ASX 200 to bounce, S&P 500 flat, Treasurer approves ANZ-Suncorp deal

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 26 points higher, up 0.33% as of 8:30 am AEST.

S&P 500 SESSION CHART

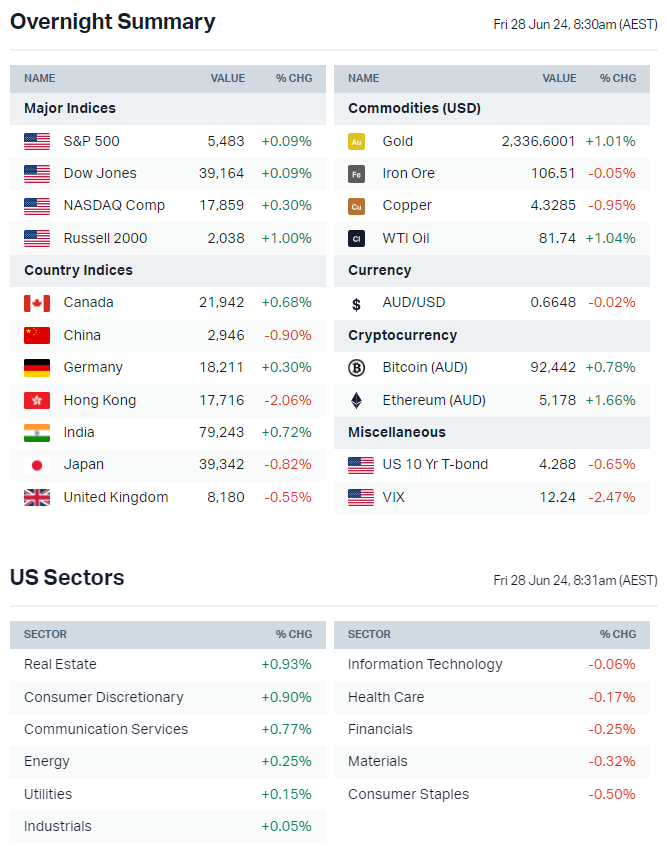

OVERNIGHT MARKETS

- Major US benchmarks ticked higher in relatively choppy trade

- Magnificent 7 names were mostly higher but Nvidia (-1.9%) pulled back

- US bond yields lower, with the 2-year down 4 bps and not far off a 3-month low

- Bond yield backup reflecting weaker-than-expected economic data from the US and China, cautious consumer readthrough from company earnings

- Amazon hits US$2tn market cap amid AI enthusiasm and announces a new direct-from-China discount section (FT)

- Yen remains at mercy of Fed's higher-for-longer stance (Bloomberg)

- Global M&A deals hit US$1.5tn in the first half of 2024 on a surge of US takeover activity (FT)

- IPOs have had best start to the year since 2021 with more than US$20bn raised so far (Bloomberg)

STOCKS

- Big US banks pass Fed's stress test, paving way for shareholder payouts (Bloomberg)

- Micron's Q3 results largely in-line but outlook comes in below consensus due to production ramp issues, AI takeaways were positive (Bloomberg)

- Levi Strauss shares slumps after quarterly sales miss consensus (Reuters)

CENTRAL BANKS

- Fed's Bowman reiterates she still does not see interest rate cuts this year (Reuters)

- Japan inflation expectations near decade high, backing case for rate hike (Bloomberg)

- ECB's Lane says ready to respond to any surprises as it decides on its next policy steps amid uncertainty (Bloomberg)

- Riksbank keeps rates at 3.75% as expected, signaling a cautious yet optimistic approach to monetary policy (Bloomberg)

GEOPOLITICS

- White House and Israel resolved some of the problems that have slowed down US weapons shipments (Axios)

- China hopes negotiations with EU over tariffs on Chinese EVs succeed (Reuters)

ECONOMY

- US capital goods orders unexpectedly fell in May, suggesting that business spending on equipment weakened for the month (Reuters)

- China's manufacturing activity to contract for second month in June (Reuters)

US-listed sector ETFs by iShares, Global X and VanEck (Source: Market Index)

ASX TODAY

- ASX 200 set to rise after a strong reversal on Thursday, where the index finished 0.3% lower, up from session lows of -1.65%

- 5G Networks sells primary businesses to managing director for $3.2m, proposes 15 cent distribution before delisting in 2025 (5GN)

- Andrew Forrest seeking seat on Austal board – his private investment vehicle Tattarang has a 19.6% stake in the company (The Aus)

- Casino regulators clear way for Bruce Mathieson to buy up more of Star (AFR)

- De Grey Mining flagged as a potential takeover target, sources say that Agnico Eagle is gathering information (The Aus)

- Insurance Australia on track to deliver FY24 Insurance Profit and Margin around the upper end of guidance ranges, GWP growth to be consistent with the 'low-double digit' guidance (IAG)

- Newmont's Akyem gold worth close to $1bn, Chinese suitors considered frontrunners but Perseus not out of the picture (The Aus)

- Federal Treasurer approves of ANZ acquisition of Suncorp Bank (SUN)

- Ventia Services awarded 5-year Homes NSW contract valued at $570m (VNT)

BROKER MOVES

- Arcadium Lithium initiated Neutral with $6.50 target (Goldman Sachs)

- Charter Hall Group downgraded to Underperform from Outperform; target cut to $11.51 from $13.74 (CLSA)

- Emeco Holdings initiated buy with $1.10 target (Argonaut)

- Macmahon Holdings downgraded to Hold from Buy; target remains $0.30 (Argonaut)

- PWR Holdings upgraded to Positive from Neutral; target remains $13 (E&P)

- Universal Store upgraded to Buy from Neutral; but target cut to $6 from $6.25 (UBS)

KEY EVENTS

Companies trading ex-dividend:

-

Fri 28 June: Abacus Group (ABG) – $0.043, Ophir High Conviction Fund (OPH) – $0.06, Danakali (DNK) – $0.009, Abacus Storage King (ASK) – $0.03

- Fri 28 June: 38 ETFs and funds are also trading ex-dividend. See a full list here

- Mon 1 July: 210 ETFs are trading ex-dividend and funds

- Tue 2 July: None

- Wed 3 July: None

- Thu 4 July: Clime Capital (CAM) – $0.014

Other ASX corporate actions today:

- Dividends paid: None

- Listing: Alfabs Australia (AAL) at 11:00 am

- Earnings: None

- AGMs: None

Economic calendar (AEST):

- 11:30 am Australia Housing Credit (May)

- 4:45 pm: France Inflation (Jun)

- 10:30 pm: Canada GDP (May)

- 10:30 pm: US Core PCE Price Index (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment