As US tech stumbles… keep your focus on commodities

Given last Monday’s dramatic market events, I thought I’d revisit our long-held theme of why investors should focus on commodities rather than steeply valued US tech!

To recap what happened last week…

Chinese-owned DeepSeek sent a shockwave through Wall Street after claiming its AI model was made at a fraction of the cost of its US rivals.

The key issue here is that it raises questions about the future of America’s AI dominance, a trend that’s driven the melt-up in US tech equities in recent years.

And right on cue, America’s largest-ever company, Nvidia, dropped 17% in a single day!

To put that in perspective… Nvidia’s fall on Monday was more than the entire GDP of Ireland ($545 billion).

This story will take months to unfold, and I expect we’ll see some wild volatility in the US tech market this year.

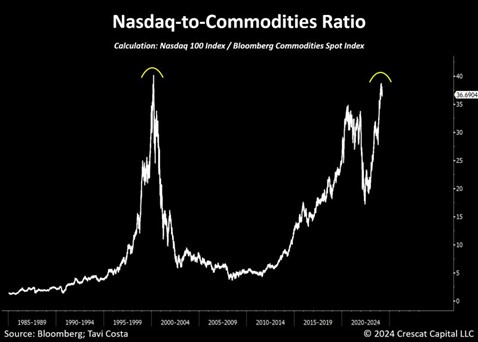

And just so you understand how ‘lofty’ this market is, check out this graph showing the current Nasdaq Index-to-Bloomberg Commodities Index ratio:

As it stands, this ratio has now reached a level not seen since the Dot-com bubble.

Unnerving, to say the least!

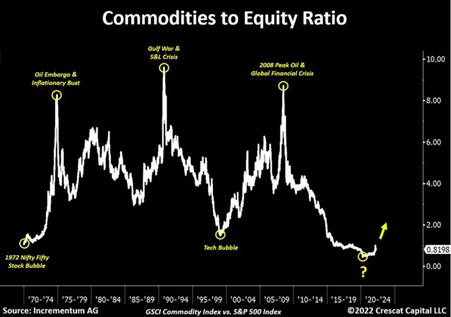

Plus, here’s a graph showing the deep value chasm that’s opened up between commodities and US equities:

Relative to the American stock market, commodities are now the cheapest they’ve been since the early 1970s.

These are the reasons why I’m tripling my conviction that undervalued commodities could deliver much better upside in the future.

But there’s another important angle to this story… one that builds into the long-term theme of higher commodity demand…

US v China: Changing of the Guard

Monday’s market reaction crystalises what I’ve thought for a long time… US hegemony is unwinding.

And the emerging realisation that America’s AI architecture is inferior to China’s is just one more aspect to consider.

China has already demonstrated that it can manufacture EVs, lithium-ion batteries, solar panels, trucks, robotics, trains, medical equipment… and just about anything else… at a lower cost and better quality versus the West.

Meanwhile, the average lifespan of Chinese citizens has surpassed that of the US, despite China spending only a fraction on healthcare.

Furthermore, China is leading in the race toward energy independence through its advanced Fission Technology research, as this Reuters article supports.

So, what are the implications?

If America no longer holds the upper hand in health, manufacturing, tech, or the supply chain of critical minerals… Then what does it have?

Clearly, America is losing its hegemony.

And that will probably deepen over the next four years under Trump’s tariffs, further isolating the US economy from global trade and potentially accelerating China’s ascension.

Which brings us to America’s last remaining economic stranglehold...

The US Dollar

The global reserve currency system—based on the US dollar, has offered enormous advantages for the American economy.

The ability to dictate terms of trade and issue sanctions if countries don’t align with its interests.

As former French Finance Minister, Valery Giscard d’Estaing stated, it’s an “exorbitant privilege.”

Expect China to take all necessary measures to establish a NEW system that gradually erodes the US dollar’s influence.

That should boost gold and silver prices as central banks attempt to prop up their precious metal reserves and tame currency volatility.

But what about commodities more broadly?

As I highlighted many times last year, you must put the China collapse narrative to bed.

Concerns over deflation and the country’s weakened real estate market are a speed bump in its multi-decade journey of rapid growth and transformation.

In my mind, the Middle Kingdom looks destined to restore its historical place as the centre of global enterprise.

It has outsmarted, outwitted, and outplayed the West in every respect.

So, what does that mean as an investor?

Going ‘all-in’ on America has been an excellent trade over the last 80 years.

But Asia now looks set to take an increasingly larger share of growth and, perhaps more importantly, global influence.

As an Australian investor, you should view this as an opportunity, not a threat.

As China emerges as the world’s largest superpower, I expect it’ll ignite the Asian sphere:

Indonesia, Thailand, Vietnam, Korea, and India will benefit from this ‘changing of the guard’—from US hegemony to a new central Asian superpower.

All this will be bullish for commodity demand as growth takes shape across the region.

As an investor, it’s time to look forward.

The future is in Asia, and that’s how you should position yourself.

You can find out what I'm recommending to readers here.

5 topics