ASX 200 to fall, Nasdaq ekes out fifth straight record close

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 17 points lower, down 0.22% as of 8:30 am AEST.

S&P 500 SESSION CHART

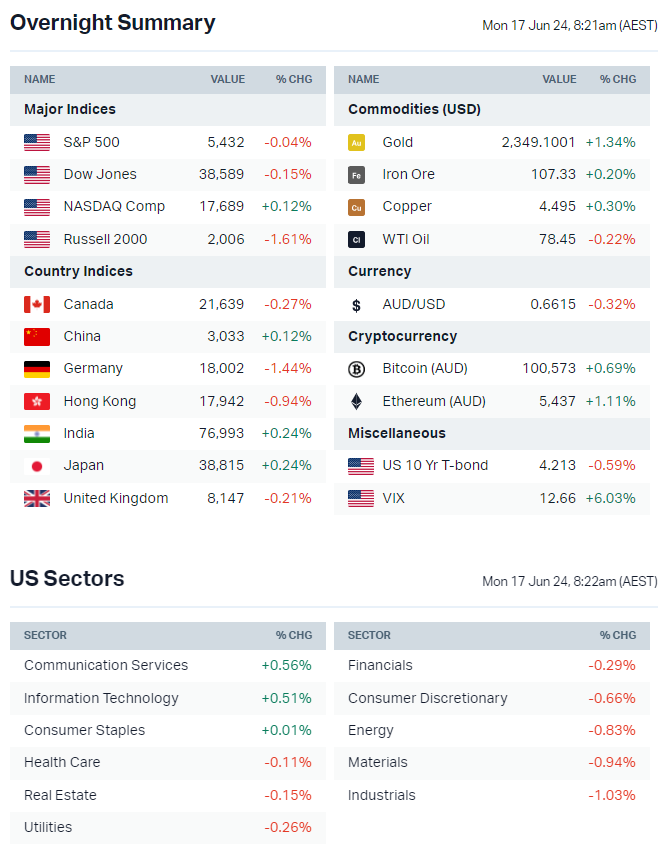

OVERNIGHT MARKETS

- Major US benchmarks finished mostly lower on Friday but managed to recoup early losses to close near best levels

- Equal-weight S&P 500 underperformed the official benchmark by 60 bps – the underperformance of cyclical pockets of the market flags a pickup in growth concerns

- Stocks struggled for direction amid ongoing breadth concerns, political turmoil in France, volatile macro narrative and unexpectedly weak consumer sentiment data

- US weekly benchmark performance: Nasdaq (+3.24%), S&P 500 (+1.58%), Dow (-0.54%) and Russell 2000 (-1.01%)

- Goldman Sachs raises year-end S&P 500 target to 5,600 (Bloomberg)

- Evercore ISI sees S&P 500 gain raging on, upping target to 6,000 (Bloomberg)

- Low volatility, minimal trading volumes, and narrow breadth could be adding to market vulnerabilities (WSJ)

- Investors continue to bet on European sovereign debt despite French chaos (Bloomberg)

- Latest EPFR flow data shows US value stocks dumped in favour of growth stocks (Reuters)

STOCKS

- Tesla investors vote to approve Elon Musk's compensation package (Bloomberg)

- Adobe upgrades revenue guidance amid stronger demand for its AI-powered creative tools (Bloomberg)

- Microsoft withdraws from release of scrutinised Windows AI tools (Reuters)

- Roaring Kitty's latest screenshot suggests he's exited his GME call options (Bloomberg)

CENTRAL BANKS

- BOJ leaves policy unchanged, plans to taper JGB purchases with details forthcoming at next meeting (Bloomberg)

- PBOC seen leaving MLF rate steady on Monday, though voices for rate cut getting louder (Bloomberg)

GEOPOLITICS

- Macron's centrists face political wipeout as united left challenges far right in French snap elections (Reuters)

- French Finance Minister warns victory by new left-wing alliance in upcoming election could lead to EU exit (Bloomberg)

- Biden says new Ukraine security agreement signals US and allies not backing down against Russia (Bloomberg)

- China's retaliation against EU tariffs may be limited (Bloomberg)

ECONOMY

- US consumer sentiment deteriorated further in June, down to 65.6 vs. 73.0 consensus, this marks the lowest reading since November 2023 (Reuters)

.png)

ASX TODAY

- ASX 200 set to fall after a relatively soft overnight session

- Pretty much the entire overnight ETF watchlist is red, led by weakness across resources, biotech and airlines

- Adbri shareholders approve scheme of arrangement (ABC)

- Auckland International Airport reports May traffic, up 5% year-on-year (AIA)

- Ramsay Healthcare mulls selling assets within Sante business (The Aus)

- Retail Food Group holder Riguad discloses 10.06% stake (RFG)

- Rio Tinto to receive approval from Serbia to progress lithium mine (FT)

- Tabcorp confirms appointment of Gillon McLachlan as CEO (TAH)

BROKER MOVES

- ASX upgraded to Equal-weight from Underweight; target up to $54.65 from $53.50 (Morgan Stanley)

- Bluescope Steel downgraded to Underperform from Hold; target cut to $17.80 from $21.63 (Jefferies)

- Chalice Mining downgraded to Neutral from Buy; target up to $1.50 from $1.45 (UBS)

- Light & Wonder initiated add with $172 target (Morgans)

- Red 5 initiated outperform with $0.50 target (Macquarie)

KEY EVENTS

Companies trading ex-dividend:

- Mon 17 June: None

- Tue 18 June: Premier Investments (PMV) – $0.63

- Wed 19 June: Afp Pharmaceuticals (AFP) – $).01

- Thu 20 June: None

- Fri 21 June: CSR (CSR) – $0.12

Other ASX corporate actions today:

- Dividends paid: EZZ Life Sciences (EZZ) – $0.015,

- Listing: None

Economic calendar (AEST):

- 12:00 pm: China Industrial Production, Retail Sales, Fixed Asset Investment and Unemployment Rate (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment