ASX 200 to fall ahead of May inflation data, S&P 500 and Nasdaq snap 3-day decline

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 29 points lower, down 0.37% as of 8:30 am AEST.

S&P 500 SESSION CHART

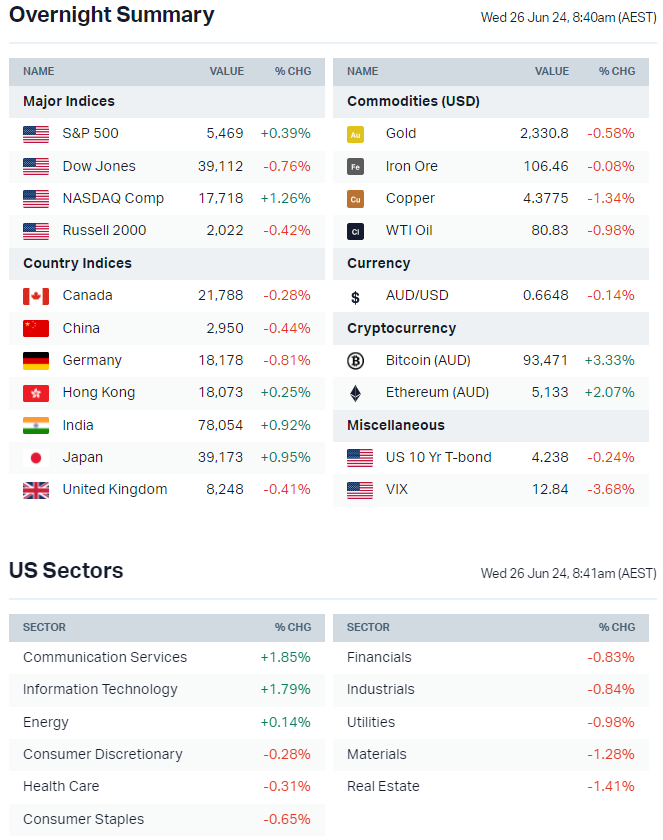

OVERNIGHT MARKETS

- Major US benchmarks finished mixed and a complete opposite of yesterday’s session

- S&P 500 and Nasdaq snapped a three-day losing streak, while the Equal-Weight S&P 500 underperformed the official index by more than 100 bps

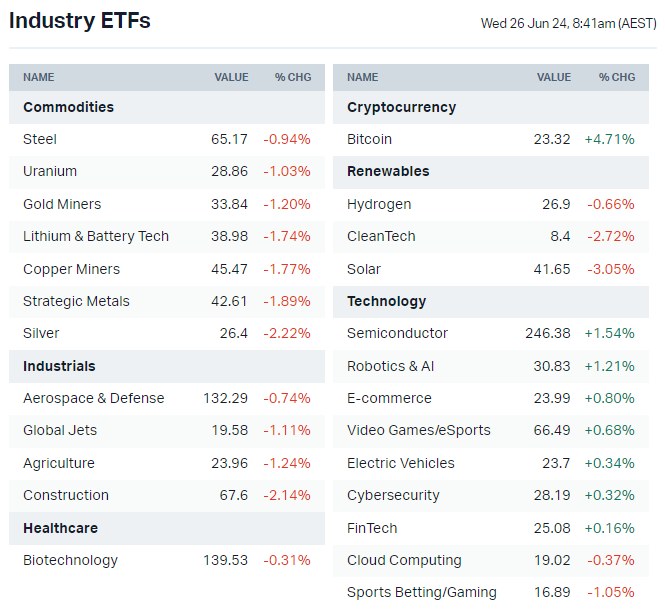

- Value and cyclicals led to the downside, notably Real Estate, Materials and Utilities

- Nvidia (+6.7%) bounced after falling as much as 16% from its highs last Thursday, erasing almost US$450bn in market cap

- Relatively uneventful session in terms of catalysts, the overnight strength being driven more by technical factors than by fundamental ones

- Yen might fall to 38-year low as intervention warnings fail to resonate (Bloomberg)

- JPMorgan strategists say bond market liquidity continues to improve (Bloomberg)

STOCKS

- Rivian shares surge 30% after hours following US$5bn investment from Volkswagen to develop next gen EVs (Forbes)

- FedEx surges after-hours as 2025 outlook beats estimates on cost cuts (Yahoo)

- Google developing challenger to Meta's chatbots (The Information)

- Banks discreetly dump CRE loans amid worries about further losses (NY Times)

- Nike bets on China comeback with $1,000 Jordan high top sneakers (Bloomberg)

- Novo Nordisk to spend US$4.1bn to boost US manufacturing (Reuters)

- Carnival raises full-year outlook amid strong demand (Bloomberg)

- Walmart CFO says Q2 will be the most challenging quarter from a comp perspective (Transcript)

CENTRAL BANKS

- BOJ opens door for double hawkish surprise with bigger QT and rate hike (Reuters)

- ECB's Schnabel downplays likelihood of ECB-Fed policy divergence (Bloomberg)

GEOPOLITICS

- Trump plans to halt US military aid to Kyiv unless it talks peace with Moscow (Reuters)

- US warned Hezbollah that it can't hold Israel back if escalation continues (Axios)

- Washington probes China Telecom and China Mobile over internet risks (Reuters)

- France's Macron warns of civil war risk in snap elections as Le Pen advances in polls (Bloomberg)

ECONOMY

- Canada inflation unexpectedly jumps to 2.9% in May from 2.7% expected and above 2.6% consensus, market trims July rate cut bets (Reuters)

- Global supply chains under pressure as Houthis step up strikes on vessels (NY Times)

ASX TODAY

- ASX 200 to fall following a weak overnight lead for ex-growth sectors and continued weakness across key commodities including copper and gold

- Aristocrat Leisure issues investor day presentation, targets at least $1bn in FY29 revenue from Interactive business, representing five-year CAGR of more than 20% (ALL)

- Qualitas secures first commitment from North American-based global institutional investor, with $550m to be invested in CRE private credit (QAL)

- Renesas receives Australia's FIRB approval for acquisition of Altium (ALU)

- Star Entertainment appoints Steve McCann as Chief Executive, McCann was formerly the CEO of Crown Resorts and prior to that served as Lendlease CEO (SGR)

- Virgin Australia seeking to go public by Christmas (The Aus)

BROKER MOVES

- Bellevue Gold initiated Buy with $2.20 target (Goldman Sachs)

- Healius downgraded to Underperform from Neutral; target cut to $1.30 from $1.50 (BofA)

- Monadelphous Group initiated Hold with $14.40 target (Morgans)

- ResMed downgraded to Perform from Outperform (Oppenheimer)

- Spark New Zealand upgraded to Overweight from Neutral; target cut to NZ$4.67 from NZ$5.03 (Jarden)

- Super Retail Group upgraded to Buy from Neutral; target up to $15 from $13 (UBS)

KEY EVENTS

Companies trading ex-dividend:

- Wed 26 June: Fisher & Paykel (FPH) – $0.218, Duxton Farms (DBF) – $0.10

- Thu 27 June – REITs: HealthCo Healthcare and Wellness REIT (HCW) – $0.002, Centuria Industrial REIT (CIP) – $0.04, Centuria Office REIT (COF) – $0.03, Homeco Daily Needs REIT (HDN) – $0.021, Arena REIT (ARF) – $0.043, Charter Hall Long Wale REIT (CLW) – $0.065, Garda Property Group (GDF) – $0.016, Hotel Property Investments (HPI) – $0.095, Charter Hall (CHC) – $0.23, Charter Hall Social Infrastructure REIT (CQE) – $0.04, Waypoint REIT (WPR) – $0.041, GDI Property Group (GDI) – $0.025, National Storage (NSR) – $0.055, Goodman Group (GMG) – $0.15, Stockland (SGP) – $0.166, Growthpoint Properties (GOZ) – $0.097, Dexus Convenience Retail REIT (DXC) – $0.053, Dexus Industria REIT (DXI) – $0.041, Dexus (DXS) – $0.213

- Thu 27 June – Everything else: Rural Funds Group (RFF) – $0.029, Virgin Money (VUK) – $0.039, Mirvac Group (MGR) – $0.06, Region Group (RGN) – $0.07

- Fri 28 June: Abacus Group (ABG) – $0.043, Ophir High Conviction Fund (OPH) – $0.06, Danakali (DNK) – $0.009, Abacus Storage King (ASK) – $0.03

Other ASX corporate actions today:

- Dividends paid: Elders (ELD) – $0.18

- Listing: Piche Resources at 12:00 pm

- Earnings:None

- AGMs: None

Economic calendar (AEST):

- 11:30 am: Australia Monthly CPI (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment