ASX 200 futures flat, S&P 500 bounces from 3-month low + US 10-year yields hit 4.5%

ASX 200 futures are trading 7 points lower, down -0.10% as of 8:20 am AEST.

S&P 500 SESSION CHART

MARKETS

- S&P 500 finished higher, bounced off early lows of -0.40% and snapped a four-day losing streak

- Treasury yields mixed, with a big curve-steepening move as the US 10-year yield rallied 10 bps to 4.53% and at its highest since October 2007

- US Dollar Index up more than 2.5% in the September quarter, on track for its biggest quarterly gain since the 7% rally in Q3 2022

- Upward pressure on rates remains a key overhang on broader risk sentiment

- Rates pressure fulled by higher oil prices, higher-for-longer Fed remarks as well as growth worries, auto strikes and looming government shutdown

- BofA notes that the S&P 500 still has five days left to trade during the worst ten-day period of the year

- Bespoke Investment says seasonals turn from super bearish to super bullish as October, November and December have historically been the three best months of the year for the market

- Chinese property stocks fall sharply on Monday over possible Evergrande liquidation following setbacks to planned restructuring of at least $30bn of offshore debt (Bloomberg)

- Hedge funds cut stock leverage at fastest pace since 2020 crash (Bloomberg)

- US stocks flash recession warning, small caps and industrial stocks drop (Bloomberg)

- Food-related commodities prices surge, complicating the inflation picture (CNBC)

STOCKS

- Amazon to invest up to $4bn in AI startup Anthropic (FT)

- Chinese telco giant Huawei teases two new EVs at launch event (CNBC)

CHINA

- Chinese property stocks tumble most in 9 months (Reuters)

- Central-bank adviser proposes structural reforms to revive economy (Reuters)

- Millions to take to skies as China gears up for long Golden Week (Bloomberg)

- Evergrande misses payment on $547m bond (Bloomberg)

ECONOMY

- German business sentiment worsens in September (Reuters)

- Taiwan August industrial production falls for a 15th straight month (FocusTaiwan)

- Australia to face deeper economic deterioration if China suffers a sharper-than-expected slowdown, according to Australian regulators (Bloomberg)

- Fed survey flags only the richest 20% of Americans still have excess pandemic savings, bottom 80% have lowest bank deposits in June this year than in March 2020 (Bloomberg)

- Moody's warns that a US government shutdown would reflect negatively on the US credit rating (Bloomberg)

Sectors to Watch

Markets are beginning to bounce from no man's land. And that's all there is to it.

- Could we see a V-shape move back to recent highs? It's not unlikely, there have been so many times where the market tumbles into a bearish position, only to recover just as fast.

- Could this just be an oversold bounce and we puke below key levels (e.g. the S&P 500's channel and 200-day moving average below)? That's also likely.

The point is, we're in a volatile and choppy market, where trends can change rather quickly. (Just like how the market from super bullish in July to super bearish now).

As for overnight sectors of interest:

- Uranium: The Global X Uranium ETF added another 4.55% as spot prices shoot to more than US$65 a pound. Local names continue to catch a bid from extremely overbought levels. A name like Deep Yellow (ASX: DYL) opened 3.8% higher on Monday and finished the session up 13.2%. The sector is running hot and refusing to offer a pullback for traders. Let's see if the rally continues to kick on.

Resources: The SPDR Energy and Materials ETFs bounced 1.25% and 0.9% respectively overnight. Both sectors have been relatively heavy in the past week amid China's ongoing real estate crisis and the surging US dollar. Can we see local Resources follow with a bounce on Tuesday?

- On a side note: China's battery grade lithium carbonate prices fell for a 15th consecutive day on Monday, to hit the lowest level in more than a year

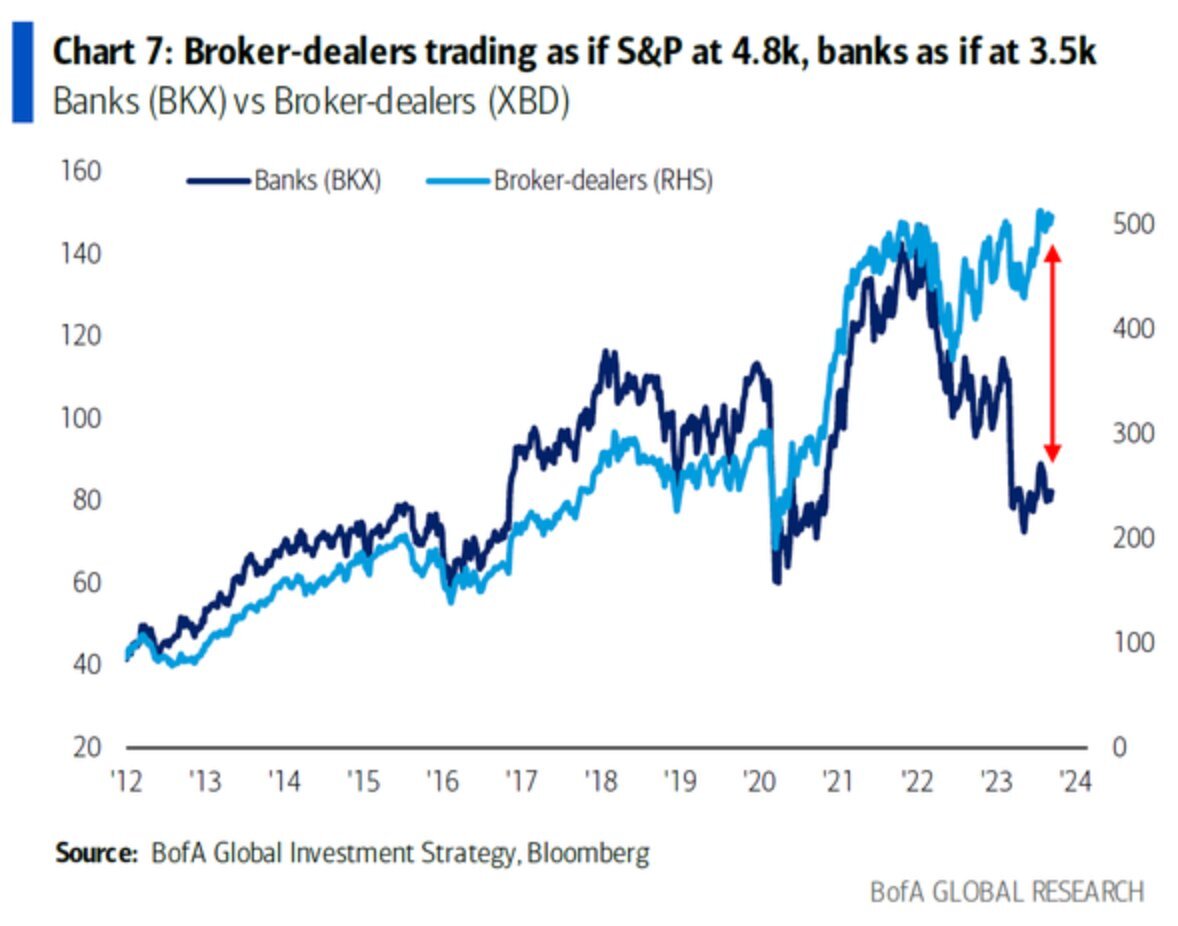

Buy Side vs. Sell Side

For every buyer, there is a seller. And for every investment banker, there is a broker or floor trader. Some interesting research from the Bank of America team has uncovered the positions that bankers are holding versus their sell side counterparts. The divergence between the two sides of markets is the largest since the data tracking started in 2012.

For instance, ask a fund manager or a sell-side team where they think the S&P 500 will finish the year out and you will get some very different responses. On one hand, the bankers think it will finish at 3,500 (or are at least trading like it will finish there). On the other hand, the brokers think the US benchmark equity index has a lot (and I do mean, a LOT) of upside.

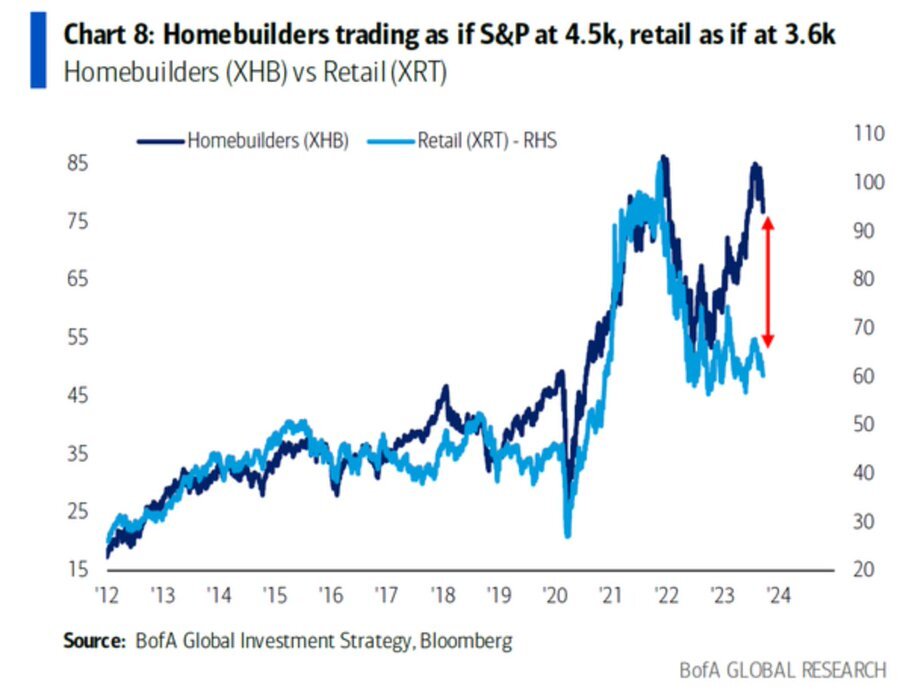

And if you think there is divergence at just the index level, that's where you're sorely mistaken. Let's combine the two parts of the market together and assess it from a sector point of view. Two of America's largest and most important sectors are homebuilders and retailers. The housing market may be essentially frozen in America thanks to 7% fixed mortgage rates but that hasn't stopped homebuilding stocks from trading near record highs. In contrast, retail stocks are trading like they are supposed to - when excess savings have rolled off and the recession is hitting at the street level.

What Do They Recommend You Do in This Environment?

BofA argues the best approach is one that's worked before - "sell the last rate hike". In bonds, a 5-year Treasury at 5% is a buy (it's currently 4.57%). You'll also want to own gold as a hedge. Finally - and this is the kicker - your stocks selection will likely to come down to whether you believe the Federal Reserve will make a policy mistake.

- If you think there will be a mistake: BofA recommends to be long REITs, retailers, and banks

- If you think there will not be a mistake: Own the Magnificent Seven stocks, homebuilders, etc.

- And if you think the less-talked about option three may occur (stagflation): Own energy stocks and consumer staples.

The rest, my dear reader, is up to you.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Nick Scali (NCK) – $0.35, Southern Cross Electrical (SXE) – $0.04

- Dividends paid: Atlas Pearls (ATP) – $).003, Contract Energy (CEN) – $0.18, Altium (ALU) – $0.29, LGI (LGI) – $0.01

- Listing: None

Economic calendar (AEST):

11:00 am: RBA Conference on Inflation

1 stock mentioned

2 contributors mentioned