ASX 200 blasts to record as every sector zooms higher, property, gold, and lithium stocks best

Today in Review

Markets

%20Intraday%20Chart%2028%20Mar%202024.png)

The S&P/ASX 200 (XJO) finished 77.3 points higher at 7,896.9, 0.99% from its session low and just 0.05% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by a near-unanimous 233 to 45. A high session close and a broad-based move are indicators of potential sustainability of the prevailing rally.

For the week, the XJO finished up 226.6 points or 2.87% higher.

The Gold (XGD) (+2.53%) sub-index was the best performing sector today, likely in response to continued strength in the gold price.

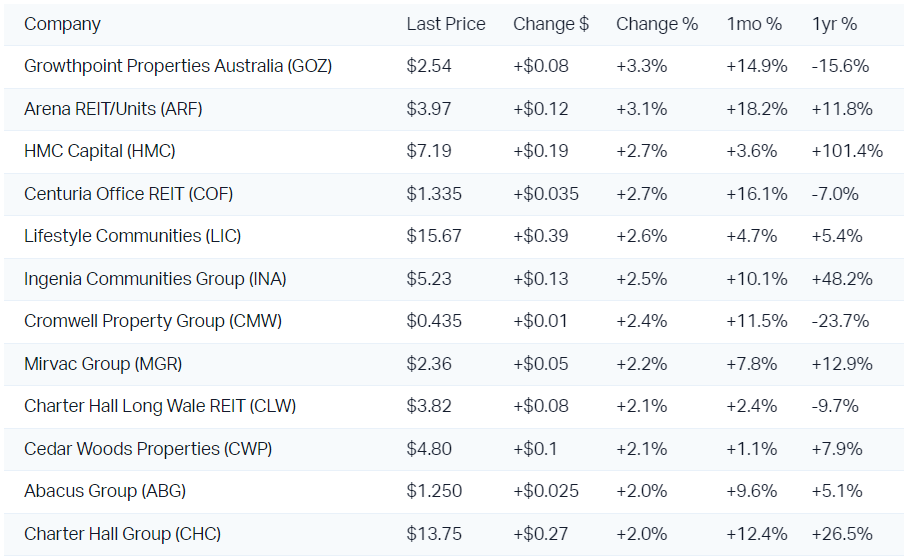

Also doing well today was Real Estate Investment Trusts (XPJ) (+1.73%) as well as the broader Resources (XJR) (+1.63%) sector. Real Estate stocks are being helped by continued deteriorating market interest rates – property stocks are the biggest beneficiaries of lower rates.

Resources stocks? That one's a bit more of a mystery. Base metals prices were unanimously lower on the LME on Wednesday, as was iron ore (also lower in Asian trade). Looking at the best performers in the sector, there's a clear skew towards gold stocks as mentioned above, and a few lithium stocks.

I've explained why gold stocks are up, but the latter is getting a boost from a 2.1% gain in the spodumene index price to US$1,098/t over the last two days. It's been a volatile week though, because you'll remember many of these same stocks got baked earlier in the week as the lithium carbonate price tumbled 6%. Clearly not a sector for the feint of heart!

All eleven of the major ASX sectors where higher today, but if there was an underperformer, it would be the Financials (XFJ) which only gained 0.375%.

ChartWatch

S&P/ASX 200 (XJO)

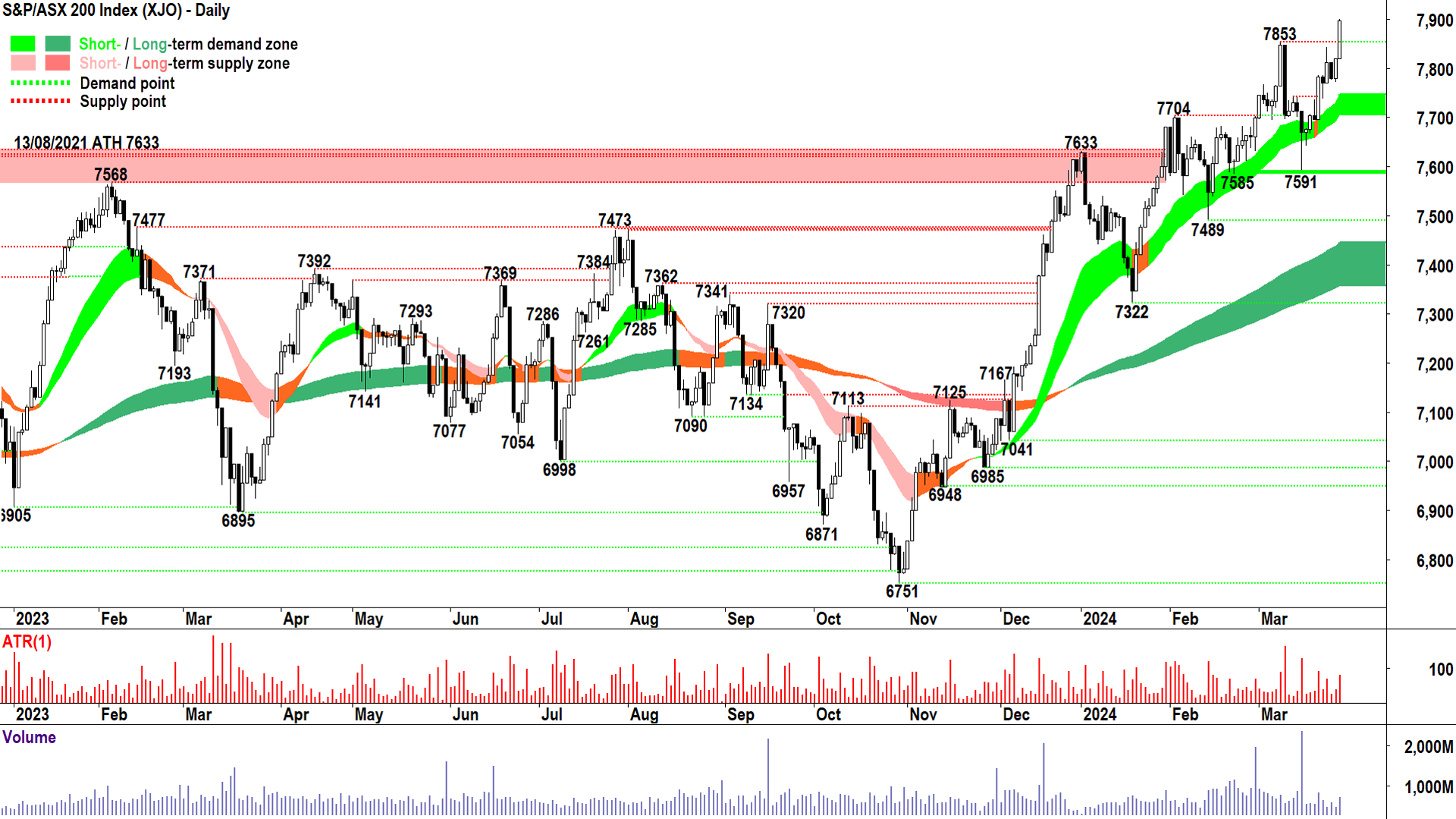

The XJO is a must-do today given the new record high and record close. You don't get these often, and you don't get them without a resounding vote of confidence among the demand and supply environment.

Cash wants in, bidding up prices to entice out stock from holders (i.e., motivated demand).

Stock holders aren't letting go without being enticed by higher bids (i.e., unmotivated supply).

It's the oldest tenet of economics. D > S = P⬆️.

There's nothing in the techincals to suggest the prevailing short and long term uptrends cannot continue. I see double green on my trend ribbons, supported by solid price action (with the close above the major peak at 7853), and predominantly demand-side candles (i.e., those with white bodies and/or downward pointing shadows).

7853 now moves to support, but really anything around the 7705-7746 of the short term trend ribbon is likely to be an area of excess demand. I suggest the bull market is hunk dory until we see a switch to supply side candles, falling peaks and falling troughs, and/or a close below 7585.

Economy

Today

-

AUS Retail Sales February

+0.3% month on month vs +0.4% forecast and +1.1% January

+1.6% compared to last February

Later this week

Friday

All day AUS Good Friday Holiday

23:30 USA Core PCE Price Index February (+0.3% forecast vs +0.4% January)

Saturday

02:30 USA Federal Reserve Chairman Powell speech at Monetary Policy Conference, in San Francisco

Latest News

Why lithium prices may never recover

High interest cash ETFs, term deposits and savings accounts – Which reigns supreme?

