How to hunt for ASX growth stocks (and 6 ideas to get you started)

In April this year, I wrote an article that outlined a rudimentary factor screening process for identifying ASX growth stocks.

I also invited two fund managers to peel back the curtain on some of the factors they rate highly in their investment process.

The wire was well received, with numerous readers commenting that it was helpful from both an educational and practical standpoint.

Today, that original post evolves. The factor screening model has been updated and my colleague - and resident technical analysis expert - Carl Capolingua is joining the party.

We aim to bring you regular (once every couple of months) commentary on the ASX growth stocks passing our fundamental (factor screening) and technical screens. Below, I outline the factors a stock must meet to qualify, while further down, Carl explains his technical criteria and then selects a handful of interesting stocks from the factor list.

Before we dive in, it is important to note that these are not recommendations and that we're more interested in highlighting the process, rather than the outcome. The analysis is for educational purposes and represents one of many ways to look at markets and hunt for growth stocks. Any discussion of past performance is not a reliable indicator of future return.

As always, do your own research before making any investment decision.

Factor screening

Whilst far from exhaustive, below are a handful factors that can be important in identifying growth stocks:

- Sales growth 1-year forward greater than 15% - the lynchpin of any growth company; it must have strong sales growth from one period to the next

- EPSg 1-year forward greater than 10% - always want to see strong earnings per share growth to complement the sales growth

- EBITDA margin 1-year forward greater than 10% - expanding margins are important for growth companies as they scale up

- ROE 1-year forward greater than 10% - ROE is a quality filter, measuring how efficiently a company generates its profits

- FCFg latest greater than 10% - Free cash flow is super important - lack of cash flow can cripple any business, let alone one trying to grow

- Cash flow return on invested capital greater than 5% - How effectively a growth company uses its invested capital to generate cash is critically important

Using an investment analysis tool, we found 23 stocks that currently fit the criteria. The data is as of the end of 4 July.

| Stock | Code | Stock | Code |

| Austin Engineering | ANG | Codan | CDA |

| Close the Loop | CLG | Capricorn Metals | CMM |

| Emerald Resources | EMR | Embark Early Education | EVO |

| Flight Centre | FLT | Goodman Group | GMG |

| Helloworld Travel | HLO | Hub24 | HUB |

| Insurance Australia | IAG | Jumbo Interactive | JIN |

| Kelly Partners Group | KPG | Otto Energy | OEL |

| Pacific Smiles Group | PSQ | ReadyTech Holdings | RDY |

| ResMed | RMD | Ramelius Resources | RMS |

| RPMGlobal | RUL | Seven Group Holdings | SVW |

| Telix Pharmaceuticals | TLX | Technology One | TNE |

| Wisetech Global | WTC |

The factor list of stocks was generated using Halo Technologies

Technical Analysis

Carl looked at the charts of each of the 23 stocks identified in the Factor Screen. He selected 6 stocks he felt best met his technical analysis criteria. In this way, we aim to show you the stocks that best match our combined desired fundamental and technical factors.

About Carl’s Technical Analysis methodology:

Carl is a trend follower, meaning he aims to identify the trend in a stock’s price, and he then only trades in the direction of this trend. The key technical analysis criteria he uses are: short and long term trends, price action, candles, volume, and volatility. Each day, Carl publishes a list of his favourite uptrends and downtrends in his ChartWatch ASX Scans on Market Index.

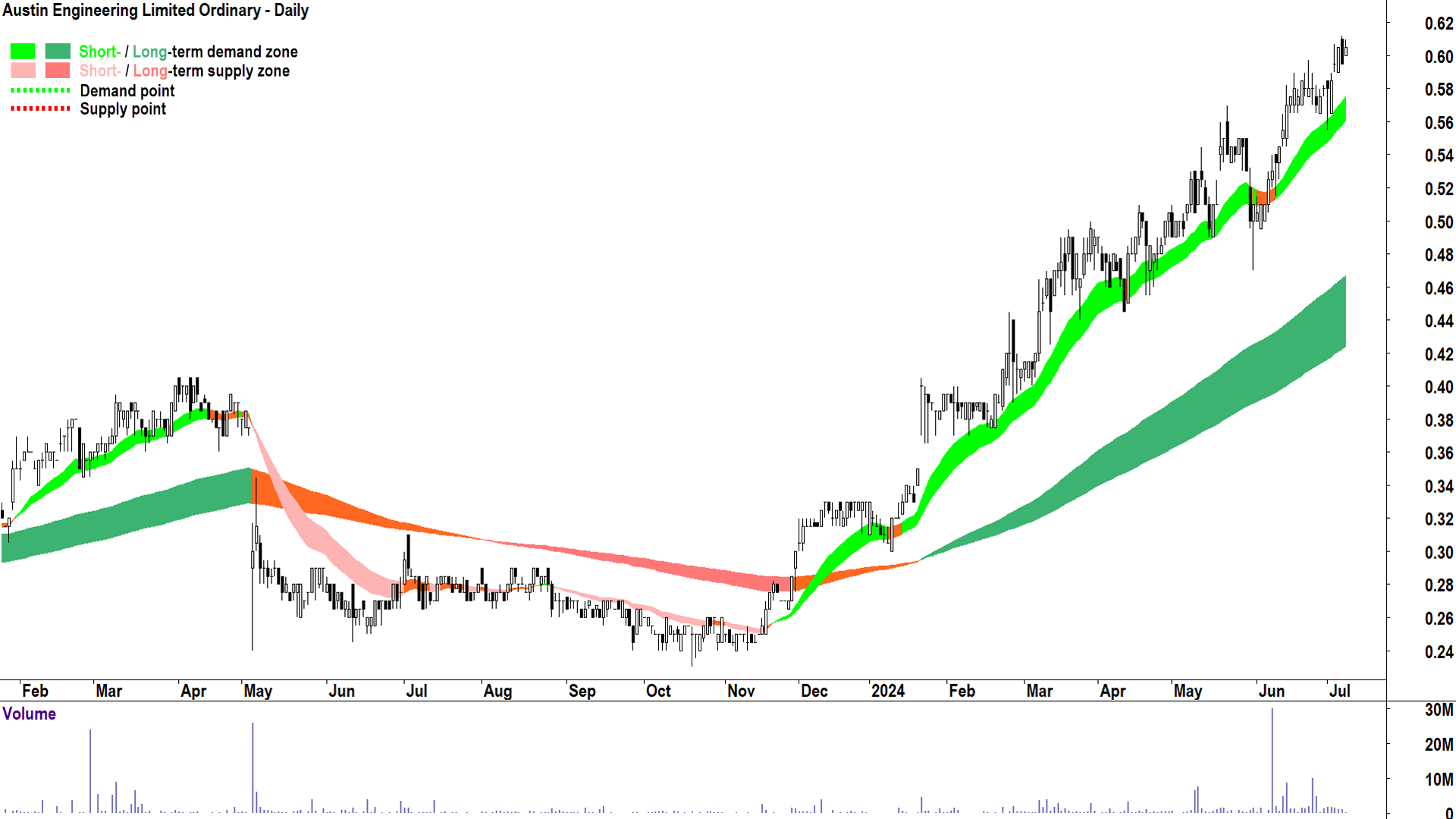

Austin Engineering (ASX: ANG)

%20chart%208%20July%202024.png)

The short and long term trends are up (light green and dark green trend ribbons) and the trend ribbons are offering dynamic support to price. The price action is rising peaks and rising troughs, indicating demand reinforcement and supply removal. The candles are predominantly demand-side (i.e., white-bodied and or downward pointing shadows).

Trend, price action, and candles are consistent with an environment of excess demand. Downside volatility is scant, and there’s nothing in the volume to suggest that the prevailing uptrend cannot continue.

There are no major points of supply that might impact the ANG price as it is trading at/near all-time highs.

The key point of demand is the 1 July trough at $0.555. The short term trend is intact as long as the ANG price continues to close above this point.

Codan (ASX: CDA)

%20chart%208%20July%202024.png)

The short and long term trends are up and the trend ribbons are offering dynamic support to price. The price action is falling peaks and falling troughs – not ideal, but there’s very little downside volatility in current price action downtrend.

Despite very moderate supply-side candles on 1 July and 4 July (i.e., black-bodied and or upward pointing shadows) the candles are still predominantly demand-side.

Trend and candles are consistent with an environment of excess demand. The price action could be better, but it is not a deal-breaker here, because downside volatility is scant. There’s nothing in the volume to suggest that the prevailing uptrend cannot continue.

The 29 October 2021 peak at $13.92 may act as a future point of supply.

The key point of demand is the short term uptrend ribbon, the low of which is currently $11.35. The short term trend is intact as long as the CDA price continues to close above this point.

Goodman Group (ASX: GMG)

%20chart%208%20July%202024.png)

The short and long term trends are up and the trend ribbons are offering dynamic support to price. The price action is rising peaks and rising troughs, indicating demand reinforcement and supply removal. There has been some stagnation in the broader price action since the start of June, though.

The candles are predominantly demand-side, although one could argue there is an increasing prevalence of supply-side candles.

Overall, trend, price action, and candles are consistent with an environment of excess demand. Downside volatility is generally scant, but the 2 July supply side candle does create an important point of interest. There’s nothing in the volume to suggest that the prevailing uptrend cannot continue.

There are no major points of supply that might impact the GMG price as it is trading at/near all-time highs.

The key point of demand is the short term

The key point of demand is the 2 July trough at $34.02. The short term trend is intact as long as the GMG price continues to close above this point.

Hub24 (ASX: HUB)

%20chart%208%20July%202024.png)

The short and long term trends are up and the trend ribbons are offering dynamic support to price. The price action is rising peaks and rising troughs, indicating demand reinforcement and supply removal. The candles are predominantly demand-side.

Trend, price action, and candles are consistent with an environment of excess demand. Downside volatility is scant, and there’s nothing in the volume to suggest that the prevailing uptrend cannot continue.

There are no major points of supply that might impact the HUB price as it is trading at/near all-time highs.

The key point of demand is the short term uptrend ribbon, the low of which is currently $44.68. The short term trend is intact as long as the HUB price continues to close above this point.

Telix Pharmaceuticals (ASX: TLX)

%20chart%208%20July%202024.png)

The short and long term trends are up and the trend ribbons are offering dynamic support to price. The price action is falling peaks and falling troughs – not ideal, but there’s very little downside volatility in current price action downtrend.

Similarly, supply side candles have been very moderate, and the candles are still predominantly demand-side.

Trend and candles are consistent with an environment of excess demand. The price action could be better, but it is not surprising to see very moderate consolidations in price action of this nature beneath a major point of supply (note the 6 June major point of supply at $19.06).

Downside volatility is scant, and there’s nothing in the volume to suggest that the prevailing uptrend cannot continue.

The 6 June peak at $19.06 is the key point of supply, a close above it could see the HUB price probe the round number at $20, i.e., the next key point of supply.

The key point of demand is the short term uptrend ribbon, the low of which is currently $17.33. The short term trend is intact as long as the TLX price continues to close above this point.

Technology One (ASX: TNE)

%20chart%208%20July%202024.png)

The short and long term trends are up and the trend ribbons are offering dynamic support to price. The price action is rising peaks and rising troughs, indicating demand reinforcement and supply removal.

Despite notable supply-side candles on 1 July and 4 July the candles are still predominantly demand-side.

Trend, price action, and candles are consistent with an environment of excess demand. Downside volatility is scant, and there’s nothing in the volume to suggest that the prevailing uptrend cannot continue.

The 28 June / 4 July peak at $18.70 is the key point of supply, a close above it could see the TNE price probe the round number at $20, i.e., the next key point of supply.

The key point of demand is the 27 June trough low of 18.03. The short term trend is intact as long as the TNE price continues to close above this point.

5 topics

1 contributor mentioned