ASX 200 to fall, Dow marks worst day since March, hedge funds boost bearish bets

ASX 200 futures are trading 24 points lower, down -0.34% as of 8:20 am AEST.

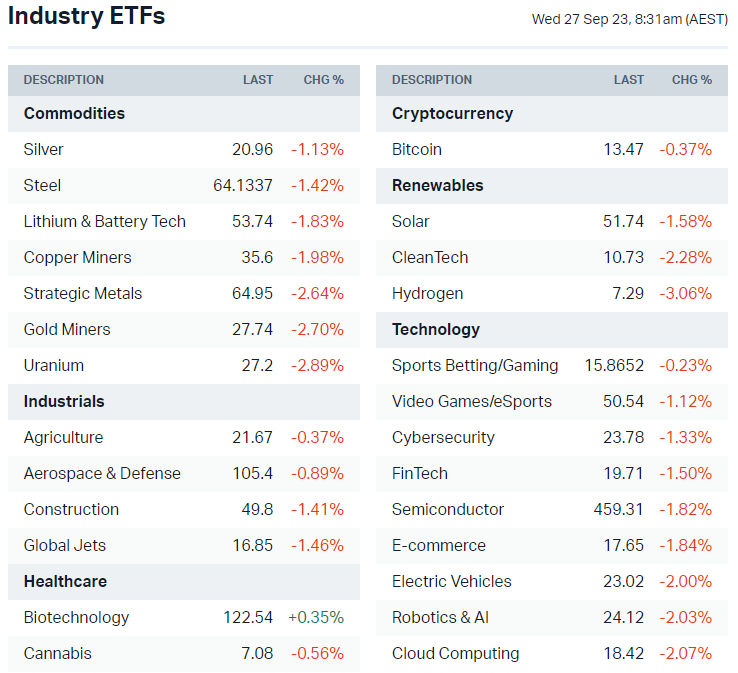

S&P 500 SESSION CHART

MARKETS

- S&P 500 finished lower, ending near worst levels and reversed Tuesday’s gains

- Dow closed below its 200-day moving average for the first time since May

- All US sectors red, led by Utilities while big tech was a notable drag on benchmarks

- US 10-year yield relatively unchanged at 4.55%, the highest since October 2007

- Markets struggled to shake the risk-off tone, weighed by higher-for-longer Fed, pickup in consumer headwinds, seasonality (16-26 September has historically been the worst 10-day return for the S&P 500), stronger US dollar and looming government shutdown

- Long-dated Treasury ETF plunges record 48% as market meltdown worsens (Bloomberg)

- Hedge funds boost bearish bets on US equities amid market jitters (Reuters)

- Government shutdown just days away, no agreement is in sight (Washington Post)

STOCKS

- Chevron readies new oil drilling push in Venezuela to boost output (Reuters)

- UPS to hire 100,000 holiday workers, pay raise to $23 per hour (CNBC)

- Volkswagen cuts EV output at German sites as demand craters (Bloomberg)

- Amazon sued by FTC and 17 states on antitrust charges (CNBC)

CENTRAL BANKS

- Fed's Kashkari expects one more rate hike this year (Bloomberg)

- Fed's Kashkari says a soft landing scenario is more likely than not, but there is a 40% chance that the Fed will need to raise interest rates "meaningfully" (Reuters)

- ECB's Lagarde says rates to stay restrictive as long as needed (Bloomberg)

CHINA

- China GDP to rise to 5.2% in Q3, says China-based economists (SecuritiesDaily)

- Evergrande misses payment on $547m onshore bond (Bloomberg)

- China's economy is set to avoid a Japanese-style deflation (Bloomberg)

ECONOMY

- Fed study shows Americans outside the wealthiest 20% of the country have run out of extra savings and have less cash on hand than when the pandemic begun (Bloomberg)

Where Are We Now?

Markets have pulled back sharply in the past week. In this segment, we'll recap some of the key data points behind the selloff and what to watch out for.

Yields have been a major pain point for markets. The US 10-year yield recently pushed above 4.50% for the first time since 2007. This move is more than just higher-for-longer.

The US is issuing over US$10 billion per day in treasuries to cover their deficit spending. This is effectively flooding the bond market with supply, driving bond prices lower and yields higher.

Positioning in the US market is extremely one sided now. Put option activity for the Nasdaq 100 has surged to its highest level since December 2021, with all long positions unwound.

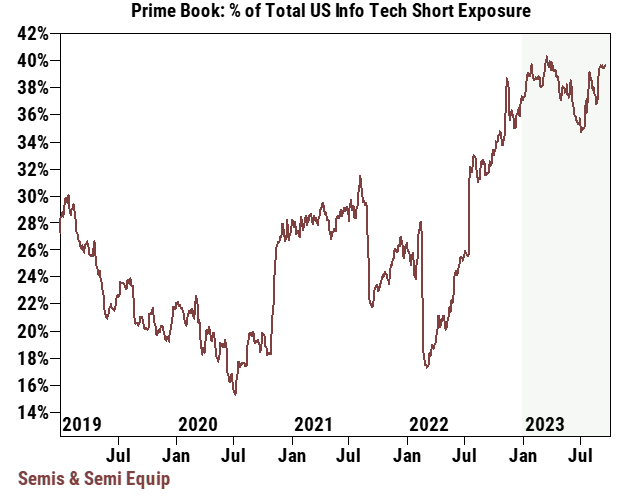

Hedge funds short exposure (as a % of total short US tech short exposure) has jumped to almost 40% from 33% a few months ago. These were the same funds that were aggressively buying into names like Nvidia and AMD earlier this year.

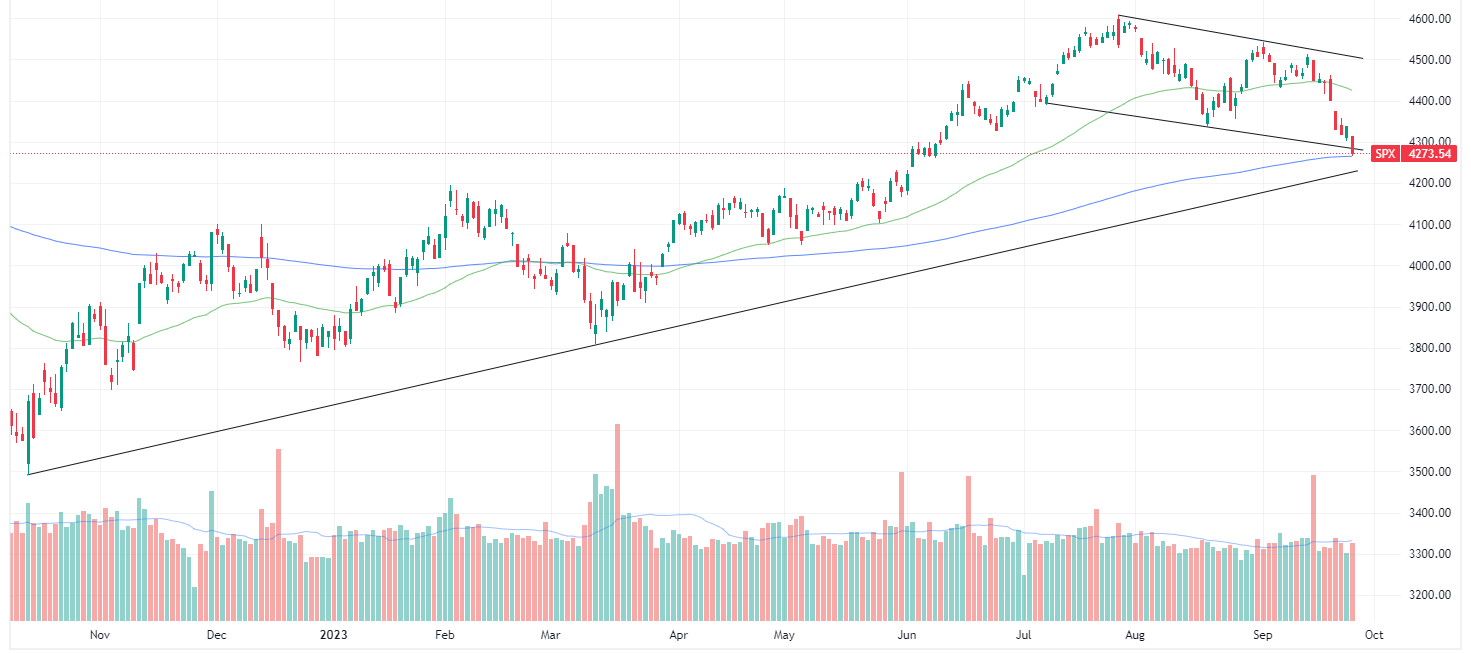

The S&P 500 has undercut its channel support and trading close to both the 200-day moving average (blue) and a longstanding trendline that goes back to October 2022. This weakness has pushed market breadth to the lowest level since May, so things aren't exactly very strong beneath the hood.

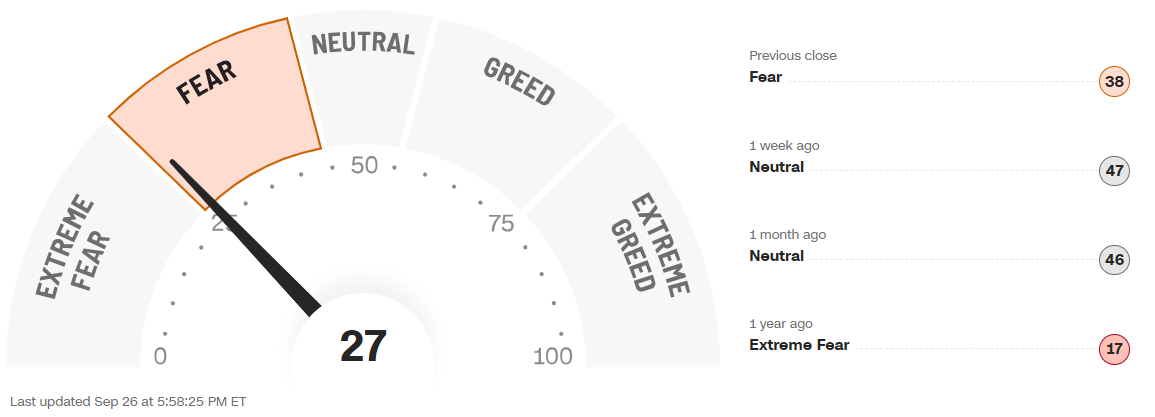

The bearishness has flushed sentiment with CNN's Fear & Greed Index falling close to 'Extreme Fear' levels. We haven't seen these levels since mid-March, which was when the S&P 500 bottomed after a 9.2% pullback from February highs.

From a technical perspective, the ASX 200 is starring at two key levels: 7,000 (which was also the mid-July low) and 6,900 (which was also the mid-March low).

Major benchmarks (both US and Australia) are becoming increasingly oversold. This places the market in an awkward place where it can experience a short-term technical bounce (which took place for the ASX 200 last Friday where it finished 0.05% higher from a session low of -1.5%). But current macro conditions may not necessarily allow for anything more than a bounce. Let's see if the market's can muster up some resilience ahead of the seasonally stronger month of October.

KEY EVENTS

ASX corporate actions occurring today:

- Trading ex-div: Imdex (IMD) – $0.02, Cedar Woods (CWP) – $0.07, Myer (MYR) – $0.01, Vulcan Steel (VSL) – $0.25, Fonterra Shareholders Fund (FSF) – $0.31

- Dividends paid: ASX (ASX) – $1.12, Amcor (AMC) – $0.18, Woolworths (WOW) – $0.58, Diverger (DVR) – $0.03, Worley (WOR) – $0.25, Pilbara Minerals (PLS) – $0.14, Aurizon (AZJ) – $0.08, Ampol (ALD) – $0.95, Iluka Resources (ILU) – $0.03, Mineral Resources (MIN) – $0.70, Regis Healthcare (REG) – $0.07, Coles (COL) – $0.30, Endeavour Group (EDV) – $0.07

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Monthly CPI Indicator

- 10:30 pm: US Durable Goods Orders

This Morning Wrap was written by Kerry Sun.

1 contributor mentioned