ASX 200 to fall, S&P 500 ticks higher, Energy and Coal stocks in focus

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 24 points lower, down -0.31% as of 8:30 am AEST.

S&P 500 SESSION CHART

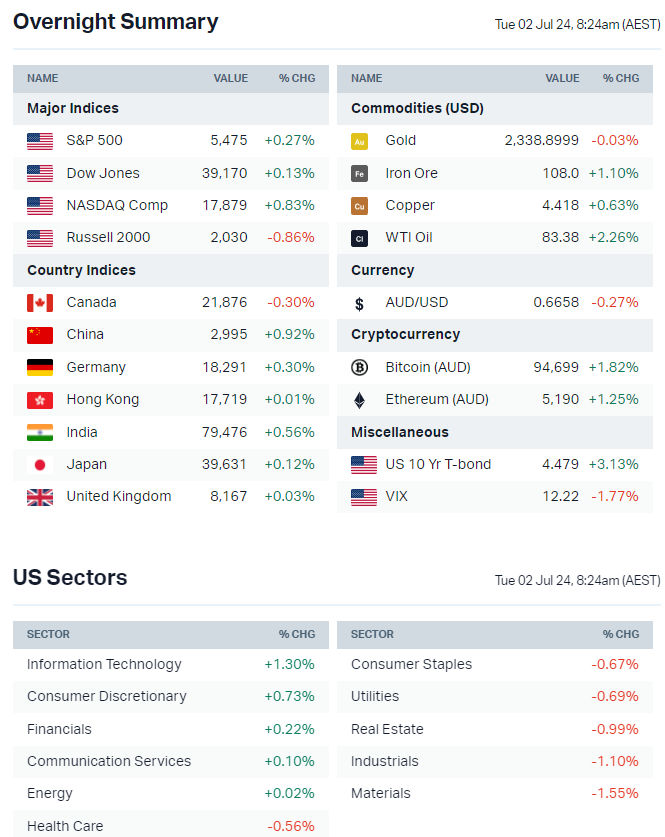

OVERNIGHT MARKETS

- Major US benchmarks were mostly higher, with big tech (Apple +2.9%, Amazon +2.1% and Amazon +2.0%) driving a bulk of the index performance

- Equal Weight S&P 500 underperformed the official index by more than 100 bps, while cyclicals and defensives were under pressure amid weaker-than-expected US manufacturing data

- Analysts looking for ~9% year-on-year S&P 500 earnings growth in Q2, which would mark the highest since early 2022. Communication Services and Tech expected to be among the standouts for earnings growth, at 18.5% and 16%, respectively

- Goldman Sachs says the six largest stocks (Amazon, Apple, Alphabet, Meta, Microsoft and Nvidia) are expected to grow EPS by 30% year-on-year while the other 494 grow just 5%

- BofA says this is the 26th time the S&P 500 has rallied between 10-20% in the first six months of the year – When this happens, the index is up 88% of the time in the second half with an average return of 8.58%

- Concentration worries grow as top ten largest companies now account for more than a third of S&P 500 (CNBC)

- Investment grade bond markets busy as companies get ahead of elections (Bloomberg)

- Strategists debate what a Trump presidency would mean for Treasuries (Bloomberg)

- Politics seen weighing on European equities despite positive earnings outlook (Reuters)

STOCKS

- Apple increases chip order, suggesting increased demand for iPhone 16 (Apple Insider)

- BlackRock buys Preqin in a US$3.2bn deal to bolster data capabilities as it expands into private-market investments (WSJ)

- Chewy erases gains after Roaring Kitty announces stake (Bloomberg)

- Target losing market share with shoppers as inflation and competition bite (FT)

CENTRAL BANKS

- Global easing cycle expected to be less synchronised (Bloomberg)

- China bond yields hit record low as PBOC signals it may sell bonds (Bloomberg)

POLITICS

- Democrats in damage control mode over Biden (Reuters)

- Le Pen dominates election results but markets cheer lack of absolute majority (FT)

- UK polls signal centre-left Labour party landslide ahead of election week (Reuters)

ECONOMY

- US manufacturing PMI printed at 48.5 in June, the lowest since February and below 49.1 consensus, inflation pressures ebbing (Reuters)

- China manufacturing PMI steady as expected but services disappoints (Reuters)

- Eurozone manufacturing PMIs decline deepens in June as demand softens (Reuters)

- German inflation eases more than expected in June (Reuters)

ASX TODAY

- ASX 200 set to open lower amid a relatively weak overnight session for value and cyclical pockets of the market

- Ansell completes acquisition of KC PPE Business (ANN)

- Deep Yellow advances Tumas Project Financing, expects production to start in the third quarter of 2026 (DYL)

- Ramelius Resources increases stake in Spartan to 17.94% from prior 8.92% (SPR)

WHAT TO WATCH TODAY

- Coal: Most coal names (CRN, NHC, SMR, TER, WHC, YAL etc) rallied 4-9% on Monday after a rail line in Queensland was suspended after a collision. Morgan Stanley estimates that this could reduce the state's weekly shipments by around 24%, equivalent to approximately 12% of global seaborne exports. "We expect this to tighten the market balance, following the recent pull back, although the extent of volume impact is uncertain," the report said. Watch out for further follow-through strength

- Energy: Brent crude rallied 2.0% overnight to US$86.6, the highest since 30 April. The overnight rally did not draw a strong response for US energy stocks (sector up just 0.02%). Worth keeping an eye out for names like Karoon (Macquarie expects KAR to harvest its market cap in free cash flow over the next four years)

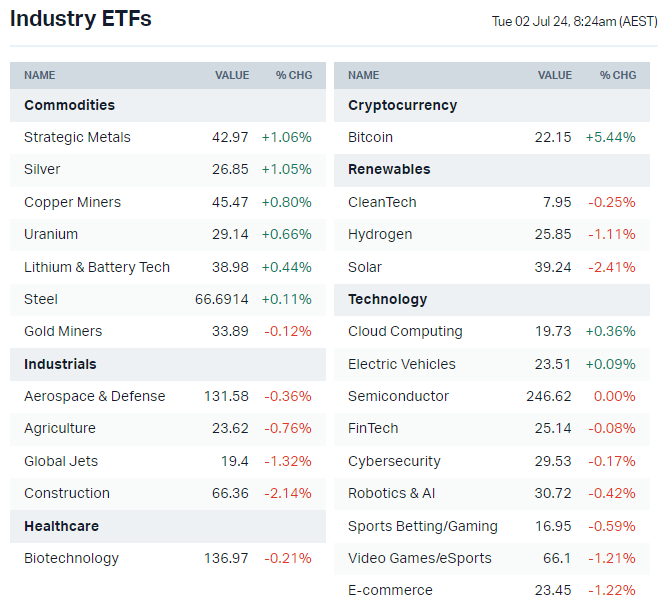

- Resources uptick: Several overnight resource-related ETFs ticked higher overnight, including nickel, rare earths (Chinese lithium futures up 1.8% on Monday), uranium (bouncing from 2% dip yesterday)

BROKER MOVES

- Botanix Pharmaceuticals upgraded to Buy from Speculative Buy; target up to $0.47 from $0.33 (Euroz Hartleys – Also the lead manager for recent $70m cap raise)

- DGL Group downgraded to Hold from Buy; target cut to $0.65 from $0.75 (Bell Potter)

- Hub24 initiated Buy with $53.20 target (Bell Potter)

- Lendlease upgraded to Buy from Neutral; target remains $6.30 (Citi)

KEY EVENTS

Companies trading ex-dividend:

- Tue 2 July: Ricegrowers (SGLLV) – $0.45, Ram Essential Services Property Fund (REP) – $0.014

- Wed 3 July: Graincorp (GNC) – $0.24

- Thu 4 July: Clime Capital (CAM) – $0.014

- Fri 5 July: None

Other ASX corporate actions today:

- Dividends paid: Aristocrat Leisure (ALL) – $0.36, Macquarie Group (MQG) – $3.85, ALS (ALQ) – $0.196

- Listing: None

- Earnings: Cleanspace (CSX)

- AGMs: None

Economic calendar (AEST):

- 11:30 am: RBA Meeting Minutes

- 7:00 pm: Eurozone Inflation (Jun)

- 11:30 pm: Fed Chair Powell Speech

- 12:00 am: US JOLTs Job Openings

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment