ASX 200 to fall, S&P 500 retreats after the Fed's hawkish pause

ASX 200 futures are trading 22 points lower, down -0.31% as of 8:20 am AEST.

S&P 500 SESSION CHART

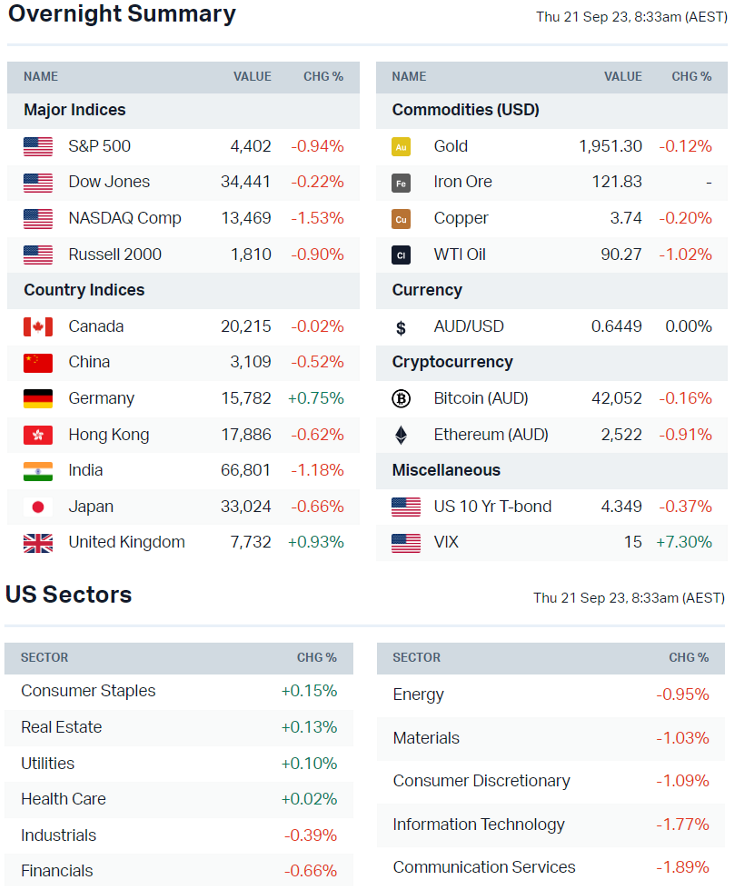

MARKETS

- Major US benchmarks opened in positive territory but sold off after the Fed’s meeting and closed at worst levels

- Megacap tech stocks was a notable drag on markets, led by names like Alphabet (-3.1%), Nvidia (-2.9%), Microsoft (-2.4%) and Apple (-2.0%)

- Fed paused in-line with market expectations but reiterated for less easing in 2024

- Higher-for-longer fuelled concerns about the lagged effects of the tightening cycle

- US 2-year Treasury yield rose 8 bps to 5.18%, the highest since July 2006

- US 10-year Treasury yield up 5 bps to 4.41%, the highest since October 2007

- WTI crude settled 1.6% lower, now down 3.3% in the last two sessions

- Gold briefly rallied 0.8% to US$1,947 but faded back to breakeven levels

- Short-end US yields rise after hawkish Fed statement (Reuters)

- Traders position for hawkish Fed decision as 2024 (Bloomberg)

- Bond market volatility lowest since Fed began tightening campaign (Reuters)

- Dollar rally is crushing one of the most popular trades of 2023 (Bloomberg)

STOCKS

- Automakers face potential risk of US$38bn lost revenues (Bloomberg)

- Klaviyo IPO priced at US$9.2 billion after pricing IPO above range (Reuters)

- Bank of America to raise minimum wage to $23 an hour in October (CNBC)

CENTRAL BANKS

- Fed leaves rates unchanged, signals another hike this year (Bloomberg)

- Fed policymakers see 5.1% policy rate at end of 2024 (Reuters)

- BoJ speculation moves to negative rate policy from yield cap (Bloomberg)

- Oil nearing $100 is a red flag for central banks' inflation fight (Bloomberg)

CHINA

- China keeps interest rates unchanged as expected (Reuters)

- China equity outflows moderating (Reuters)

- China suffered capital outflow of US$49bn in Aug, largest since 2015 (Insider)

- Copper demand in China is lagging at a time when consumption is usually elevated, demonstrates more trouble for economy (Insider)

ECONOMY

- UK inflation surprises on the downside (FT)

- Global debt hits all-time high of US$307 trillion, or 336% of world GDP (FT)

Another Hawkish Pause

The Fed kept interest rates unchanged at 5.25% to 5.50% but signaled for one more hike by year end. The decision to pause included the following key points:

- 12 Fed officials see 1 more hike

- 7 Fed officials see no more rate hikes

- Dot plot showed median 2023 projection of one more hike in 2023

- Median 2024 dot plot was shifted up to 5.125% from 4.62% (two rate cuts next year, down from the four that was forecast in June)

- Fed upgrades GDP growth estimate for 2023 to 2.1% and 1.5% in 2024

- Fed expects no recession through 2024

- Fed forecasts inflation to ease to 2.6% in 2024

Fed funds futures are currently pricing in a 47.2% likelihood that we see 25 bps or more of hikes by year end, according to CME Group.

