ASX 200 dips from record as lower metals and energy prices sink resources

Today in Review

Markets

ASX 200 Session Chart

%20Intraday%20Chart%205%20Feb%202024.png)

The S&P/ASX200 (XJO) finished 73.5 points lower at 7,625.9, 0.43% from its session low and 0.96% from its high. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 53 to 222.

There were few reasons for today's decline. Many media outlets have called it "profit taking after the market made new highs". I don't buy that. It's just one of those things financial journos write when they don't have any idea for why the market fell on a particular day.

Hey, I'm not saying I've got any better idea, but I wouldn't ever use the P.T. excuse! It could have been something Jerome Powell said in his interview this morning on US 60 Minutes. I felt it was pretty much par for the course, as in, nothing we haven't heard from him before. Rates will come down at some stage, but only when the Fed is really certain inflation is under control.

US stocks futures were trading lower throughout today's local session and continue to do so at the time of writing.

Chinese Services PMI data was worse than expected (see Economy below), but not terribly so. The weak data on input prices was perhaps more concerning as it smacks of weak consumer demand in the Chinese economy. Chinese stocks did dip sharply on their open in Shanghai, but are trading back towards Friday's close.

That's it! I'm out of ideas for why we would so blatantly ignore such positive leads from US stocks on Friday.

As for the worst performing sectors today, this was a little easier to figure out and to be fair, they had a substantial imp[act on the end result for the ASX 200. Base metals prices were lower again on Friday, along with iron ore and crude oil prices. This helped the S&P/ASX 200 Materials Sector (XMJ) to a 2.7% loss – the clear worst performing of the ASX's 11 major sector indices.

The Gold (XGD) -4.6% sub-sector, and energy commodity influenced Utilities (XUJ) -1.5% and Energy (XEJ) -1.1% sectors also fared poorly today. Gold prices are down on strength in the US dollar and due to a big drop in Silver Lake Resources (ASX: SLR). SLR tumbled 11.5% after it agreed to what I can only assume was a disappointing all-scrip bid from fellow gold producer Red 5 (ASX: RED) +3%

The Health Care (XHJ) +0.14% was the best performing sector, and the only one in the black. It's a typically defensive sector, and today definitely was a day for playing defense.

ChartWatch

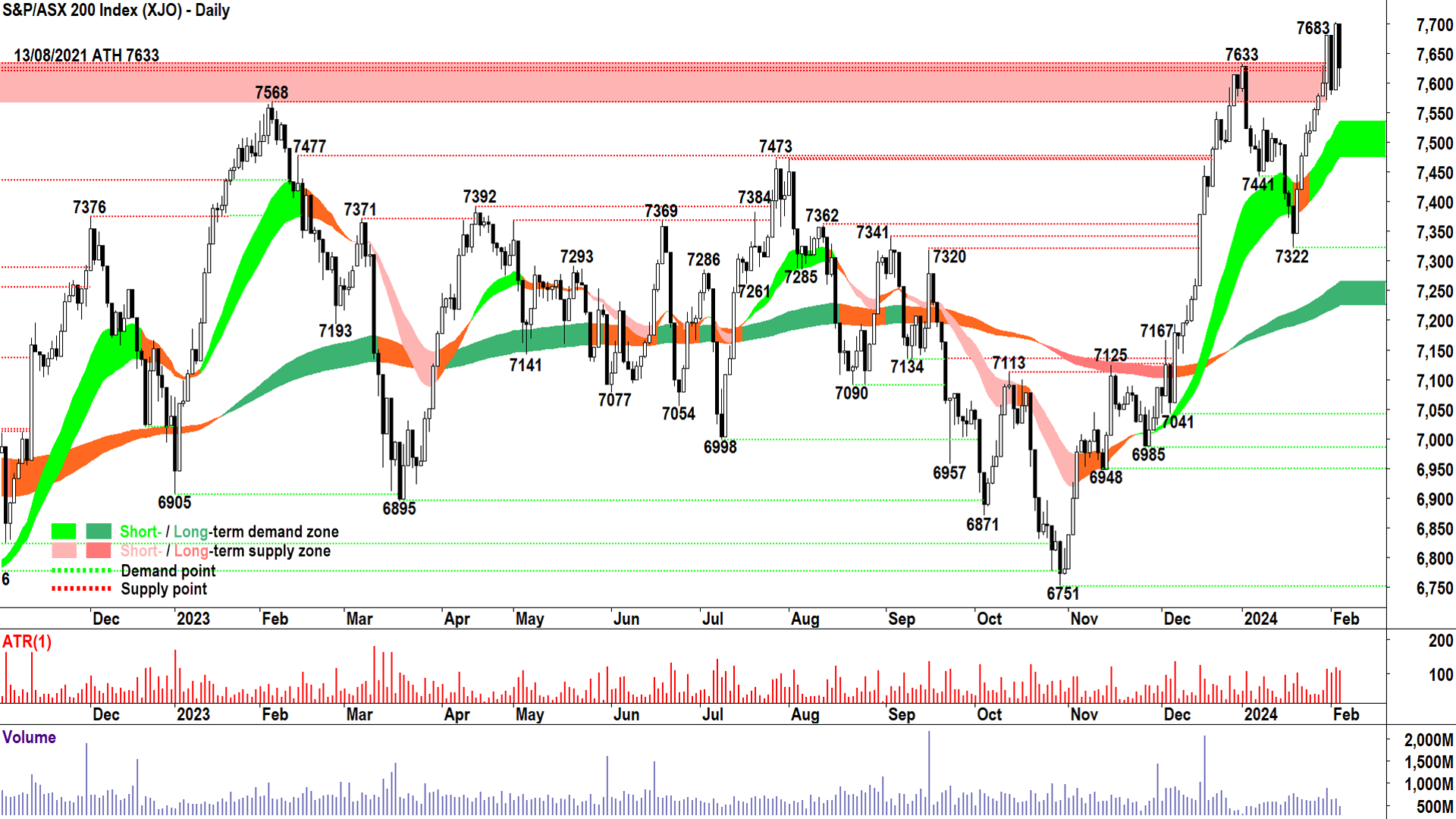

S&P/ASX200 (XJO)

Ice cream sandwiches. I love them! Especially on a warm summer's day like today. Aussie investors probably thought today's "Ice cream Sandwich" Japanese candlestick pattern tasted pretty awful, though.

An ice cream sandwich pattern occurs when two large black candles occur either side of a similarly large white candle. Basically, down-up-down. It's a very rare candle pattern which is often associated with a market top.

Hey - I said "often". Nothing is guaranteed in markets, and certainly not in technical analysis! But, the price action does suggest that at least in the short term, something isn't quite right with the ASX bulls' ability to control prices around recent record highs.

Rather than the typical supply vacuum one would ordinarily expect to see on a clean breakout to new highs, this one has been dogged by nagging selling in 2 out of the past 4 record probing sessions. I still see plenty of positive in the technicals for the benchmark index, including strong short and long term trends and good price action from the January low at 7233 – so there's little to suggest a major market top just yet.

Support now moves to 7475-7535 (the light green short term trend ribbon), and as long as the price continues to close above this range, the short term uptrend is intact. Until then, black candles and or upward pointing shadows will indicate excess supply is creeping in, and white candles and or downward pointing shadows will indicate demand remains healthy.

US 10-Year T-Note Yield

The Bureau of Labor Statistics (BLS) reported that 353,000 jobs were created in the US economy in January, well above the 187,000 forecast by economists. Even better (or worse for those counting on an imminent Fed rate cut), November's result of 216,000 jobs was revised massively higher to 333,000 jobs.

The interest rate on the benchmark US 10-year T-Note rose basis 14 basis points (0.14%) to 4.02%. When you consider the Fed usually deals in 0.25% changes, the move on Friday was tantamount to half a typical Fed rate hike – at a time when markets are baying for cuts ASAP!

Keep an eye on this chart. US stocks popped on Friday on the back of "this is good economic news" sentiment, but we've seen the market switch sentiment very quickly to "too good news will take away our rate cuts!" It's a fine line we will have to tread throughout 2024 and I suggest a close above 4.2% would put extreme pressure on stocks.

US Dollar Index

The US dollar tends to be bought up against other currencies on the back of strong economic data. This is because such data tends to increase the rate of interest able to be earned in that economy, and therefore tends to attract international capital flows from relatively weaker economies.

A strong US dollar helps ASX companies which export goods and services and natural resources, like the big miners, but it can hurt those which rely on importing these items, such as discretionary retailers. It can also put a dampener on commodity prices which are typically priced in US dollars. Gold is typically the most impacted by changes in the US dollar because its price is less influenced by regular demand and supply factors compared to industrial metals.

The US dollar popped nearly 1% on Friday on the back of the stronger jobs report – kind of a big deal in terms of a daily move in currency terms. The move took it above a key technical resistance level around 103.65, and if it can close above 104.27, there's a good chance it could move back to the 2023 highs around 107.

Economy

-

China Caixin Services PMI January: Actual 52.7 vs consensus forecast 53.0 vs December 52.9

Private sector survey measuring activity in non-manufacturing sectors (i.e., “services”) sectors within China, note a reading over 50 indicates expansion, vs below 50 indicates contraction

Today’s reading suggests continued growth in China’s services sector but slowing slightly from December. The result was worse than expected by economists, however

Very low inflationary environment (i.e., indication of weak consumption demand) for Chinese economy confirmed as average input prices rose at the second-slowest rate over the past 19 months

Later this week...

Tuesday

02:00 USA ISM Services PMI January: consensus forecast 52.0 vs December 50.6

14:30 AU RBA statement, cash rate, press conference: consensus forecast 4.35% (i.e., no change)

Thursday

12:30 China CPI y/y to January: consensus forecast -0.5% p.a. vs -0.3% p.a. in November; China PPI y/y to January: consensus forecast-2.6% p.a. vs November -2.7% p.a.

Friday

09:30 AU RBA Governor Bullock speaks

Latest News

The case for keeping it simple (and how it helped this fundie return 30.8% in 2023)

ASX 200 stocks hit with the biggest broker downgrades last week: Sayona, Gold Road

Is the Nickel price close to a trough? Morgan Stanley has the answer

Will the Goldilocks market continue in 2024?

ASX 200 stocks hitting fresh 52-week highs and lows – Week 6

6 stocks for a full portfolio reset in 2024

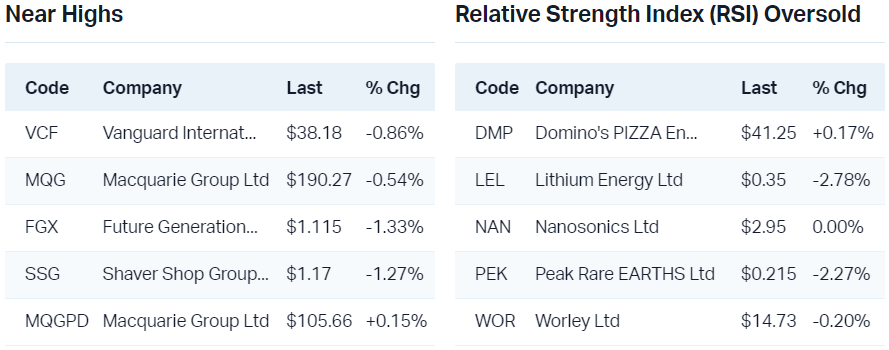

Interesting Movers

Trading higher+9.5% Opthea (OPT) - Continued positive response to 2 Feb: Opthea Strengthens Team with Key Clinical & Regulatory Hires

+7.9% Zip Co (ZIP) - No News, rise is consistent with short term uptrend, long term trend changing from down to up

+6.0% Michael Hill International (MHJ) - No news 🤔

+5.5% Liberty Financial Group (LFG) - No news 🤔

+5.5% Johns Lyng Group (JLG) - Johns Lyng USA appointed to Allstate Panel, rise is consistent with prevailing short and long term uptrends

+4.9% Ainsworth Game Technology (AGI) - No news 🤔

+4.5% Immutep (IMM) - No news 🤔

+3.8% Regal Partners (RPL) - No News, rise is consistent with short term uptrend, long term trend changing from down to up

+3.7% Pro Medicus (PME) - PME launches Visage Ease VP for Apple Vision Pro, upgraded to BUY from hold at Jefferies and price target increased to $120.00 from $82.00

+3.0% Red 5 (RED) - SLR: Presentation - Red 5 and Silver Lake Resources to Merge

-11.5% Silver Lake Resources Ltd (SLR) - Presentation - Red 5 and Silver Lake Resources to Merge

-9.0% Resolute Mining (RSG) - No news, tough day at the office for gold sector, closed below long term uptrend ribbon

-8.2% Liontown Resources (LTR) - No news, fall is consistent with prevailing short and long term downtrends

-7.5% Catapult Group International (CAT) - No news 🤔

-7.5% Ramelius Resources (RMS) - No news, tough day at the office for gold sector

-6.9% West African Resources (WAF) - No news, tough day at the office for gold sector

-6.8% Perseus Mining (PRU) - No news, tough day at the office for gold sector

-6.8% Fletcher Building (FBU) - Update on NZICC and WIAL Carpark projects

-6.6% Nickel Industries (NIC) - Weaker nickel price on Friday

-6.0% Bellevue Gold (BGL) - No news, tough day at the office for gold sector

-5.9% Chalice Mining (CHN) - Weaker nickel price on Friday, fall is consistent with prevailing short and long term downtrends

-5.6% De Grey Mining (DEG) - No news, tough day at the office for gold sector

Broker Notes

Australian Clinical Labs (ACL) downgraded to neutral from buy at BofA; Price Target: $3.30 from $3.50

Altium (ALU) retained at overweight at Morgan Stanley; Price Target: $50.00

Atturra (ATA) retained at buy at Shaw and Partners; Price Target: $1.45

Bapcor (BAP) initiated hold at Canaccord Genuity; Price Target: $5.60

Boral (BLD) retained at underweight at Morgan Stanley; Price Target: $3.90 from $3.30

Bluescope Steel (BSL) retained at underweight at Morgan Stanley; Price Target: $21.00 from $18.00

BWP Trust (BWP) retained at sell at Citi; Price Target: $3.40

-

Car Group (CAR)

Retained at neutral at Citi; Price Target: $34.30

Retained at overweight at Morgan Stanley; Price Target: $30.00

Commonwealth Bank of Australia (CBA) retained at sector perform at Citi; Price Target: $84.00

Chalice Mining (CHN) retained at outperform at Macquarie; Price Target: $2.00 from $3.00

Carnaby Resources (CNB) retained at outperform at Macquarie; Price Target: $1.10 from $1.15

Computershare (CPU) retained at outperform at Macquarie; Price Target: $28.00

Charter Hall Retail REIT (CQR) downgraded to hold from buy at Jefferies; Price Target: $3.66 from $3.50

Centaurus Metals (CTM) retained at outperform at Macquarie; Price Target: $0.70 from $1.00

Domino's Pizza Enterprises (DMP) upgraded to hold from underperform at Jefferies; Price Target: $44.00 from $46.00

Dexus (DXS) downgraded to hold from buy at Jefferies; Price Target: $9.13 from $9.10

Fletcher Building (FBU) retained at buy at Goldman Sachs; Price Target: $4.90

Goodman Group (GMG) retained at buy at Citi; Price Target: $25.50

Graincorp Class A (GNC) retained at outperform at Macquarie; Price Target: $9.70

GPT Group (GPT) retained at equalweight at Morgan Stanley; Price Target: $4.60

GUD Holdings (GUD) initiated buy at Canaccord Genuity; Price Target: $15.15

Insurance Australia Group (IAG) retained at outperform at Macquarie; Price Target: $6.10

Imdex (IMD) downgraded to sell from hold at Bell Potter; Price Target: $1.50 from $1.60

Lunnon Metals (LM8) retained at outperform at Macquarie; Price Target: $0.70 from $1.10

Megaport (MP1) retained at buy at Citi; Price Target: $12.05

-

Nufarm (NUF)

Retained at buy at Bell Potter; Price Target: $6.35 from $6.30

Retained at buy at Citi; Price Target: $5.60

Nextdc (NXT) retained at buy at Citi; Price Target: $15.45

Playside Studios (PLY) retained at buy at Shaw and Partners; Price Target: $0.90

Pro Medicus (PME) upgraded to buy from hold at Jefferies; Price Target: $120.00 from $82.00

REA Group (REA) retained at overweight at Morgan Stanley; Price Target: $200.00

Regis Resources (RRL) retained at buy at Bell Potter; Price Target: $2.60

Seek (SEK) retained at overweight at Morgan Stanley; Price Target: $29.00

Saturn Metals (STN) retained at buy at Shaw and Partners; Price Target: $0.44

Suncorp Group (SUN) retained at outperform at Macquarie; Price Target: $17.00

Syrah Resources (SYR) retained at equalweight at Morgan Stanley; Price Target: $0.40 from $0.60

Wesfarmers (WES) downgraded to hold from buy at Jefferies; Price Target: $57.00

Westgold Resources (WGX) downgraded to hold from buy at Euroz Hartleys; Price Target: $1.90 from $2.20

Wisetech Global (WTC) retained at overweight at Morgan Stanley; Price Target: $85.00

Scans

This article first appeared on Market Index on 5 February 2024.

5 topics

10 stocks mentioned