AREITs – The World Game

Many sports fans are currently in the grip of World Cup fever, nocturnal creatures obsessively drinking in every minute of soccer’s greatest tournament, even if it no longer features the Socceroos.

If you believe I’m about to draw some thoughtful parallels between soccer – the biggest sport on earth with some 240 million individual participants in more than 200 countries – and Australian real estate investment trusts (AREITs) that long shot is sailing way over the bar.

But against a wider global backdrop of trade wars and immigration battles, there’s a global aspect to AREITs that often goes unremarked. For investors in the sector, perhaps nervous about the growth of online retail and Amazon’s arrival it has reassuring implications.

Recent research conducted by APN’s Real Estate Securities team indicates that, much like supporters of the world game, AREITs investors come from everywhere. In fact,

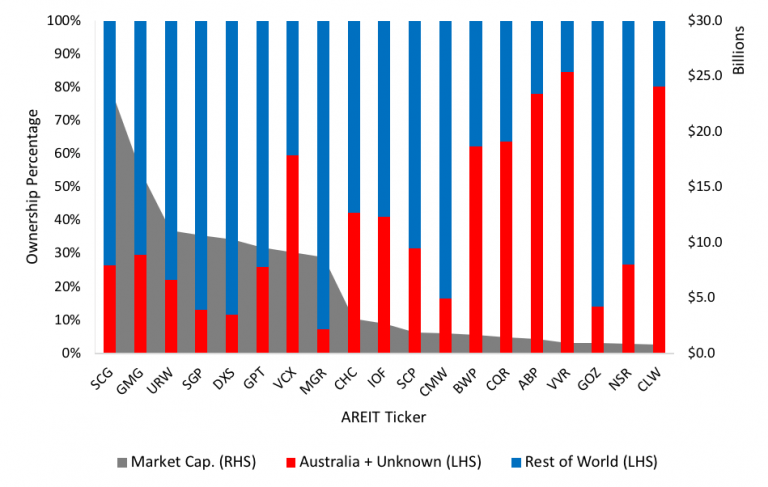

offshore investors make up at least 72% of the market capitalisation, weighted for the 19 AREITs listed within the S&P/ASX 200 AREIT Index.

S&P/ASX 200 AREIT Index – Reported ownership by market capitalisation*

Source: Bloomberg, APN FM

*Ownership data for the S&P/ASX 300 AREIT Index constituents has been obtained from Bloomberg and is based on publicly reported holdings not total shares outstanding. Data as at 19 June 2018

While soccer might be third or fourth cab-off-the-sporting-rank locally, and Australia routinely described as a minnow when competing on the world stage, our national sides are respected as capable and fierce competitors. Given the high level of reported offshore ownership in the AREIT sector (which also appears positively related to market capitalisation – the bigger the AREIT, the higher percentage of offshore ownership), global investors believe the same about some of our largest property trusts.

So, what has attracted extensive offshore investors to the sector?

The first is our stable political environment and advanced economy. Australian real estate investment is backed by a strong rule of law and transparent asset ownership while a diverse, growing and highly educated population supports economic growth.

Australia’s property trust sector has converted these favourable legal, economic and demographic features into one of the most compelling listed property investment environments on the planet.

The second point concerns valuations and likely future performance. Global investors are attracted to the sector for the same reasons we are. The share prices of high quality AREITs currently imply 6% to 7% discount to fair value (we examine net asset value and discounted cash flow as valuation measures, not the VAR – Video Assistant Referee – being made famous for all the wrong reasons in Russia. There’s little risk of a dodgy penalty here).

Offshore investors are also perhaps struck by the gap between the high prices being paid for individual commercial property assets and the lower prices of those assets wrapped up in AREIT share prices. Like us, they probably believe this is something that supports the view that, on a global basis, AREITs look cheap.

There have already been a number of corporate transactions involving offshore investors. The attractiveness of AREIT pricing to global investors means there’s likely to be more of them.

The third and final factor (the hat-trick?) concerns yield. Quite simply, there aren’t many places which offer a reliable, stable yield of 5.5-6.0% or more in a growing economy with a stable political environment.

What are the implications of high foreign ownership in the AREIT sector?

For local investors and the companies in which they invest, the advantages include access to a larger pool of equity capital that can finance growth, promote higher trading liquidity and increased levels of investor scrutiny. The end result is a more efficient market with better price discovery.

The biggest drawback of having large, global investors on the share register is that it requires AREIT management teams to circumnavigate the world to brief their largest investors. We would prefer they stay at home, squeezing every drop of value from their assets! But we can’t have our cake and eat it too.

But, on balance, the high levels of foreign ownership among Australian property trusts is a big vote of confidence in the sector, not a red card. Current AREIT shareholders should take comfort from the fact that investors from across the globe see a good deal of value in Australian commercial property.

Looking for more real estate insights and analysis?

Visit the blog to access the latest analysis and insights from a specialist real estate investment manager.

This article has been prepared by APN Funds Management Limited (ACN 080 674 479, AFSL No. 237500) for general information purposes only and without taking your objectives, financial situation or needs into account.

3 topics