ASX 200 to rise, Meta announces maiden dividend, Charts of the Week

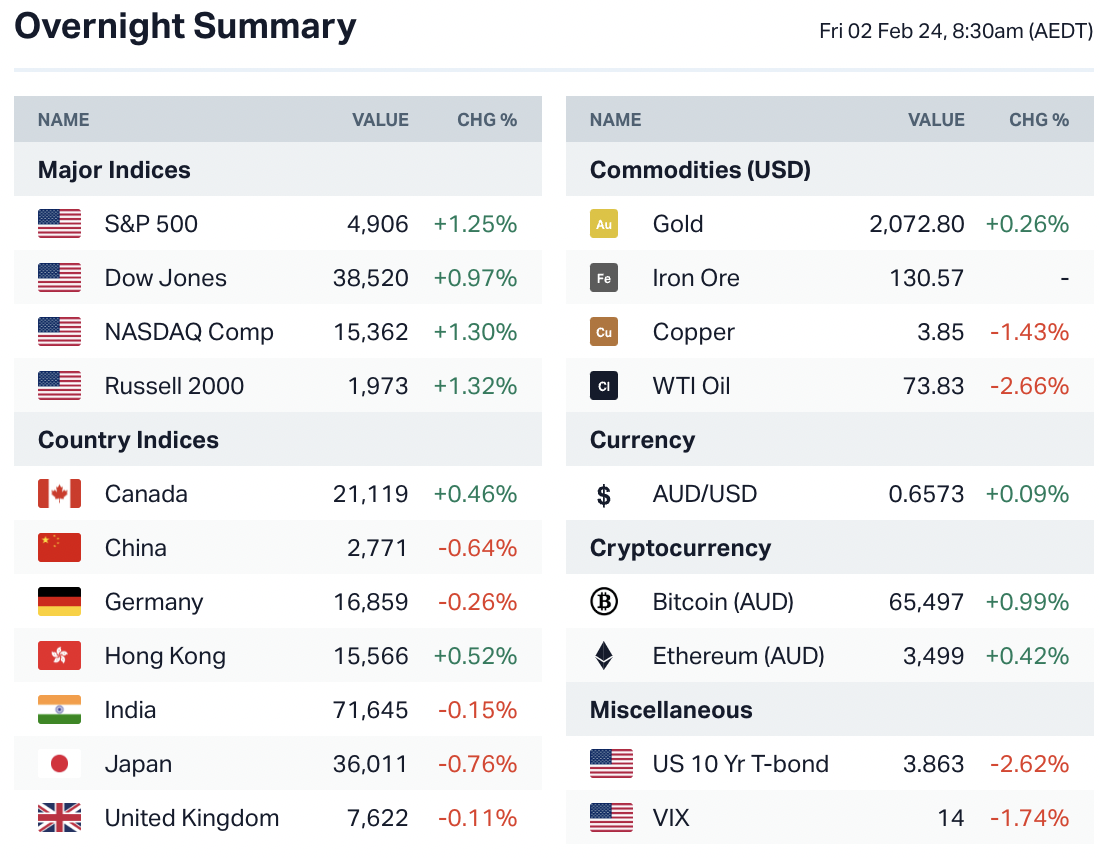

ASX 200 Futures are up 30 points, or 0.39%, as of 8:25am AEDT.

The S&P 500 bounced after yesterday's Fed-induced selloff, the market continues to expect six rate cuts by year end despite Powell's pushback against a March rate cut, the Bank of England keeps rates on hold and signals to cuts once inflation eases, oil prices fall on reports of a ceasefire between Israel and Hamas, Meta announces its maiden dividend, and Charts of the Week!

Let's dive in.

S&P 500 SESSION CHART

S&P 500 finished higher and finished near best levels

Markets trying to bounce following several headwinds in the previous session such as high bar for big tech earnings, renewed regional bank concerns and Powell’s pushback against a March rate cut

March rate cut expectations eased to 38.5% but the market still expects six 25 bp rate cuts by year end

US 10-year yield lower, down 28 bps in the last four sessions

Oil prices settle 2% lower on reports of a ceasefire between Israel and Hamas

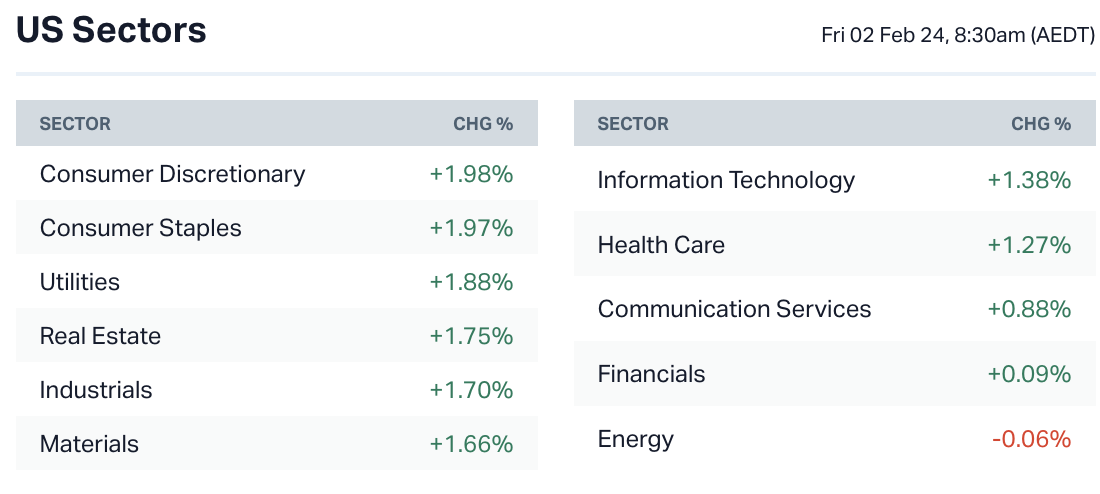

BofA says if money market rates drop,"there could be a wall of money that makes its way into equity income ... utilities, real estate ... areas of the S&P 500 that really haven't caught a bad."

US regional banks slide as NYCB's surprise quarterly loss renews fears about commercial real estate and sector wide contagion (Reuters)

Walmart opening 150 new stores over the next five years (Axios)

Nvidia's new China-focused AI chip set to be sold at similar price to Huawei (Reuters)

Deutsche Bank said provisions for losses in US commercial real estate were more than four times bigger in Q4 (Bloomberg)

Adidas says currency swings will worsen the effects of a slowdown in the sports apparel market (Bloomberg)

Okta to lay off 7% of employees due to high costs (CNBC)

Zoom announces it will lay off 150 employees this week (Bloomberg)

Latest BOJ rhetoric reinforces March/April rate hike views (Nikkei)

BoE keeps rates on hold, signals cuts possible once inflation eases (Reuters)

Sweden's Riksbank keeps rates on hold as expected, opens up to cuts in H1 (Bloomberg)

Fed holds as expected, though says no cuts until inflation moving more sustainably toward target (Bloomberg)

ECB Lane says central bank needs more confidence inflation is headed to 2% (Bloomberg)

Iraqi and Iranian authorities urging militia to stand down a sign the parties want to avoid a regional conflict (Reuters)

State Department preparing policy options for possible US recognition of a Palestinian state (Axios)

Ukraine says arms shortages gives Russia three-to-one advantage (Bloomberg)

China pledges to keep spending this year despite challenges to key government revenue sources (Bloomberg)

Private data shows China home prices and sales fell sharply in January (Reuters)

China shares see biggest equity outflows since 2014 as Beijing's efforts fail to stem sell-off after Evergrande hit (Nikkei)

US manufacturing sector on cusp of recovery in January, PMI shows (Reuters)

Eurozone inflation eases as expected last month but underlying price pressures fell less than forecast (Reuters)

Eurozone manufacturing PMI downturn eased for third month in January (Reuters)

UK manufacturing PMIs records 18th consecutive month of contraction as orders fell, Red Sea disruption hits (Reuters)

South Korea exports log fastest growth since May 2022 amid surge in semiconductor shipments (Reuters)

Charts of the Week

Setting the scene: The market might get a little choppy right now, weighed by the Fed's pushback against March rate cut expectations and a softer-than-expected US earnings season (notably weak guidances from economic bellwethers like UPS and megacap tech stocks selling off on decent numbers). That isn't to say the market can't continue to trend higher – But the path of least resistance calls for a bit of sideways action.

Alligator Energy (ASX: AGE) – I hate referencing technical setups but here we go ... it looks like both a cup and handle as well as a bull pennant/flag. Uranium has also been a very bullish sector, with the Global X Uranium ETF rallying more than 6% overnight. This likely calls for a sea of green for local names on Friday, and a possible breakout for AGE.

Gentrack (ASX: GTK) – Tight price action for a little over two months, between the $6.00 to $6.10 range. GTK has been trading like this for quite some time (consolidation into breakout into more consolidation into another breakout). The only problem with this stock is that its rather illiquid (e.g. it would be hard to both buy and sell $20,000 without moving the share price/paying a sizeable spread).

Insurance Australia (ASX: IAG) – Insurance and insurance brokers are running hot right now. A broker like Helia has been trading pretty much vertical since November 2023. Whereas insurers like Suncorp and QBE are slowly grinding higher (these stocks are very, very slow movers). IAG is starting to push previous resistance of around $6.10. Third time lucky?

Iress (ASX: IRE) – Iress was absolutely smashed last reporting season, down 35.5% on results day. Three months later, it re-rated around 33% across seven days after issuing a guidance upgrade. The stock has been consolidating ever since.

West African Resources (ASX: WAF) – Most gold charts look pretty awful (largely due to operational reasons and little cash flows) but not WAF. Tightening around the 95 cents level and tagging a few higher highs.

Welcome Capstone Copper

Capstone Copper (ASX: CSC) will make its debut today at 12:00 pm AEDT.

At a glance – Capstone Copper is an established copper producer and developer with a portfolio of long-life operations in the Americas (US, Mexico and Chile). The company is currently listed on the Toronto Stock Exchange with a market cap of C$4.6bn.

What makes this IPO interesting is the market's current lack of large cap copper opportunities (after BHP's acquisition of Oz Minerals). If you want +$1bn pure play exposure, there's only Sandfire Resources. Towards the smaller end of town, names like 29Metals and Aeris Resources have been sold to oblivion amid persistent operational challenges.

Key Events

ASX corporate actions occurring today:

Trading ex-div: Australian Foundation Investment (AFI) – $0.115, Euroz Hartleys (EZL) – $0.018, Nickel Industries (NIC) – $0.025

Dividends paid: None

Listing: Capstone Copper (CSC) at 12:00 pm AEDT

Economic calendar (AEDT):

10:00 am: Korea Inflation (Jan)

11:30 am: Australian Home Loans (Dec)

11:30 am: Australian Producer Price Index (Q4)

12:30 am: US Unemployment Rate (Jan)

This Morning Wrap was written by Kerry Sun.

2 topics

1 contributor mentioned