ASX 200 flat, US core inflation accelerates + Australia's most crowded trades

ASX 200 futures are trading 5 points lower, down -0.07% as of 8:20 am AEST.

S&P 500 SESSION CHART

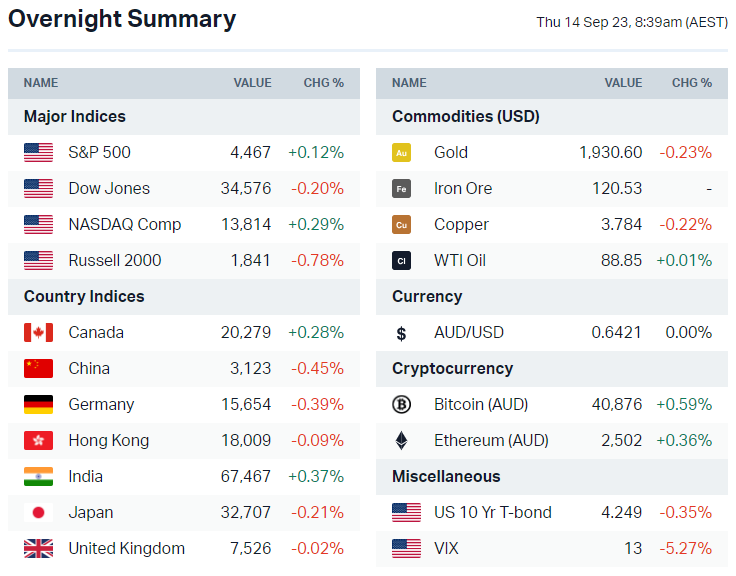

MARKETS

- Major US benchmarks mixed in a relatively overnight session

- S&P 500 and Nasdaq higher amid choppy trade, closed near 50-day moving averages

- Not much volatility despite major catalysts such as Apple’s iPhone 15 reveal and US CPI

- Market expectations of a Fed pause next week sit at 97%, up from 92% a day ago, according to CME’s Fedwatch Tool

- Goldman Sachs's CEO says US economy is likely to avoid a significant recession but warned that inflation will likely be more persistent (Reuters)

- OPEC+ cuts to tighten oil market sharply in Q4, IEA says (Reuters)

STOCKS

- Apple iPhone price increase part of subtle strategy to wire more money from consumers without triggering sticker shock (Bloomberg)

- Arm is expected to price IPO at top end of range or higher (Bloomberg)

- Moderna receives clearance from CDC for updated Covid vaccines (CNBC)

- Citi CEO Jane Fraser announces corporate reorganisation (CNBC)

- American Airlines slashes third-quarter profit estimates due to higher fuel prices and costs from a new pilot labour agreement, shares down 5.7% (CNBC)

- Google lays off hundreds on recruiting team (Semafor)

- Birkenstock files for IPO in further boost to US market (Bloomberg)

CENTRAL BANKS

- ECB's crucial 2024 projection to put inflation above 3.0% (Reuters)

- Traders flip to bet on ECB hike as inflation upends rate view (Bloomberg)

- BOJ watchers bring forward hike forecasts on Ueda's remarks (Bloomberg)

CHINA

- China property jumps to top credit risk in BofA survey(Bloomberg)

- China says it has not banned purchase use of foreign phone brands (Reuters)

ECONOMY

- US core inflation accelerates for the first time in 6 months but in-line with expectations, headline comes in hotter-than-expected (Bloomberg)

- UK economy flags sharp decline in July, revives recession risk (FT)

- Eurozone factory output falls larger-than-expected 1.1% in July (Bloomberg)

- Japan manufacturer confidence falls by most in eight months (Reuters)

- South Korea import prices rise most in 17 months on higher oil prices, while unemployment hits a record low in August (Yonhap)

US Inflation: Headline Higher, Core Unchanged

US inflation notched upwards for a second consecutive month in August to 3.7%, up from 3.2%.

- Headline CPI YoY: 3.7% (vs. 3.6% expected)

- Headline CPI MoM: 0.6% (in-line with expectations)

- Core CPI YoY: 4.3% (in-line with expectations)

- Core CPI MoM: 0.3% (vs. 0.2% expected)

As for specific areas:

- Energy prices accelerated month-on-month to 5.6% in August from 0.1% in July, reflecting the largest pain point at the headline level

- Food inflation notched upwards to 0.6% month-on-month from 0.2% in July

- Shelter CPI moved down for a fifth consecutive month to 7.3% year-on-year from an 8.2% peak in March

Morgan Stanley says a 10% increase in oil prices adds approximately 35 bps to headline inflation for three months but only 3 bps to core inflation.

"Higher energy prices must be sustained for some time to have a greater, more durable effect ... The Fed will look through this shock," the analysts said.

At least for now, the market still expects the Fed to pause when it meets next week, with a 97% probability of holding rates at 5.25% to 5.50%.

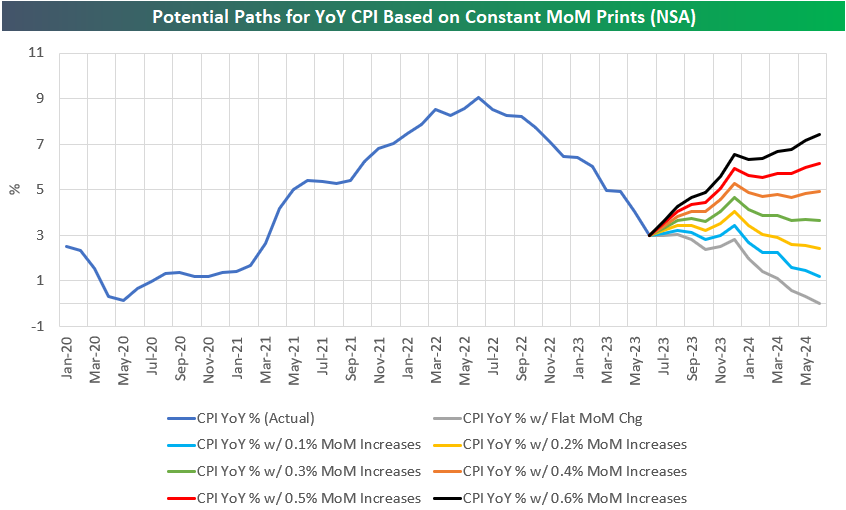

But looking ahead, Bespoke says that "because of base effects, year-on-year inflation is likely to trend sideways between 3.5-4.5% for the rest of the year regardless of what happens to month-on-month."

And on the topic of month-on-month, the only way we get back to the 2-3% target is via a sustained period of prints of less than 0.2%. The problem is if inflation continues to grow at 0.3% per month, we'll get stuck around the 3.5% level.

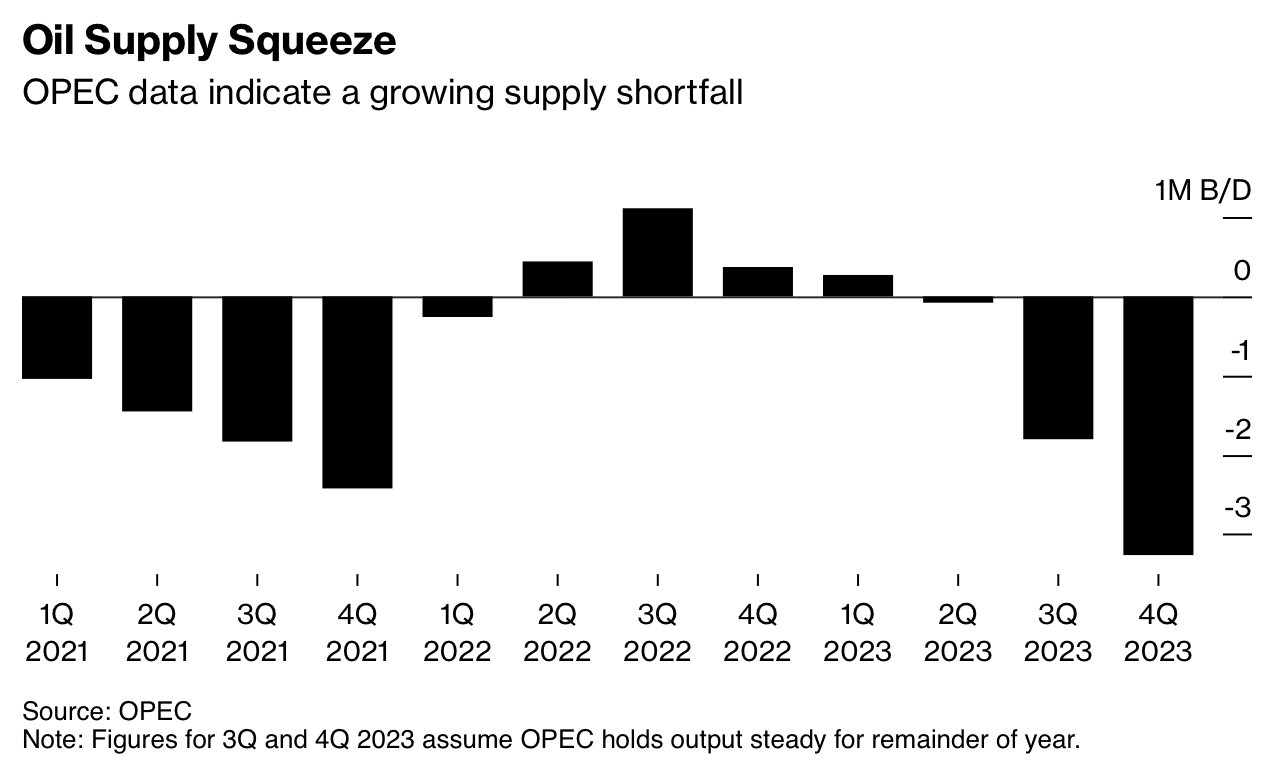

Oil markets: Forced Shortages

It's a great time to be an energy bull, with a benchmark like the SPDR Energy Select Sector trading near decade highs.

Bloomberg says the global oil market faces a supply shortfall of more than 3 million a barrels a day next quarter, potentially the biggest deficit in more than a decade as Saudi Arabia extends its production cuts.

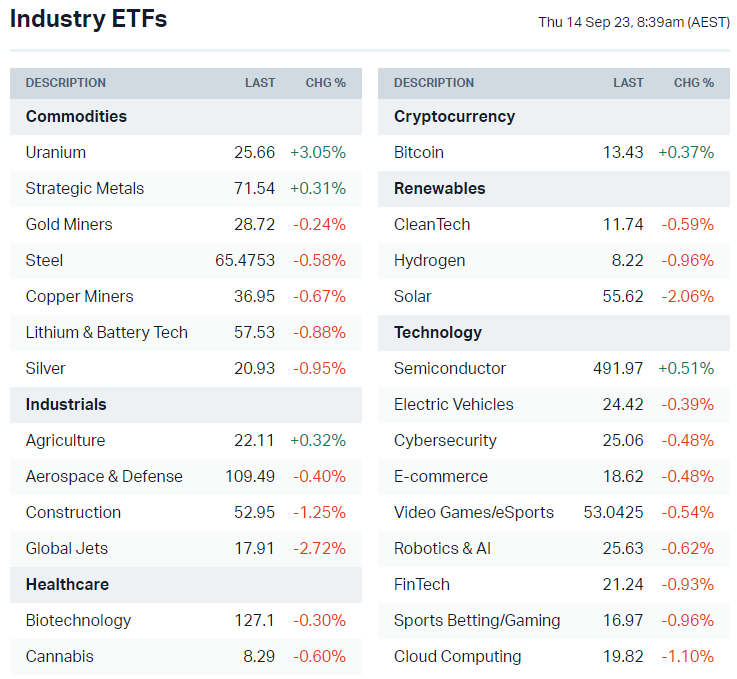

Overnight movers: Uranium Soars

The Global X Uranium ETF rallied 3.05% overnight, marking its highly close since April 2022. Uranium spot prices soared to US$62 a pound earlier this week and above the key US$60 level for the first time since 2011. Let's see if we see local names like Paladin Energy (ASX: PDN) and Boss Energy (ASX: BOE) kick on.

Broker Watch

Citi: Dreaming of a soft landing? Get real

Citi's Andrew Hollenhorst has held firm to his view that the US economy will experience a hard landing while many of his peers have either erased or continued to kick their recession calls down the road. Hollenhorst wrote this in a recent research note:

Our view is that the laws of “economic gravity” seen in previous cycles will ultimately reassert themselves, and the US economy will face recession during 2024. In contrast, advancing the case for a soft landing requires a convincing narrative as to why “this time is different.”

To make this case, Hollenhorst picks five major wage disinflation events since 1965 in the US. That is, periods where wage growth has declined significantly - 2% on average. His research finds that unemployment increased by nearly 3% on average at the same time - and yes, all five coincided with a recession.

And while yes, some things about this cycle are different, the general axiom remains the same. To reverse a softening in wage growth, there needs to be a significant increase in the unemployment rate. And where there is a significant increase in unemployment, a recession usually occurs.

UBS: Australia's most crowded trades

UBS always has great insights in their thematic equities notes. Today, their note is about crowded trades and there appears to have been a noticeable shift in favour of utilities, real estate, and industrials stocks. The case in point here is that the three most crowded ASX 100 trades are: Goodman Group (ASX: GMG), Brambles (ASX: BXB), and Charter Hall (ASX: CHC).

In contrast, the financials sector remains the most deserted trade. Note, these are crowded long trades.Among the crowded short trades, the top three place-getters were Harvey Norman (ASX: HVN), Nine Entertainment (ASX: NEC), Mineral Resources (ASX: MIN).

Key Events

ASX corporate actions occurring today:

Trading ex-div: South32 (S32) – $0.05, Kelsian Group (KLS) – $0.095, Austral (ASB) – $0.03, Inghams (ING) – $0.10, Spark New Zealand (SPK) – $0.125, DDH1 (DDH) – $0.02, Tourism Holdings (THL) – $0.138, PWR Holdings (PWH) – $0.08, Seven Group (SVW) – $0.23, Fletcher Building (FBU) – $0.147

- See full list of ASX stocks and ETFs trading ex-dividend here

- Listing: Freightways Group (FRW) at 11:00 am

Economic calendar (AEST):

- 11:30 am: Australia Unemployment Rate

- 10:15 pm: ECB Interest Rate Decision

- 10:30 pm: US Producer Price Index

- 10:30 pm: US Retail Sales

- 10:45 pm: ECB Press Conference

8 stocks mentioned

2 contributors mentioned