ASX 200 to rise, copper prices climb + Tesla rallies 10% on Morgan Stanley upgrade

ASX 200 futures are trading 7 points higher, up 0.09% as of 8:20 am AEST.

S&P 500 SESSION CHART

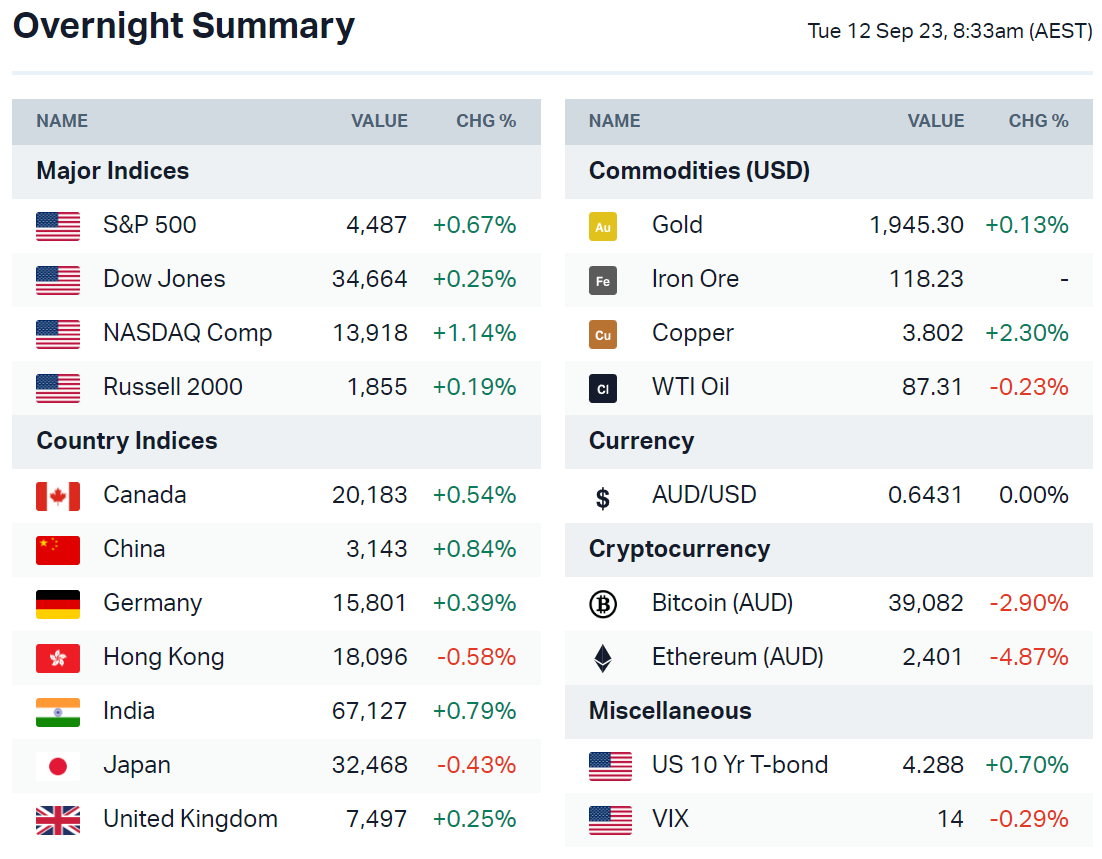

MARKETS

- S&P 500 recovers from session lows of 0.23% to finish near best levels

- US Dollar Index falls 0.5% but still near 6-month highs

- Commodities higher, notably copper (+2.4%)

- Discretionary was a major gainer after Tesla rallied 10.1% to $273 off the back of a Morgan Stanley upgrade and target price of $400

- Major market themes to watch: Peak Fed in September, Q3 earnings estimates on the rise after three straight quarters of declines, labor market loosening via slower hiring trends and declining job openings, China’a Xi opposed to aggressive stimulus

- Big week ahead with US inflation, PPI and retail sales, Apple’s iPhone 15 event, ECB meeting and China activity data

- BofA says cash attracted US$68.4bn in the week-ended 6 September, the most in nine weeks while tech saw an outsized US$1.7bn first outflow in 11 weeks

- BofA says firms have dialled back on long exposure from the very elevated levels seen going into August

- Goldman Sachs says notional short flow across US equities was largest in nearly six months

- Jamie Dimon says its a 'huge mistake' to think the economy will boom (CNBC)

- Instacart cut-price IPO to test Wall Street appetite for new tech listings (FT)

- Strong demand pushes Arm to close IPO order book early (FT)

STOCKS

- J.M. Smucker to buy Twinkies maker Hostess Brands in $5.6bn deal (Reuters)

- Chevron asks regulator to intervene in Australia LNK strikes (Reuters)

- Tesla upgraded to Overweight from Equal-weight at Morgan Stanley, price target hiked from $250 to $400, implying more than 60% upside from current levels – Key focus points include the development of Tesla’s Dojo supercomputer (Yahoo)

- Qualcomm extends deal to supply Apple on 5G chips (FT)

- FDA approved a new round of Pfizer and Moderna covid shots to be rolled out with flu vaccines (NYT)

CENTRAL BANKS

- BOJ's Ueda signals chance of ending negative rates (Reuters)

- ECB grapples with knife-edge decision on interest rates (FT)

- BoE braced for bump in the road in fight against UK inflation (FT)

CHINA

- China shows signs of stability as credit, inflation improve (Bloomberg)

ECONOMY

- Survey shows majority of investors expect US consumer spending to shrink in early 2024 (Bloomberg)

- EU downgrades growth forecast and raises inflation expectations, Germany in recession (Bloomberg)

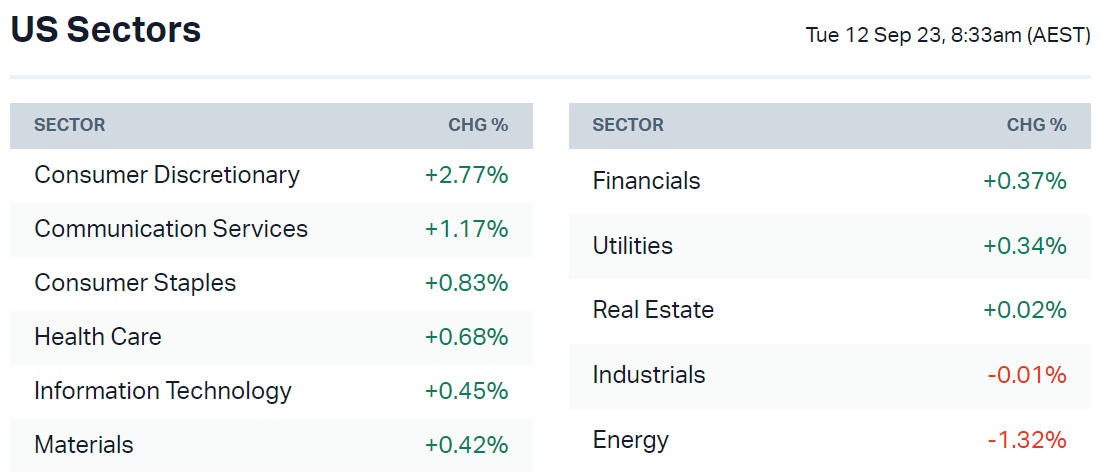

Sectors to Watch

The market's beginning to stabilise after an unsurprisingly weak start to September. A few sectors to note today:

- Cannabis: The Global X Cannabis ETF rallied 16% to a 6-month high following a recommendation from the US Department of Health and Human Services to the Drug Enforcement Administration in an August 29 letter. The sector is a shell of its former self but maybe we'll see some positive flow for local names.

- Copper: Copper prices rallied 2.4% overnight to US$3.8. Likewise, the Global X Copper ETF rose 2.8% (off session highs of 3.9%). Let's see if this'll give names like Sandfire Resources, 29Metals and Aeries Resources a kick.

- Energy: The Energy trade is starting to get a little short-term overextended, evidenced by some recent weakness across names in sub-sectors like coal, uranium and oil. Overnight, the SPDR Energy Sector fell 1.3% (from session highs of +1.0%).

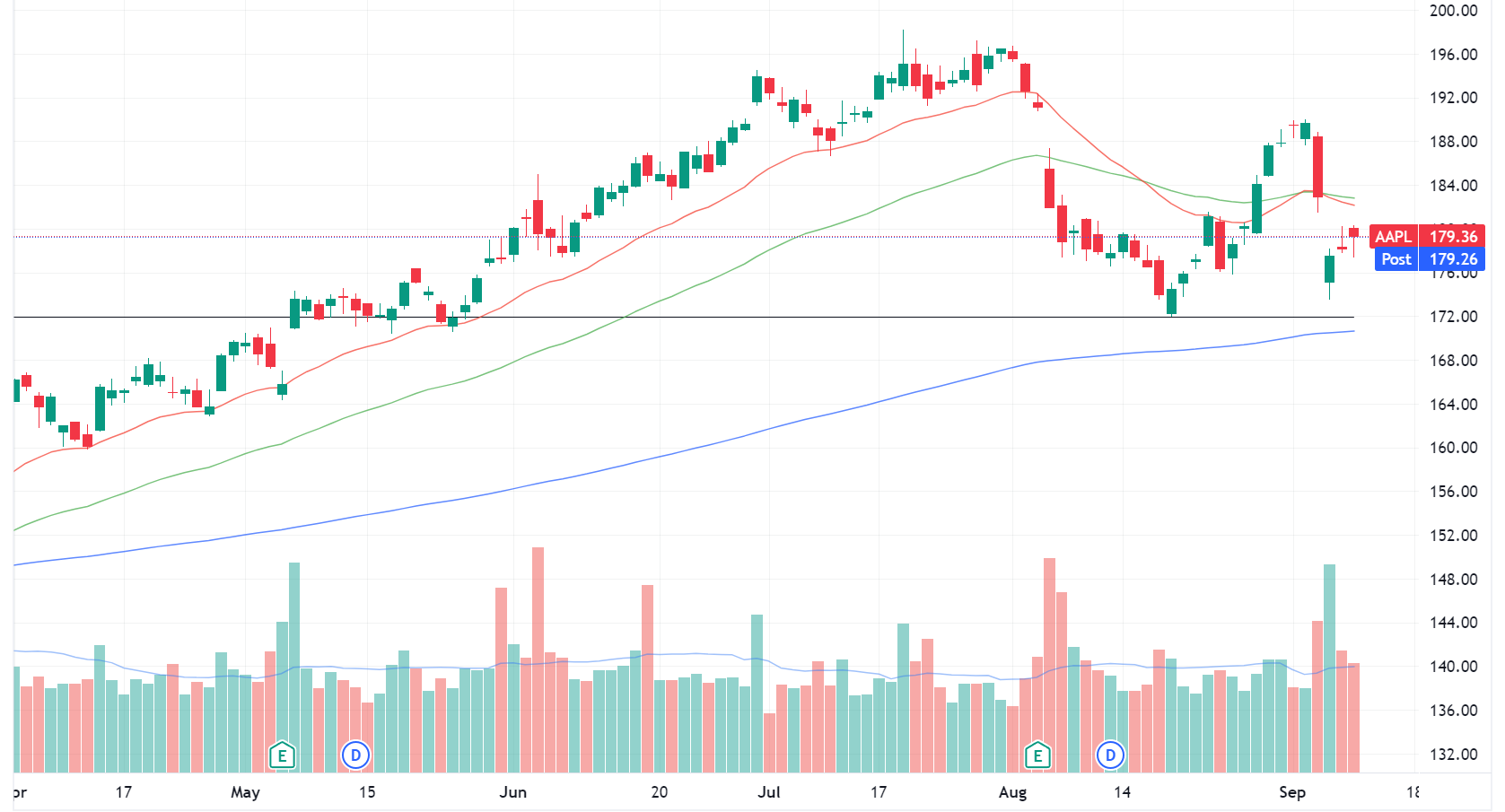

Apple's iPhone 15: A Market-Moving Catalyst?

Apple's set to reveal its iPhone 15 on Wednesday. The company's weighting in the S&P 500 is around 7-8% and nearly 11% in the Nasdaq (as well as an almost 50% weighting in Warren Buffett's Berkshire Hathaway).

Apple has had a pretty choppy week after reports of China banning the iPhone, down as much as 6.5% in two days. Two interest views about the Apple-China situation:

- Morgan Stanley: “Apple's 2-day -6% stock move suggests the market thinks recent China headlines will evolve into something broader. We believe that's unlikely ... Reiterate Overweight, $215 target.”

- Approximately 95% of Apple products are still manufactured in China. What happens if production comes under fire (like what we're seeing with the consumer side.

Key Events

ASX corporate actions occurring today:

Trading ex-div: Lovisa (LOV) – $0.31, TPG Telecom (TPG) – $0.09, Bluescope Steel (BSL) – $0.25, News Corp (NWS) – $0.10

- See full list of ASX stocks and ETFs trading ex-dividend here

- Listing: James Bay Minerals (JBY) – 11:00 am

Economic calendar (AEST):

- 11:30 am: Australia Consumer Confidence

- 12:30 pm: Australia Business Confidence

- 5:00 pm: UK Unemployment

- 8:00 pm: Germany Economic Sentiment Index

This Morning Wrap was written by Kerry Sun.

1 contributor mentioned