ASX 200 to rise, Dow notches 7th consecutive day of gains, Life360 release earnings

ASX 200 futures are up 23 points, or 0.29%, as of 8:25am AEST.

Yesterday was a brutal day despite futures only indicating a flat open at first. But it was not just because Commonwealth Bank disappointed. A slew of disappointing trading updates from some of the country's largest retailers did their bit to send the Consumer Discretionary sector 2.5% lower at the close. Today, QBE Insurance and West African Resources will hold AGMs while Life360 is due to hand down earnings. The last time the latter reported results, it led to a 24% day-of share price surge.

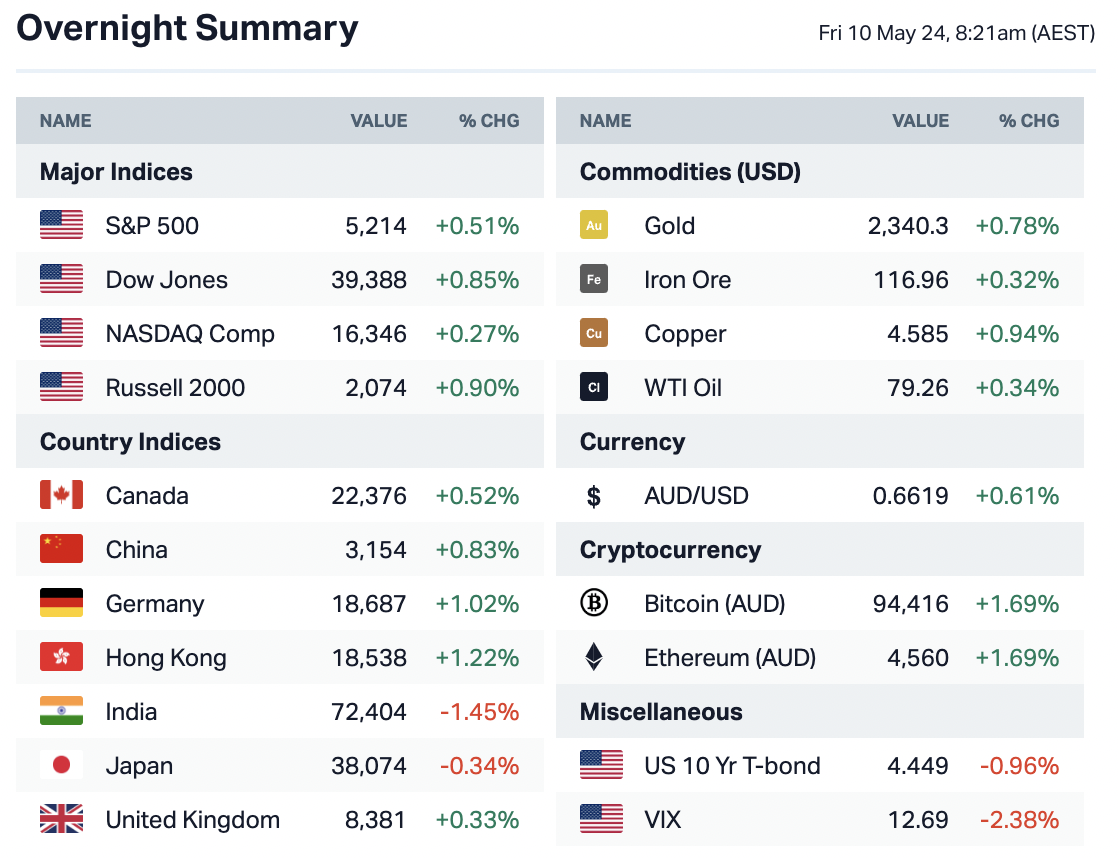

Meanwhile, in the US, the value-heavy Dow Jones Industrial Average has extended its best winning streak for 2024 - up seven days in a row. The S&P 500 also reclaimed the psychologically important 5,200 level at the close.

Let's dive in.

S&P 500 SESSION CHART

OVERNIGHT MARKETS

- Dow closes more than 300 points higher, securing 7th winning day

- European stocks close higher as BOE holds rates; Sabadell up 3% on fresh BBVA bid

- 10-year Treasury yields falls after new data, strong bond auction

- Oil edges up to one-week high on rising demand hopes after China, U.S. data

- Gold gains over 1% as soft U.S. jobs data lifts Fed rate-cut bets

INTERNATIONAL STOCKS

- Dropbox’s results get a break from investors after big selloff in February

- Arm’s stock dips after earnings, but here’s the case for optimism

- Unity names a permanent CEO while reporting better-than-expected results

- AMC is gaining market share, but debt sparks analyst concern

- Tesla ramping up job cuts in China

- Sources say Musk's AI startup set to close funding round at a valuation of around $18 billion as soon as this week

CENTRAL BANKS

- Bank of England keeps interest rates at 5.25% but hints at a June cut

- ‘It’s our duty’: Bank of England chief says cutting rates before a UK election wouldn’t be an issue

- BOJ's Ueda in strongest signal yet, hints possible policy action if yen moves impact inflation

- Sweden's central bank enacts 25 bps hawkish rate cut, its first in eight years

- Markets fade chance of RBA rate hike this year, while rate cut calls undermined by strong inflation

ECONOMY

- China's exports rose slightly more than expected in April, while imports surged

- Two major Chinese cities scrap remaining curbs on residential property purchases

- China adopts America's GFC-era cash for clunkers policy in bid to boost consumer spending

- China's overcapacity alarms the world; problem solvable with short-term pain

- Japan real wages extend record declines, hopes turn to data from around June

Key Events

Economic calendar (AEST):

4:00pm – GBP – GDP, construction output, goods trade balance, industrial production, manufacturing production, business investment

10:30pm – CAD – Employment change, unemployment rate

12:00am – University of Michigan consumer sentiment and inflation expectations

This Morning Wrap was written by Hans Lee and Chris Conway.

2 topics