ASX 200 edges higher aided by iron ore, base metals, and lithium stocks, gold loses its shine

Today in Review

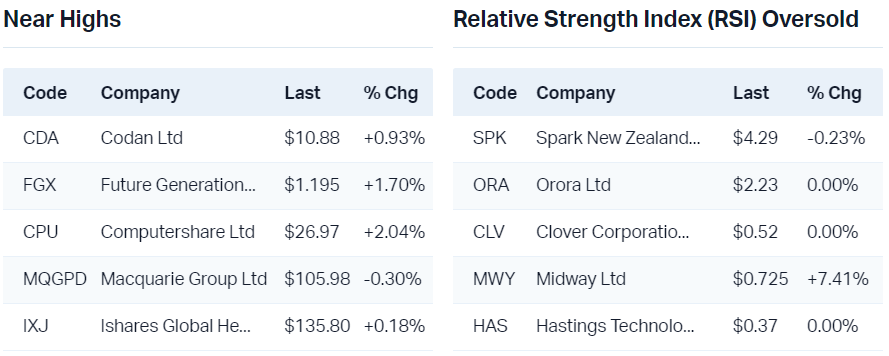

Markets

%20Intraday%20Chart%2010%20Apr%202024.png)

The S&P/ASX 200 (XJO) finished 20.6 points higher at 7,844.8, 0.26% from its session low and 0.31% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 163 to 113.

The Real Estate Investment Trusts (XPJ) (+1.2%) sector was the best performing sector today, bouncing back after six very weak sessions. The reason for recent weakness is a corresponding rise in bond yields – property stocks hate rising yields! Today's strength is a direct result of a modest pullback in key bond yields overnight in the US.

Also doing well today was the Health Care (XHJ) (+1.0%) sector as Ansell (ASX: ANN) (+4.1%) and Fisher & Paykel Healthcare (ASX: FPH) (+2.5%) were each the beneficiary of positive broker updates (see Broker Moves).

Doing it tough today was the Information Technology (XIJ) (-1.2%) sector. It has been a high flyer this year and it just feels like we're in the early stages of a rotation out of this sector and into some of the unloved sectors like Resources (XJR), which happens to be the focus of today's ChartWatch.

On the topic of Resources, the sector managed a 0.6% gain today, which to be fair, would have been substantially better if not for a modest but pervasive pullback in gold stocks. The Gold (XGD) sub-index was 0.7% lower, dragged down by news-related declines in Westgold Resources (ASX: WGX) (-4.1%) and Perseus Mining (ASX: PRU) (-2.6%). More on those in the Interest Moves section.

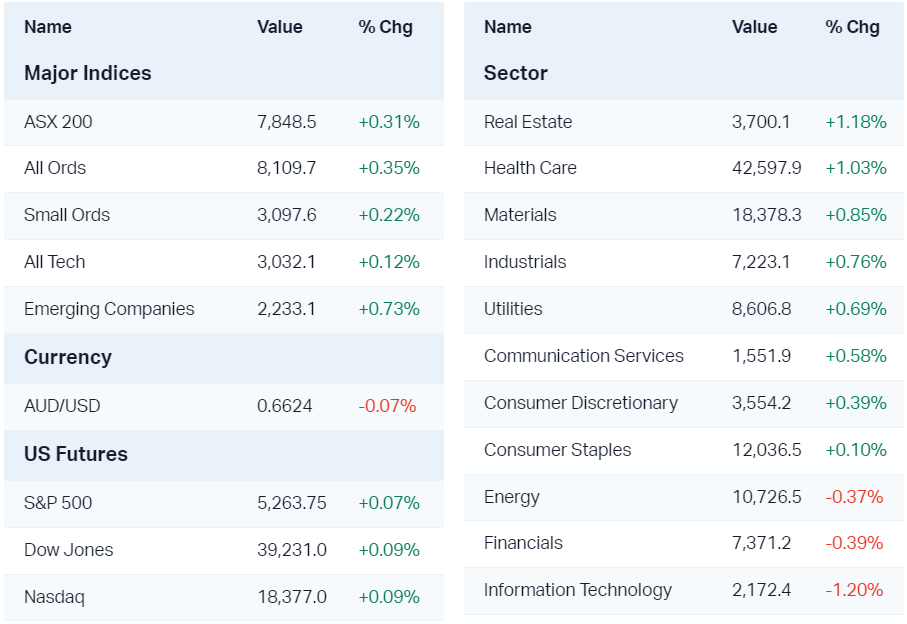

ChartWatch

S&P/ASX Resources Sector Index (XJR)

%20chart.png)

The Resources sector is one of the most volatile sectors on the ASX. Risk, reward, they’re two sides of the same coin for investors in Aussie resources stocks!

Encouragingly, the technicals suggest we may be moving back to an environment which is skewed back to the reward side of the equation. I note a new short term uptrend (light green ribbon), good price action in the form of rising peaks and rising troughs, and candles that are back to predominantly white/downward pointing shadows.

Together, each of these signal the demand-side is back in control of Aussie resources stocks.

Most importantly for me, is the fact the price punched through the dynamic resistance of the long term trend ribbon (now neutral), pulled back to retest it, and then punched higher again with this latest move. This tells me this key zone is once again acting as dynamic support.

Note, I typically don’t do key levels for sector indices as I believe that unlike major benchmark indices which attract derivatives traders, there’s little focus on historical points of demand and supply.

The respective points of demand and supply of the XJR’s constituents will be more important, and to be fair, they collectively often coincide with key levels here. See below for analysis of one of the XJR’s biggest constituents!

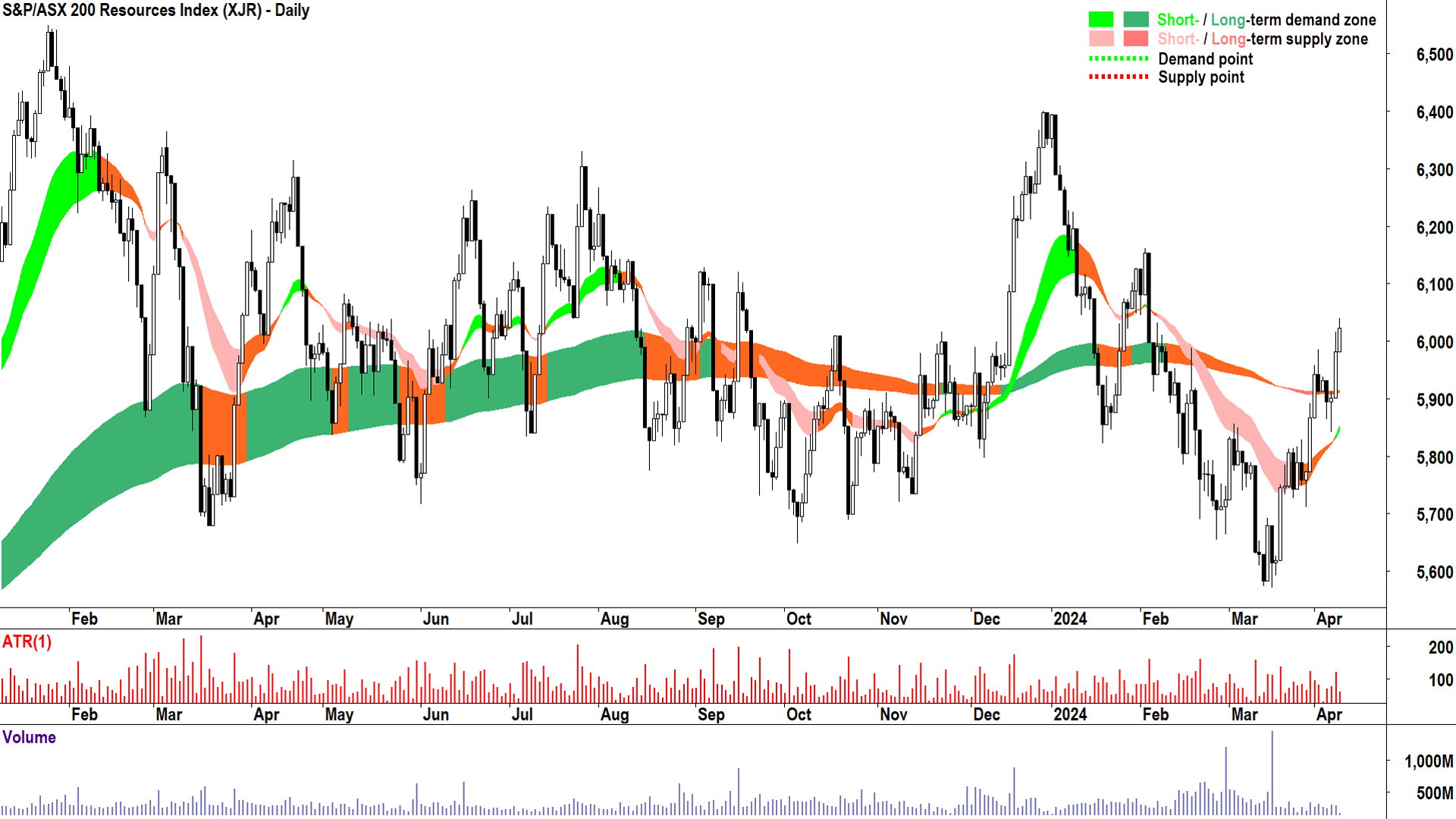

Rio Tinto (ASX: RIO)

.png)

Certainly going to be a massive influence on the fortunes of both of the above charts is Rio Tinto. The price action swung back to rising peaks and rising troughs yesterday, an indication the market sentiment has shifted back to buy the dip.

Even better, when it did it (yesterday’s candle = in response to the big rise in iron ore prices reported here on Monday), it did so on a massive gap up. Big up-gaps signal a significant change in market thinking, triggering a big shift towards excess demand.

Two more checks to go. The price has closed back above the long term trend ribbon after testing it a couple of times. This confirms it is again offering dynamic support. Secondly, today’s long white candle with high close (another sign of excess demand) closed above the key historical point of supply of 126.60.

The next points of supply to be encountered are 131.98 and 133.83. 123.95 has moved to a point of demand, but really, I expect there to be a solid demand zone between it and down to 119.97.

