ASX 200 to fall, NVIDIA cracks $1,000 milestone and announces stock split, Anglo American knocks back third BHP offer

ASX 200 futures are down 74 points, to 7,796, at 8:40am AEST.

It was a massive night for overseas news. NVIDIA's latest quarterly earnings and forecast both shattered the consensus estimate, sending its shares past the US$1,000 mark for the first time. It also said it would lift its quarterly dividend by - get this - 150% (!) and commence a 10-for-1 stock split. It was a moment captured like this on CNBC:

But not to be outdone, BHP made a third offer for Anglo American - this time, valued at nearly $74 billion. Even more remarkably, Anglo American have given BHP just one week to Mike Henry's team to come up with a fourth offer.

What a time to be alive.

Let's dive in.

S&P 500 SESSION CHART

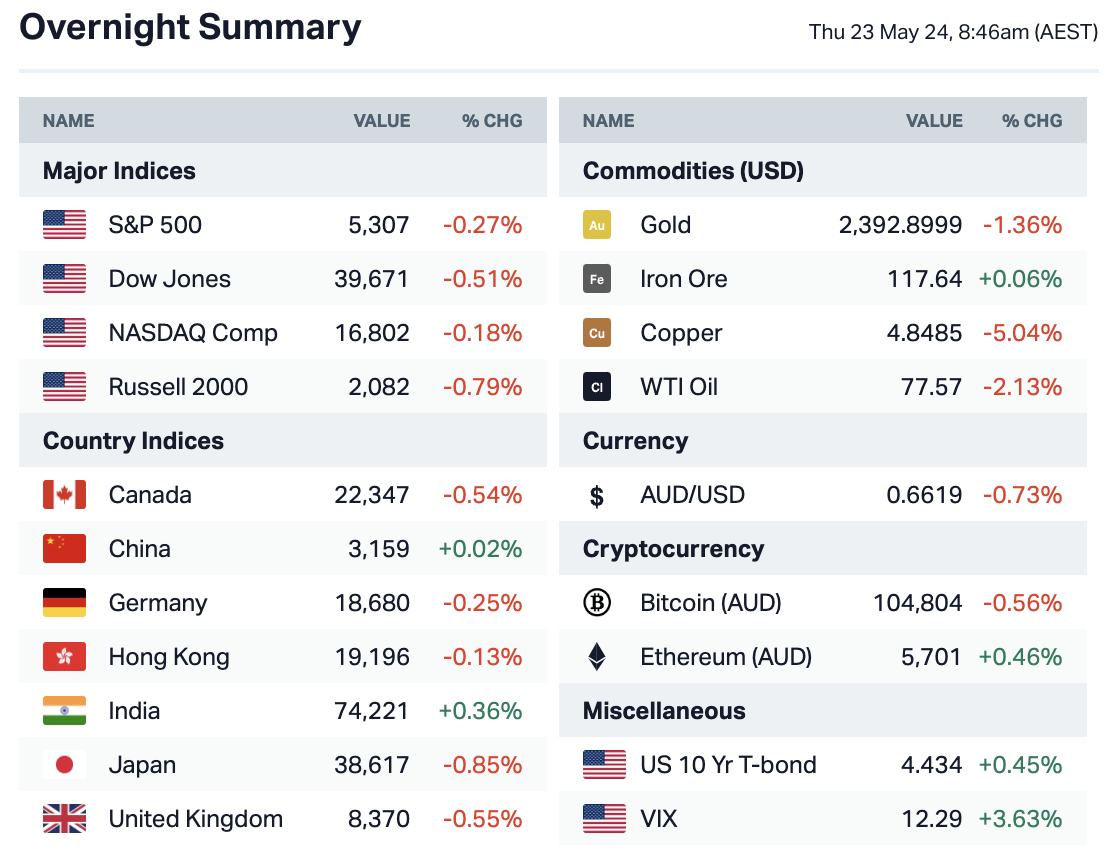

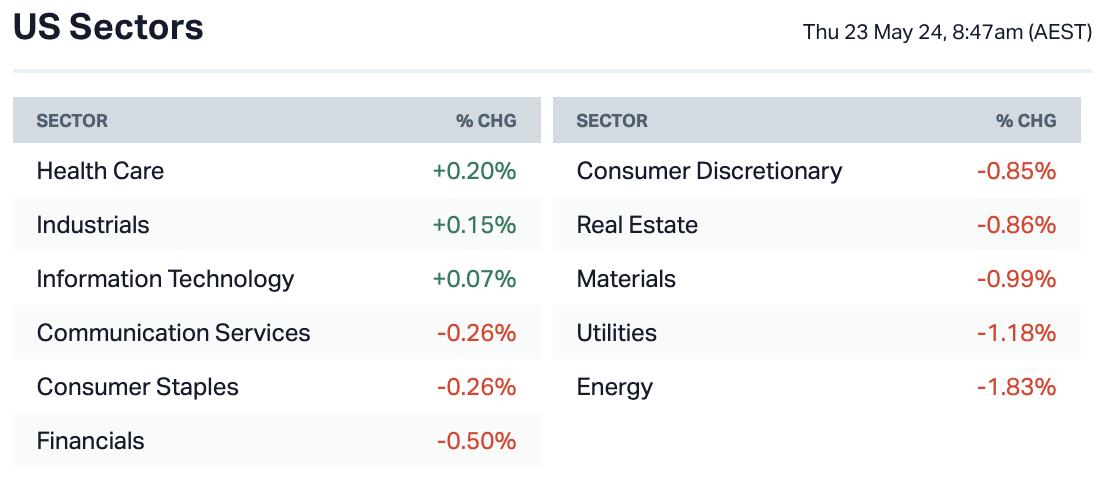

OVERNIGHT MARKETS

Dow closes down 200 points after Fed officials show willingness to hike rates if needed

‘Various’ Fed officials said they were willing to hike interest rates if needed, minutes show

European markets close lower as UK inflation misses estimate

Treasury yields inch higher as Fed still sees no rate cuts soon

Oil prices extend losing streak, books third consecutive daily decline

Gold prices dip after record highs on profit taking, rate cut bets cool

INTERNATIONAL STOCKS

Nvidia reports a 262% jump in sales, signals continuing AI boom

Amazon plans to give Alexa an AI overhaul — and a monthly subscription price

DeepL, a European rival to Google Translate, rides AI hype to a $2 billion valuation

Boeing deliveries to China delayed by state regulator review, Reuters source says

Miner Anglo American rejects third takeover offer from rival BHP Group as talks deadline extended

Lululemon chief product officer leaving, company restructuring product and brand teams

Zesla's European sales slump as EV market shows growth

MORE ON THE MARKETS

Investors holding cash despite stock market highs signals potential for continued bull market

Bond traders doubt Fed's rate cuts as market shifts amid inflation data

