ASX 200 futures flat, Nvidia tops Microsoft as world's most valuable company

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 6 points lower, down 0.07% as of 8:30 am AEST.

S&P 500 SESSION CHART

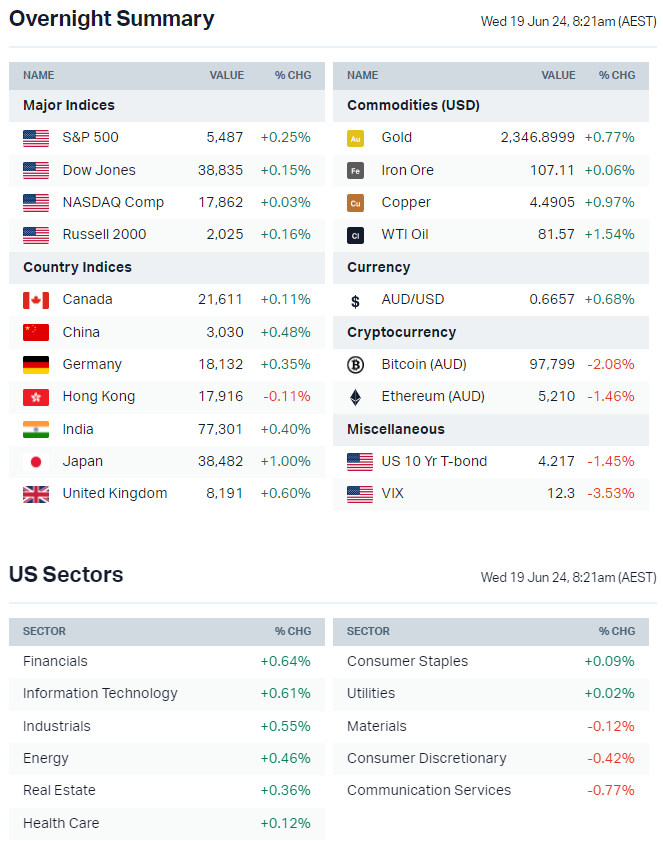

OVERNIGHT MARKETS

- US markets finished higher, with the S&P 500 logging its 31st record high of the year

- Megacap tech stocks traded mostly lower but Nvidia (+3.5%) has now overtaken Microsoft as the world’s most valuable company

- Bond yields lower after weaker-than-expected US retail sales data offered more support for a September rate cut but stoked weakening growth concerns

- Brent crude settled 1.1% higher, trading above US$85 for the first time since 1-May

- Another relatively uneventful session ahead of tomorrow’s US market holiday (Juneteenth National Independence Day)

- Citi joins Goldman and Evercore in upgrading S&P 500 year-end target (Bloomberg)

- Goldman Sachs sees inflection point for US labour market, says first-quarter inflation jump was likely an anomaly, sticks to two rate cut calls (Bloomberg)

BOFA FUND MANAGER SURVEY

- Latest Bank of America Global Fund manager survey showed investors most bullish since November 2021 but sentiment still not yet extreme

- Cash levels of 4.0% are the lowest since June 2021

- Investors are most overweight stocks and underweight bonds since November 2022

- Soft landing has become the consensus call and hard landing views hit new lows

- Magnificent 7 is among the most crowded trade on record at 69%

- On use of cash, 26% of companies should return capital to shareholders, the highest since April 2024, while 35% wanted to see increase capex

STOCKS

- Apple drops its 'buy now, pay later' service in US just months after rollout (FT)

- EV startup Fisker files for bankruptcy, aims to sell assets (WSJ)

- Berkshire Hathaway boosts stake in Occidental Petroleum to nearly 29% (Reuters)

- McDonald's to end test run of AI-powered drive-thru tech provided by IBM (AP)

CENTRAL BANKS

- BOJ Governor Ueda flags possibility of rate hike in July (Bloomberg)

- RBA on hold, does not rule out another hike as inflation risks to the upside (Bloomberg)

- BoK says pace of consumer inflation continues to slow and hints at rate cut by year end (Korea Times)

- Central banks expect global reserves of gold to increase over the next year as US dollar popularity wanes (FT)

GEOPOLITICS

- Putin vows to support North Korea against United states, plans to deepen trade and security ties (Reuters)

- US warns China it will defend the Philippines after latest seizure of Philippine boats (ABC)

- New intelligence raises US, Israeli concerns about Iranian nuclear program (Axios)

- China retaliates in tit-for-tat anti-dumping investigation into EU pork (Reuters)

- Le Pen's party says it needs absolute majority to govern France, says will be serious on finances to reassure markets (Bloomberg)

ECONOMY

- US retail sales tepid in May, up 0.1% month-on-month vs. 0.3% consensus (Reuters)

- Germany June ZEW economic sentiment posts first monthly decline since January (Bloomberg)

ASX TODAY

- ASX 200 to open relatively flat despite a solid overnight lead

- Resource stocks bounced overnight, notably uranium, gold, copper and nickel

- Brambles readying offer for Loscam’s southeast Asia business (AFR)

- Fletcher Building to divest 50% of Fiji construction business for NZ$20m (FBU)

- Pacific Equity Partners mulls bid for New Zealand energy distributor Powerco (AFR)

- QBE Insurance to commence orderly closure of North America middle-market segment, restructuring charge of $100m before tax will be recorded in FY24 result, first-half FY24 GWPs up 3% YoY (QBE)

BROKER MOVES

- Abacus Storage King REIT initiated Neutral with $1.30 target (Jarden)

- Beach Energy downgraded to Neutral from Overweight; target cut to $1.55 from $1.75 (Jarden)

- Beach Energy downgraded to Neutral from Outperform; target cut to $1.55 from $1.95 (Macquarie)

- Charter Hall Social Infrastructure REIT upgraded to Neutral from Underweight; target cut to $2.75 from $3.05 (Jarden)

- Goodman Group downgraded to Overweight from Buy; target up to $37.60 from $30.50 (Jarden)

- GPT Group upgraded to Overweight from Underweight; target up to $4.85 from $4.70 (Jarden)

- Ingenia Communities downgraded to Overweight from Buy; target up to $5.50 from $5.45 (Jarden)

- Lifestyle Communities upgraded to Buy from Overweight; target cut to $15 from $17 (Jarden)

- Mirvac upgraded to Overweight from Neutral; target cut to $2.20 from $2.25 (Jarden)

- Scentre Group downgraded to Overweight from Buy; target up to $3.65 from $3.60 (Jarden)

- Stockland upgraded to Buy from Overweight; target up to $5.45 from $5.05 (Jarden)

KEY EVENTS

Companies trading ex-dividend:

- Wed 19 June: Afp Pharmaceuticals (AFP) – $).01

- Thu 20 June: None

- Fri 21 June: CSR (CSR) – $0.12

- Mon 23 June: None

- Tue 24 June: None

Other ASX corporate actions today:

- Dividends paid: McGrath (MEA) – $0.016

- Listing: None

Economic calendar (AEST):

- 9:50 am: Japan Balance of Trade (May)

- 4:00 pm: UK Inflation (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment