ASX 200 to open higher, Cyclicals and value shine, S&P 500 lower as Nvidia slides

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 36 points higher, up 0.46% as of 8:30 am AEST.

S&P 500 SESSION CHART

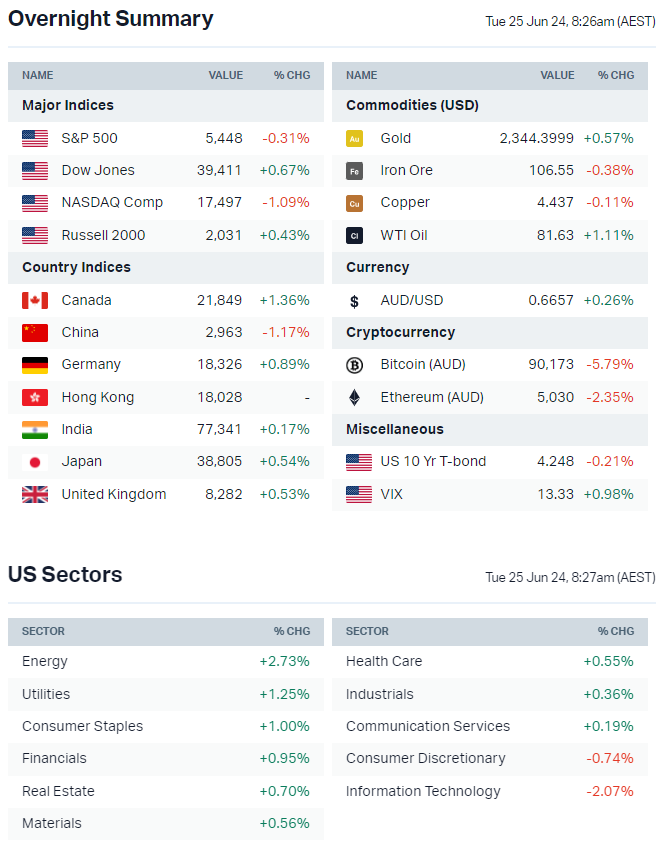

OVERNIGHT MARKETS

- Major US benchmarks finished mixed but breadth was solid, with the Dow, Russell 2000 and Equal-weight S&P 500 closing higher

- Equal-weight S&P 500 outperformed the benchmark by 39 bps – This gets back to concentration dynamics surrounding big tech

- Market rally beginning to broaden towards cyclical and value pockets of the market

- Semis and risk-assets under pressure, with Nvidia (-6.7%) and Bitcoin (-5.2%) – likely reflecting overbought conditions and stretched positioning

- US investors growing more anxious on Wall Street's rich valuations (Bloomberg)

- Japan's top currency diplomat says authorities ready to intervene in yen if necessary – the yen against the US dollar hit a 34-year low on Monday (Bloomberg)

- Nvidia enters correction territory as it marks worst three day run since December 2022, down 12.9% (Bloomberg)

- Bitcoin extends recent slide, falling below US$60,000 for first time since early May (Bloomberg)

STOCKS

- Nvidia's sales growth is so rapid that analysts are unable to keep up (Bloomberg)

- EU regulators accuse Apple of breaching digital competition rules for App Store (Reuters)

- Ford reportedly suspends release of new battery electric vehicles amid profitability concerns (ArgusMedia)

- Shein reportedly has confidentially filed for a public listing in London (CNBC)

- KKR mulls new North America private equity fund, seeks US$20bn from investors (Reuters)

CENTRAL BANKS

- Fed's Daly warns of labour market risks, nearing inflection point (Bloomberg)

- BoC's Macklem says they can beat inflation without unemployment spike (Bloomberg)

- BOJ debated need for timely rate hike, signalling July move, also plan to reduce JGB purchases (Reuters)

- ECB's Schnabel warns of potential inflation shocks, emphasises flexible approach to interest rates (Bloomberg)

GEOPOLITICS

- Israeli PM Netanyahu signals intense stage of Gaza fighting is close to end and open to partial deal with Hamas (Bloomberg)

- China agrees to talks with EU on EV tariffs (NY Times)

- Japan PM Kishida losing public support despite plans for more stimulus (Kyodo)

ECONOMY

- German IFO misses with economy showing signs of a weak recovery after bottoming out earlier this year (Bloomberg)

ASX TODAY

- ASX 200 set to open higher as market rally begins to rotate into value and cyclicals

- Strong lead in for Energy stocks – Best performing sector on the S&P 500, Brent crude settled 0.1% higher (up from session lows of -0.9%)

- James Hardie (ADRs +5.2%) issues North America aspirational financial targets at Investor Day, targeting double-digit revenue growth over the long-term (JHX)

- Paladin Energy to acquire Fission Uranium in all-stock deal – post completion, existing Paladin and Fission shareholders will own ~76% and ~24% of the enlarged Paladin respectively (PDN)

- Qantas to acquire 14 additional mid-life Dash 8-400 aircraft, investment will be within FY25 net capex guidance of $3.7-3.9bn (QAN)

- Red 5 CEO Luke Tonkin discloses sale of 5.4m shares (RED)

- ResMed sinks as drug trial sparks Ozempic-style sell-off (AFR)

- Seven West Media cuts close to 10% of workforce (The Aus)

BROKER MOVES

- Capitol Health downgraded to Hold from Buy; target up to $0.32 from $0.29 (Bell Potter)

- City Chic downgraded to Hold from Buy; target cut to $0.20 from $0.62 (Bell Potter)

- Monadelphous Group upgraded to Buy from Hold; target remains $14.45 (Argonaut)

- ResMed downgraded to Neutral from Buy; target cut to $30 (Citi)

KEY EVENTS

Companies trading ex-dividend:

- Tue 25 June: None

- Wed 26 June: Fisher & Paykel (FPH) – $0.218

- Thu 27 June – REITs: HealthCo Healthcare and Wellness REIT (HCW) – $0.002, Centuria Industrial REIT (CIP) – $0.04, Centuria Office REIT (COF) – $0.03, Homeco Daily Needs REIT (HDN) – $0.021, Arena REIT (ARF) – $0.043, Charter Hall Long Wale REIT (CLW) – $0.065, Garda Property Group (GDF) – $0.016, Hotel Property Investments (HPI) – $0.095, Charter Hall (CHC) – $0.23, Charter Hall Social Infrastructure REIT (CQE) – $0.04, Waypoint REIT (WPR) – $0.041, GDI Property Group (GDI) – $0.025, National Storage (NSR) – $0.055, Goodman Group (GMG) – $0.15, Stockland (SGP) – $0.166, Growthpoint Properties (GOZ) – $0.097, Dexus Convenience Retail REIT (DXC) – $0.053, Dexus Industria REIT (DXI) – $0.041, Dexus (DXS) – $0.213

- Thu 27 June – Everything else: Rural Funds Group (RFF) – $0.029, Virgin Money (VUK) – $0.039, Mirvac Group (MGR) – $0.06, Region Group (RGN) – $0.07

- Fri 28 June: Abacus Group (ABG) – $0.043, Ophir High Conviction Fund (OPH) – $0.06, Danakali (DNK) – $0.009, Abacus Storage King (ASK) – $0.03

Other ASX corporate actions today:

- Dividends paid: Infratil (IFT) – $0.109, Westpac (WBC) – $0.75

- Listing: None

- Earnings: Collins Food (CKF)

- AGMs: Macquarie Group (MQG)

Economic calendar (AEST):

- 10:30 am: Australia Consumer Confidence (Jun)

- 10:30 pm: Canada Inflation Rate (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment