ASX 200 delivers dead cat bounce, gold and tech stocks best, coal stocks slump

Today in Review

Markets

%20Intraday%20Chart%2012%20Mar%202024.png)

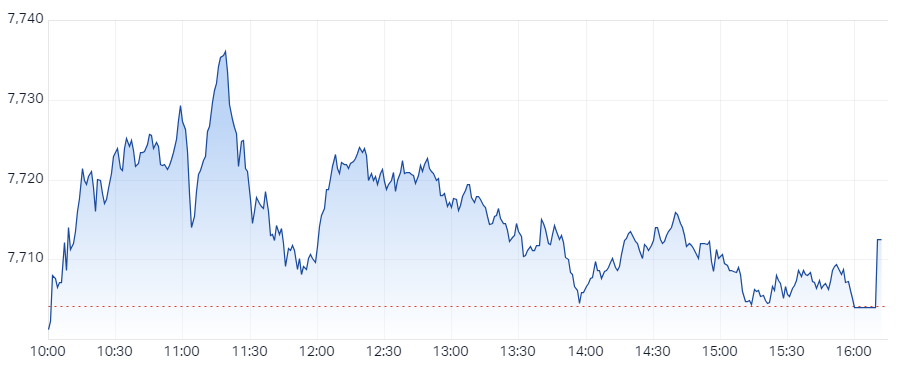

The S&P/ASX 200 (XJO) finished 8.3 points higher at 7,712.5, 0.31% from its session high and just 0.15% from its low. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by an impressive 173 to 98.

The Gold (XGD) (+2.4%) sub-index was the best performing sector today. Nothing specific here, gold prices are roughly flat. I do note Newmont Corporation (NEM) (+3.5%) was up nearly 4% last night on the NYSE, and the US-listed gold sector was also generally higher.

Also doing well today was the Information Technology (XIJ) (+1.1%). Tech has just been so solid since the October low, and this strength is hard to shake in a market with few growth alternatives. The majors of Wisetech Global (WTC) (+1.8%), Xero (XRO) (+1.2%) and Life360 (360) (+5.2%) contributed most of the index points, but there were several other commendable performances.

Doing it tough today was the Energy (XEJ) (-0.8%) sector, and whilst Resources (XJR) (-0.1%) didn’t have the ignominy of being the worst sector again, it remained a notable loser on the day.

In energy, a sharp fall in coking coal prices along with modestly weaker thermal coal prices did the damage to coal stocks, which featured on the sector's biggest losers list. In Yancoal's (YAL) (-8.0%) defence, though, it did go ex-dividend 32.5 cents per share today fully franked.