ChartWatch: One broke Easter bunny! Soaring cocoa and other ‘make or break inflation’ commodities

Morning Wrap: ASX 200 to rise, S&P 500 closes at record high + Small cap Russell 2000 soars

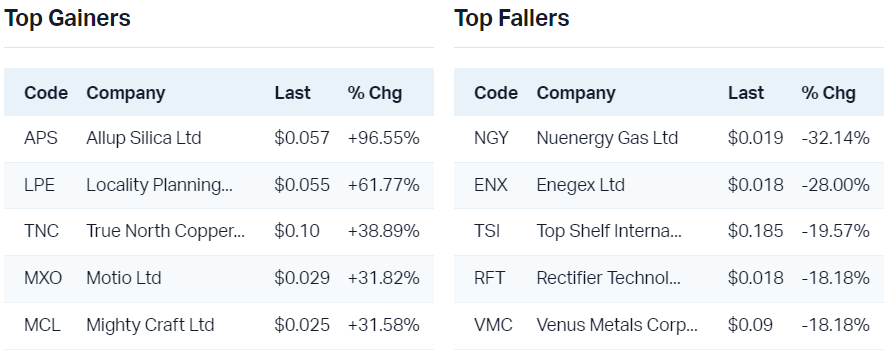

Interesting Movers

Trading higher

+12.1% Mesoblast (MSB) - Continued positive response to Tuesday's: FDA Notifies Clinical Data Sufficient for Refiling aGVHD BLA

+10.3% Resolute Mining (RSG) - 2023 Annual Report, broad strength in ASX gold sector today on rising gold price, bouncing off short and long term trend ribbons

+8.3% Strike Energy (STX) - Minimum Holding Share Buy Back

+8.3% Arcadium Lithium (LTM) - No news, rising spodumene price (+2% last 2 days) helped general sector strength today

+7.8% Alkane Resources (ALK) - No news, broad strength in ASX gold sector today on rising gold price, rise is consistent with prevailing short term uptrend, trying to reclaim long term trend ribbon

+7.5% Chalice Mining (CHN) - No news, assisted by lithium sector strength

+6.3% Omni Bridgeway (OBL) - Investor Presentation

+6.2% Silex Systems (SLX) - No news, rise is consistent with prevailing short and long term uptrends, closed above key historical supply at 5.12

+6.0% SSR Mining (SSR) - No news, broad strength in ASX gold sector today on rising gold price

+6.0% Alumina (AWC) - 2023 Annual Review, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up

+5.6% Premier Investments (PMV) - No news, continued positive response to Tuesday's: 1H24 Investor Presentation, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up

+5.4% Catapult Group International (CAT) - No news, rise is consistent with prevailing short and long term uptrends

+5.3% Whitehaven Coal (WHC) - No news, bounce in thermal and met coal futures

Trading lower

-7.3% Zip Co (ZIP) - No news, very big and very black candle after yesterday's upward pointing shadow 🤔

-6.4% Wildcat Resources (WC8) - No news, has been extremely volatile lately, closed back below short term trend ribbon

-3.6% KMD Brands (KMD) - No news, fall is consistent with prevailing short and long term downtrends

-3.3% WA1 Resources (WA1) - West Arunta Project - Luni Assay Results

-3.2% G8 Education (GEM) - No news, perhaps something to do with Monday's: Class Action Settlement

-3.2% Clarity Pharmaceuticals (CU6) - Completion of Placement and Institutional Entitlement Offer

-3.2% EML Payments (EML) - No news 🤔

-2.8% Fisher & Paykel Healthcare (FPH) - FPH initiates voluntary limited recall

Broker Notes

29Metals (29M) downgraded to underweight from neutral at Jarden; Price Target: $0.30 from $0.38

ALS (ALQ) retained at at UBS; Price Target: $13.30

Alumina (AWC) downgraded to equal-weight from overweight at Morgan Stanley; Price Target: $1.30 from $1.10

Comet Ridge (COI) retained at buy at Bell Potter; Price Target: $0.27 from $0.26

Deterra Royalties (DRR) retained at overweight at Morgan Stanley; Price Target: $5.60

Galan Lithium (GLN) retained at outperform at Macquarie; Price Target: $0.60

Genesis Minerals (GMD) retained at outperform at Macquarie; Price Target: $2.00

Infomedia (IFM) downgraded to hold from buy at Bell Potter; Price Target: $1.80 from $1.75

IGO (IGO) downgraded to underweight from equal-weight at Morgan Stanley; Price Target: $5.95 from $7.20

Premier Investments (PMV) retained at buy at Citi; Price Target: $36.00 from $30.20

Platinum Asset Management (PTM) upgraded to buy from hold at Bell Potter; Price Target: $1.20 from $1.13

Reliance Worldwide Corporation (RWC) retained at buy at UBS; Price Target: $6.50 from $5.40

-

Westpac Banking Corporation (WBC)

Retained at neutral at Citi; Price Target: $22.25

Retained at neutral at Goldman Sachs; Price Target: $23.41 from $23.46

Retained at underperform at Macquarie; Price Target: $26.00

Retained at underweight at Morgan Stanley; Price Target: $22.40

Scans

This article first appeared on Market Index on Thursday 28 March 2024.

5 topics

12 stocks mentioned