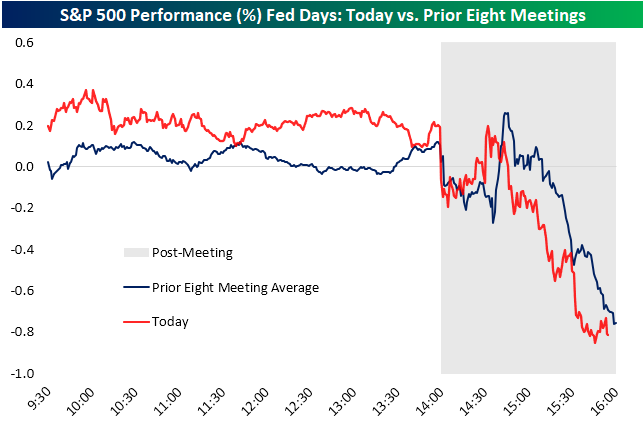

The below table shows how the S&P 500's average performance on Fed interest rate decisions days (so far this year).

It's not the interest rate decision that tanks markets. It's Powell's press conference which starts 30 minute after the rate decision. Today's price action was a near perfect match against averages.

Powell's press conference contained no surprises and continued to reiterate that higher for longer is here to stay. Here are the key takeaways from his speech:

- More hikes if needed: "We're prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we're confident that inflation is moving down sustainably toward our objective."

- Neutral rate: Powell said the neutral interest rate may be higher "for various reasons ... policy has not been restrictive enough for long enough."

- Tempered soft landing expectations: Powell declined to commit to a soft landing as a baseline scenario despite its positive short-and-medium run economic forecasts

- Energy prices are a problem: "Energy prices being higher, that is a significant thing. Energy prices being up can affect spending, it can affect over time a sustained period of higher energy prices can affect consumer expectations about inflation."

ASX 200 on Ice

The Index is in a rather vulnerable place, with futures implying a minor breach of the below trendline. The question is: Do we see a shakeout low or do things get uglier (and put July or March lows back into play).

ASX 200 daily chart (Source: TradingView)

Two Big IPOs in a Week

After a drought of mega-listings, two massive IPOs in a week have caught the financial world's imagination.

- Earlier this week, Softbank-backed Arm debuted to much fanfare. After rising 25% on debut, its share price has fallen in every session since.

- Instacart, a grocery delivery app, debuted with an US$11 billion valuation of its own. After rising 12% in its debut, the founder and chairman stepped down.

Although he was personally estimated to be worth US$3.5 billion in 2021, that valuation has dropped in recent years. The company was also worth a lot more two years ago, as this Chartr infographic shows.

Nonetheless, the two listings are being viewed by some market participants as a sign that risk sentiment is back in markets. But is it?

Greg Martin from Rainmaker Securities offered this take to Yahoo Finance in an interview: "I think we have to be careful about drawing insights ... The next few new issuances are more likely truly representative of whether there's a real reopening of the IPO market."

We'll find out if the hype lasts into a third IPO when marketing startup Klaviyo starts trading next week.

BlackRock Downgrades Chinese Equities

In proof that the major asset managers don't always get it right, BlackRock has had to walk back its Chinese equities overweight. Chinese assets are now rated neutral on a tactical (short-term) view. It blamed the underperformance on a refrain we've heard many a time before.

"Growth has slowed. Policy stimulus is not as large as in the past. Structural challenges imply deteriorating long-term growth [while] geopolitical risks persist. “We see growth on a slower trajectory [for emerging markets]," BlackRock's Jean Boivin and Wei Li wrote in a recent note.

BlackRock have also had some tough times with its all-in tilt on ESG and green investing. AUM in the world's largest asset manager rebounded in the June quarter but the inflows were mostly driven by its passive product iShares.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Embelton (EMB) – $0.20, Capitol Health (CAJ) – $0.005, Eureka Group (EGH) – $0.007, Lycopodium (LYL) – $0.45, Count (CUP) – $).02, Lindsay Australia (LAU) – $).03, NRW Holdings (NWH) – $0.08, Pacific Smiles (PSQ) – $0.02, Genesis Energy (GNE) – $0.08

- Dividends paid: Helloworld (HLO) – $0.06, McPherson’s (MCP) – $0.01, Jumbo Interactive (JIN) – $0.20, SkyCity Entertainment (SKC) – $0.055, Auswide Bank (ABA) – $0.21, SDI (SDI) – $0.01, McMillan Shakespeare (MMS) – $0.66

- Listing: None

Economic calendar (AEST):

- 9:00 pm: UK Interest Rate Decision

- 12:00 am: ECB President Lagarde Speech

2 contributors mentioned