ChartWatch

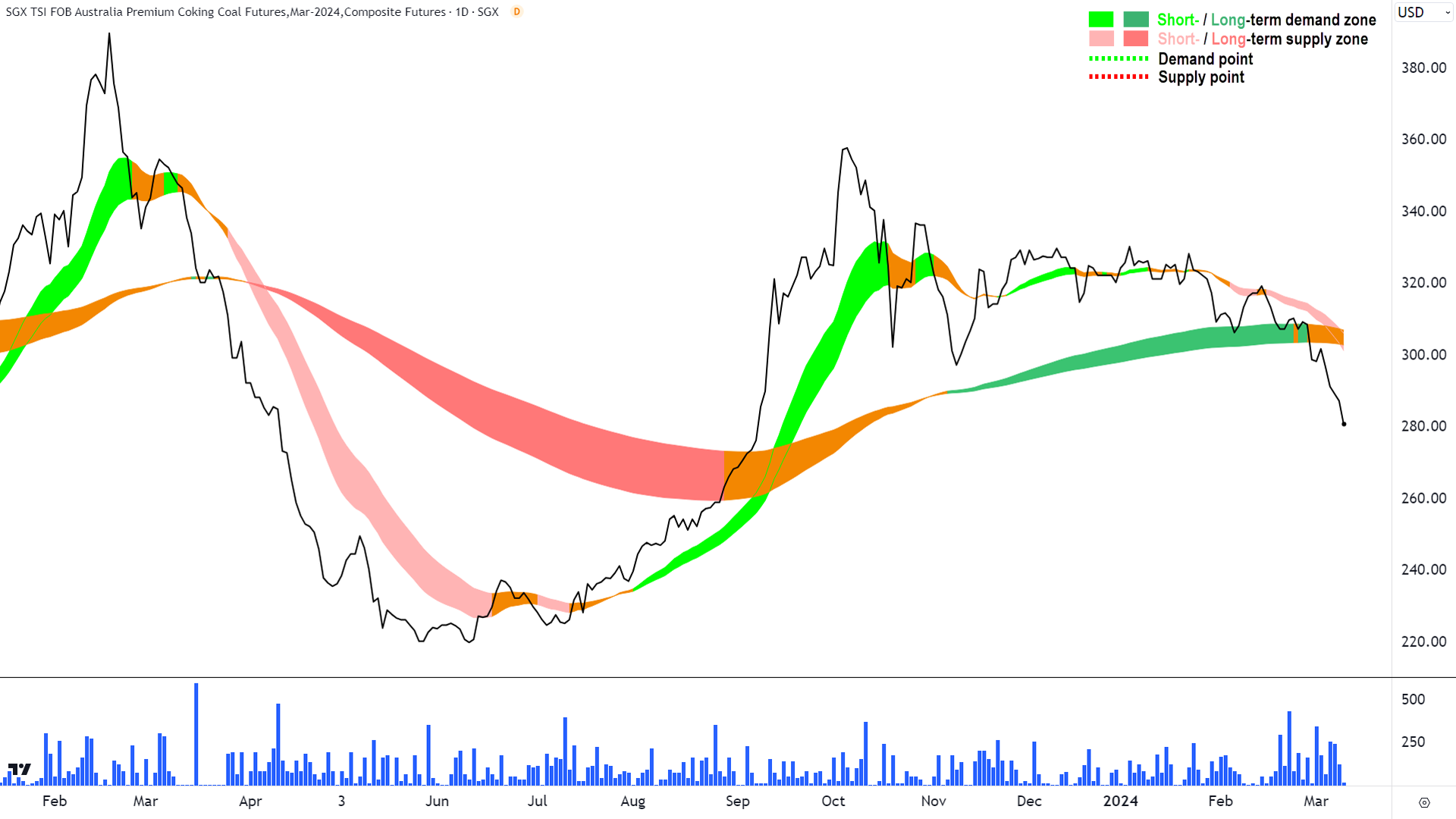

Coking Coal Futures March 2024 (SGX)

Another disappointing commodities chart. I don't seek these out, I promise! Simply, market moves dictate we investigate some of the underlying drivers of commodity stock prices.

As mentioned above, coal stocks were notable on the biggest losers list today. Here's why: Coking coal futures on the Singapore Exchange (SGX).

The short term trend is down, it's well established, and looks to be rolling hard. The long term trend has transitioned to neutral from up. Importantly, the coking coal price has dipped below the dynamic support the long term uptrend ribbon is expected to offer. Once this occurs the long term uptrend ribbon tends to flip to offering dynamic resistance.

The rally from June 2023 to the October peak was so fluid, it created few major areas of historical support/resistance which we can use as potential demand points in the current decline. Possibly 255 (from August-September)? But possibly also all they way back to 220...

Coronado Global Resources Inc (CRN) and Stanmore Resources (SMR) are two of the key coking coal stocks on the ASX.

(It's worth mentioning you combine coking coal with iron ore to produce steel...check yesterday's ChartWatch of iron ore and you'll understand what's going on here!)

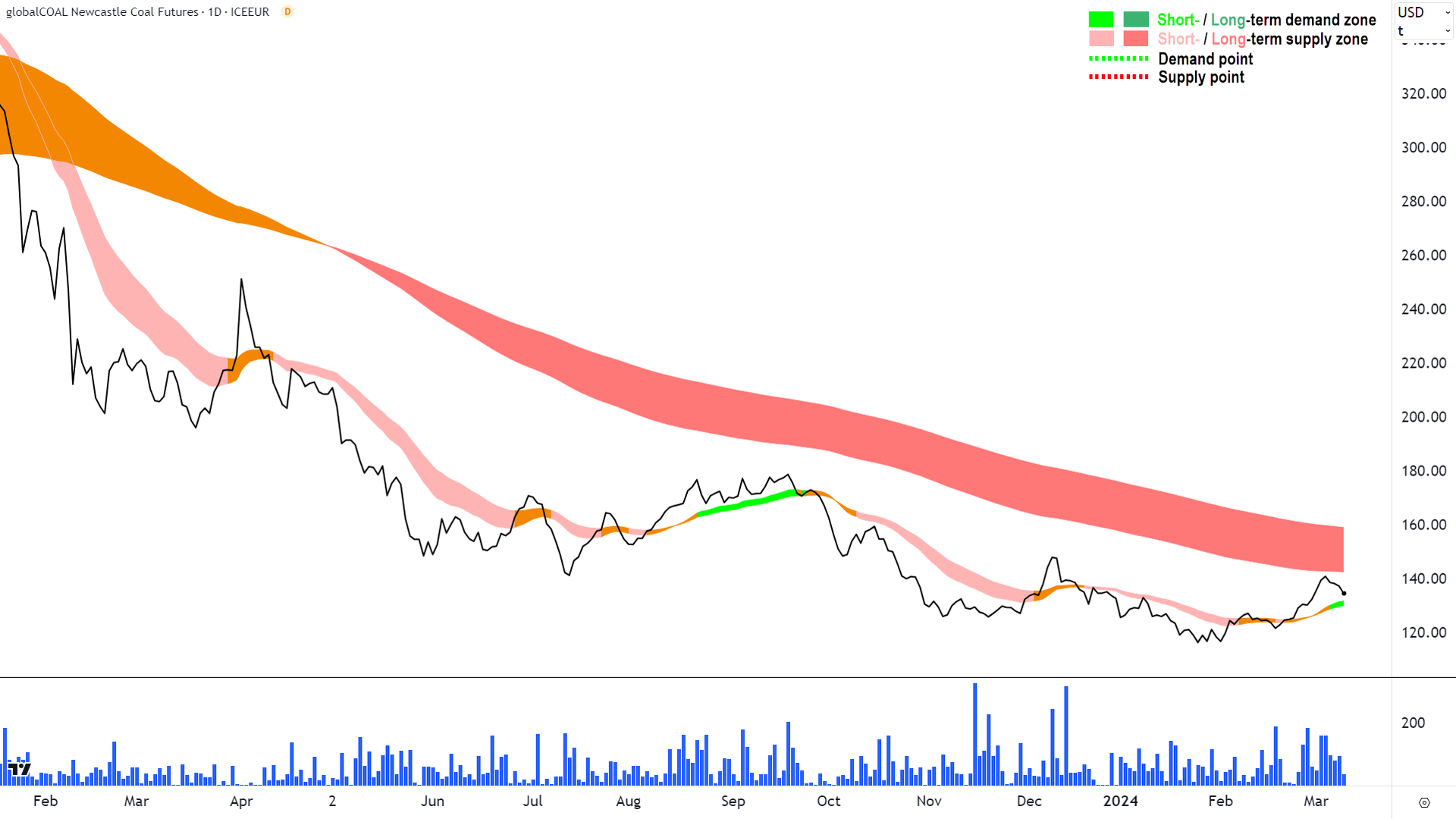

Newcastle Thermal Coal (ICE)

Unfortunately, thermal coal futures aren't looking much better, so it's a bit of a one-two blow for coal producers like Whitehaven Coal (WHC), New Hope Corporation (NHC), and Yancoal (YAL).

The recent downturn is putting serious pressure on a modest short term rally which has managed to flip the short term trend ribbon back to up. The long term trend ribbon remains firmly set to the downside, and will continue to be the biggest impediment to upward price movement.

Given we've covered the commodity charts for iron ore and coal over the last couple of Evening Wraps, I will conduct a more comprehensive investigation of ASX iron ore and coal stocks in a feature ChartWatch tomorrow. Stay tuned!

Economy

Today

-

NAB Business Confidence February

Business conditions improved 3pts to +10 index points, back above their long term average

Trading conditions and profitability lifted 4pts each, employment flat

Conditions "very robust" in services sectors such as transport, recreation & personal services and finance, business & property

Conditions "fairly weak" in retail and construction

Businesses reported elevated rates of input cost growth in both labour and materials, thus far, they're able to pass "some costs" through to consumers

Later this week

Tuesday

23:30 US Core Consumer Price Index (CPI) February (+0.3% monthly for +3.1% p.a. forecast vs +0.4% monthly for +3.1% p.a. in January)

Wednesday

04:00 US 10-year bond auction

Thursday

04:00 US 30-year bond auction

23:30 US Core Producer Price Index (PPI) February (+0.2% monthly forecast vs +0.5% monthly in January)

23:30 US Retail Sales February (+0.8% forecast vs -0.8% January)

Friday

23:30 US Empire State Manufacturing Index (-7.6% forecast vs -2.4% previous)

Saturday

01:00 US Prelim UoM Consumer Sentiment (77.3 forecast vs 76.9 previous)

Latest News

Insider Trades: Directors are buying shares in these 13 ASX 200 companies

Australian bank shares are booming: How far can the rally go?

Short Selling: IGO, Chalice Mining and Core Lithium shorts ease, Select Harvests' turnaround

How to invest $100k for growth

Should BHP, Rio Tinto and Fortescue investors be worried about the iron ore selloff?

Morning Wrap: ASX 200 futures flat, S&P 500 claws back early losses + US CPI Preview

Interesting Movers

Trading higher

-

+23.4% Mesoblast (MSB) - FDA Supports Accelerated Approval Pathway for Heart Failure

+13.6% Novonix (NVX) - No news, continued positive response to 28 Feb 2023 Full Year Results, possible short covering rally

+10.3% Bellevue Gold (BGL) - February 2024 production update

+9.5% Strike Energy (STX) - Walyering Production Update

+9.5% Imugene (IMU) - Phase 1 onCARlytics Trial Advances to Combination Arm

+8.6% Cooper Energy (COE) - No news, rise is consistent with prevailing short term uptrend, long term uptrend is transitioning from down to up

+8.2% Adairs (ADH) - Resignation of Chairman, rise is consistent with prevailing short and long term uptrends

+8.1% Alumina (AWC) - Alumina enters into binding Scheme Implementation Deed

+7.6% Fineos Corporation Holdings (FCL) - No news, volatility is consistent with recent performance

+7.5% Latin Resources (LRS) - Modest lithium sector rally as GFEX lithium carbonate futures continue to push higher

+7.3% Core Lithium (CXO) - Modest lithium sector rally as GFEX lithium carbonate futures continue to push higher

+6.8% EML Payments (EML) - No news, rise is consistent with prevailing short term uptrend, long term uptrend is transitioning from down to up

+6.3% Vulcan Energy Resources (VUL) - Modest lithium sector rally as GFEX lithium carbonate futures continue to push higher

+6.2% Zip Co (ZIP) - No news, continued positive response to 27 Feb 2023 Full Year Results, slew of recent broker rating and price target upgrades, possible short covering rally

+6.1% Chalice Mining (CHN) - No news, volatility is consistent with recent performance

+6.1% Readytech Holdings (RDY) - Was retained at buy at Goldman Sachs yesterday

+5.3% Neuren Pharmaceuticals (NEU) - No news, continues to bounce off long term uptrend ribbon

+5.2% Life360 (360) - No news, rise is consistent with prevailing short and long term uptrends

+5.0% Sayona Mining (SYA) - Modest lithium sector rally as GFEX lithium carbonate futures continue to push higher

Trading lower

-8.0% Yancoal Australia (YAL) - Ex-dividend $0.325 full franked, possibly also falling coking and thermal coal prices

-5.3% Grange Resources (GRR) - Ex-dividend $0.02 full franked

-5.0% Immutep (IMM) - Phase 1 onCARlytics Trial Advances to Combination Arm

-4.5% Develop Global (DVP) - No news, fall is consistent with prevailing short and long term downtrends

-4.3% Alpha HPA (A4N) - No news, fall is consistent with prevailing short term downtrend, long term trend potentially transitioning from up to down

-4.2% Australian Clinical Labs (ACL) - No news, fall is consistent with prevailing short and long term downtrends

-4.0% APM Human Services International (APM) - No news, volatility is consistent with recent performance

-3.9% Coronado Global Resources (CRN) - (Note yesterday went ex-dividend $0.0053 fully franked) No news, fall is consistent with a sharp fall in coking coal prices, and of course, with the prevailing short and long term downtrends

-3.8% Alliance Aviation Services (AQZ) - No news, fall is consistent with prevailing short and long term downtrends

-3.6% Whitehaven Coal (WHC) - No news, fall is consistent with a sharp fall in coking coal prices as well as modest fall in thermal coal prices. Fall is also consistent with the prevailing short term downtrend, long term up trend threatening to transition to down

-3.5% Champion Iron (CIA) - Iron ore stocks under pressure due to sharp fall in iron ore price on Monday

Broker Notes

29METALS (29M) retained at neutral at Citi; Price Target: $0.45 from $0.50

Ainsworth Game Technology (AGI) retained at outperform at Macquarie; Price Target: $1.45

Aristocrat Leisure (ALL) retained at outperform at Macquarie; Price Target: $48.50

ALS (ALQ) retained at outperform at Macquarie; Price Target: $14.25 from $13.60

Aurelia Metals (AMI) retained at buy at Ord Minnett; Price Target: $0.22 from $0.21

-

ANZ Group (ANZ)

Retained at neutral at Citi; Price Target: $26.00

Retained at neutral at UBS; Price Target: $30.00 from $25.00

Light & Wonder (LNW) retained at outperform at Macquarie; Price Target: $176.00

National Australia Bank (NAB) retained at sell at UBS; Price Target: $28.00 from $26.00

Paragon Care (PGC) retained at buy at Bell Potter; Price Target: $0.31 from $0.26

Proteomics International Laboratories (PIQ) downgraded to hold from buy at Morgans; Price Target: $1.38

SG Fleet Group (SGF) retained at overweight at Morgan Stanley; Price Target: $3.10

Solvar (SVR) retained at hold at Bell Potter; Price Target: $0.91 from $1.07

-

Transurban Group (TCL)

Downgraded to neutral from outperform at Macquarie; Price Target: $13.69

Retained at equal-weight at Morgan Stanley; Price Target: $13.68

Westpac Banking Corporation (WBC) retained at sell at UBS; Price Target: $23.00 from $20.00

Scans

This article first appeared on Market Index on Tuesday 12 March.

5 topics

12 stocks mentioned