Traders pare expectations of two Fed rate cuts in 2024

China equity market rebound characterised by improving breadth

Domestic investors fuelling China rally as foreign inflows remain relatively mild

ECONOMY

UK inflation declines less than expected, fueling doubts over BoE rate cut timing

UK employers grant nearly 5% pay increases amid persistent inflation pressures

Weak yen fuels rebound in Japan imports, autos and semi components drive export growth

Japan manufacturer sentiment unchanged as yen-driven inflation weighs on confidence

Japan currency diplomat Kanda sees G7 officials discussing Chinese overcapacity this week amid US tariffs

CENTRAL BANKS

Federal Reserve minutes indicate worries over lack of progress on inflation

Fed's Mester and Bostic reinforce higher-for-longer message

BoE Governor Bailey anticipates significant inflation drop and potential rate cut

RBNZ leaves OCR unchanged, but forecasts lean hawkish amid inflation concerns

China's central bank guides banks to step up lending in May

BOK unanimously expected to remain on hold Thursday

ASX TODAY

BHP (NYSE: BHP)'s US-listed shares tumbled nearly 5% on the news its third offer had been rejected by Anglo American. That will likely weigh on the index today - at least at the start of trade.

Nufarm (ASX: NUF) releases earnings.

GQG Partners, Gold Resources, Karoon Energy, Pepper Money, Resolute Mining, Stanmore Resources and Ventia Services all host AGMs.

Aristocrat Leisure (ASX: ALL) and Orica (ASX: ORI) trade ex-dividend.

Key Events

Trading ex-dividend this week:

Orica Ltd (ORI) - 23 May - $0.19

Aristocrat (ALL) - 23 May - $0.36

Whitefield (WHF) - 24 May -$0.102

Economic releases:

8:45 am – NZD – Retail sales, core retail sales

9:00 am – AUD – Flash manufacturing PMI, flash services PMI

10:30 am – JPY – flash manufacturing PMI

11:00 am – AUD -MI inflation expectations

From 5:15 pm – EUR – French, German, euro and British manufacturing PMI

10:30 pm – USD – Unemployment claims

11:00 pm – CNY – CB leading index

11:45 pm – USD – Flash manufacturing PMI, flash services PMI

This Morning Wrap was written by Hans Lee and Chris Conway.

2 topics

4 stocks mentioned