ASX 200 to fall, Dow Jones breaches 40,000 level for first time, Walmart at all-time highs

ASX 200 futures are down 44 points to 7,875 as of 8am AEST.

Some of yesterday's post-inflation and retail sales rally was given back today but not before the Dow Jones hit 40,000 points for the first time in intra-day trading. Consumer giant Walmart upped its earnings outlook despite admitting that spending momentum started to slow in April.

It's expected to be a muted day locally given there are no major corporate and economic items previewed for today.

Let's dive in.

S&P 500 SESSION CHART

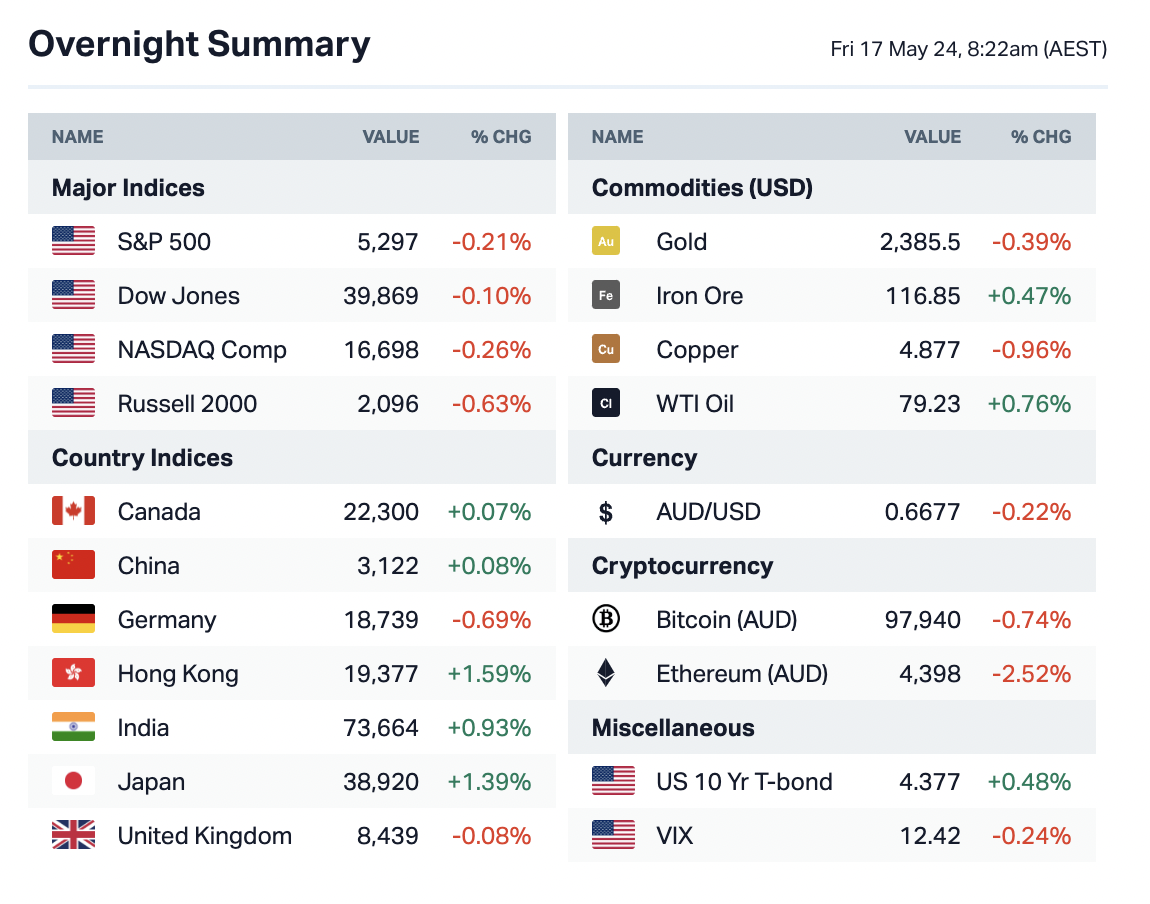

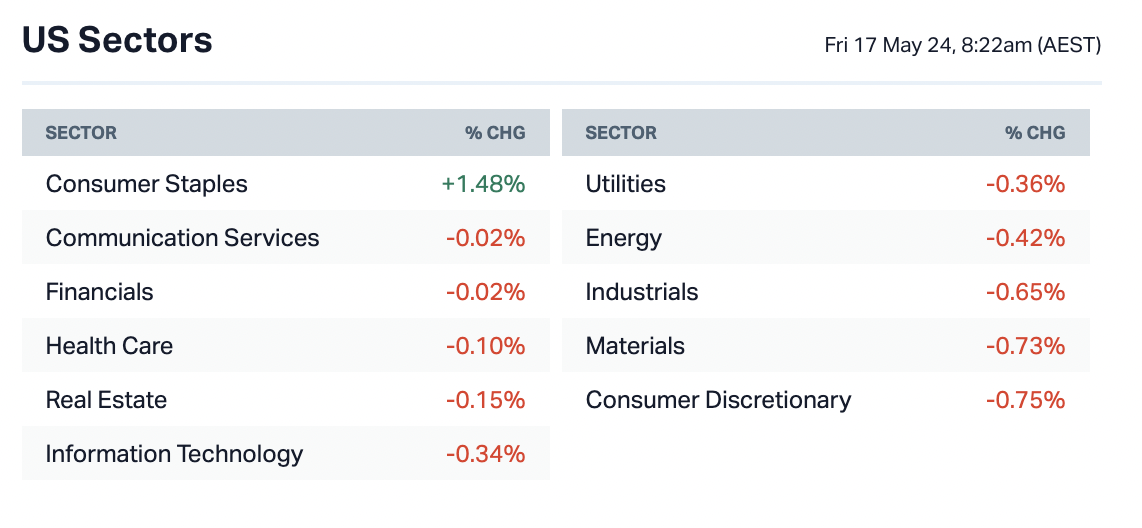

OVERNIGHT MARKETS

- Dow closes lower Thursday after briefly topping 40,000 for first time

- Europe stocks close lower as earnings dampen rally following soft U.S. inflation data; BT up 17%

- Treasury yields move higher as investors digest inflation data

- Oil prices rise as crude inventories fall and U.S. inflation eases

- Gold eases as dollar gains, Fed rate cut bets lend support

- Gold, silver and platinum’s red-hot rally still has further to go, strategists say

Author's Note: The strategists in question work at Saxo Bank. They have predicted that gold prices could soon test the $2,400 level, silver may climb as high as $30 per ounce, while platinum has upside potential to reach $1,130 per ounce. If you want to read some background on those calls, you can find that here and here.

INTERNATIONAL STOCKS

- Walmart surges to all-time high as earnings beat on high-income shopper, e-commerce gains

- FDA approves Amgen’s treatment for most deadly form of lung cancer

- Cisco gives upbeat sales and profit guidance following rebound in orders

- Berkshire Hathaway unveils $6.7B stake in insurer Chubb, ending months of speculation

- Deutsche Bank dials back expectations for second share buyback this year

- Disney says it is dramatically cutting investments in traditional TV

CENTRAL BANKS

- Chicago Fed's Goolsbee wants to see more progress on disinflation

- Minneapolis Fed's Kashkari says Fed should hold rates for a while longer

- ECB highlights financial stability risks on high debt levels, low productivity and geopolitics

ECONOMY

- U.S. data fuels bets of Fed rate cuts as early as September — but analysts aren’t convinced

- China activity data seen broadly improving, buoying outlook for recovery as policymakers ramped up support

- Japan's economy shrunk by more than expected, raising spectre of stagflation

- Surprise jump in Australian unemployment rate

Key Events

Economic calendar (AEST):

11:30am – CNY – New home prices

12:00pm – CNY – Industrial production, retail sales, fixed asset investment, unemployment rate

7:00pm – EUR – Final core CPI

This Morning Wrap was written by Hans Lee and Chris Conway.

2 topics