ASX 200 slumps in face of growing wall of worries, no sector spared, but one copper stock stood out

Today in Review

Markets

%20Intraday%20Chart%2016%20Apr%202024.png)

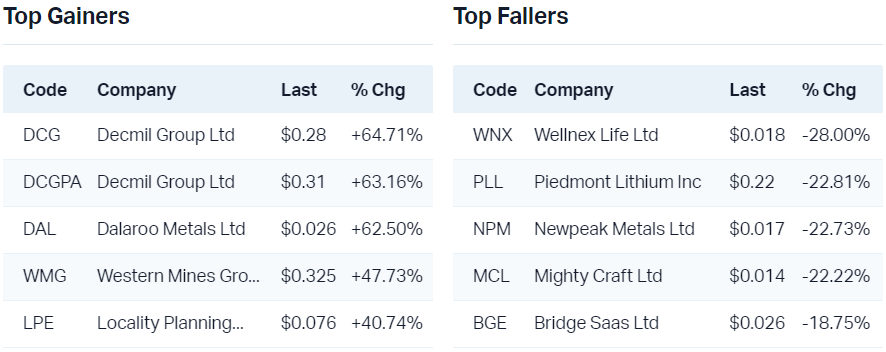

The S&P/ASX 200 (XJO) finished 140 points lower at 7,612.5, 1.84% from its session high and just 0.35% from its low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by as dismal 16 to 277 – easily the worst I’ve seen since I started writing this Evening Wrap!

All 11 of the major ASX sectors were down today and all 11 sectors lost at least 1% of their value. If there’s any point discussing the least worst, that prize goes to the Communication Services (XTJ) (-1.0%) sector, which is basically just Telstra (ASX: TLS).

Among the hardest hit sectors, were a group that is increasingly garnering the ignominy of being labelled the usual suspects since the market started chucking its rate cut tantrum – Consumer Discretionary (XDJ) (-2.40%) and Real Estate Investment Trusts (XPJ) (-2.0%).

Flip-flopping in and out of the best and worst sectors lists over the last week or so are Resources (XJR) and Utilities (XUJ) which were also at the bottom of the performance pile today, down 2.0% and 2.2% respectively.

No tables today. What would I show you? Varying degrees of stocks which got belted? Wait a second, which were the 16 rising stocks in the ASX 200? That’s got to be an interesting table! What's that, BWP is at number 2? We're in big trouble! 😁

ChartWatch

NASDAQ Composite Index

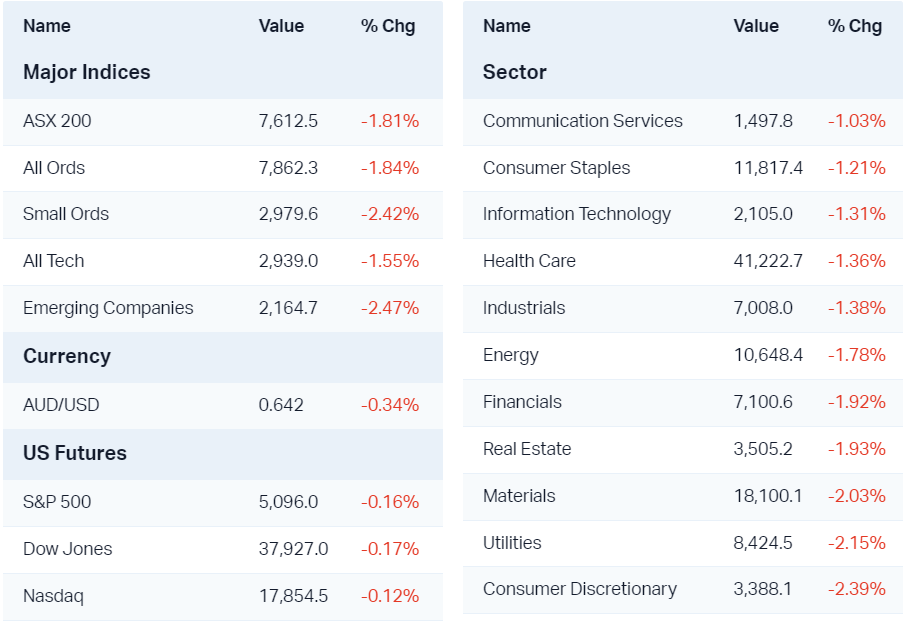

The NASDAQ Composite has been the stalwart of US stock indices since the 2022 lows. Over that time, it has reliably defined the parameters of the current bull market in US stocks.

So, the current break down in the short term uptrend, price action, and candles is disturbing. Still, I note the long term trend hasn’t flinched at all after the last couple weeks’ gyrations, and the balance of probability remains with this new short term downtrend running its course at some stage and realigning with the prevailing long term uptrend.

How bad are the short term technicals? Let’s bullet a few issues:

Price action is lower peaks and lower troughs indicating demand removal and supply reinforcement, also a shift to a sell the rally mentality among market participants.

Close below the short term uptrend ribbon, this ribbon has been incredibly accurate (if I say so myself) in defining where short term pullbacks are dynamically supported, it now is likely to act as dynamic resistance

Candles are predominantly black, Monday’s candle in particular is a convincing display of control by the supply-side

15862 is the next point of demand. If it goes, watch out for demand-side candles at 15451.

Really, anything above 16046 is going to be a wall of supply.

White candles and or downward pointing shadows will stop the short term bloodshed, whereas black candles will perpetuate it.

Sandfire Resources (ASX: SFR)

.png)

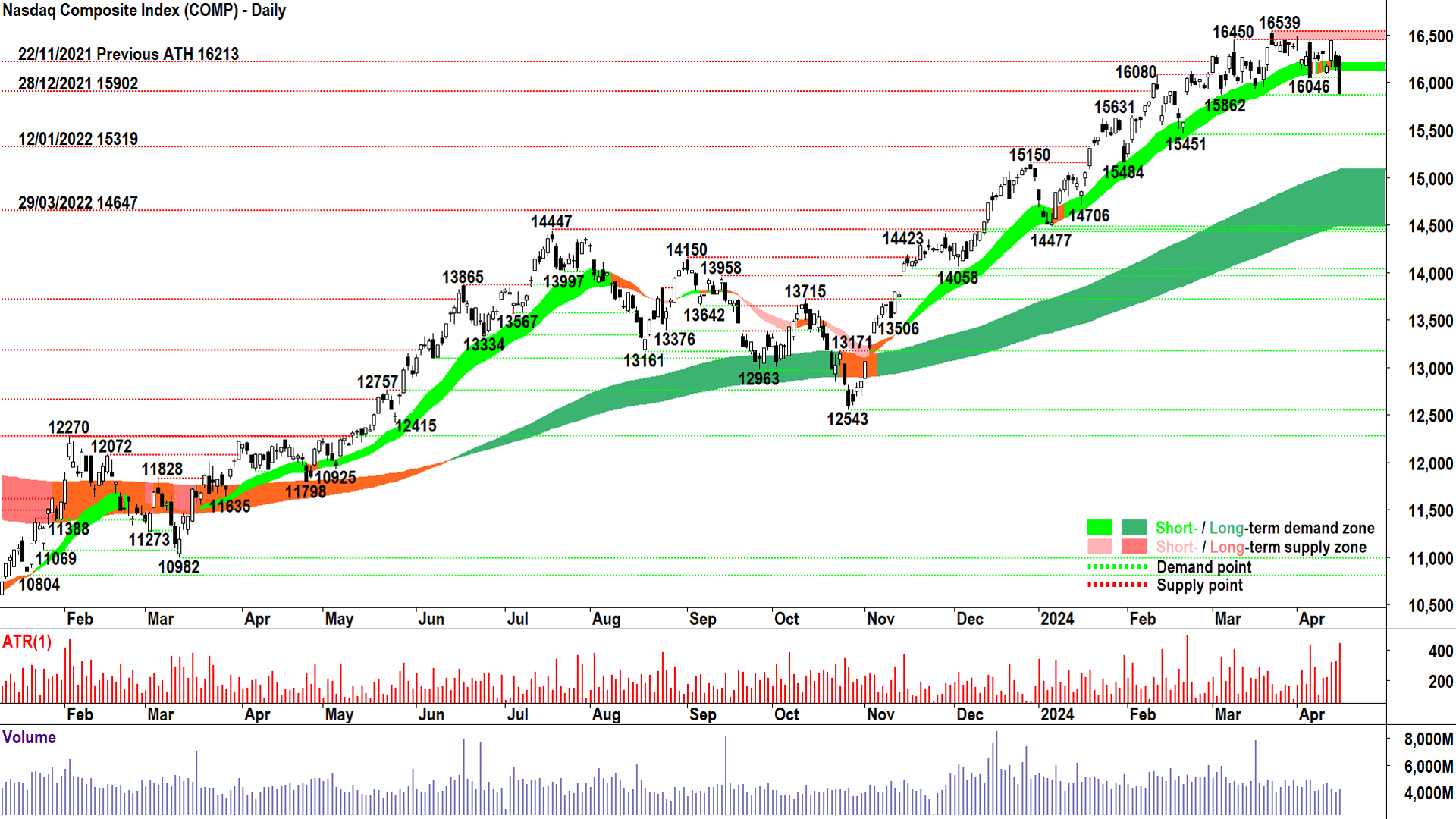

Sandfire deserves a special mention today. A 1.1% gain would be good on any day. It’s absolutely brilliant today.

The pillars of my technical analysis strategy are Trend, Price Action, Candles, Volume and Volatility. Each is discernible from a stock’s chart. The final pillar, Relative Strength Comparative (RSC), considers factors external to the stock’s chart. This is a key advantage of this indicator – it takes into account independent data.

RSC compares the performance of a stock with another security, generally an index relevant to the stock. It’s common to compare a stock’s performance with the performance of the relevant benchmark index. For Sandfire and other ASX stocks, I like to compare their performance to the S&P/ASX 200.

I use a proprietary RSC indicator – you won’t find it in any of your technical analysis platforms. Also, please don’t confuse it with the Relative Strength Index (RSI) – it’s not even close conceptually, and my research suggests the RSI has little value as a technical indicator – but that’s a story for another day.

Basically, when the RSC (which is the bottom-most indicator in the Sandfire chart above) is green and rising, the stock in question is outperforming the benchmark index. This means that it’s better on up days, and like today, its better when most stocks are getting belted. When this occurs, I like to say, “It’s in the basket”.

This means it’s in a basket of securities which are going to be bought by active fund managers (not the tag along with the index passive fund managers) no matter what.

Other than excellent RSC, the Sandfire chart has several other key indicators of strong demand-side control: Short and long term uptrends, higher peaks and troughs (on a closing basis), and predominantly demand-side candles.

8.61 is the nearest point of demand, the short term uptrend remains intact as long as the price continues to close above this level. 9.28 is the nearest point of supply, above there it’s all blue sky.

Economy

Today

-

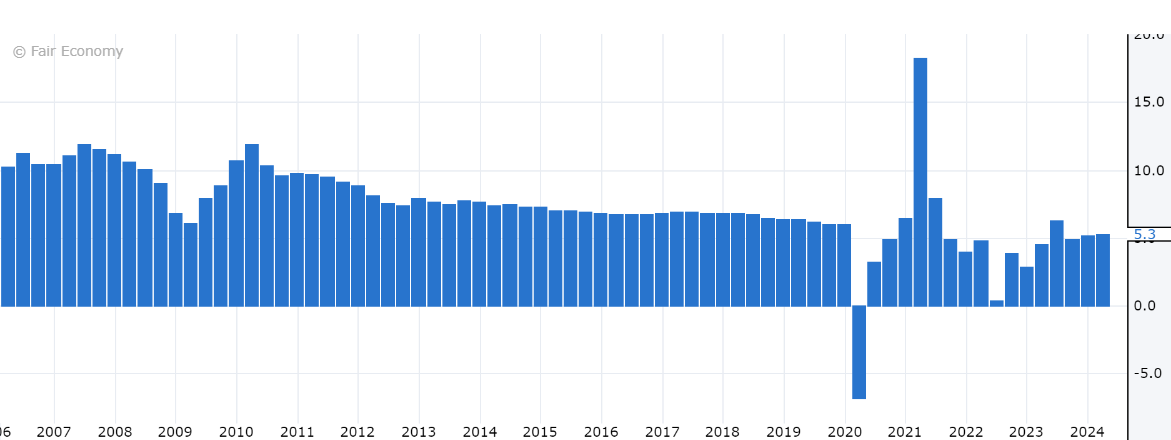

China "Data Dump"

New Home Prices monthly change -0.34% in March and -2.2% p.a. (vs -0.36% February and -1.4% p.a.)

Industrial Production +4.5% p.a. in March (vs +6% p.a. forecast vs +7% p.a. February)

GDP +5.3% p.a. in the first quarter (+4.8% p.a. forecast vs +5.2% p.a. December quarter)

Retail Sales +3.1% p.a. in March (vs +5.1% p.a. forecast vs +5.5% p.a. February)

Fixed Asset Investment +4.5% p.a. in March (+4% p.a. forecast vs +4.2% p.a. previous)

Unemployment Rate 5.2% in March (+5.2% forecast vs +5.3% February)

Later this week

Tuesday

22:30 USA Building Permits & Housing Starts

23:00 USA Industrial Production

Wednesday

03:15 USA Federal Reserve Chairman Jerome Powell speaks

Thursday

11:30 AUS Employment Change (+7,200 forecast vs +116,500 previous)

11:30 AUS Unemployment rate (3.9% forecast vs 3.7% previous)

Friday

00:00 USA Existing Home Sales

Latest News

Russia metals sanctions on aluminium, copper, and nickel: Which ASX miners stand to benefit?

Insider Trades: Directors bought and sold shares in these 12 ASX companies

Short Selling: Flight Centre and Elders shorts rise, Develop Global shorters exit

Is the Mid-East conflict a lightning rod for another surge in crude oil prices?

Interesting Movers

Trading higher

+8.7% Spartan Resources (SPR) - New High-Grade Discovery - Pepper Prospect, rise is consistent with prevailing short and long term uptrends 🔎📈

+3.2% WA1 Resources (WA1) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+2.8% RPM Global Holdings (RUL) - No news, regular buyback likely having an impact, rise is consistent with prevailing long term uptrend, closed back above short term trend ribbon 🔎📈

+2.1% Integral Diagnostics (IDX) - No news, strong chart here, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up🔎💹

+2.1% BWP Trust (BWP) - No news, we're in trouble if BWP has made the interesting gainers list!!! 🤯

+1.9% Genex Power (GNX) - No news, takeover gyrations around bid price…oops…not looking good today…

+1.1% Sandfire Resources (SFR) - High grade copper prices up on Monday on Russia sanctions, rise is consistent with prevailing short and long term uptrends 🔎📈

+1.0% Yancoal Australia (YAL) - Thermal and metallurgical coal prices rallied Monday, rise is consistent with prevailing long term uptrend, short term trend is transitioning from down to up 🔎📈

Trading lower

-22.8% Piedmont Lithium Inc (PLL) - Annual Report - ASX Additional Information

-14.4% The Star Entertainment Group (SGR) - Continued negative response to yesterday's NSW Inquiry - Commencement of hearings, fall is consistent with prevailing short and long term downtrends 🔎📉

-12.2% Resolute Mining (RSG) - No news 🤔

-11.4% Vulcan Energy Resources (VUL) - No news 🤔

-10.9% Zip Co (ZIP) - 3Q FY24 results update, fall is consistent with falling peaks and falling troughs, closed below short term uptrend ribbon 🔎📉

-10.9% Ioneer (INR) - No news 🤔

-9.7% Core Lithium (CXO) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-9.3% Bannerman Energy (BMN) - No news 🤔

-8.8% Imugene (IMU) - Imugene and Kincell Bio Announce Strategic Partnership, fall is consistent with prevailing short and long term downtrends 🔎📉

-8.3% Deep Yellow (DYL) - No news 🤔

-7.9% Sayona Mining (SYA) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

Broker Notes

Life360 (360) - Retained at buy at Bell Potter; Price Target: $16.25

ANZ Group (ANZ) - Retained at underperform at Macquarie; Price Target: $27.00

Arena REIT/Units (ARF) - Retained at equal-weight at Morgan Stanley; Price Target: $4.04 from $3.80

Antipa Minerals (AZY) - Retained at buy at Shaw and Partners; Price Target: $0.04

Black Cat Syndicate (BC8) - Retained at buy at Shaw and Partners; Price Target: $0.74

Bendigo and Adelaide Bank (BEN) - Retained at underperform at Macquarie; Price Target: $8.50

Bannerman Energy (BMN) - Retained at buy at Shaw and Partners; Price Target: $7.40 from $7.04

-

Bank of Queensland (BOQ)

Retained at sell at Citi; Price Target: $5.05

Retained at underperform at Macquarie; Price Target: $4.75

-

Bluescope Steel (BSL)

Retained at neutral at Citi; Price Target: $24.50 from $22.30

Retained at outperform at Macquarie; Price Target: $29.45 from $25.00

Commonwealth Bank of Australia (CBA) - Retained at underperform at Macquarie; Price Target: $95.00

-

Charter Hall Group (CHC)

Downgraded to underweight from buy at Bank of America; Price Target: $11.50 from $13.40

Retained at overweight at Morgan Stanley; Price Target: $14.99 from $13.35

Centuria Industrial REIT (CIP) - Retained at equal-weight at Morgan Stanley; Price Target: $3.81 from $3.50

Charter Hall Long Wale REIT (CLW) - Retained at equal-weight at Morgan Stanley; Price Target: $4.08 from $3.96

Centuria Capital Group (CNI) - Retained at overweight at Morgan Stanley; Price Target: $2.03 from $1.95

Centuria Office REIT (COF) - Retained at underweight at Morgan Stanley; Price Target: $1.40 from $1.26

Charter Hall Retail REIT (CQR) - Retained at equal-weight at Morgan Stanley; Price Target: $3.93 from $3.83

Cettire (CTT) - Upgraded to buy from hold at Bell Potter; Price Target: $4.00 from $4.50

Domino's Pizza Enterprises (DMP) - Retained at neutral at UBS; Price Target: $40.00 from $42.00

Droneshield (DRO) - Downgraded to hold from buy at Bell Potter; Price Target: $1.00 from $0.90

Data#3 (DTL) - Downgraded to overweight from buy at Jarden; Price Target: $8.65 from $9.15

Dexus (DXS) - Retained at underweight at Morgan Stanley; Price Target: $8.14 from $7.75

Goodman Group (GMG) - Retained at overweight at Morgan Stanley; Price Target: $34.33 from $34.00

GPT Group (GPT) - Retained at equal-weight at Morgan Stanley; Price Target: $4.70 from $4.50

Healthco Healthcare and Wellness REIT (HCW) - Retained at equal-weight at Morgan Stanley; Price Target: $1.41 from $1.65

Homeco Daily Needs REIT (HDN) - Retained at equal-weight at Morgan Stanley; Price Target: $1.39 from $1.35

HMC Capital (HMC) - Retained at equal-weight at Morgan Stanley; Price Target: $6.81 from $6.60

Impedimed (IPD) - Initiated at buy at Ord Minnett; Price Target: $0.16

Judo Capital Holdings (JDO) - Retained at underperform at Macquarie; Price Target: $1.00

Lendlease Group (LLC) - Retained at equal-weight at Morgan Stanley; Price Target: $7.25 from $7.30

Mirvac Group (MGR) - Retained at equal-weight at Morgan Stanley; Price Target: $2.41 from $2.30

Macquarie Group (MQG) - Retained at overweight at Morgan Stanley; Price Target: $225.00

National Australia Bank (NAB) - Retained at underperform at Macquarie; Price Target: $32.50

National Storage REIT (NSR) - Retained at underweight at Morgan Stanley; Price Target: $2.35 from $2.30

Region Group (RGN) - Retained at equal-weight at Morgan Stanley; Price Target: $2.44 from $2.35

Scentre Group (SCG) - Retained at overweight at Morgan Stanley; Price Target: $3.79 from $3.46

Stockland Group (SGP) - Retained at overweight at Morgan Stanley; Price Target: $5.30 from $5.10

Smart Parking (SPZ) - Retained at buy at Shaw and Partners; Price Target: $0.70

Southern Cross Gold (SXG) - Initiated at buy at Shaw and Partners; Price Target: $2.61

Talga Group (TLG) - Retained at buy at Bell Potter; Price Target: $2.35 from $2.50

Vicinity Centres (VCX) - Retained at underweight at Morgan Stanley; Price Target: $2.17 from $2.01

Westpac Banking Corporation (WBC) - Retained at underperform at Macquarie

Waypoint REIT (WPR) - Retained at underweight at Morgan Stanley; Price Target: $2.56 from $2.50

Wisetech Global (WTC) - Upgraded to positive from neutral at E&P; Price Target: $104.01 from $85.49

Xero (XRO) - Retained at buy at UBS; Price Target: $141.90 from $139.10

Scans

This article first appeared on Market Index on Tuesday 16 April 2024.

5 topics

11 stocks mentioned