ASX 200 futures flat, S&P 500 scores fourth straight record close

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 8 points lower, down -0.10% as of 8:30 am AEST.

S&P 500 SESSION CHART

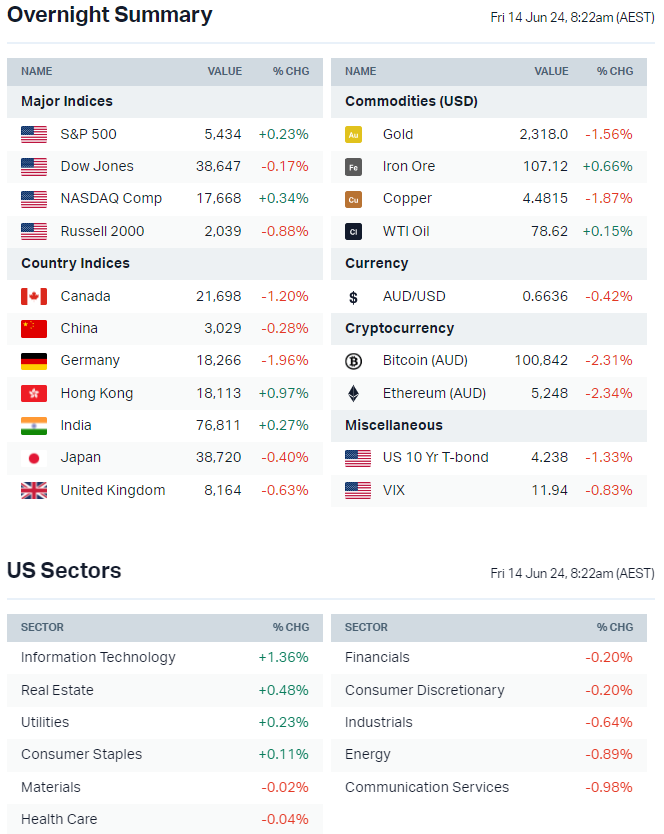

OVERNIGHT MARKETS

- US stocks finished mixed but not far off best levels after some midday weakness

- Breadth remains a concern – Nasdaq 100 is up 3% so far this week and traded higher on all four trading days but breadth has been 50/50, according to Bespoke

- Broadcom (+12.2%) is the latest AI bright spot after topping Q2 earnings expectations and upgrading its FY24 guidance – AI semiconductor revenue of US$3.1bn was up 35% quarter-on-quarter and 280% year-on-year

- Market struggled for momentum despite more signs of disinflation momentum from cooler-than-expected US PPI data – poor breadth, cyclical underperformance and upcoming buyback blackout period remain the key areas of concern

- Bond yields down for a fourth straight session – the US 2-year closed at its lowest level since 5 April

- Traders push up odds of September Fed rate cut following CPI report (Bloomberg)

- Latest US inflation data could support stock market laggards (Reuters)

- Private credit funds have raised over US$13bn in US investment grade corporate bond market this year, pacing toward record (Bloomberg)

STOCKS

- Tesla extends gains after Musk says shareholders voting yes for his US$56bn pay package (Bloomberg)

- Apple not paying OpenAI as part of partnership, sees mutual benefits derived from distribution (Bloomberg)

- OpenAI has more than doubled annualized revenue in last six months (The Information)

CENTRAL BANKS

- Fed now projects one rate cut in 2024 from three previously (Bloomberg)

- Powell sends mixed interest rate signal (FT)

- ECB's Nagel says core inflation "still very sticky", stresses meeting-by-meeting approach to cuts (Bloomberg)

- BOJ to discuss tapering JGB purchases at Friday's meeting (Bloomberg)

GEOPOLITICS

- G7 members reach deal to provide US$50bn to Ukraine using profits from frozen Russian assets (FT)

- NATO says over 300,000 troops are now on 'high readiness' (Economic Times)

- Hezbollah says it attacked nine Israeli sites with rockets, reportedly largest attack on Israel since war began (Reuters)

- Biden administration extremely concerned about risk of all-out war between Israel and Hezbollah (Axios)

- US expands Russia sanctions to undercut its war machine, targeting chips sent via China (Reuters)

- China EV stocks shrug off EU tariff decision (Bloomberg);

ECONOMY

- US PPI unexpected fell in May to 2.2% vs. consensus 2.5%, core PPI unchanged month-on-month vs. expectations for a 0.3% rise (Reuters)

- Eurozone industrial production unexpectedly fell at the start of Q2, with intermediate goods driving decline (Bloomberg)

ASX TODAY

- ASX 200 set for a relatively flat start following a mixed overnight lead (where strength remains concentrated to a handful of megacap tech stocks)

- Commodity prices were relatively weak overnight after the US dollar bounced 0.5% to a near six week high

- Overnight resource-related ETFs (Rare earths, gold, silver, nickel, copper etc.) continued to roll over, pointing to a weak start for local names

- Chemist Warehouse deal can still get past ACCC health check (AFR)

- Deterra to buy UK-based Trident Royalties for $276m (DRR)

- Downer EDI seeking to sell its 30% stake in Linen Services (AFR)

- Winsome Resources seeking to raise $20m at 85 cents per share (AFR)

BROKER MOVES

- Champion Iron upgraded to Buy from Outperform; target up to $7.90 from $7.20 (CLSA)

- Corporate Travel upgraded to Buy from Hold; target down to $16 from $17.50 (Jefferies)

- Jumbo Interactive upgraded to Outperform from Neutral; target up to $17.45 from $17.15 (Macquarie)

- Lottery Corp upgraded to Outperform from Neutral; target up to $5.50 from $5.25 (Macquarie)

- Reece Australia initiated Sell with $23.35 target price (Goldman Sachs)

- Telix Pharmaceuticals upgraded to Buy from Hold; target remains $19 (Bell Potter)

KEY EVENTS

Companies trading ex-dividend:

- Fri 14 June: None

- Mon 17 June: None

- Tue 18 June: Premier Investments (PMV) – $0.63

- Wed 19 June: Afp Pharmaceuticals (AFP) – $).01

- Thu 20 June: None

Other ASX corporate actions today:

- Dividends paid: Technology One (TNE) – $0.05, Nufarm (NUF) – $0.04

- Listing: Resouro Strategic Metals – 10:30 am AEST

Economic calendar (AEST):

- 10:30 am: Australia Consumer Confidence (Jun)

- 1:00 pm: BOJ Interest Rate Decision

- 12:00 am: US Consumer Sentiment (Jun)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment