ASX 200 notches record close in volatile week end, more volatility on tap next week

Today in Review

Markets

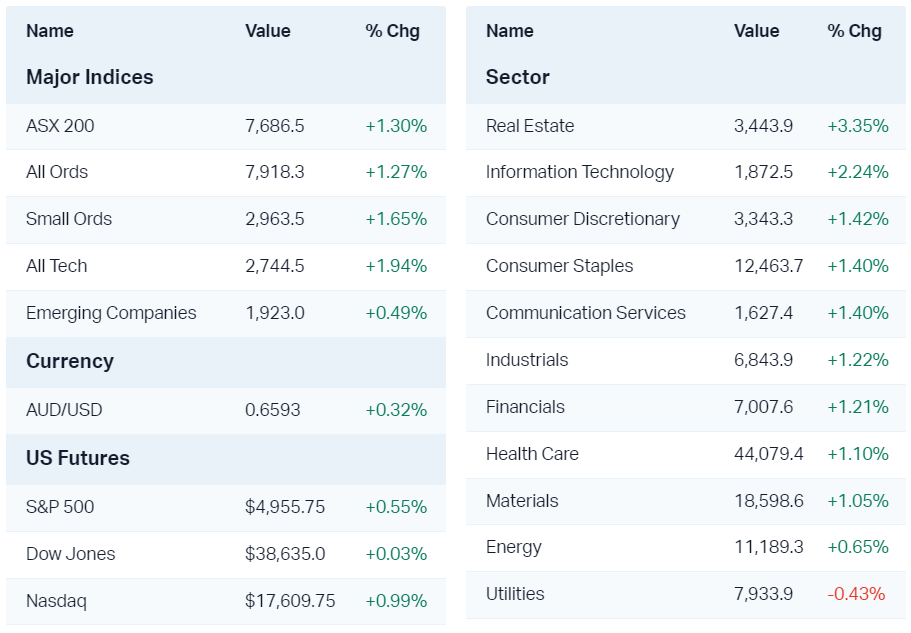

ASX 200 Session Chart

%20Intraday%20Chart%202%20Feb%202024.png)

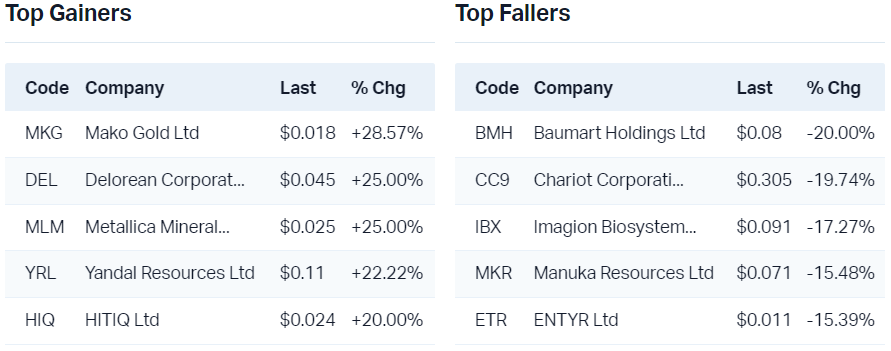

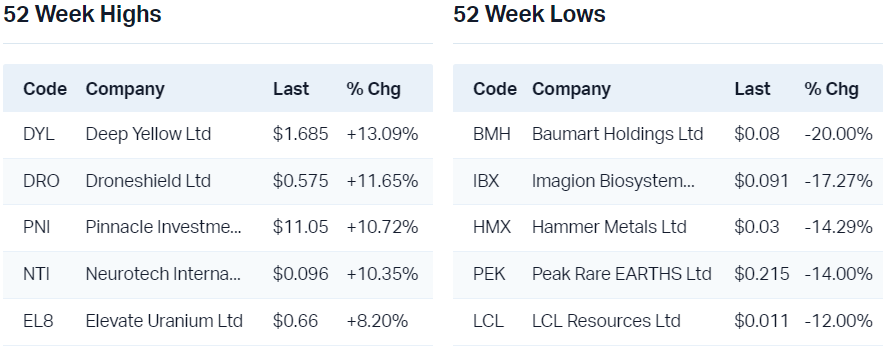

The S&P/ASX200 (XJO) finished 111.2 points higher at 7,699.4, 1.47% from its session low and just 0.05% from its high/low. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by an impressive 246 to 35. For the week, the XJO finished up 144 points or 1.87% higher.

For those who are only reading one market wrap this week, this one, here's how the last three trading sessions went:

Wednesday: Aussie CPI beat. Record high. All 11 major ASX sectors up

Thursday: #BankingCrisis. All 11 major ASX sectors down

Friday: False alarm! Mega-cap tech earnings beat. Record high. All 10/11 major ASX sectors up

If you add up the daily ranges over the last three trading sessions the S&P/ASX 200 has moved a total of 310 points. The net move from Wednesday's close to Friday's close, however, is just 18 points.

So, basically there's been a great deal of fuss over nothing! What's going to happen on Monday? Haha, I'll you fill in the blank! 😁

Today's move was dominated by Real Estate Investment Trusts (XPJ) +3.3% and Information Technology (XIJ) +3.1%. Note, the two worst performing sectors yesterday were Property and Financials (XFJ) – the point being whilst Property bounced back accordingly today, the Financials was notably absent from the best performers list.

Also doing well today was the S&P/ASX All Ordinaries Gold Sub-Index (XGD) +3.0% as gold prices rose Thursday and are tracking higher in Asian trade.

Whilst all of the major ASX sector indices were higher, Utilities (XUJ) -0.4% and Energy (XEJ) +1.1% were notable laggards. Both have companies which are negatively impacted by lower energy commodity prices overnight.

Just an FYI, Credit Corp (ASX: CCP) and Pinnacle Investment Management (ASX: PNI) kicked off this year's first half FY24 earnings season this week. Details of PNI's announcement can be found in the Interesting Movers sector below, but for the most comprehensive H1 FY24 earnings season calendar you'll find anywhere: Be sure to bookmark THIS PAGE!

ChartWatch

KBW Regional Bank Index

Shanghai Stock Exchange (SSE) Composite Index

.png)

Uranium

Economy

- No major economic news events today!

What to watch out for...

- Sat: 00:30 US Non-farm payrolls, average hourly earnings, and unemployment rate for January, consensus +177,000, +0.3%, 3.8% vs December +216,000, +0.4%, 3.7%

Latest News

5 stocks you should watch this reporting season

The ASX reporting season calendar to rule them all!

Morning Wrap: ASX 200 to rise, Meta announces maiden dividend, Charts of the Week

Evening Wrap: ASX 200 gives it all back, then some, as markets reminded banking crisis lingers

"Everything is looking appealing" in the uranium market, according to Keller

Is it time to fix that term deposit rate? What to expect from the RBA and interest rates in 2024

Interesting Movers

Trading higher

- +12.8% Deep Yellow (DYL) - No news, uranium prices rose Thursday on more production issues at Kazatomprom, rise is consistent with prevailing short and long term uptrends

- +9.4% Opthea (OPT) - Opthea Strengthens Team with Key Clinical & Regulatory Hires

- +8.6% Pinnacle Investment Management Group (PNI) - 1HFY24 Financial Highlights and Investor Presentation

- +8.0% Boss Energy (BOE) - No news, uranium prices rose Thursday on more production issues at Kazatomprom, rise is consistent with prevailing short and long term uptrends

- +7.6% OM Holdings 10c (OMH) - No news since 31-Jan: Investor Presentation

- +7.2% Skycity Entertainment Group (SKC) - Continued positive response to 1 Feb: Update On Austrac Proceedings And Accounting Provision

- +6.6% Paladin Energy (PDN) - No news, uranium prices rose Thursday on more production issues at Kazatomprom, rise is consistent with prevailing short and long term uptrends

- +6.4% Adriatic Metals (ADT) - No news since 30-Jan: Quarterly Activities Report & Cashflow, rise is consistent with prevailing short and long term uptrends

- +6.3% SG Fleet Group (SGF) - No news, bouncing off long term uptrend ribbon

- +6.2% Goodman Group (GMG) - No news, very strong Property sector today, rise is consistent with prevailing short and long term uptrends

- +6.1% Alpha HPA (A4N) - No new, bounce after recent sharp selloff

- +5.9% Silex Systems (SLX) - No news, uranium prices rose Thursday on more production issues at Kazatomprom, rise is consistent with prevailing short and long term uptrends

- +5.8% Lotus Resources (LOT) - No news, uranium prices rose Thursday on more production issues at Kazatomprom, rise is consistent with prevailing short and long term uptrends

Trading lower

- -7.8% Chalice Mining (CHN) - Resignation of Director - Morgan Ball, fall is consistent with prevailing short and long term downtrends

- -6.8% EML Payments (EML) - No news, fall is consistent with prevailing short and long term downtrends

- -6.3% Piedmont Lithium Inc (PLL) - No news, Macquarie cut price target to $0.49 from $0.60, fall is consistent with prevailing short and long term downtrends

- -5.9% Kingsgate Consolidated (KCN) - Continued negative response to 1 Feb: Sydney Mining Club Presentation

- -5.4% Westgold Resources (WGX) - Ceasing to be a substantial holder from MS

- -4.5% Fineos Corporation Holdings (FCL) - No news 🤔

- -4.3% AGL Energy (AGL) - Downgraded to neutral from outperform at Macquarie and price target cut to $9.30 from $10.89, fall is consistent with prevailing short and long term downtrends

- -4.1% Zip Co (ZIP) - No news 🤔

- -3.9% Arcadium Lithium (LTM) - No news, fall is consistent with prevailing short and long term downtrends

Broker Notes

- Ainsworth Game Technology (AGI) retained at outperform at Macquarie; Price Target: $1.35

- AGL Energy (AGL) downgraded to neutral from outperform at Macquarie; Price Target: $9.30 from $10.89

-

Aristocrat Leisure (ALL)

- Retained at outperform at Macquarie; Price Target: $48.50

- Retained at outperform at Macquarie; Price Target: $484.50

- Bapcor (BAP) retained at outperform at Macquarie; Price Target: $7.58

- Car Group (CAR) retained at outperform at Macquarie; Price Target: $35.30 from $31.50

- Commonwealth Bank of Australia (CBA) retained at sell at Goldman Sachs; Price Target: $82.37 from $82.55

- Capricorn Metals (CMM) retained at buy at Bell Potter; Price Target: $5.95 from $5.70

- CSL (CSL) retained at buy at Citi; Price Target: $325.00

- Cleanaway Waste Management (CWY) retained at neutral at Goldman Sachs; Price Target: $2.70

- Envirosuite (EVS) retained at buy at Bell Potter; Price Target: $0.13 from $0.16

- Genetic Signatures (GSS) retained at buy at Bell Potter; Price Target: $0.75 from $0.80

- IGO Limited (IGO) downgraded to hold from buy at Bell Potter; Price Target: $7.80 from $8.50

- KMD Brands (KMD) retained at neutral at Macquarie; Price Target: $0.62

- Light & Wonder Inc. (LNW) retained at outperform at Macquarie; Price Target: $100.00

- NIB Holdings (NHF) retained at neutral at Macquarie; Price Target: $7.70

- Nickel Industries (NIC) retained at buy at Bell Potter; Price Target: $1.53 from $1.80

-

Nufarm (NUF)

- Downgraded to neutral from outperform at Macquarie; Price Target: $5.73 from $5.80

- Retained at buy at Citi; Price Target: $5.60

- Origin Energy (ORG) retained at buy at UBS; Price Target: $9.60 from $7.40

- Propel Funeral Partners (PFP) retained at outperform at Macquarie; Price Target: $6.06 from $5.95

- Piedmont Lithium Inc (PLL) retained at outperform at Macquarie; Price Target: $0.49 from $0.60

- Pinnacle Investment Management Group (PNI) retained at outperform at Macquarie; Price Target: $10.64 from $10.75

- REA Group (REA) downgraded to sell from underperform at CLSA; Price Target: $160.00 from $158.00

- Rio Tinto (RIO) retained at neutral at Macquarie; Price Target: $120.00

- Regal Partners (RPL) retained at buy at Bell Potter; Price Target: $3.25 from $3.36

- Resolute Mining (RSG) retained at outperform at Macquarie; Price Target: $0.57

- Saturn Metals (STN) retained at buy at Shaw and Partners; Price Target: $0.44

- Super Retail Group (SUL) retained at neutral at Macquarie; Price Target: $16.15 from $12.60

- Sayona Mining (SYA) downgraded to hold from speculative buy at Canaccord Genuity; Price Target: $0.06 from $0.20

- Syrah Resources (SYR) retained at outperform at Macquarie; Price Target: $0.90

- Treasury Wine Estates (TWE) retained at outperform at Macquarie; Price Target: $14.00

- Universal Store Holdings (UNI) retained at buy at UBS; Price Target: $4.60 from $4.25

Scans

This article first appeared on Market Index on 2 February 2024.

5 topics

10 stocks mentioned