Not to mention all this debt created to buy stocks which, in my humble opinion, is just another way to achieve Socialism. Debt in Japan has achieved epic proportions and it is yet to cause havoc, especially if you put it together with the problems I have highlighted above.

In Canada, a country that I visited a couple of months ago, everything appears to be going fine. I was able to see a somehow strong economy combined with low interest rates but, of course, this has fuelled a massive bull market in real estate.

The Canadian real estate market is on fire (so far). We see pictures on the news of properties falling apart being sold for millions to a Chinese investor that has never set foot in the country. I spoke to many people over there, brokers, financial advisors, company CEOs and CFOs, students, uber drivers, etc and all of them were unanimous in affirming that there is a massive bubble going on. The only difference is that the blue collar workers are dying to get in, whilst the other ones think it is time to get out.

Australia is not far away from this and I wrote about it at the beginning of last year (Australia_Property_Market).

These are the obvious risks I can see today. It does not mean that they will happen or that I expect them to happen – they are just risks. Who would have thought that 10 years ago, Iceland, a tiny country in northern Europe, would start a crisis that almost brought down the entire financial system?

I am more afraid of the risks I cannot see, than the ones that are obvious and, hence, easier to prepare for. But under no circumstances, they should be disregarded. One should adapt his/her portfolio to what he/she perceives as a good return with lower risk.

11 topics

Marcelo Lopez, CFA, has been a portfolio manager at L2 Capital Partners since 2009 and focuses on opportunities globally. Prior to that he was a portfolio manager at Gartmore Investment Management in London.

Expertise

Marcelo Lopez, CFA, has been a portfolio manager at L2 Capital Partners since 2009 and focuses on opportunities globally. Prior to that he was a portfolio manager at Gartmore Investment Management in London.