AREITS: Where to from here?

AREITS still a little expensive

Pete Wargent, Director AllenWargent.

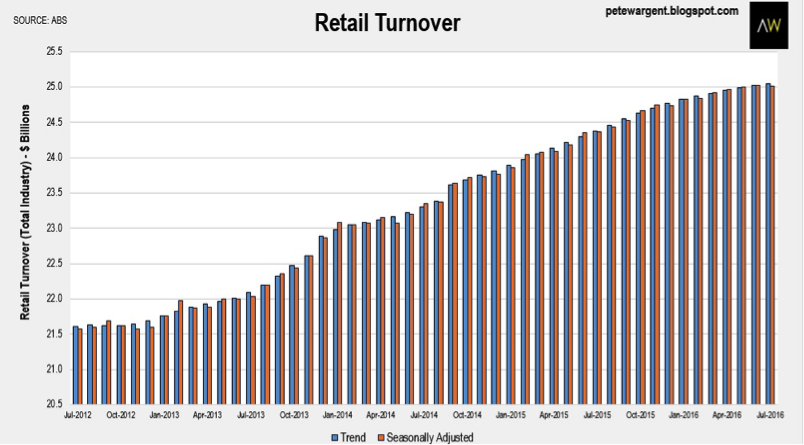

After a prolonged rebound since the first quarter of 2009, the sector remains a little expensive. With lower gearing than before the crisis, trusts are trading at a premium to Net Tangible Asset values. The most recently available data suggested that retail turnover growth has flattened, although the ABS series contained some anomalies, including an unusual looking dive in department store turnover, which could feasibly snap back in due course. Overall, however, retail price pressures have pulled back, and having previously been held up by the wealth effect in the two most populous capital cities, retail turnover growth has clearly lost momentum, which may put some pressure on retail-focused portfolios in the absence of further monetary easing. More optimistically, demand for office space presently appears to be robust in both Sydney and Melbourne as larger businesses expand, with vacancy rates expected to remain reasonably tight. Evidently the trajectory of interest rates will be critical in determining the sustainability of dividend yields in the sector.

Hard-to-replicate assets are the better bet

By Justin Blaess, Principal & Portfolio Manager, Quay Global Investors

Listed markets can move very much in a random walk over the short-term. Over the longer-term investment fundamentals have a greater influence. Generally speaking, AREIT’s offer investors transparent access to high-quality real estate with predictable and growing cash flows. The predictability of these cash flows helps to decrease risk. This contrasts to the recent dividends cuts across some of the largest stocks on the ASX. After the recent pull back, A-REITs do look more attractive, and also in a global context. This should help underpin prices, however the performance discrepancies across the sector going forward could be large. We have a preference towards hard-to-replicate real estate, such as flagship shopping malls, rather than, say, residential development. Over the longer term you will be protected from supply and in time more than likely will preserve and grow your capital regardless of short-term market events.

Opportunities in property with demographic drivers

Mark Pratt, General Manager at Australian Unity Real Estate Investment

Commercial property covers a diverse suite of asset types with varying drivers, and different risk reward profiles. Mark Pratt, General Manager at Australian Unity Real Estate Investment highlights metropolitan office space as offering a good opportunity set. Pricing has not moves as far as prime assets, and there is continuing demand for the assets. In this video he expands on this theme, and also identifies two specialised types of Australian commercial property he focuses on that are well supported by powerful demographic trends.

AREITs with quality assets to keep delivering

John McBain; Group CEO Centuria Capital

Centuria participates in the AREIT market, and we believe that most of the current crop of AREITs are well positioned from a return and risk perspective. Gearing seems conservative across the board, at around 40% or lower, and the platforms are performing true to form as relatively passive rent collectors. Where their share market valuations exceed net assets by aggressive margins, from time to time we will witness the equity capital markets bringing these back into line. As an overall trend though, we expect sensibly valued AREITs with quality growth assets to continue to deliver healthy distribution yields, together with some degree of premium to net asset value for quality platforms managed by reputable managers.

Two more wires on property waiting for you

Livewire has run a series of three wires in recent weeks on the subject of property. So if you enjoyed this wire, you can read more valuable insights from the same contributors by clicking below:

The biggest risk to Australian Property markets: (VIEW LINK)

What’s the most important data point in property today: (VIEW LINK)

4 topics