ASX 200 to fall, S&P 500 lower as Nvidia fades early strength, gold rally continues

ASX 200 futures are trading 47 points lower, as of 8:20 am AEDT.

The ASX 200 is set to ease from record highs following a heavy overnight session for US stocks, the Dow closed out its worst week since October, Nvidia finished 5% lower despite soaring 5% in early trade, gold continues to run hot – Up for an eight straight session and US unemployment unexpectedly hit a two-year high of 3.9% in February.

Let's dive in.

ASX TODAY

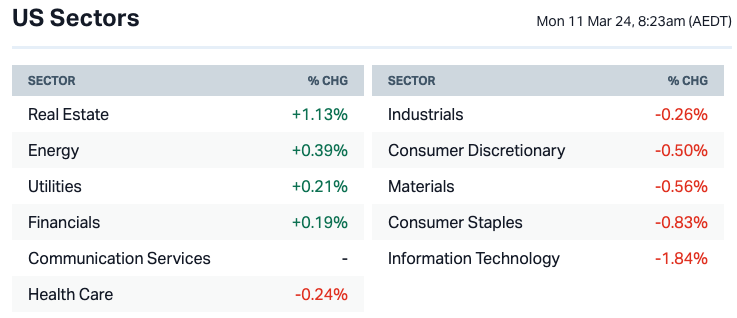

ASX 200 set for a relatively heavy session after closing at record highs on Friday

Bond yields continued to fall overnight, which may buoy yield-sensitive sectors like Real Estate and Utilities

Local tech stocks to face selling pressure after weak lead from Wall Street

Resources sector (notably lithium, uranium) also set for a weak start

Paladin Energy proposes ten-for-one share consolidation to better reflect the company’s position as an ASX 200 company and provide greater appeal to international investors

Kogan CFO and COO disclose sale of 2.0m shares at $8.0 per share

TPG in talks to acquire Techem from Partners Group (Bloomberg)

Ingenia Communities sees interest from Warburg Pincus PE group (AFR)

BROKER MOVES

MAAS Group downgraded to Buy from Hold at Jefferies but target raise to $5.0 from $4.40

Sayona Mining upgraded to Speculative Buy from Hold at Canaccord Genuity with $0.06 target price

MARKETS

S&P 500 lower, faded from session highs of 0.62%

Nvidia reversal was the big story – Briefly rallied 5.1% to record high of $974.0 but finished the session down -5.55% to $875.3

Bond yields continued to fall, with the US 10-year Treasury yield down for a fourth straight session to lowest level since 5-Feb

Gold rallied for an 8th consecutive session, up to US$2,178 (down from session highs of US$2,195)

Major US benchmarks were mostly lower last week, led by the Nasdaq (-1.17%), Dow (-0.93%) and S&P 500 (-0.26%)

Small-cap Russell 2000 outperformed, finishing the week up 0.30%

Big tech posted mixed performance last week, with Apple (-4.9% and Tesla (-13.4%) offsetting gains from Nvidia (+6.4%)

BofA says global equities attracted another US$6.9bn inflows for week ended 6-Mar, marking a seventh straight week of inflows

INTERNATIONAL STOCKS

TSMC's Jan-Feb period sees 9.4% sales boost thanks to AI drive (Bloomberg)

Costco shares sell off after Q4 earnings miss expectations (CNBC)

Gap shares rally on strong holiday-quarter results (CNBC)

CENTRAL BANKS

Powell suggests Fed nearly confident enough on inflation to begin rate cuts (Bloomberg)

BOJ considers new quantitative policy framework and leaning toward exiting negative rates in March (Reuters)

ECB officials back Lagarde flag for likely cut in June (Bloomberg)

GEOPOLITICS

China raising more than US$27bn for third chip fund in response to US attempts to restrain China's abilities (Bloomberg)

House committee advances bill that would force ByteDance to divest TikTok (FT)

Biden instructs military to create temporary port on Gazan coast for aid (Bloomberg)

Gaza ceasefire prospects dim amid Hamas' insistence on permanent truce (FT)

7nm chip powering Huawei's Mate 60 relied on US technology (Bloomberg)

ECONOMY

US unemployment rate unexpectedly rises to two-year high of 3.9% (Reuters)

Canada unemployment rate edges back up to 5.8% in February (Reuters)

China inflation rebounds thanks to holiday boom but deflation risks linger (SCMP)

Japan household spending falls by most since Feb-2021 (Reuters)

German industrial production rebounds in January (Bloomberg)

ASX corporate actions occurring today:

Trading ex-div: Adairs (ADH) – $0.05, Generation Development Group (GDG) – $0.01, Joyce Corp (JYC) – $0.11, Ramsay Healthcare (RHC) – $0.40, CSL (CSL) – $1.826, Coronado Global (CRN) – $0.005, COG Financial Services (COG) – $0.04, Seven Group (SVW) – $0.23, Dusk Group (DSK) – $0.025, Turners Automotive (TRA) – $0.056

Dividends paid: Infomedia (IFM) – $0.022, Prestal (PTL) – $0.06, Domain (DHG) – $0.02, Fiducian Group (FID) – $0.18

Listing: None

Economic calendar (AEDT):

No major economic announcements.

This Morning Wrap was published by Hans Lee. Kerry is away for the Victorian Labour Day public holiday.

2 topics