ASX 200 stumbles again as weaker China data, US rate concerns hurt resources stocks

Today in Review

Markets

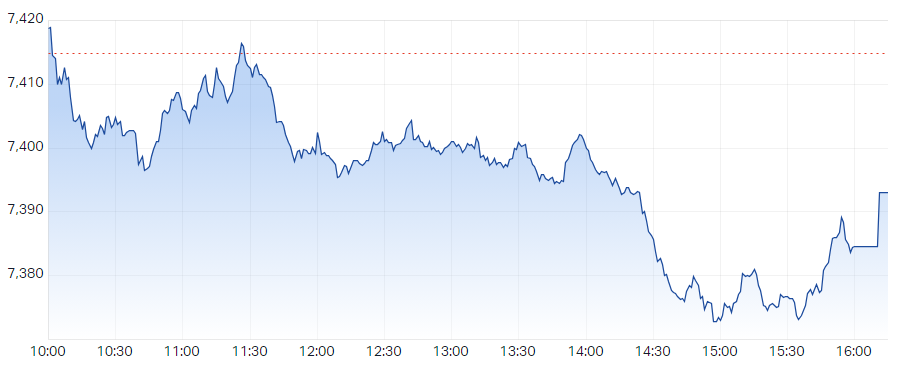

ASX 200 Session Chart

%20Intraday%20Chart%2017%20Jan%202024.png)

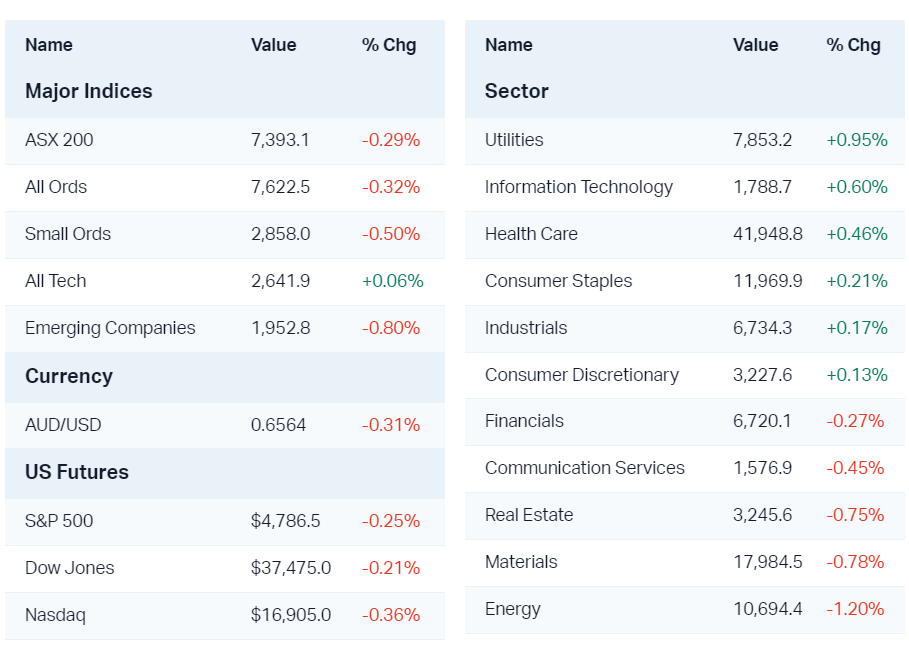

The S&P/ASX200 (XJO) finished 21.7 points lower at 7,393.1, pretty much in the middle of its tight 46 point trading range. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by 101 to 174.

Information Technology (XIJ) +0.6% and Health Care (XHJ) +0.5% were the next best performers, both enjoying modest but broad-based moves within their respective sectors. A little odd, as tech is usually considered risk-on, while healthcare is considered risk-off.

Check the Economy section below on the particulars of the data dump, but it's worth noting today's numbers only really confirm something we've known for a long time. The Chinese economy is slowing, and it's being hobbled by an unfolding meltdown in the Chinese property sector. If you want too see what this meltdown looks like, check out this article I wrote earlier today.

Ordinarily I'd say it's unusual to see such a dramatic reversal in fortunes from what appeared to be such a promising run to the end of December. But, looking at this chart, the XMJ seems to do it more often than not! Welcome to the world of commodities investing, particularly in an environment which has been uncertain as the last 18-months or so.

Failing this, there's still a key demand point or two not too far below the long term trend ribbon, particularly from the 28 November low of 17678. Beneath there, it could be a slippery slope, with demand points between 17032-17126 and then 16687 ultimate potential downside targets. Let's hope not.

Economy

China "Data Dump"

- Industrial Production: +6.8% p.a., better than expected (+6.6% p.a. consensus forecast and +6.6% p.a. previous).

- Quarterly GDP: 5.2% p.a., worse than expected (+5.3% p.a. consensus forecast and +4.9% p.a. previous). Weakness in the property sector offset by stronger manufacturing sector.

- New home prices: -0.45% in December, worse than -0.37% in November. 62 out of 70 cities reported falls.

- Retail sales: +7.4% p.a., worse than expected (8% p.a. and 10.1% p.a., previous).

- Fixed asset investment: 3% p.a., better than expected (+2.9% p.a. consensus forecast and +2.9% p.a. previous)

- Unemployment rate: 5.1%, worse than expected (5.0% consensus forecast and 5.0% previous) (Note: youth unemployment is 14.9%)

- NBS Press Conference: Economic growth in 2023 was "hard won". Insufficient demand due to an soft price growth means China's economy faces a complex set of challenges in 2024, but NBS expects economy will continue to recover.

What to watch out for...

Tonight:

- From 12:30am: US Retail Sales for December; Forecast to rise +0.2% vs +0.2% in November

Later this week:

- Thurs from 12:30am: US retail sales; from 11:30am Australian employment change and unemployment rate

Latest News

14 stocks to help you sleep at night

Insider Trades: Directors are buying shares in these 11 ASX companies

China’s stocks and property sector are tanking, how you can play along at home!

Evolution Mining shares nosedive 19% as quarterly results disappoint

12 things investors could get wrong in 2024

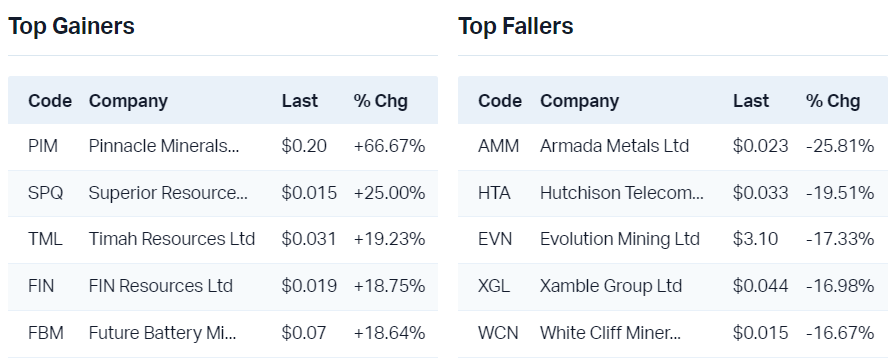

Interesting Movers

Trading higher

- +5.5% The A2 Milk Company (A2M) - No news 🤔

- +5.1% Data#3 (DTL) - No news since 16-Jan DTL to report strong 1H FY24 earnings growth, various broker moves today (see below)

- +4.5% Bannerman Energy (BMN) - Uranium prices up again overnight, continued rally in line with short and long term uptrends

- +4.0% Telix Pharmaceuticals (TLX) - No news, rally is consistent with prevailing short and long term uptrends

- +3.9% Deterra Royalties (DRR) - No news, rally off long term uptrend ribbon

- +3.7% K&S Corporation (KSC) - No news, rally is consistent with prevailing short and long term uptrends

- +3.2% Bega Cheese (BGA) - No news, resumption of short term uptrend, bouncing off short term uptrend ribbon, long term trend turning up

- +3.1% Tuas (TUA) - No news, bounce after recent correction

- +2.9% KMD Brands (KMD) - No news, bounce in some consumer discretionary stocks

- +2.9% Michael Hill International (MHJ) - No news, bounce in some consumer discretionary stocks

- +2.8% Cettire (CTT) - No news, bounce in some consumer discretionary stocks

- +2.7% Smartpay Holdings (SMP) - No news, rally is consistent with prevailing short and long term uptrends

- +2.6% Deep Yellow (DYL) - Uranium prices up again overnight, continued rally in line with short and long term uptrends

Trading lower

- -17.3% Evolution Mining (EVN) - December 2023 Quarterly Report

- -7.5% Piedmont Lithium Inc (PLL) - No news, drop is consistent with prevailing short and long term downtrends

- -6.5% Develop Global (DVP) - No news, drop is consistent with prevailing short and long term downtrends

- -6.3% Bapcor (BAP) - Resignation of Chief Financial Officer, drop is consistent with prevailing short and long term downtrends

- -5.7% Calix (CXL) - Calix announces change of auditor, drop is consistent with prevailing short and long term downtrends

- -5.1% Newmont Corporation (NEM) - Fall in the gold price, drop is consistent with prevailing short term trend

Broker Notes

- AMP (AMP) retained at sell UBS; Price Target: $0.85 from $0.82

- Aurizon Holdings (AZJ) downgraded to neutral from outperform at Macquarie; Price Target: $2.88 from $4.04

- BHP Group (BHP) retained at hold Ord Minnett; Price Target: $43.00 from $41.00

- Coventry Group (CYG) retained at buy Bell Potter; Price Target: $1.80 from $1.45

- Domino's Pizza Enterprises (DMP) retained at buy Citi; Price Target: $61.10

- Droneshield (DRO) retained at buy Bell Potter; Price Target: $0.50

- Deterra Royalties (DRR) retained at hold Ord Minnett; Price Target: $4.40 from $4.20

-

Data#3 (DTL)

- Downgraded to neutral from overweight at JPMorgan; Price Target: $8.80

- Retained at overweight Morgan Stanley; Price Target: $8.20

- Retained at buy UBS; Price Target: $8.20

- Fortescue (FMG) retained at lighten Ord Minnett; Price Target: $17.30 from $16.00

-

HUB24 (HUB)

- Downgraded to neutral from overweight at Barrenjoey; Price Target: $35.40

- Retained at neutral Macquarie; Price Target: $34.10

- Retained at overweight Morgan Stanley; Price Target: $41.00

- Retained at buy Ord Minnett; Price Target: $39.00

- Retained at neutral UBS; Price Target: $37.50

-

Insignia Financial (IFL)

- Downgraded to sell from neutral at UBS; Price Target: $2.05

- Downgraded to sell from neutral at UBS; Price Target: $2.05

- Iluka Resources (ILU) retained at accumulate Ord Minnett; Price Target: $9.50 from $10.50

- National Australia Bank (NAB) upgraded to equalweight from underweight at Morgan Stanley; Price Target: $30.30 from $27.40

- Newmont Corporation (NEM) retained at buy Ord Minnett; Price Target: $81.00 from $82.00

- New Hope Corporation (NHC) retained at hold Ord Minnett; Price Target: $5.70 from $6.10

-

Netwealth Group (NWL)

- Upgraded to neutral from sell at Citi; Price Target: $16.10

- Retained at buy UBS; Price Target: $18.40

- PSC Insurance Group (PSI) initiated neutral at Jarden; Price Target: $4.80

-

Rio Tinto (RIO)

- Retained at buy Citi; Price Target: $139.00

- Retained at neutral Macquarie; Price Target: $120.00

- Retained at overweight Morgan Stanley; Price Target: $145.00

- Retained at hold Ord Minnett; Price Target: $116.00

- Retained at neutral UBS; Price Target: $130.00

- Resmed Inc (RMD) retained at buy Citi; Price Target: $29.00

- South32 (S32) retained at hold Ord Minnett; Price Target: $3.80 from $3.90

- SEEK (SEK) downgraded to neutral from outperform at Macquarie; Price Target: $26.00 from $29.00

- Treasury Wine Estates (TWE) retained at neutral Citi; Price Target: $11.00 from $11.80

- Westpac Banking Corporation Ordinary (WBC) downgraded to underweight from equalweight at Morgan Stanley; Price Target: $21.70 from $20.90

Scans

This wrap originally appeared on Market Index on 17 January 2024.

4 topics

8 stocks mentioned