Economy

Today

There weren't any major data releases in our time zone today

Later this week

-

Wednesday

22:30 USA Core CPI March (+0.3% forecast vs +0.4% February)

-

Thursday

04:00 USA Federal Reserve FOMC Meeting Minutes

22:15pm EU ECB Main Financing Rate (4.5% no change forecast)

22:30pm USA Core PPI March (+0.2% forecast vs +0.3% February)

-

Friday

03:00 USA 30-year Government T-Bond Auction

11:00 CHN Trade Balance

-

Saturday

00:00 USA University of Michigan Consumer Sentiment (79.0 forecast vs 79.4 previous)

Latest News

3 ASX rare earths stocks to watch as prices finally show signs of stabilising

Insider Trades: Directors bought and sold shares in these 8 ASX 200 companies last week

Interesting Movers

Trading higher

+14.3% Latin Resources (LRS) - No news, lithium prices continue to grind higher in China promoting broad ASX lithium sector strength

+13.6% Chalice Mining (CHN) - No news, general strength in beaten down battery metals stocks, closed above major point of supply at 1.37 set on 8 March 🔎📈

+13.5% Vulcan Energy Resources (VUL) - No news, lithium prices continue to grind higher in China promoting broad ASX lithium sector strength

+9.5% Novonix (NVX) - NOVONIX Announces Participation in April Investor Events, general strength in beaten down battery metals stocks, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up, closed at major point of supply at 1.10 set on 13 March 🔎📈

+8.5% Jupiter Mines (JMS) - No news, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up, closed at major point of supply at 0.255 set on 10 April 2023 🔎📈

+8.4% Metals X (MLX) - Continued positive response to yesterday's Annual Report, sharp rise in tin price Tuesday, rise is consistent with prevailing short and long term uptrends 🔎📈

+8.0% Firefly Metals (FFM) - General strength in copper juniors today, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+7.9% 29METALS (29M) - General strength in copper juniors today, rise is consistent with prevailing short term uptrend, price action returned to rising peaks and rising troughs🔎📈

+7.4% Nuix (NXL) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.3% Stanmore Resources (SMR) - No news, sharp rise in coking coal price Tuesday

+5.7% Zip Co (ZIP) - No news, bounced off short term uptrend ribbon 🔎📈

+4.8% Nanosonics (NAN) - No news, characteristic of recent volatility, bouncing up and down around $2.60 point of demand within well established short and long term downtrends 🔎📉

+4.2% Liontown Resources (LTR) - No news, lithium prices continue to grind higher in China promoting broad ASX lithium sector strength

+4.1% Develop Global (DVP) - No news, lithium prices continue to grind higher in China promoting broad ASX lithium sector strength

+4.1% Ansell (ANN) - Continued positive response to Tuesday's Ansell to acquire Kimberly Clark's Personal PPE Business, several positive broker updates (see Broker Moves)

Trading lower

-4.8% Imugene (IMU) - No news, closed below long term trend ribbon 🔎📉

-4.1% Westgold Resources (WGX) - Continued negative response to yesterday's Merger to Create 400 kozpa Australian Gold Miner, and last week's Q3, FY24 Production Update

-3.3% Mesoblast (MSB) - No news, characteristically volatile since massive surge on 26 March FDA Notifies Clinical Data Sufficient for Refiling aGVHD BLA

-3.0% Wisetech Global (WTC) - No news, closed below the short term uptrend ribbon, fall is consistent with falling peaks and falling troughs

-2.9% Iress (IRE) - No news 🤔

-2.6% MA Financial Group (MAF) - No news, fall is consistent with prevailing short term trend, long term trend is transitioning from up to down 🔎📉

-2.6% Perseus Mining (PRU) - Silvercorp accepts Perseus's offer for OreCorp, generally weaker ASX gold sector today

-2.3% Ramelius Resources (RMS) - Silvercorp accepts Perseus's offer for OreCorp, generally weaker ASX gold sector today

Broker Notes

-

Ansell (ANN)

Upgraded to neutral from negative at E&P; Price Target: $24.50 from $24.00

Upgraded to overweight from neutral at JP Morgan; Price Target: $29.90 from $26.00

Retained at accumulate at Ord Minnett; Price Target: $32.00 from $31.00

Retained at neutral at UBS; Price Target: $26.00 from $25.00

ARB Corporation (ARB) retained at buy at Citi; Price Target: $44.90

Beach Energy (BPT) retained at accumulate at Ord Minnett; Price Target: $2.40 from $2.50

Deterra Royalties (DRR) retained at overweight at Morgan Stanley; Price Target: $5.60

Develop Global (DVP) retained at buy at Bell Potter; Price Target: $3.30 from $4.10

-

Elders (ELD)

Upgraded to buy from neutral at Citi; Price Target: $8.50 from $7.30

Retained at neutral at UBS; Price Target: $9.00 from $9.70

Evolution Mining (EVN) retained at overweight at Morgan Stanley; Price Target: $3.90

Fisher & Paykel Healthcare (FPH) upgraded to buy from neutral at UBS; Price Target: $29.10 from $28.50

Goodman Group (GMG) retained at buy at Citi; Price Target: $32.50

Nickel Industries (NIC) retained at overweight at Morgan Stanley; Price Target: $0.95

Rio Tinto (RIO) retained at overweight at Morgan Stanley; Price Target: $140.00

-

Regis Resources (RRL)

Retained at buy at Bell Potter; Price Target: $2.60

Retained at overweight at Morgan Stanley; Price Target: $2.40

South32 (S32) retained at overweight at Morgan Stanley; Price Target: $3.35

Suncorp Group (SUN) retained at buy at UBS; Price Target: $18.20 from $16.80

Tabcorp Holdings (TAH) downgraded to underweight from neutral at JP Morgan; Price Target: $0.67 from $0.70

-

Whitehaven Coal (WHC)

Retained at overweight at Morgan Stanley; Price Target: $8.50

Retained at buy at UBS; Price Target: $8.70

Scans

This article first appeared on Market Index on Wednesday 10 April 2024.

5 topics

15 stocks mentioned